Economy

GST Reforms in Chemicals and Fertilizers Sector

Posted On: 09 SEP 2025 18:20 PM

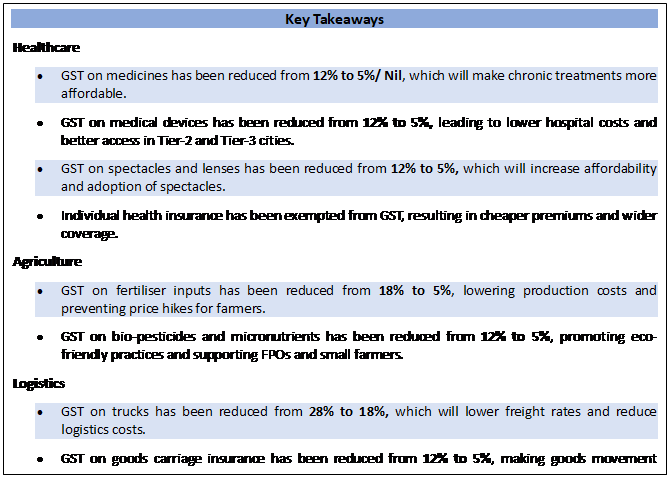

Reduced GST brings relief in healthcare, agriculture and logistics

Introduction

The GST rationalisation under the current regime, guided by Prime Minister Modi's vision of “Sabka Saath, Sabka Vikas, Sabka Vishwas, Sabka Prayas”, reflects the Government’s steadfast commitment to keeping the interests of the common man at the core of policymaking. By establishing a health-positive tax environment through lowering the cost of medicines and essential medical devices, encouraging preventive care, and boosting health insurance coverage, these reforms advance the vision of “Affordable Healthcare for All”, closely aligned with the Government’s flagship schemes such as Ayushman Bharat, Poshan Abhiyaan, and the Fit India Movement.

Simultaneously, the rationalisation policy extends crucial support to farmers by making agricultural inputs more affordable and sustainable, correcting structural inefficiencies in fertiliser production, and strengthening the logistics backbone of the economy. Driven by the larger goal of “Seva, Sushasan aur Garib Kalyan”, and rooted in the "Viksit Bharat 2047" government vision, these reforms come as a testament to the Government’s unwavering resolve for affordable healthcare, farmer prosperity, environmentally conscious practices, and efficient supply chains.

Pharmaceuticals

- Healthcare services provided by doctors, hospitals and diagnostic centres are already exempt from GST.

- The GST rationalisation seeks to promote a health-positive tax regime, discouraging harmful consumption, lowering costs of medicines and important medical devices, boosting insurance coverage, and encouraging preventive care.

Medical Treatment & Devices

- Drugs & Medicines:

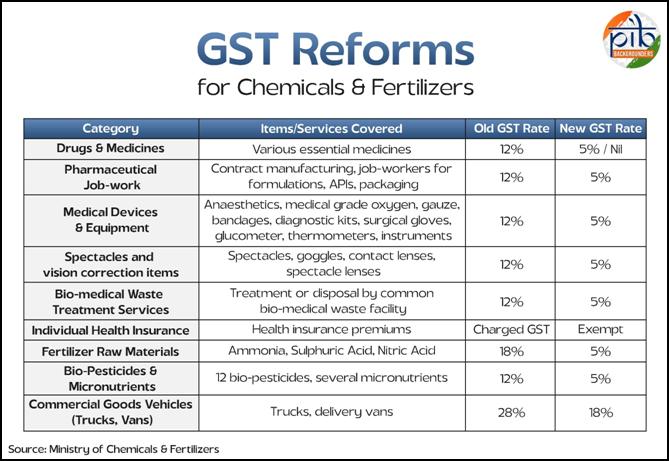

- GST Reduction from 12% to 5% / Nil will cut costs of various essential medicines, easing the financial burden on patients.

- Boosts affordability for long-term treatments of chronic illnesses and strengthens India's role as “Pharmacy of the World”, particularly for generics, while ensuring domestic affordability.

- Job-work in Pharmaceutical Manufacturing falling under Chapter 30:

- Pharma companies rely heavily on contract manufacturing and job-workers for formulations, APIs, packaging, etc.

- Lower GST (5% instead of 12%) on job-work invoices for contract manufacturing and packaging will reduce tax outgo and overall cost of production, addressing inverted duty structure issues.

- Medical Devices & Equipment:

- GST reduction from 12% to 5% for anaesthetics, medical grade oxygen, gauze, bandages, diagnostic kits, surgical gloves, glucometers, thermometers, and other appliances makes healthcare delivery cheaper for hospitals, diagnostic centres, and clinics.

- This step encourages adoption of modern diagnostic tools, improving care in Tier-2/3 areas.

- Spectacles and goggles for correcting vision, Contact Lenses, Spectacle lenses:

- Spectacles are not a luxury but a health necessity. It is expected that the population dependent on lenses/ spectacles will increase.

- GST cut from 12% to 5% for spectacles, spectacle lenses, contact lenses, and goggles makes vision correction affordable to millions, benefiting students, the elderly, and low-income households.

- As per some reports, 10 crore people may be without proper spectacles. This reform will help in increasing adoption of spectacles. Lower GST will improve demand, which will boost the spectacles industry.

- Services by way of treatment of effluents by a Common Effluent Treatment Plant will be reduced from 12% to 5%.

- Tax reduction on CETPs will encourage industries to adopt centralize waste treatment solutions, leading to a pollution-free environment and promoting sustainable development across industrial regions.

- It will help municipal corporations adopt clean energy solutions for waste management.

