Economy

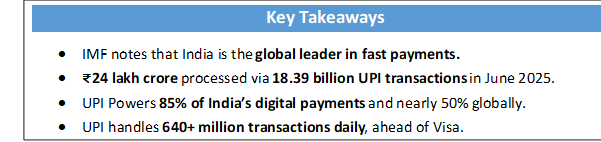

India’s UPI Revolution

Over 18 billion Transactions Every Month, A Global Leader in Fast Payments

Posted On:

20 JUL 2025 10:40AM

Introduction

India has emerged as the global leader in fast payments, according to a recent note by the International Monetary Fund titled Growing Retail Digital Payments: The Value of Interoperability. At the heart of this transformation is the Unified Payments Interface, better known as UPI. Launched in 2016 by the National Payments Corporation of India, UPI has changed how people send and receive money in the country.

It brings all your bank accounts together in one mobile app. You can transfer money instantly, pay merchants, or send funds to friends with just a few taps. Its appeal lies in its speed and ease of use. Today, UPI processes over 18 billion transactions every month in India.

This shift has taken India away from cash and card-based payments and pushed it towards a digital-first economy. Millions of individuals and small businesses now rely on UPI for safe and low-cost transactions. By making payments quick and accessible, UPI has become a powerful tool for financial inclusion.

India’s leadership in real-time payments is not an accident. It reflects years of bold digital groundwork and a vision to use technology for inclusive growth. UPI is no longer just a payment system. It is a global benchmark for innovation in public digital infrastructure.

UPI in Figures: A Snapshot of Success

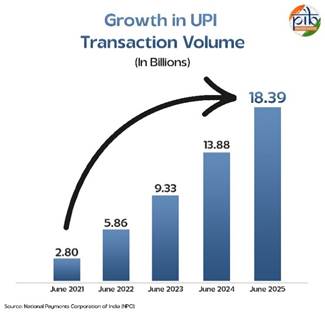

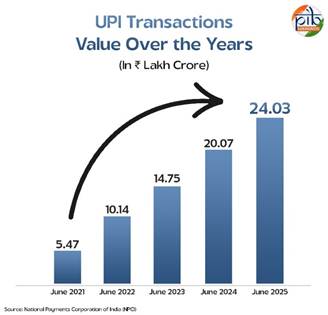

The scale of UPI today is remarkable. In June 2025 alone, it handled over ₹24.03 lakh crore in payments. This was spread across 18.39 billion transactions. Compared to the same month last year, when there were 13.88 billion transactions, the growth is clear. There is an increase of about 32 per cent in just one year.

The UPI system now serves 491 million individuals and 65 million merchants. It connects 675 banks on a single platform, allowing people to make payments easily without worrying about which bank they use.

Today, UPI accounts for 85 per cent of all digital transactions in India. Its impact goes beyond national borders, powering nearly 50 per cent of global real-time digital payments.

These figures show more than just numbers. They reflect trust, convenience and speed. Every month, more individuals and businesses choose UPI for their payments. This growing use is a strong sign that India is moving steadily towards a cashless economy.

UPI Leads the World in Real Time Payments

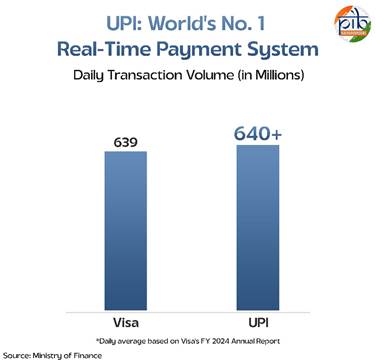

India’s Unified Payments Interface is also now the world’s number one real-time payment system. It has surpassed Visa to take the lead in processing daily transactions. UPI handles more than 640 million transactions every day, compared to Visa’s 639 million. This scale is extraordinary, especially when you consider that UPI achieved it in just nine years.

As mentioned earlier, UPI now accounts for almost 50 per cent of transactions globally. This shows the strength of an open and interoperable system built for speed and simplicity.

The success story does not stop at home. UPI is making its presence felt across borders. It is already live in seven countries, including the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France and Mauritius. Its entry into France is a milestone because it is UPI’s first step into Europe. This allows Indians travelling or living there to pay seamlessly without the usual hassles of foreign transactions.

India is also pushing for UPI to become a standard within the BRICS group, which now has six new member nations. If this happens, it will improve remittances, boost financial inclusion and raise India’s profile as a global tech leader in digital payments.

