Key Takeaways

- New Labour Codes simplify compliance for MSMEs through faster approvals, digital processes, and reduced regulatory burden.

- Uniform national standards and a facilitative inspection system strengthen ease of doing business while ensuring safer, more equitable workplaces across India.

- Higher operational thresholds and flexible employment provisions give MSMEs the agility to adapt quickly to changing business conditions.

- Comprehensive wage, social security, and welfare reforms extend protection and dignity to all workers.

|

Introduction

The Micro, Small and Medium Enterprises (MSME) sector is the backbone of India’s economy, accounting for a substantial 30.1% of the country’s GDP, 35.4% of manufacturing output, and 45.73% of overall exports. The sector provides employment to nearly 28 crore people across 6.5 crore units. This scale, reach, and diversity make it one of the most crucial engines of development and economic resilience.

Given the central role of MSMEs, continued policy support remains essential to promote competitiveness and consistent growth. Further to strengthen this sector, the Labour Codes implemented by the Government, seek to modernize India’s labour ecosystem by formalizing employment, simplifying compliance through digital integration, strengthening social security and ensuring workplace safety and equality.

MSMEs in India: The Scale and Classification

MSMEs are complementary to large industries as ancillary units and contribute significantly in the inclusive industrial development of the country. They are classified on the basis of investment in plant and machinery and annual turnover:

|

Classification

|

Investment in Plant & Machinery

|

Annual Turnover

|

|

Micro

|

Not more than Rs. 2.5 crores

|

Not more than Rs. 10 crores

|

|

Small

|

Not more than Rs. 25 crores

|

Not more than Rs. 100 crores

|

|

Medium

|

Not more than Rs. 125 crores

|

Not more than Rs. 500 crores

|

Covering the wide spectrum of firms, the sector stands to benefit significantly from the clear and consistent provisions brought in by the new Labour Codes.

Labour Codes and Ease of Doing Business for MSMEs

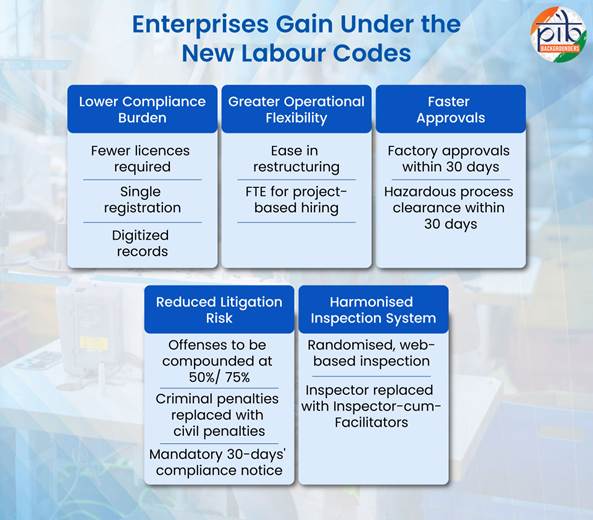

One of the central aims of the Labour Codes is to simplify and streamline regulatory processes that often overwhelm MSMEs. The reforms address long-standing bottlenecks through rationalised thresholds, digitised paperwork, predictable timelines, and reduced inspections.

Streamlined Factory Licensing and Faster Approvals

- The threshold to obtain a factory license has been increased: a) From 10 to 20 workers (with power) and b) From 20 to 40 workers (without power)

- A 30-day time limit has been prescribed for granting permission for construction or expansion of a factory, with the provision for deemed permission.

- The site appraisal committee must give its recommendations for the initial location or expansion of factories involving hazardous processes within 30 days. This will facilitate quicker setup and expansion of MSME factories by cutting approval delays.

· The overall approval timeline has been reduced from 90 days to 30 days.

These measures drastically cut approval delays and enable MSMEs to establish and scale operations faster.

Simplified Rules for Contract Labour

- The threshold for applicability of the provisions relating to contract labour license has been increased from 20 to 50 workers.

- Now, contractors employing fewer than 50 workers do not need a license.

This will reduce excessive regulation for smaller establishments and reduce compliance burden on MSMEs.

Single Registration, Single Return, Single License

The Codes introduce electronic single registration, a single return, and single all-India licences valid for five years as well as deemed approvals.

Such provisions in the Codes will promote both ease of living and ease of doing business, simplify compliance, reduce procedural delays, lower administrative cost. This is specifically beneficial for the MSME sector that finds it difficult to manage compliance.

Uniform National Standards & National Board

- In place of six boards under the existing laws, there will be a single national tripartite board to advise the Central Government on standards, regulations, etc under the Codes.

- The Government will notify standards on occupational safety and health for MSME workplaces across India. This will replace the current situation where different states have framed different standards for the same industries.

This will bring uniformity of standards across the country which will eliminate state-wise variation, promote fairness, predictability, and simpler compliance for MSMEs operating in multiple states.

Higher Thresholds for Operational Flexibility

- The threshold for lay-off, retrenchment, and closure has increased to 300 workers. This allows smaller industrial establishments employing fewer than 300 workers to restructure operations based on their requirements without needing complex government approvals.

