Economy

India’s Economic Surge

With 6.5% GDP growth, India stands as the fastest growing major economy

Posted On:

06 JUL 2025 11:31AM

|

“In this global milieu, the Indian economy remains a key driver of global growth. Growth momentum is buoyed by strong domestic growth drivers, sound macroeconomic fundamentals and prudent policies.”

~ Sanjay Malhotra, RBI Governor

|

|

Key Takeaways

- India’s GDP grew 6.5% in 2024–25, the highest among major economies.

- Inflation fell to 2.82% in May 2025, the lowest level since February 2019.

- Total exports reached a record USD 824.9 billion in 2024–25.

|

Introduction

India’s economy continues to grow at a steady and confident pace, standing out as the fastest growing major economy in the world. Gross Domestic Product (GDP) is a measure of size and health of the economy. It is the total value of all the goods and services produced within a country. In 2024–25, real GDP growth was estimated at 6.5 per cent. The Reserve Bank of India expects the same rate to continue in 2025–26. This performance comes at a time when the global economy faces uncertainty, making India’s steady momentum all the more significant.

Supported by strong domestic demand, easing inflation, robust capital markets and rising exports, the broader economic picture is one of resilience and balance. Key indicators such as record foreign exchange reserves, a manageable current account deficit, and increasing foreign investment reflect growing global trust in India’s long-term prospects. Together, these trends show an economy that is not only expanding but doing so with strength across sectors.

Robust GDP Growth

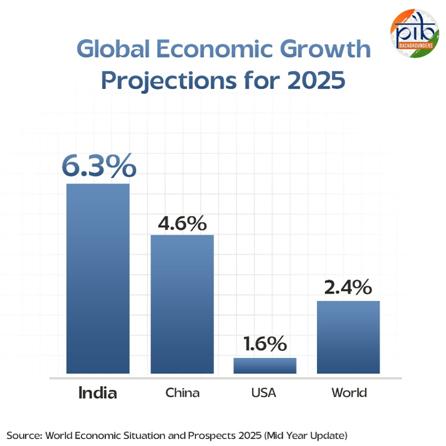

India’s growth story continues to draw global attention, backed by strong fundamentals and consistent performance. Real GDP, which measures the economy’s output after removing the effects of inflation, expanded by 6.5 per cent in 2024–25. The Reserve Bank of India expects this pace to continue into 2025–26. Other projections echo this optimism, with the United Nations forecasting growth of 6.3 per cent this year and 6.4 per cent next year, while the Confederation of Indian Industry places its estimate slightly higher at 6.40 to 6.70 per cent.

This sustained performance is being driven by strong domestic demand. Rural consumption has picked up, city spending is rising, and private investment is on the upswing. Businesses are expanding capacity, with many operating near their maximum output levels. At the same time, public investment remains high, especially in infrastructure, while stable borrowing conditions are helping firms and consumers make forward-looking decisions.

Global conditions, by contrast, remain fragile. The United Nations has described the world economy as being in a “precarious moment,” citing trade tensions, policy uncertainties, and declining cross-border investments. Amid this, India continues to stand out as a bright spot, with global institutions and industry bodies expressing confidence in its growth prospects.

Over the past decade, India’s economic size has expanded sharply. In 2014–15, the GDP at current prices was ₹106.57 lakh crore. This figure is expected to rise to ₹331.03 lakh crore in 2024–25, nearly tripling in ten years. In the past year alone, nominal GDP increased by 9.9 per cent, while real GDP rose by 6.5 per cent, underscoring the economy’s continued resilience and vigour.

Inflation Under Control

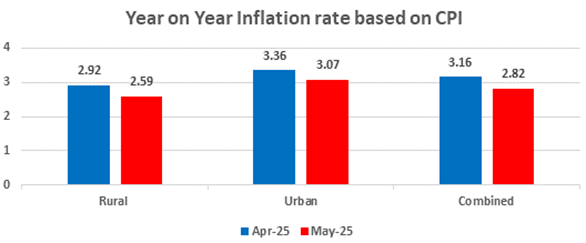

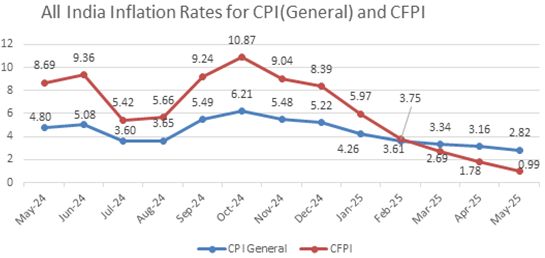

Inflation in India has eased sharply, offering relief to both households and businesses. In May 2025, the year-on-year inflation rate based on the Consumer Price Index (CPI) stood at 2.82 per cent. This marks the lowest level since February 2019. It also reflects a drop of 34 basis points from the previous month.

