Social Welfare

Strengthening Homes, Lives & Jobs

Posted On: 19 SEP 2025 12:48 AM

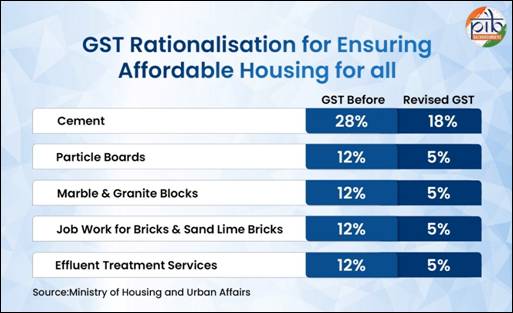

GST Rationalisation for Ensuring Affordable Housing for All

Key Takeaways

- Cement GST reduced from 28% to 18%, cutting costs that form 15–20% of total building expenses and nearly 11% of overall construction costs.

- Particle boards GST reduced from 12% to 5%, benefitting MSME-driven clusters and promoting eco-friendly jute-based housing solutions.

- Marble & granite blocks GST reduced from 12% to 5%, lowering flooring and finishing costs while sustaining lakhs of jobs in stone-producing states.

- Job work for bricks & sand lime bricks GST reduced from 12% to 5%, reducing small house construction costs and supporting MSME-operated brick kilns.

- Effluent treatment services GST reduced from 12% to 5%, encouraging CETP adoption, green jobs, and sustainable waste management.

Introduction

The Government of India has announced significant GST rate reductions on key construction materials and services. These measures are expected to make housing more affordable, reduce infrastructure costs, strengthen MSMEs, and create employment opportunities. The reforms are fully aligned with the national mission of Housing for All, and will also support flagship initiatives such as Smart Cities, metro projects, and other urban and rural infrastructure developments by lowering input costs. Additionally, they are set to encourage greater private investment in the construction sector.

Government Initiatives to Ensure Housing for All

The Government of India is advancing the goal of “Housing for All” through two flagship schemes. Pradhan Mantri Awas Yojana (PMAY) – Urban, launched in 2015, provides pucca houses to eligible beneficiaries from the EWS, LIG, and MIG categories, as well as slum dwellers. PMAY – Grameen, introduced in 2016, aims to provide pucca houses with basic amenities to houseless households and those living in kutcha or dilapidated homes in rural areas. Both schemes are implemented in convergence with initiatives like Swachh Bharat Mission, Saubhagya, and Ujjwala Yojana, ensuring beneficiaries also have access to toilets, electricity, and clean cooking fuel. This integrated approach promotes affordable housing while improving overall quality of life.

Cement (GST reduced from 28% to 18%)

Cement constitutes one of the largest input costs in construction, contributing 15–20% of total building costs and nearly 11% of overall construction expenses.

- The reduction in GST will substantially lower overall construction costs, making housing and infrastructure projects more affordable.

- Lower cement prices will directly benefit Pradhan Mantri Awas Yojana (Urban and Grameen) and other public infrastructure initiatives.

- The cement industry is highly employment-intensive, spanning mining, logistics, manufacturing, and distribution. Increased demand due to lower prices will boost job creation across cement plants, ancillary industries, and logistics.

- Reduced cement costs will also improve the efficiency of public spending on housing and infrastructure projects.

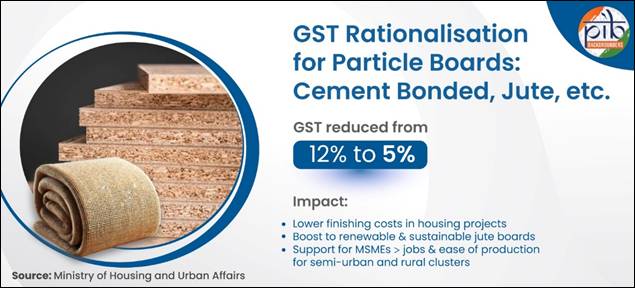

Particle Boards: Cement Bonded, Jute, etc. (GST reduced from 12% to 5%)

Particle boards play a critical role in housing, prefabricated structures, and furniture manufacturing.

- Lower GST will enhance their competitiveness and bring down finishing costs in both urban and rural housing projects.