- The threshold for applicability of Standing Orders has increased from 100 to 300 or more workers. Establishments with fewer than 300 workers are now exempt from the requirement of certification of standing orders.

MSMEs can now adapt more quickly to changing economic conditions. This flexibility reduce compliance burden, promotes business growth, job creation, and sustainability of small and medium enterprises while maintaining a balance between regulation and operational freedom.

Third-Party Audits and the Inspector-Cum-Facilitator Model

- Provision has been made for third-party audit and certification of start-up establishments or specific classes of establishments, helping them assess and improve health and safety without intervention of the Inspector-cum-Facilitator.

- Inspector-cum-Facilitators will function in place of traditional inspectors, and inspections will be conducted through a randomized, web-based system aimed at reducing the traditional “inspector raj”.

These changes promote a more harmonious environment by making inspections facilitative rather than intrusive and burdensome. This helps establishments comply with the law, raise awareness amongst the workers, and support greater ease of doing business.

Decriminalisation of Offences and Compounding

- First-time offences punishable with fine only shall be compoundable by paying 50% of the maximum fine.

- Offences punishable with fine or imprisonment, or with both, shall be compoundable by paying 75% of the maximum fine.

- Criminal penalties such as imprisonment are replaced with civil penalties like monetary fines.

- Employers will be given a mandatory 30-days' notice for compliance before taking any legal action.

- Several offences have been decriminalized, replacing criminal penalties with fines.

These provisions make the law less punitive and more compliance-oriented. Employers can avoid prolonged litigation by paying the prescribed penalty, enabling quicker resolution of issues. The provisions lower compliance risk for small firms, promote voluntary compliance, reduce fear of prosecution, and make enforcement more facilitative for MSMEs.

Reduced Paperwork and Electronic Record-Keeping

There is a drastic reduction in the number of registers to be maintained. The new provisions promote digitization of records, allowing all registers and documents to be maintained electronically. This aligns with the digital-first approach reducing paperwork and administrative burden.

Social Security and EPF Reforms for MSMEs

The Labour Codes modernise the social security landscape, making compliance simpler and more predictable.

- Under the Social Security Code, 2020, a 5-year time limit is set for initiating inquiries by Employee Provident Fund (EPF) authorities. Such inquiries must be completed within 2 years, extendable by 1 year with CPFC approval.

- The earlier power to reopen cases on a suo moto basis under the Employees' Provident Funds and Miscellaneous Provisions Act, 1952 has been abolished.

- The deposit amount for filing an appeal before the Employees’ Provident Fund Organisation (EPFO) Tribunal has been reduced to 25% of the awarded amount, instead of the earlier 40% to 70%.

- Self-assessment of cess allows employers to assess construction costs themselves and pay the applicable cess.

These provisions ensure timely action, provide legal certainty, and reduce the compliance burden on employers. The reduced deposit requirement lowers the financial burden on employers before filing an appeal. Self-assessment also simplifies the process and promotes timely compliance in construction-related works.

Flexibility in Employment Practices

Fixed-Term Employment (FTE)

Fixed-term employment can benefit the employers in following ways:

- Flexibility in Hiring: MSMEs can hire workers for seasonal or project-based needs without committing to long-term employment, helping them stay agile in fluctuating market conditions.

- Reduced Compliance Burden: FTE allows natural expiry of employment at contract end, reducing disputes or procedural burdens related to retrenchment or layoffs.

- Cost Efficiency: MSMEs can control overheads during low-demand periods since FTE workers are hired only when required.

- Encourages Formalisation: Many MSMEs rely on casual or informal labour. FTE converts such engagement into formal employment with legal benefits, improving compliance and transparency.

- Access to Skilled Labour: MSMEs can hire skilled professionals for specific projects without long-term liability, improving productivity and innovation.

Regulation of Strikes

- The definition of strike now includes concerted casual leave taken by more than fifty percent of the workers on a given day, thereby prohibiting flash strikes and preventing loss of man days or work.

- Strikes require 14 days’ notice and are restricted during conciliation or tribunal proceedings.

- Mandatory conciliation is introduced as part of the process.

These provisions prevent sudden disruptions, reduce loss of productivity, and give employers confidence to expand operations and hire more workers, knowing productivity will be stable.

Flexible Working Hours and Overtime

The appropriate Governments (Central/State) now have full flexibility to fix working-hour limits, replacing the earlier uniform cap of 75 overtime hours per quarter.

This flexibility in hours of work will enable industry to fix the hours of work as per the business needs including when they get peak orders. It will also generate growth and employment.

Protection of Employer Assets

Any amount an employer deposits with the appropriate Government (Central/State) to secure the performance of a contract, as well as any amount the Government owes the employer for that contract, cannot be attached by any court in order for debts or liabilities incurred by the employer. The only exception is when the employer owes dues to employees working on that specific contract.

Hence, amounts deposited with Government to secure contract performance are protected from attachment except for dues owed to employees.

