Technology

GST Rationalisation in Electronics and Green Technologies

Posted On: 10 SEP 2025 13:08 PM

Making Technology Affordable, Strengthening Domestic Manufacturing, and Driving Sustainable Growth

Key Takeaways

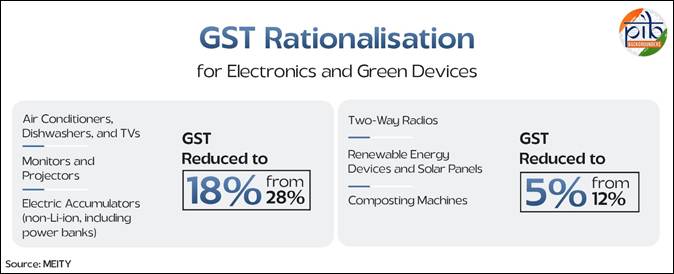

- GST on Air Conditioners, Dishwashers, and TVs reduced from 28% to 18%, boosting affordability and domestic electronics manufacturing.

- GST on Monitors and Projectors cut from 28% to 18%, lowering ICT costs for education, offices, and start-ups.

- GST on Electric Accumulators reduced from 28% to 18%, making energy storage more affordable.

- GST on Two-Way Radios reduced from 12% to 5%, strengthening communication for police, paramilitary, and defence.

- GST on Renewable Energy Devices, Solar Panels, and Composting Machines lowered from 12% to 5%, promoting sustainability and green energy adoption.

Introduction

In the 56th Meeting of the Goods and Services Tax (GST) Council, chaired by the Union Finance & Corporate Affairs Minister, on September 3, 2025, the rationalisation of GST rates on key electronic items comes as an important step towards strengthening India’s domestic manufacturing ecosystem while simultaneously enhancing consumer affordability. The revised rates not only make essential and aspirational electronic products more accessible but also contribute to the Government’s larger vision of promoting “Make in India” and reducing import dependence, thereby fulfilling the vision of Prime Minister Narendra Modi of building an Atmanirbhar Bharat.

Efforts by the Government of India for Advancing the Electronics and IT Sectors

The Government of India is advancing the electronics and IT sectors under the National Policy on Electronics, 2019 through a structured, multi-pronged strategy. The Electronics Component Manufacturing Scheme (ECMS), with a ₹22,919 crore outlay, targets a strong domestic component ecosystem by attracting ₹59,350 crore in investment, creating 91,600 jobs, and achieving ₹4,56,500 crore in production, while Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) provides a 25% capital incentive for component, semiconductor, and sub-assembly manufacturing. Together, these initiatives mark a shift from assembly and finished goods towards deeper component and material production, with MeitY leading as the nodal agency.

On GST reforms, the President of the Gujarat Chamber of Commerce, Mr. Sandeep Engineer, said, "I sincerely thank the government for simplifying the GST tax structure. This simplification provides significant relief on daily essentials, boosting the economy and injecting nearly one lakh crore into liquidity, which will further strengthen economic growth.”

Key GST Revisions and Their Impact

Air Conditioners, Dishwashers and Televisions: GST reduced from 28% to 18%

- The reduction is a dual benefit: it improves affordability for consumers while providing a significant boost to India’s electronics manufacturing sector.

- Lower GST is expected to increase demand. Enhanced demand for air conditioners and large-screen televisions will expand the market size for domestic producers, strengthening production capacity.

- Stronger backward linkages will emerge in components such as compressors, displays, semiconductors, and related sub-systems.

- Micro, Small and Medium Enterprises (MSMEs) will benefit through increased opportunities in plastics, wiring, cooling systems, LED panels, and assembly services.

- Localisation efforts are expected to gain momentum, thereby reducing dependence on imports.

- In addition, lowering the GST rate on dishwashers will make them more affordable for households, improving ease of living and driving adoption.

On GST reforms for televisions and air conditioners, a trader from Ahmedabad, Gujarat said, "For premium items like large TVs and ACs, the GST has been reduced. For other items like washing machines, it remains the same as before. The government has made a good decision.”

Monitors and Projectors: GST reduced from 28% to 18%

- The reduction will lower costs for educational institutions, offices, and digital learning centres.

- Affordable Information and Communication Technology (ICT) hardware will play a key role in strengthening the digital economy, fostering innovation, and supporting the start-up ecosystem.

