Economy

Social Security Boost for India’s Gig Workers

Posted On:

30 AUG 2025 9:52AM

|

Key takeaways

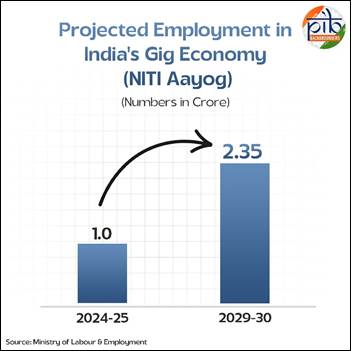

- India’s gig workforce is projected to grow from 1 crore in 2024–25 to 2.35 crore by 2029–30.

- Code on Social Security, 2020 provides legal recognition and social security benefits to gig and platform workers.

- e-Shram portal has registered over 30.98 crore unorganised workers, including 3.37 lakh platform workers.

- Uttar Pradesh, Bihar, and West Bengal have the highest registrations, with strong female participation.

|

Introduction: The Rise of India's Gig Workforce

India’s rapidly growing gig workforce is driving a new wave of economic change across the world. With its half-a-billion-strong labour force, the world’s youngest population, fast-paced urbanisation, and the widespread use of smartphones and digital tools, the country is emerging as a key hub for this transformation.

The gig and platform economy is creating fresh opportunities in areas such as ridesharing, delivery services, logistics, and professional work. According to NITI Aayog, the sector expected to employ over 1 crore workers in 2024–25, with the number projected to grow to 2.35 crore by 2029–30.

Social Security and Support for Gig and Platform Workers

The Code on Social Security, 2020, passed by Parliament, for the first time defines ‘gig workers’ and ‘platform workers’ and provides measures for their social security. This includes benefits such as life and disability cover, accident insurance, health and maternity benefits, and old age protection.

|

Gig workers earn their livelihood outside the traditional employer–employee setup. Platform-based workers are subset of gig workers whose work depends on online apps or digital platforms of the aggregator platforms.

|

Recognizing the contribution of the platform workers to the nation’s economy, Union Budget 2025-26 announced provisions for

- Registration of online platform workers on e-Shram portal,

- Issue of identity cards, and

- Healthcare coverage under Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY).

The AB-PMJAY health scheme provides a cover of Rs. 5 lakhs per family per year for secondary and tertiary care hospitalization across over 31,000 public and private empanelled hospitals in India. The AB-PMJAY scheme for platform workers is yet to be launched.

|

The Code on Social Security, 2020 (SS Code, 2020) consolidates and simplifies nine central labour laws relating to social security. Its main goal is to extend social security benefits to all employees and workers, including those in the unorganised, gig, and platform economy.

Key provisions:

1. Laws Merged

The following Acts stand repealed and merged into the Code:

- Employees’ Compensation Act, 1923

- Employees’ State Insurance Act, 1948

- Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

- Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959

- Maternity Benefit Act, 1961

- Payment of Gratuity Act, 1972

- Cine Workers Welfare Fund Act, 1981

- Building and Other Construction Workers’ Cess Act, 1996

- Unorganised Workers’ Social Security Act, 2008

2. Wider Coverage

- Extends social security benefits to employees in the organised sector, unorganised sector, self-employed, and for the first time, gig workers and platform workers.

3. Social Security Schemes

- Central and State Governments can frame schemes covering:

- Provident fund and pension

- Employees’ State Insurance (health, disability, accident cover)

- Gratuity

- Maternity benefits

- Other benefits such as life cover, old-age protection, and crèche facilities

4. Provisions for Unorganised, Gig, and Platform Workers

- Gig and platform workers (e.g., app-based workers) are recognized in the Code.

- They are eligible for social security schemes funded by government, aggregators/platforms, and sometimes the workers themselves.

- Setting up of Social Security Fund to support such workers.

The Code also has a provision to constitute a National Social Security Board to look after the welfare of gig and platform workers.

|

e-Shram Portal: A Database for Unorganised Workers

The Ministry of Labour and Employment launched the e-Shram portal on 26 August 2021 to build a comprehensive National Database of Unorganised Workers (NDUW) including platform

workers, migrant workers, agriculture workers etc.

The e-Shram portal is meant to register and support the unorganised workers by providing them a Universal Account Number (UAN) on a self-declaration basis.

As of 3 August 2025, more than 30.98 crore unorganised workers have registered, including over 3.37 lakh platform and gig workers.

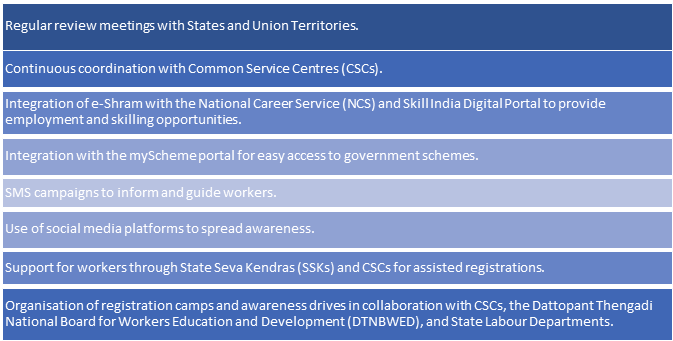

Steps to Promote e-Shram Registration

The Ministry of Labour and Employment has taken various steps to promote registrations on eShram portal and increase awareness among unorganised workers, such as:

Top States reporting the highest number of registrations

The portal has recorded the highest number of registrations from Uttar Pradesh (8.39 crore), followed by Bihar (3.00 crore) and West Bengal (2.64 crore). These numbers reflect the unorganised workforce in these states and the government’s efforts to register and support workers across the country.

Women form a significant portion of these registrations, with Uttar Pradesh leading at 4.41 crore female registrants, followed by Bihar (1.72 crore) and West Bengal (1.44 crore).

Conclusion

India’s gig and platform economy is rapidly transforming the labour market, creating new opportunities while presenting unique challenges in terms of social security and welfare. Through initiatives like the Code on Social Security (2020) and the e-Shram portal, the government is taking concrete steps to recognise, protect, and empower gig and platform workers.

By facilitating registration, providing health and accident coverage, and ensuring easy access to benefits, these measures aim to bring platform workers into the mainstream and strengthen the nation’s workforce. As the sector grows, continued support, awareness, and innovative policy interventions will be crucial in ensuring that every gig worker can work with dignity, security, and opportunity.

References

Ministry of Labour & Employment

Niti Aayog

Click here to see pdf

****

SK/ M

(Explainer ID: 155119)

आगंतुक पटल : 5493

Provide suggestions / comments