Asset Quality Review Exercise Must be Conducted Immediately After Forbearance is withdrawn: Suggests Economic Survey

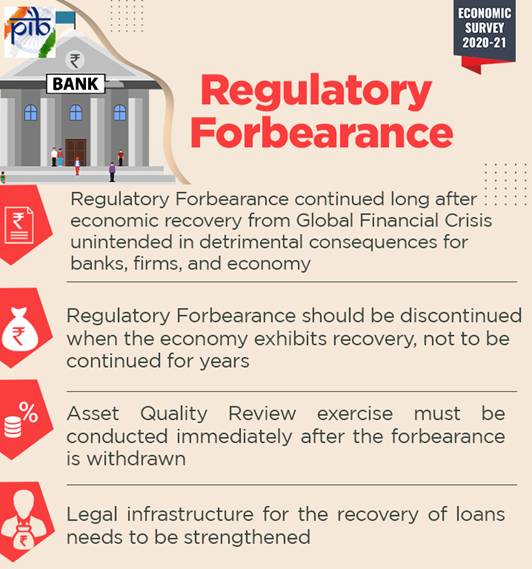

The Economic Survey suggests that given the problem of asymmetric information between the regulator and the banks, which gets accentuated during the forbearance regime, an Asset Quality Review exercise must be conducted immediately after the forbearance is withdrawn. The Economic Survey 2020-21 was presented by the Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman in Parliament today. According to the Survey, the legal infrastructure for the recovery of loans needs to be strengthened de facto. Regulatory forbearance for banks involved relaxing the norms for restructuring assets, where restructured assets were no longer required to be classified as Non-Performing Assets (NPAs henceforth) and therefore did not require the levels of provisioning that NPAs attract.

The Economic Survey notes that to address the economic challenges posed by the COVID-19 pandemic, financial regulators across the world have adopted regulatory forbearance and India is no exception. The Survey notes that the emergency measures such as forbearance prevent spillover of the failures in the financial sector to the real sector, thereby avoiding a deepening of the crisis. Therefore, as emergency medicine, forbearance occupies a legitimate place in a policy maker’s toolkit. The Survey, however, points out that forbearance represents an emergency medicine that should be discontinued at the first opportunity when the economy exhibits recovery. It is not a staple diet that gets continued for years, says the Economic Survey 2020-21.

The Survey further observes that during the Global Financial Crisis, forbearance helped borrowers’ tide over temporary hardship caused due to the crisis and helped prevent a large contagion. However, the forbearance continued long after the economic recovery, resulting in unintended and detrimental consequences for banks, firms, and the economy.

The current regulatory forbearance on bank loans has been necessitated by the COVID-19 pandemic. Given relaxed provisioning requirements, banks exploited the forbearance window to restructure loans even for unviable entities, thereby window dressing their books. As a result of the distorted incentives, banks misallocated credit, thereby damaging the quality of investment in the economy. The inflated profits were then used by banks to pay increased dividends to shareholders, including the government in the case of public sector banks. As a result, banks became severely undercapitalized. Undercapitalization distorted banks’ incentives and fostered risky lending practices, including lending to zombies. As a result of the distorted incentives, banks misallocated credit, thereby damaging the quality of investment in the economy. Firms benefitting from the banks’ largesse also invested `in unviable projects. In a regime of injudicious credit supply and lax monitoring, a borrowing firm’s management’s ability to obtain credit strengthened its influence within the firm, leading to deterioration in firm governance.

***

RM/RKJ/RC