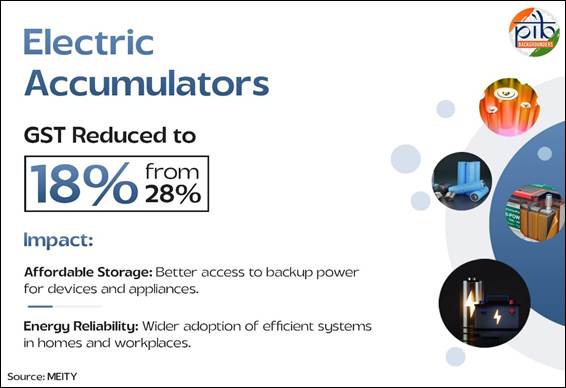

Electric Accumulators: GST reduced from 28% to 18%

- Affordable energy storage solutions will enhance access to backup power for digital devices and small appliances.

- This measure encourages wider adoption of efficient energy systems in both households and workplaces, ensuring greater energy reliability.

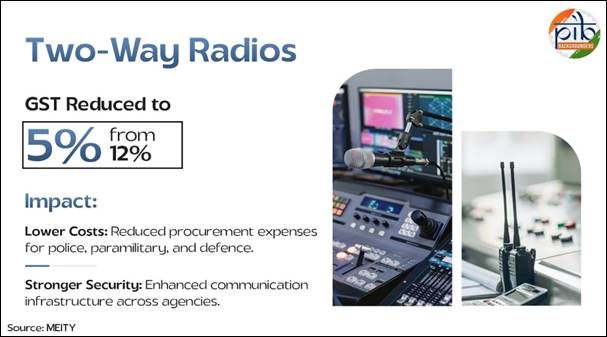

Two-Way Radios: GST reduced from 12% to 5%

- The reduction will lower procurement costs for police forces, paramilitary units, and defence establishments.

- It will significantly strengthen internal security by enhancing communication infrastructure across agencies.

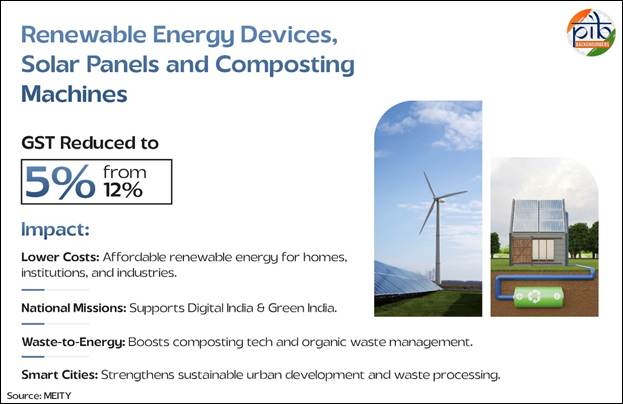

Renewable Energy Devices and Solar Panels/Photovoltaic Cells: GST reduced from 12% to 5%

- This measure will bring down the cost of renewable energy deployment at household, institutional, and industrial levels.

- It directly supports India’s twin national missions: Digital India and Green India, by ensuring access to affordable, clean, and sustainable power.

Composting Machines: GST reduced from 12% to 5%

- By making composting technology more affordable, the move will encourage wider adoption of waste-to-energy and organic waste management solutions.

- It supports the Government’s vision of sustainable and smart cities, with improved waste processing and environmental management.

The MD of Polymed, Mr. Himanshu Baid said, “This was a long-awaited reform by the Government of India. Essential home-care products will now become more affordable.”

Conclusion

The rationalisation of GST rates on electronic goods and clean energy devices marks a significant policy intervention by the Government of India to strengthen domestic electronics manufacturing, enhance competitiveness of MSMEs, and increase affordability of essential technologies for citizens. By lowering costs and stimulating demand, these reforms directly complement initiatives under the National Policy on Electronics and the broader vision of Atmanirbhar Bharat. At the same time, they advance national priorities of environmental sustainability, innovation-driven growth, and improved ease of living, reinforcing the Government’s commitment to building a resilient and inclusive digital economy.

References

Ministry of Electronics and Information Technology

https://www.india.gov.in/spotlight/electronics-component-manufacturing-scheme

https://www.pmindia.gov.in/en/news_updates/cabinet-approves-scheme-for-promotion-of-manufacturing-of-electronic-components-and-semiconductors/

https://www.digitalindia.gov.in/press_release/union-minister-ashwini-vaishnaw-launches-guidelines-and-portal-for-electronics-component-manufacturing-scheme

Expert Quotes

https://x.com/ians_india/status/1963499393459609663

https://x.com/ians_india/status/1963558632228020610

https://x.com/ians_india/status/1963598489717543152

https://x.com/ians_india/status/1963620016894423150

Click here for pdf file

****

SK | SA

Visitor Counter : 1

Provide suggestions / comments

Read this explainer in :

Hindi