Worker-Centric Reforms Enhancing Welfare and Dignity

Wage, Social Security and Welfare Provision

- Universalisation of Minimum Wages: No employer shall pay any employee less than the minimum wage notified by the Government. Minimum wages, earlier applicable only to scheduled employments, now cover all employees and must be reviewed or revised at intervals not exceeding five years.

Minimum rates of wages shall be fixed for time work and piece work, based on hourly, daily, or monthly wage periods, taking into account the skill of the employee and the arduousness of the work.

- Floor Wage: A floor wage will be fixed and regularly revised by the Government considering minimum living standards, including food and clothing. This will reduce migration of labour from one state to another due to varying wage levels.

- Overtime Wages: Employers must pay employees twice the normal wage rate for any work beyond normal working hours.

- Time Limits for Payment of Wages: The employer shall pay or cause to be paid wages to all the employees, based on prescribed timelines:

|

Sl.

|

Type of Employee

|

Time Limit for Payment of Wages

|

|

1.

|

Daily-wage employee

|

End of the shift

|

|

2.

|

Weekly-rated employee

|

Before the weekly holiday

|

|

3.

|

Fortnightly-rated employee

|

Within 2 days of the end of the fortnight

|

|

4.

|

Monthly-rated employee

|

Within 7 days of the next month

|

|

5.

|

On termination or resignation

|

Within 2 working days

|

- Provisions on timely payment and unauthorised deductions, earlier applicable only to employees earning up to ₹24,000 per month, now apply to all employees.

- Limitation Period: The period for filing claims by an employee has been extended to three years, instead of the earlier six months to two years.

- Bonus: Bonus shall be paid to every employee drawing wages within the limit fixed by the appropriate Government (Central/State).

- Eligible employees must have worked at least 30 days in an accounting year.

- The annual bonus shall be paid at a minimum of 8.33% and a maximum of 20% of the wages earned.

- Prohibition of Gender Discrimination: Employers shall not discriminate based on gender, including transgender persons, in recruitment, wages, or conditions of employment for the same or similar work.

- Commuting Accidents Covered: The scope of employee compensation now includes accidents occurring during commuting, from his residence to the place of employment, or returning from place of his employment to his residence after performing duty.

- ESIC Coverage Expansion: ESIC coverage extended pan-India; the earlier concept of notified areas has been removed. Voluntary membership introduced for establishments with fewer than 10 persons through employer and employee joint consensus.

- Expansion of Family Definition: In case of a female employee, the definition of family has been extended to include parents-in-laws (father-in-law and mother-in-law), based on income levels prescribed by the Government.

- Formalisation Through Appointment Letters: Every employee must be given an appointment letter in the prescribed format detailing designation, category, wages, and social-security information.

- Free Annual Health Check-Ups: Every employee is eligible for free annual health check-ups.

- Annual Leave with Wages: Workers are entitled to paid leave on working for 180 days or more in a calendar year (reduced from 240 days).

- Inter-State Migrant Worker: The definition of Inter State Migrant Workmen has been widened to include those employed directly or through contractor and also covers workers who migrate on their own.

- Health, Safety and Welfare Facilities: The Government will prescribe uniform provisions for cleanliness, drinking water, toilets, rest rooms in factory mines employing 50 or more workers, canteens in the establishments employing 100 or more workers including contract labour.

- Worker Re-Skilling Fund: In case of any retrenchment of a worker by an employer, the employer will need to contribute equivalent to 15 days’ last drawn wages of the retrenched worker to the worker re-skilling fund within 45 days of retrenchment.

These provisions strengthen wage protection, ensure timely payments, and extend the coverage of minimum wages and bonus to a wider group of employees. Workers receive expanded social security and health and welfare benefits. Anti-discrimination measures uphold gender equality in employment, and the worker re-skilling fund provides financial support during transitions after retrenchment.

Fixed Term Employment Benefits

- Equal Benefits: FTE workers are entitled to wages, hours of work, allowances, leave, and social security benefits at par with regular employees doing similar work

- Job Formalisation: FTE replaces informal, insecure jobs with formal contracts, ensuring legal rights and benefits such as PF, ESI, and bonus.

- Skill Enhancement: Working under multiple contracts across sectors helps workers gain varied skills and experience.

- Predictable Tenure: Workers know their employment duration, salary, and conditions upfront, reducing exploitation and uncertainty.

- Potential for Renewal or Absorption: Good performance in FTE roles may often lead to absorption in regular employment and help fulfil their aspirations to work in large, organised industries for better wages, working conditions, and prestige.

These provisions give workers equal benefits, formal contracts, skill growth, predictable tenure, and potential absorption into regular employment with better conditions.

Conclusion

The Labour Codes collectively represent one of the most significant reforms in India’s labour governance framework. By simplifying compliance, encouraging digital processes, promoting voluntary adherence, and expanding social security, the Codes create a balanced environment where MSMEs can grow more easily while workers benefit from fair wages, dignity, and protection. India’s MSME ecosystem will strengthen under these new Codes, aligning with the principles of “Sabka Saath, Sabka Vikas” and contributing to the vision of Viksit Bharat by 2047 and ensuring that the benefits of development reach every worker and entrepreneur.

Click here to see PDF

M