Economy

Delhi After the GST Rate Cuts: What Changes for Consumers and Businesses

Posted On:

25 SEP 2025 16:04 PM

Key Takeaways

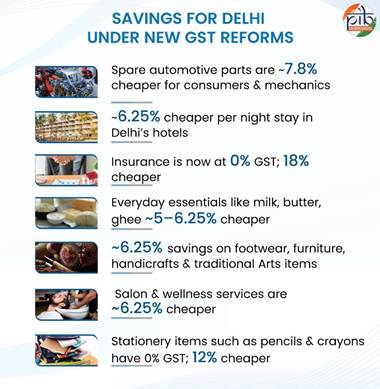

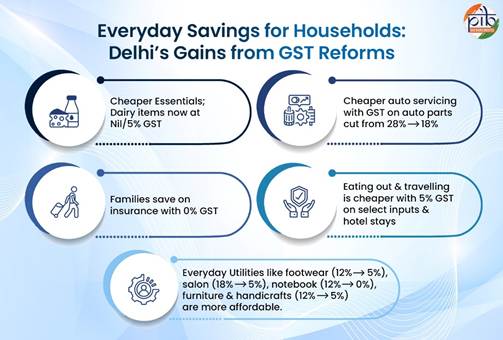

- Everyday essentials like dairy (milk, paneer, ghee), footwear, furniture, stationery and even salon services now cost 6–12% less, easing household budgets.

- Insurance is now GST-free (18% saved on premiums); to directly lift household purchasing power.

- Lower GST on automobiles and parts to support the domestic industry and bring relief to consumers.

- Tourism sector to benefit with under ₹7,500/night becoming ~6.25% cheaper.

|

Introduction

Cheaper essentials, stronger markets and new opportunities for Delhi’s businesses are at the heart of the latest GST reforms. By lowering and rationalising tax rates across a wide range of goods and services, the government has aimed to ease the burden on households while giving a push to economic activity.

For Delhi’s traders, manufacturers and service providers, the change is expected to translate into higher demand and improved competitiveness. From Karol Bagh’s automobile and apparel markets to Sadar Bazar and Khari Baoli’s wholesale trade, Chawri Bazar’s paper hub and the bustling lanes of Chandni Chowk, the impact will be widespread. At the same time, lower rates on mass-consumption goods and essential services will directly reduce costs for families across the state.

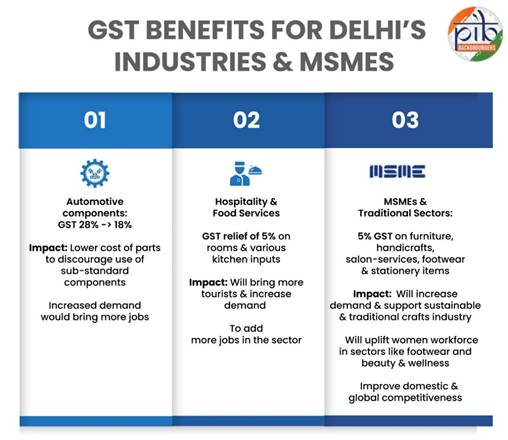

Automotive Components & Aftermarket

Delhi is a major hub for automotive components trading. Areas like Karol Bagh and Kashmere Gate are famous for their wholesale and retail aftermarkets. These family-run businesses and MSMEs form a network that not only serves Delhi’s huge vehicle population but also distributes parts across North India and even exports to neighbouring countries (Delhi auto hubs’ trade is valued ~₹1,000 crore monthly to Bangladesh). Delhi’s markets are a critical distribution node for India’s auto components market which had a turnover of ₹6.14 lakh crore in FY24.

The reduction of GST on auto parts from 28% to 18% will reduce the cost of vehicle maintenance for consumers and mechanics by ~7.8%. Cheaper spare parts mean lower service bills for vehicles, which will encourage owners to replace worn-out parts more promptly. This will improve vehicle safety and efficiency on Delhi’s roads.

For businesses, the tax cut improves the competitive position of the organized, GST-compliant traders. As the price gap narrows, authorized parts have become relatively more affordable, discouraging the use of sub-standard counterfeit components.

Travel and Hospitality Services

As the national capital, Delhi is a major destination for tourists, business travellers and medical tourism. It offers everything from luxury properties to budget stays in Paharganj and Karol Bagh. In 2024, Delhi’s hotel market recorded about 72.9% average occupancy with an average daily rate (ADR) of nearly ₹10,273.

The new GST rate of 5% for rooms below ₹7,500/ night directly reduces the cost of staying in Delhi’s hotels. For example, booking a room at ₹5,000 per night would now attract additional tax of only ₹250 (5%). This makes hotel stays around 6.25% cheaper. These savings accumulate over a multiple-night stay which will result in higher occupancy rates.

To complement room-rate relief, key kitchen inputs used by hotels, restaurants, cafés, and caterers have also been cut from 18% to 5%. The 13-percentage point tax reduction on these crucial kitchen supplies will directly lower the input costs for restaurants and hotels. This will help stabilize menu prices and improve the profitability of small and medium-sized eateries. The tax cuts also benefit Delhi residents as organizing family functions or weddings in hotels is now cheaper. The reduction in kitchen input costs will also make food more affordable for people dining out.