- Jute particle boards, being renewable and biodegradable, support India’s climate and sustainability goals.

- The sector is largely MSME-driven, and the GST cut will benefit semi-urban and rural clusters by improving employment and reducing working capital pressures.

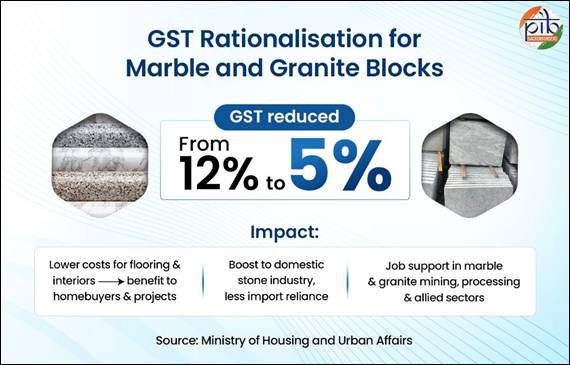

Marble and Granite Blocks (GST reduced from 12% to 5%)

India has a large natural stone sector, with states like Rajasthan, Gujarat, Karnataka, and Andhra Pradesh being major producers.

- Reduced GST will lower the costs of flooring, tiling, and interior finishing, directly benefiting homebuyers and infrastructure projects.

- The GST cut will boost domestic competitiveness while reducing reliance on imported natural stones.

- The marble and granite industry provides employment to lakhs of workers, and the tax relief will help sustain jobs in extraction, processing, and related activities.

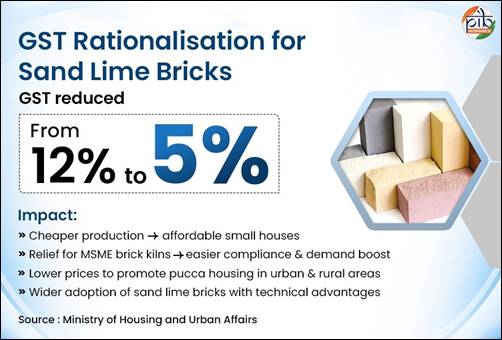

Job Work for Manufacture of Bricks (GST reduced from 12% to 5%)

GST on job work for bricks cut from 12% to 5%, easing rural housing costs and supporting MSME running brick kilns.

Sand Lime Bricks (GST reduced from 12% to 5%)

Bricks remain the most essential material in the housing sector, particularly for rural and low-cost construction.

- The reduction in GST of sand lime bricks will lower the cost of production, making construction of small houses cheaper.

- Brick kilns are predominantly MSME-operated, and the rate cut will reduce compliance burdens, ease working capital needs, and stimulate demand.

- Lower brick prices will accelerate the adoption of pucca housing in both urban and rural regions.

- Sand lime bricks, with several technical advantages over traditional red bricks, will become more affordable, driving wider usage in housing projects.

Effluent Treatment Services (GST reduced from 12% to 5%)

The GST reduction has also been extended to services related to Common Effluent Treatment Plants (CETPs).

- The lower tax will encourage industries to adopt centralized effluent treatment solutions, promoting sustainable industrial growth.

- Municipal corporations will benefit from affordable clean energy and waste management solutions.

- The measure will support the creation of green jobs in waste segregation, plant operations, and maintenance, contributing to environmental sustainability.

Conclusion

The GST rate cuts across cement, particle boards, marble and granite, bricks, and effluent treatment services represent a holistic step towards making housing and infrastructure more affordable and sustainable. These reforms will not only reduce the burden on households and public projects but will also:

- Strengthen MSMEs in the construction value chain

- Generate large-scale employment in multiple sectors

- Promote sustainable development through eco-friendly materials and waste management solutions

- Encourage private investment in urban infrastructure

Overall, the rationalisation of GST rates aligns with the government’s vision of inclusive growth, improved urban infrastructure, and the realization of the Housing for All mission.

References

Ministry of Housing and Urban Affairs

https://pmaymis.gov.in/

https://www.myscheme.gov.in/schemes/pmay-g

Click here to download PDF

*****

SK | M

Provide suggestions / comments

Read this explainer in :

Hindi