Technology

GST Reforms Power India’s Green Transition

प्रविष्टि तिथि:

16 SEP 2025 12:58 AM

Affordable sustainability aligned with Net Zero 2070

Introduction

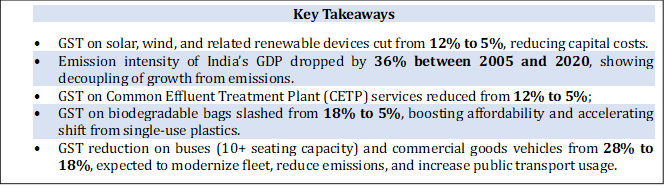

India’s commitment to sustainability and climate action has been reinforced through the recent GST rationalisation, which strategically reduces tax rates on renewable energy technologies, waste management services, biodegradable products, and green transportation. Under the visionary leadership of PM Modi, these reforms are designed to accelerate the adoption of clean energy, encourage eco-friendly manufacturing, strengthen waste treatment infrastructure, and promote sustainable mobility solutions. Aligned with national initiatives like Viksit Bharat 2047 and the LiFE movement, these changes support India’s Net Zero 2070 ambition and strengthen its adherence to the Paris Agreement by making green alternatives more affordable and accessible to consumers and industries alike.

India, at the 26th Conference of Parties to the UNFCCC in November 2021, announced its target to achieve Net Zero by 2070. The strategy rests on four pillars: India’s minimal historical emissions, rising energy needs, pursuit of low-carbon development, and building climate resilience.[1]

Renewable Energy & Climate Strategy

Solar & Wind Devices [GST reduced from 12% to 5%]

- Solar Cookers

- Bio-gas plant

- Solar power-based devices

- Solar power generator

- Wind mills, Wind Operated Electricity Generator (WOEG)

- Waste to energy plants / devices

- Solar lantern / solar lamp

- Ocean waves/tidal waves energy devices/plants

- Photo voltaic cells, whether or not assembled in modules or made up into panels.[2]

The Ministry of New and Renewable Energy is running a Production Linked Incentive Scheme for High Efficiency Solar PV Modules with an outlay of ₹24,000 crore. The aim is to build large-scale factories in India to produce high-efficiency solar panels, which will increase clean energy production, cut down dependence on imports, and help meet India’s renewable energy goals.[3]

- The reduction in GST will directly decrease the capital costs of solar panels, PV cells, wind turbines, and related devices.

- This reduction will enhance the viability of solar and wind projects, leading to lower tariffs for end consumers.

- The GST rate cuts will bolster domestic manufacturing by supporting India’s solar cell and module manufacturing ecosystem under PLI schemes, making domestic products more competitive against imports.

- This will make solar pumps more affordable, reducing irrigation costs and providing support to farmers.

The installed capacity of solar energy in India has increased more than 42 times, from 2.82 GW in 2014[4] to 119.54 GW[5] as of 31st July, 2025. India has progressively continued decoupling of economic growth from greenhouse gas emissions. The emission intensity of India’s gross domestic product (GDP) has reduced by 36 per cent between 2005 and 2020.

Emission Intensity is calculated by dividing total greenhouse gas (GHG) emissions’ by a country’s gross domestic product (GDP).[6]

Waste Management & Pollution Control

Effluent Treatment (CETPs) [GST reduced from 12% to 5%]

GST on services provided by Common Effluent Treatment Plant reduced from 12% to 5%.

- Reducing taxes on CETPs will motivate industries to use centralized waste treatment methods, resulting in a pollution-free environment and supporting sustainable development in industrial areas.

- This will assist municipal corporations in implementing clean energy solutions for managing waste.

- The GST cuts will create green jobs in areas like waste segregation, plant operations, and maintenance.

As of 4th August, 2025, there are a total of 222 Common Effluent Treatment Plants (CETPs) operating across India, out of which 53 CETPs are designed to achieve Zero Liquid Discharge (ZLD), located in various states.[7]

Plastic Alternatives & Biodegradable Materials

GST Reduction on Biodegradable Bags (18% to 5% GST)

- Reduced GST on biodegradable bags makes them more affordable, encouraging consumers and retailers to move away from single-use plastics and thereby helping to decrease plastic pollution.

- This supports India’s adherence to the Plastic Waste Management Rules, 2022, and reinforce ban on single-use plastics.

- It will promote investment in research and development, and the expansion of bio-polymers, starch-based, and compostable materials.

- Quicker adoption of biodegradable bags will lower plastic leakage into rivers, soil, and marine environments.

- As many biodegradable bag producers are small and medium enterprises or startups, the lower GST facilitates their market entry and increases demand.

Green Mobility & Sustainable Transport

Buses (seating capacity of 10+ persons) [GST down from 28% to 18%]

- Lower tax rate will reduce the upfront cost of buses and minibuses (10+ seater).

- This will spur demand from fleet operators, corporates, schools, tour operators, and state transport undertakings.

- Further encouraging the shift from private vehicles to shared/public transport, reducing congestion and pollution.

- This will also promote fleet expansion & modernization, reducing the usage of old buses.

Commercial Goods Vehicles (Trucks, delivery-vans, etc) [GST down from 28% to 18%]

- Trucks are the backbone of India’s supply chain, carrying 65%-70% of goods traffic.

- The GST rate cuts will encourage fleet expansion and modernization, thereby phasing out older vehicles and leading to lower pollution and emissions.

Conclusion

The GST rationalisation is a major push towards advancing India’s climate goals by making renewable energy, waste management, biodegradable products, and green mobility more affordable and within reach. By cutting costs, encouraging domestic manufacturing, and supporting sustainable industries, these changes will accelerate the adoption of clean energy and pollution control solutions. In doing so, it reinforces India’s commitments under the Paris Agreement and lays the foundation for a cleaner, healthier, and more sustainable future.

References:

- Ministry of Environment, Forest and Climate Change

GST Reforms Power India’s Green Transition

*****

SK | SA

(तथ्य सामग्री आईडी: 149292)

आगंतुक पटल : 877

Provide suggestions / comments