Food prices, which often have a big impact on overall inflation, have also cooled. The Consumer Food Price Index (CFPI) recorded an inflation rate of just 0.99 per cent in May 2025. This is the lowest food inflation seen since October 2021. Rural and urban food inflation were almost identical, at 0.95 per cent and 0.96 per cent, respectively. Compared to April 2025, food inflation declined by 79 basis points, showing a clear downward trend in essential items like vegetables and grains.

According to the Reserve Bank of India’s Financial Stability Report released in June 2025, the outlook for inflation remains favourable. Food prices are expected to stay stable due to robust crop production. On the global front, the risk of imported inflation appears low for now. A slowdown in global demand is likely to keep prices of crude oil and other commodities in check. However, recent tensions in the Middle East have added some uncertainty to this picture.

Overall, the Reserve Bank believes that inflation will stay aligned with its medium-term target of 4 per cent. In fact, it may even fall slightly below that level in the coming months. This easing trend gives confidence that the current price stability is not temporary, but part of a broader pattern of economic stability.

Market Confidence at Record Levels

India’s capital markets are booming, and the confidence is visible. They have become a powerful engine for economic growth by turning household savings into investments. Despite global tensions and domestic uncertainties, the stock market maintained strong performance by December 2024. It outperformed many other emerging economies, showing how investors, both local and global, trust India’s growth story.

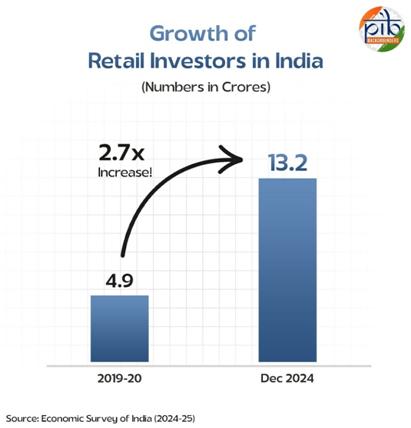

Retail participation has risen sharply. The number of retail investors jumped from 4.9 crore in 2019 to 13.2 crore by the end of 2024. This increase shows a growing public interest in equity markets and a belief in the country’s long-term potential. More people now see the stock market as a way to build wealth, not just for large companies but for ordinary citizens too.

The primary market, where companies raise funds by selling shares to the public, has also been very active. Between April and December 2024, India saw 259 initial public offerings or IPOs. This was a 32.1 per cent rise compared to the same period the year before. The total money raised through these IPOs almost tripled, rising from ₹53,023 crore to ₹1,53,987 crore. India’s share in global IPO listings rose from 17 per cent in 2023 to 30 per cent in 2024, the highest in the world.

Strengthening External Sector

India’s external sector continues to provide a strong cushion for the economy. With rising foreign exchange reserves, a manageable current account balance, and steady inflows of foreign investment, India is well placed to deal with global uncertainties. These indicators reflect growing international confidence in the country’s economic policies and long-term stability.

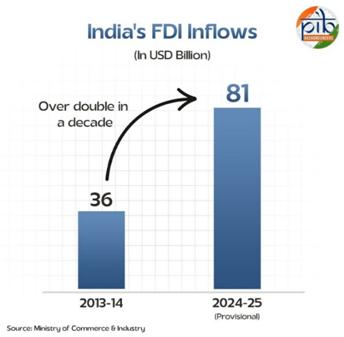

Foreign Direct Investment

India continues to be a top choice for global investors. The country has an investor-friendly FDI policy, allowing 100 per cent foreign ownership in most sectors through the automatic route. As a result, FDI inflows rose to a USD 81.04 billion (provisional) in FY 2024–25, marking a 14 per cent increase from USD 71.28 billion in FY 2023–24. This is more than double the USD 36.05 billion received in FY 2013–14, showing long-term progress.

