Economy

Simplified GST for Growth of Indian Commerce and Trade

Posted On:

05 SEP 2025 17:13 PM

Empowering commerce through simplified taxation

Key Takeaways

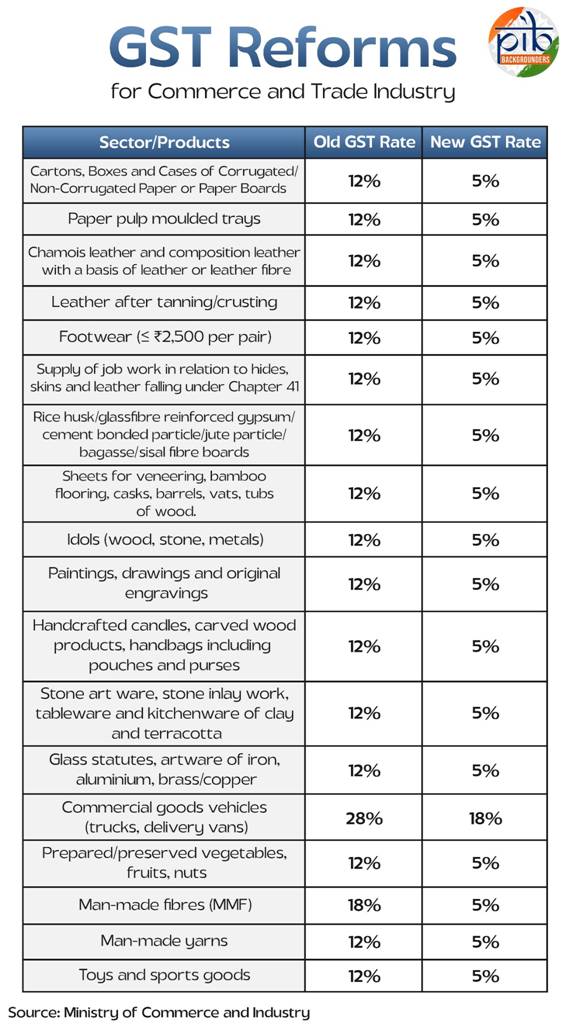

- GST on leather, footwear, and related job work reduced from 12% to 5%.

- On packaging paper GST cut to 5%, and down from 28% to 18% on Commercial Goods Vehicles.

- Textiles see major correction with man-made fibres cut from 18% to 5%, yarn from 12% to 5%.

- On Toys and sports goods, GST reduced from 12% to 5%, making them more affordable.

- Processed fruits, vegetables, and nuts now taxed at 5%, down from 12%.

Introduction

The 56th Meeting of the GST Council, chaired by the Union Finance & Corporate Affairs Minister, on September 3, 2025, has introduced a simplified GST structure with significant rate reductions across key sectors of trade and commerce. Essential industries such as leather, footwear, paper, textiles, handicrafts, toys, packaging, and logistics have been covered under this reform.

By lowering GST slabs to 5% on several goods and rationalising rates in transport and allied sectors, the reforms aim to reduce costs for consumers, ease compliance for traders, and enhance competitiveness for Indian businesses.

"When consumption increases, many goods that are produced at the MSME level will also see higher demand. This will benefit them as their business will grow. On the other hand, with the creation of two slabs, the compliance burden on MSMEs will be greatly reduced."- The Secretary General of ASSOCHAM, Mr. Manish Singhal

The key GST reductions across major sectors of trade and commerce are noted in the following segments.

Leather and Footwear

The leather and footwear sector is a key employer in India, with a strong export base. GST rationalisation here reduces the burden on manufacturers and makes products more accessible to consumers.

- GST reduced from 12% to 5% on Chamois leather, composition leather with a basis of leather or leather fibre, and Leather prepared after tanning or crusting.

- Footwear priced up to ₹2500 per pair now attracts just 5% GST, directly benefiting consumers.

- Supply of job work in relation to hides, skins, and leather (falling under chapter 41) also cut from 12% to 5%, reducing MSME production costs.

- Lower taxation is expected to improve global competitiveness of Indian footwear and leather exports.

E-Commerce, Paper and Packaging

E-commerce is one of the fastest-growing sectors, heavily dependent on cost-effective packaging and logistics. GST reductions in this area lower costs for both businesses and consumers.

- Packing paper, cases, cartons, boxes (of corrugated paper or non-corrugated paper or paper boards) and paper pulp moulded trays now taxed at 5%, reducing packaging and shipping costs per order.

- It reduces logistics and packaging costs, making goods more affordable for consumers. It will help Food processing units, as well.

- This will lower packing cost per shipment and will benefit MSME sellers on e-commerce platforms and in wholesale markets, who gain improved margins and affordability for consumers.

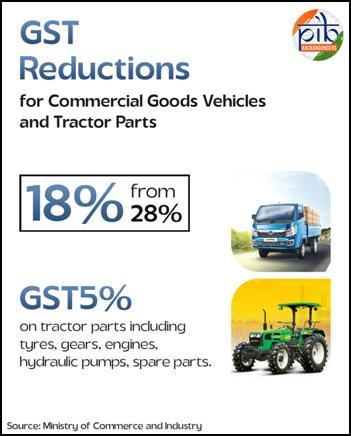

- Reduction in GST on trucks and delivery vans (from 28% to 18%) decreases freight rates per tonne-km, improving efficiency of last-mile deliveries. Trucks are the backbone of India’s supply chain. They carry 65%-70% of goods traffic in India.

- Cheaper trucks will directly help in reducing logistics cost, improving export competitiveness.

- The combined effect supports logistics, warehousing, and online retail ecosystems, enhancing India’s competitiveness in global supply chains.