Delhi-NCR is the top city for hospitality job opportunities, with a 20.37% increase in job postings in 2022-23. A sustained boost in the sector would translate into increased job creation and better earnings for the large workforce employed in Delhi’s hotels and restaurants.

Dairy Products

Delhi is a massive consumer of milk and dairy products. The city is served by an extensive supply network from cooperatives like Mother Dairy and Amul. Delhi employs thousands of workers in milk processing plants (like the Mother Dairy plant in Patparganj) and as delivery agents or vendors in local markets.

By eliminating GST on a variety of dairy products, the government has effectively made these items outright cheaper. For instance, with 0% GST, a 200g pack of paneer priced at ₹90 will now be available for ~₹85.7. Similarly, UHT milk, which is preferred amongst urban consumers for its shelf life, is also cheaper. Butter and ghee, which are staples in households, also move from 12% to 5% GST. Making daily food items cheaper is a form of direct stimulus to consumption. Additionally, better nutrition from potentially higher consumption of protein-rich paneer will bring long-term health benefits.

The rise in demand for dairy products will also benefit the dairy companies and cooperatives operating in Delhi. In addition, the benefits of higher sales volumes will ripple back to dairy farmers, improving their income & livelihoods.

Insurance Services

Delhi is a major market for insurance companies as a significant portion of Delhi’s middle-class and salaried residents purchase insurance policies for their families. In FY25, the total premium collected by India’s insurers was around ₹7.05 lakh crore. Additionally, the insurance industry nationally added over 11 lakh new agents in FY25 alone. Being a financial hub with insurance company headquarters and branch offices in Connaught Place and Nehru Place, a good proportion of this workforce is hosted by Delhi.

Removing the 18% GST on health and life insurance premiums is a direct and substantial financial relief for households. Now, every rupee paid in premium strictly goes towards coverage, not tax. Hence, a family paying a total annual premium of ₹1,00,000 for health and life insurance will save ₹18,000 per year. This saved amount effectively acts as an economic stimulus when families redirect it to consumption or investment. In the long run, greater insurance coverage would mean better financial security for Delhi’s citizens.

Furthermore, insurance as a sector employs a large white-collar workforce of agents, underwriters, and administrative staff. Hence, the increased demand for policies would lead to growth in sales which would boost such jobs across Delhi’s financial services ecosystem.

Other Consumer Utilities

Footwear, eco-friendly furniture, beauty and wellness services, and printing-paper packaging all sit in Delhi’s consumer basket while powering its MSME engine. The GST cut on affordable footwear and finished leather along with furniture, printing & stationery items will lower final prices and ease working-capital strain for small traders.

Footwear & Leather Goods

Delhi has major footwear hubs like Karol Bagh, Sadar Bazar, Naraina, and Okhla driving wholesale trade and small-scale manufacturing. The sector is highly labour-intensive and employs large numbers of artisans and workers from weaker sections of society, with nearly 40% women’s participation. Nationally, the industry supports over 4.42 million jobs, while Delhi plays a key role as a trading and finishing hub.

The recent GST cut, from 12% to 5% on footwear and finished leather, directly lowers input costs for manufacturers of bags, belts, and other accessories, improving their competitiveness. This will also increase consumer demand. For instance, shoes priced at ₹2,000 now incurs GST ₹100 (at 5%), making the product ~6.25% cheaper for the consumer.

Furniture

GST on items like bamboo, cane, and rattan furniture is now 5%, improving affordability for households and demand certainty for artisans and small retailers. The furniture sector provides employment to thousands in both formal showrooms and informal workshops across Delhi, with major markets in Kirti Nagar and Panchkuian Road.

The fall in prices will result in increased demand which will provide steadier work for traditional craft units. This move supports sustainable and traditional crafts, aligning with environmental and cultural promotion goals.

Beauty & Wellness Services

GST on Beauty and wellness services has also shifted from 18% (with ITC) to 5% (without ITC), directly reducing the cost of these services for consumers. This will support an industry which is mostly women-intensive, MSME-led workforce of beauticians, therapists, and support staff. Lower end-prices will raise footfall for neighbourhood salons and independent entrepreneurs and help in stabilizing earnings.

Printing, Packaging & Stationery

Exercise books and pencils are now tax-free at 0%. This will ease school costs for families and boost steady retail in stationery markets.

GST on cartons and boxes has also been reduced from 12% to 5%, cutting packaging outlays for small manufacturers and online sellers. Similarly, printing job work has also been moved from 12% to 5%, making organized print shops more competitive.

Overall, these measures have lowered everyday prices for households while strengthening the MSME backbone.

Conclusion

The recent GST reforms provide a multi-sector stimulus to Delhi’s economy. By focusing on key consumption items and essential business inputs, the broad effects will include providing direct relief to households in their everyday expenses, and benefitting businesses and traders, mainly MSMEs, from reduced costs and improved competitiveness.

Hence, these rate cuts are set to boost Delhi’s economy by not only providing immediate relief to consumers especially in the upcoming festive season but also setting path for long-term benefits such as more jobs and resilient markets.

Click here to see PDF

SK/M

Visitor Counter : 50

Provide suggestions / comments

Read this explainer in :

Hindi