- The rate cuts will stimulate green jobs in waste segregation, plant operations and maintenance.

The Common Effluent Treatment Plant (CETP) is waste-water treatment facility, wherein, effluents from medium/ small scale industries, in an industrial cluster/ estate, are brought to a centralized place for treatment.

- GST Reduction on Biodegradable Bags (18% to 5% GST)

- Lower GST makes biodegradable bags more affordable, encouraging consumers and retailers to shift away from single-use plastics. It will help reduce plastic pollution.

- It Strengthens India’s compliance with the Plastic Waste Management Rules, 2022 and the ban on single-use plastics.

- It will encourage investment in R&D and scale-up of bio-polymers, starch-based and compostable materials.

- Faster adoption of biodegradable bags reduces plastic leakage into rivers, soil, and marine ecosystems.

- Many biodegradable bag makers are small and medium enterprises or startups. Lower GST eases their market entry and expands demand.

“I think our Prime Minister has considered the common person and shown empathy, which is why GST was reduced from 12% to 5%. At the same time, he has provided significant relief to the pharma industry: 90% of refunds under the inverted duty structure will now be provisional and disbursed quickly, which will be a major boon for us." Nipun Jain, Chair of the DGFT & SME Committee at Pharmexcil

Health Services

- Treatment or Disposal of Biomedical Waste: Services by way of treatment or disposal of bio medical waste by a common bio-medical waste treatment facility to a clinical establishment will be reduced from 12% to 5%.

- Job Work in Pharmaceutical Manufacturing: GST on job-work for pharmaceutical goods manufacturing reduced from 12% to 5%.

Individual Health Insurance

- No GST on Individual Health Insurance:

- Premiums become cheaper for middle-class families, encouraging wider adoption and reducing out-of-pocket medical expenses. It will help in penetration of Health insurance and formal medical care.

- The cut complements Ayushman Bharat and PMJAY, expanding private coverage, and drives toward universal healthcare access.

“Many people today, especially from the middle and poorer sections, suffer from illnesses, and medicines had already become expensive for them. Providing relief by removing GST on medicines is therefore a very good step." Businessman Niranjan Hiranandani

Fertilizers

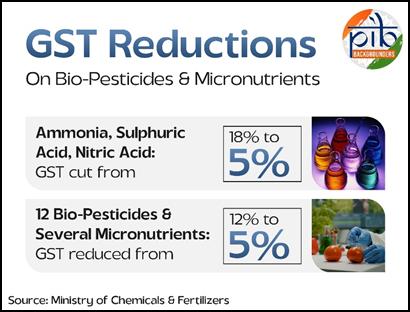

- Ammonia, Sulphuric Acid, Nitric Acid: GST cut from 18% to 5% corrects inverted duty structure, saves raw material cost for fertilizer companies, improves working capital efficiency.

- It will reduce input cost for fertiliser companies, preventing price hikes for farmers.

- It will also ensure timely availability of affordable fertilisers, directly aiding farmers during sowing seasons.

Bio-Pesticides & Micronutrients

12 Bio-Pesticides & Several Micronutrients:

- GST reduced from 12% to 5%; promotes eco-friendly, sustainable farming practices by making bio-based inputs more affordable.

- It will encourage farmers to shift from chemical pesticides to bio-pesticides, improving soil health and crop quality.

- The rate cut benefits small organic farmers and FPOs, aligns with Natural Farming Mission, and applies to micronutrients under serial 1(g), Schedule 1, Part (A) of Fertilizer Control order 1985.

- The GST cut is expected to expand the market for eco-friendly agri-inputs, supporting new product lines and revenue for fertilizer companies.

Additionally, GST on Solar power-based devices to come down to 5% from 12%; cheaper solar power-based devices will reduce irrigation costs and support farmers.

Commercial Goods Vehicles

Trucks, Delivery Vans, etc

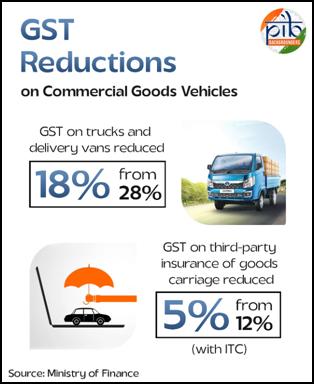

- Trucks are the backbone of India’s supply chain (carry 65%-70% of goods traffic).

- GST reduced from 28% to 18%, making trucks more affordable, reducing freight rates per tonne-km, and resulting in cheaper movement of agricultural goods.

- Reducing GST reduces upfront capital cost of trucks, which lowers freight rates per tonne-km.

- This has a cascading effect. It will lead to cheaper movement of agri goods, cement, steel, FMCG, and e-commerce deliveries. It will reduce inflationary pressures.

- It will support MSME truck owners, who form a large share of India’s road transport sector.

- Cheaper trucks directly help reduce logistics cost, improving export competitiveness.

- Helps align with PM Gati Shakti & National Logistics Policy targets.

- Cheaper trucks lower logistics costs and improve export competitiveness. GST on third-party insurance of goods carriage also reduced from 12% to 5% with ITC (Input Tax Credit), complementing these efforts.

Conclusion

Through targeted GST reductions across the health, pharmaceutical, fertilizer, and logistics sectors, the government is prioritising preventive health, boosting affordability, supporting sustainable agriculture, and enhancing supply-chain competitiveness. These measures reinforce the vision of "Health for All", improve farmer welfare, and promote sustainable growth in keeping with national priorities such as Ayushman Bharat and Natural Farming Mission.

References:

Click here to see PDF

******

SK/ SM

Visitor Counter : 1

Provide suggestions / comments

Read this explainer in :

Hindi