The services sector led the inflow of equity investments, attracting 19 per cent of total FDI in FY 2024–25. This was followed by computer software and hardware at 16 per cent, and trading at 8 per cent. FDI into the services sector grew by 40.77 per cent, reaching USD 9.35 billion, compared to USD 6.64 billion the previous year. In the manufacturing segment, FDI grew by 18 per cent, from USD 16.12 billion in FY 2023–24 to USD 19.04 billion in FY 2024–25.

Foreign Exchange Reserves

India’s foreign exchange reserves stood at USD 697.9 billion as of 20 June 2025. These reserves are enough to cover more than 11 months of goods imports, providing a safety net in times of global shocks. This means that even if exports slow down, India has enough foreign currency to pay for essential imports. At the same time, external debt remains at a moderate level, accounting for 19.1 per cent of the GDP as of March 2025. These numbers show that India’s financial position with the rest of the world is healthy and stable.

India’s current account balance recorded a surplus of USD 13.5 billion (1.3 per cent of GDP) in Q4:2024–25, compared with USD 4.6 billion (0.5 per cent of GDP) in the same quarter of the previous year. This improvement highlights the growing strength of India’s export earnings and the stability of foreign inflows.

In FY 2024–25, the current account deficit was contained at just 0.6 per cent of GDP. The low deficit was mainly due to strong services exports and steady remittances from Indians living abroad.

Manufacturing and Exports

India’s export performance continues to reflect the growing strength of its economy, particularly in services and high-value manufacturing. Over the past decade, the country has steadily expanded its footprint in global trade. This growth has been powered by stronger industrial capacity, greater competitiveness in services, and the rise of strategic sectors like defence production and electronics.

India’s total exports touched a new high of USD 824.9 billion in 2024–25, growing by 6.01 per cent from USD 778.1 billion in 2023–24. This marks a sharp rise from USD 466.22 billion in 2013–14, underlining a decade of sustained export momentum.

Services exports remain a key contributor. In 2024–25, India exported USD 387.5 billion worth of services, a 13.6 per cent increase over the previous year’s USD 341.1 billion. A decade ago, in 2013–14, services exports stood at USD 152 billion. This strong and consistent growth highlights India’s ability to deliver high-quality services to global clients, particularly in IT, consulting, finance, and digital technologies.

Merchandise exports, excluding petroleum products, also achieved a record. In 2024–25, these exports reached USD 374.1 billion, growing by 6.0 per cent from USD 352.9 billion in the previous year. This is the highest non-petroleum merchandise export figure ever recorded. It also reflects a significant improvement from USD 314 billion in 2013–14. Much of this growth has come from sectors such as machinery, chemicals, electronics, and defence equipment, which are gaining traction in global markets.

Underlying this export growth is the steady rise in manufacturing. As per the Ministry of Statistics and Programme Implementation, the Gross Value Added (GVA) of manufacturing at constant prices rose from ₹15.6 lakh crore in 2013–14 to ₹27.5 lakh crore in 2023–24. The sector’s share in the economy remained stable at around 17.3 per cent, but the nearly twofold increase in output shows its expanding base.

Conclusion

India’s economic performance over the past year reflects not just growth, but a deeper sense of stability and direction. With real GDP rising at 6.5 per cent and inflation easing to its lowest in years, the country has shown that it can balance expansion with price stability. At the same time, strong participation in capital markets, record levels of exports, and healthy foreign exchange reserves point to growing confidence both at home and abroad.

Key sectors such as manufacturing, services, and infrastructure are pushing ahead, supported by steady investment and policy focus. External risks remain, but India’s fundamentals are sound. As the global economy continues to face challenges, India’s consistent performance offers reassurance that it is well placed to lead from the front and keep building a stronger, more inclusive future.

References:

RBI:

PIB Backgrounders:

Ministry of Commerce and Industry:

Ministry of Statistics & Programme Implementation:

Click here to download PDF

*******

RT/M

(Explainer ID: 154840)

आगंतुक पटल : 40586

Provide suggestions / comments