Interoperability and UPI

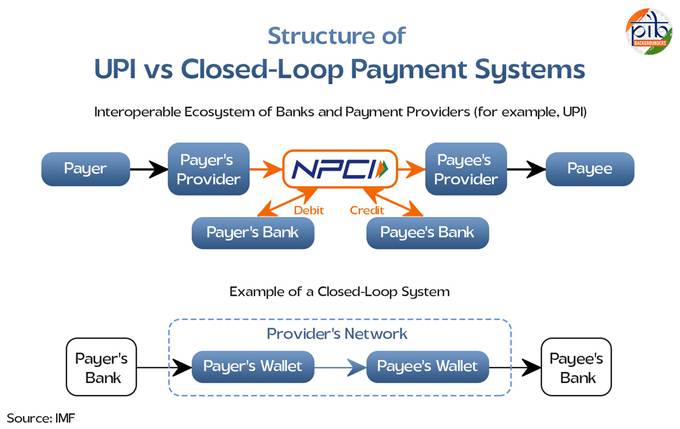

Interoperability means different systems can work together smoothly. In payments, it allows people to send and receive money even if they use different banks or apps. For this to happen, all parts of the system must follow common rules. These include technical standards so the software works together, clear ways to interpret shared information, and agreed rights and responsibilities for everyone involved.

Before UPI, digital payments in India were limited by closed-loop systems. A closed-loop system is one where transactions can only happen within the same platform. For example, a wallet app allowed transfers between its own users but not to someone using a different wallet. Similarly, while people could use IMPS to move money between banks, they could not do so through third-party apps.

UPI changed this. It connected banks and fintech apps through a common platform. Now, a user can pick any UPI-enabled app and pay someone using another app, without worrying about which bank they use. This is true interoperability in action.

This openness has two big benefits. First, users have the freedom to choose their favourite app, based on trust or ease of use. Second, it creates healthy competition among providers to offer better features and security. As more apps join and improve, people get more choices and better services. This has helped UPI grow quickly and become part of everyday life for millions.

How UPI Has Changed Everyday Life

UPI has made digital payments part of daily life in India. It brings ease, speed, and safety to even the smallest transactions. Here is how it impacts ordinary people:

- Money Anytime, Anywhere: No need to stand in queues or wait for bank hours. UPI lets people send or receive money instantly, 24x7, right from their mobile phones.

- One App for All Accounts: Managing money is simpler. People can link all their bank accounts in one app instead of juggling multiple platforms.

- Safe and Quick Payments: With secure two-step authentication, payments happen in seconds without compromising safety.

- Privacy First: Users no longer share sensitive bank details. A simple UPI ID is enough, reducing risks for everyone.

- QR Code Convenience: Paying with UPI is as simple as scanning a QR code. This helps speed up transactions at shops and service points.

- No More Cash-On-Delivery Hassles: Online shopping becomes easier as UPI replaces the need to keep exact change for deliveries.

- Payments for Everything: People can now pay bills, donate, or recharge phones without stepping out of their homes.

- Help Is Just a Tap Away: Any issue with a payment can be reported directly in the app, making grievance redressal easy.

The Digital Foundation Behind UPI

UPI’s rise as the world’s leading real-time payment system was not an accident. It is the result of years of planning and investment in digital infrastructure. India built a strong foundation that brought millions into the formal financial system, gave them secure digital identities and connected them through affordable internet. This combination created the perfect environment for UPI to grow and succeed.

Pradhan Mantri Jan Dhan Yojana

Financial inclusion was the first big step. The Jan Dhan scheme opened bank accounts for millions who had never used formal banking before. As of July 9 2025, over 55.83 crore accounts have been created. These accounts give people direct access to government benefits and a safe place to save money.

Aadhaar and Digital Identity

Aadhaar provided a unique identity for every resident. Each person gets a number linked to their biometrics, making authentication easy and reliable. This system ensures that benefits and services reach the right person. Since inception, over 142 crore Aadhaar cards have been generated cumulatively as on 30th June 2025, forming the backbone of many digital services, including UPI.

Connectivity and the 5G Revolution

The next pillar was connectivity. India achieved one of the fastest 5G rollouts in the world, with 4.74 lakh base stations now active and covering almost all districts. This supports a massive mobile subscriber base of 116 crore in 2025. At the same time, internet data costs have fallen sharply from ₹308 per GB in 2014 to just ₹9.34 in 2022. With fast networks and affordable data, more people than ever can access digital services.

Conclusion

India has emerged as the global leader in fast payments, and UPI is at the heart of this achievement. It has not only made digital transactions quick and secure but has also set a new global standard for innovation in public digital infrastructure.

What started as a simple system to link bank accounts to mobile apps has become the backbone of a digital-first economy. Its growth is built on strong foundations of financial inclusion, digital identity and affordable connectivity. UPI’s expansion into other countries highlights its global potential. As more nations adopt this model, India’s vision of a secure, real-time, and open payment system is influencing the future of digital finance.

The UPI story is far from over. It is a story of technology designed for people, and it will continue to connect lives and economies around the world.

References:

NPCI:

PIB Backgrounders:

MyGov:

IMF:

Click here to see PDF

RT/M

(Explainer ID: 154912)

आगंतुक पटल : 32361

Provide suggestions / comments