"It will be very beneficial for the industry as well, especially in the MSME sector, that due to the reduction in the tariff of GST, the demand in the local market will increase, people will be able to buy it easily, and because of that, the economy of India is more likely to be strong."- Vice President of Vilayat Industries Association, Mr. Harish Joshi

Wood Products

Agro-based and eco-friendly wood substitutes see lower taxation, encouraging sustainable manufacturing and MSME competitiveness.

- GST reduced from 12% to 5% on rice husk board, glassfibre reinforced gypsum board, cement bonded particle board, jute particle board, bagasse board, sisal fibre board, etc.

- Sheets for veneering, bamboo flooring, casks, barrels, vats, tubs of wood included.

- Supports MSMEs in wood manufacturing and promotes eco-friendly alternatives.

- This will make the products of many MSME wood manufacturing units competitive.

Handicrafts

The handicrafts sector, vital for artisans and exports, benefits from tax rationalization, making traditional goods more affordable and globally competitive.

- GST cut from 12% to 5% on idols made of wood, stone, and metals.

- Applies to paintings, drawings, original engravings, handcrafted candles, carved wood products, handbags including pouches and purses, stone art ware, stone inlay work, tableware and kitchenware of clay & terracotta.

- Covers Glass statutes, artware of iron, aluminium, brass/copper, etc.

- Reforms strengthen India’s cultural economy and artisanal livelihoods.

"Now, GST has brought a new golden age for both traders and consumers in our nation. From today, a golden era and a golden realm have also arrived for our traders and consumers."- Financial Advisor at Chamber of Commerce, Mr. Praveen Sahu

Commercial Goods Vehicles

As the backbone of India’s logistics, trucks and delivery vans benefit from GST cuts that lower transport and export costs.

- GST reduced from 28% to 18% on commercial goods vehicles.

- Reduces capital costs for truck owners, lowering freight rates per tonne-km.

- This will have a cascading effect. It will lead to cheaper movement of agri goods, cement, steel, FMCG, and e-commerce deliveries. It will reduce inflationary pressures.

- Supports MSME truck operators, who form a large share of India’s road transport sector.

Tractor Parts

India is one of the world’s largest tractor markets and this GST cut will push demand in both domestic and export segments. Agriculture-linked manufacturing sees a boost as tractors and their parts now attract lower GST, supporting both farmers and industry.

- The components for tractor manufacturing like tyres, gears etc. will also be taxed at 5%.

· Ancillary MSMEs making engines, tyres, hydraulic pumps, and spare parts will benefit from higher production. The GST Cut will also strengthen India’s positioning as a global tractor manufacturing hub.

Fruits, Vegetables & Food Processing

Agro-processing industries gain from reduced GST, promoting cold storage and reducing food wastage. Reduction of GST on most of the food items to 5% or NIL strengthens the entire food processing value chain from farmers to MSMEs, from retailers to exporters.

- Prepared and preserved vegetables, fruits, and nuts taxed at 5% (down from 12%).

- It encourages investment in cold storage, food processing, and value addition.

- Helps farmers realise better prices for their produce and reduces wastage of perishables.

- Enhances exports of processed food items, strengthening India’s agri-export hub positioning.

Textile

The GST rationalisation in textiles removes structural anomalies, reduces costs, boosts demand, supports exports, and sustains jobs. It will strengthen the entire textile value chain from fibre to garment, by reducing cost distortions. It will also correct anomalies at the fibre stage, reducing costs at yarn/fabric stage, boosting garment affordability, reviving demand at retail stage, and enhancing export competitiveness. This will give impetus to Fibre neutral policy.

- Man-made fibres (MMF) GST reduced from 18% to 5%.

- Man-made yarns cut from 12% to 5%.

- The reduction will correct the Inverted Duty Structure (IDS) issue in MMF. It will align fibre, yarn, and fabric rates, removing longstanding anomalies that increased working capital burden for manufacturers.

- It will make synthetic textiles more competitive, reducing reliance on imports.

- The rate cut will make Indian MMF-based garments more price-competitive in global markets, supporting India’s ambition to become a global textile hub. It will support the exporters.

Toys & Sports Goods

The toy industry, important for child development and MSME manufacturing, benefits from reduced GST.

- GST on toys and sports goods cut from 12% to 5%.

- Makes toys more affordable, encouraging early childhood learning through play.

- Boosts “Vocal for Local” initiative by supporting domestic MSME toy makers.

- Protects against influx of cheap imports from neighbouring countries.

Conclusion

“We had never thought that what PM Modi envisioned would be implemented so soon. The speed of implementation is key. This is a great incentive for the common man. This is a big step for the ease of doing business. The basic needs of the common man have been taken care of. This will give a huge boost to the economy." - President of the PHD Chamber of Commerce and Industry (PHDCCI), Mr. Hemant Jain

By lowering rates across industries such as leather, footwear, e-commerce, textiles, handicrafts, toys, agro-processing, and logistics, the government has reduced compliance costs, enhanced affordability for consumers, and improved margins for MSMEs. These measures not only ease the cost of doing business but also align with broader national priorities of promoting exports, supporting artisans and farmers, and encouraging sustainable manufacturing. Collectively, the reforms reinforce India’s growth trajectory by creating a more efficient, inclusive, and globally competitive tax framework.

References

Ministry of Finance

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=2163555

Ministry of Commerce and Industry

Expert Quotes

https://x.com/ANI/status/1963461303953232028

https://x.com/ians_india/status/1963476413069365741

https://x.com/ians_india/status/1963560752478134444

https://x.com/ians_india/status/1963475101094932852

Download in PDF

***

SK | SM

(Factsheet ID: 149265)

Visitor Counter : 174

Provide suggestions / comments