Economy

India’s GDP Surge: Driving the Growth Story

Posted On:

30 AUG 2025 6:14PM

Key Takeaways

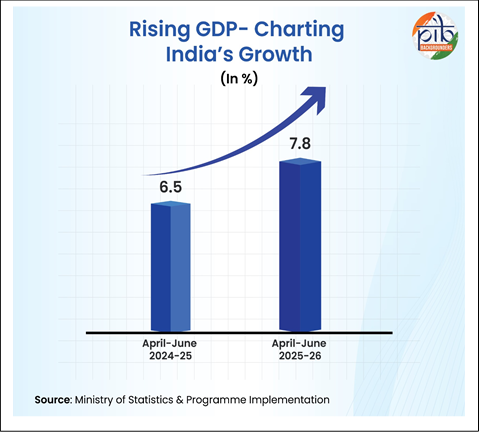

· Real GDP is likely to grow by 7.8% in Q1 of FY 2025-26 vs. 6.5% in Q1 of FY 2024-25.

· By 2030, India is set to become the world’s third-largest economy with a projected GDP of $7.3 trillion.

- India’s employment has surged, with 17 crore jobs created in the past decade.

- New reforms like Next-generation GST are underway and PM Viksit Bharat Rozgar Yojana has been launched towards realizing the goal of Viksit Bharat 2047.

|

Introduction

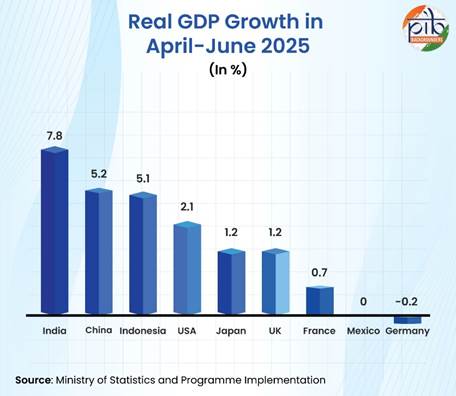

India’s strong services activity has helped GDP growth comfortably beat expectations for the second quarter in a row, rising to an impressive high of 7.8% for April-June 2025. The swift growth in the first quarter of the current financial year further consolidates India’s position as the world’s fastest growing major economy.

Currently the world’s fourth-largest economy, India is on track to become the third-largest by 2030 with a projected $7.3 trillion GDP. This momentum is powered by decisive governance, visionary reforms, and active global engagement. Notably, growth is accelerating, with real GDP expected to rise by 7.8% in Q1 FY 2025-26, up from 6.5% a year earlier.

The ascent is powered by strong domestic demand and transformative policy reforms, making India a prime destination for global capital. With easing inflation, higher employment, and buoyant consumer sentiment, private consumption is expected to further drive GDP growth in the coming months.

Growing Gross Domestic Product (GDP)

Gross Domestic Product (GDP) reflects the size and health of an economy by capturing the total value of goods and services produced within a country. Real GDP, which measures the economy’s output after removing the effects of inflation, grew by 6.5% in Q1 of 2024–25. In Q1 of FY 2025-26, real GDP is estimated at ₹47.89 lakh crore, against ₹44.42 lakh crore in Q1 of FY 2024-25, depicting an impressive growth of 7.8%.

- In Q1 of FY 2025-26, allied sector, comprising agriculture, livestock, forestry & fishing and mining & quarrying grew by 3.7% in, up from 1.5% in the prior corresponding period.

- Secondary sector, comprising manufacturing, electricity, gas, water supply & other utility services and construction posted strong gains, with manufacturing (7.7%) and construction (7.6%) both crossing the 7.5% growth mark.

- Tertiary sector recorded a robust 9.3% growth at constant prices, higher than 6.8% in Q1 FY 2024-25.

In our view, Q1 numbers reflect the basic resilience of our economy. It reflects strengthening of the momentum in the economy and it is anchored in strong macroeconomic fundamentals. On the supply side, we have seen an all-round growth. On the manufacturing, construction and service side activity, as well as the fact that agriculture side has shown a robust growth. The rabi harvest as well as kharif sowing have been much in excess of the last quarters. We have a good buffer stock. We have had a good rainfall...On the demand side the primary drivers have been domestic and in our economy, net exports don't contribute so much on the demand side. - Anuradha Thakur, Economic Affairs Secretary, Ministry of Finance

|

The sharp pick-up in growth in April-June 2025 has been catalysed by the services sector growth hitting a high of 9.3%. All components of the services sector, such as trade, hotels, transport, communication and services related to broadcasting, financial, real estate & professional services and public administration, defence & other services have been on an upward trajectory. GVA growth, which is seen as a more meaningful measure of activity levels, registered a high of 7.6% in April-June 2025. GVA is arrived at by subtracting net indirect taxes, indirect taxes after adjusting for subsidies – from the GDP.

Notably, India is projected to reach a GDP of Rs. 4,26,45,000 crore (US$ 5 trillion) by 2027 and is on course to surpass Germany by 2028. By 2030, India is set to become the world’s third-largest economy with a projected GDP of $7.3 trillion.

Industrial Production (IIP)

Index of Industrial Production (IIP) measures the change in the physical volume of output in the industrial sector over a specific period, usually monthly, compared to a chosen base year. It tracks the production of a "basket" of industrial products from sectors like mining, manufacturing, and electricity, providing insights into the health and trends of an economy's industrial performance. It is integral for economic planning and estimating a sector's contribution to GDP.

- Notably, the IIP growth rate for the month of July 2025 was 3.5%, an impressive uptick against 1.5% in the month of June 2025, driven by 5.4% growth in manufacturing sector.

- Within the manufacturing sector, 14 out of 23 industry groups recorded a positive growth in July 2025 over July 2024. The top three positive contributors for the month of July 2025 were manufacture of basic metals (12.7%), manufacture of electrical equipment” (15.9%) and manufacture of other non-metallic mineral products (9.5%).

Increasing GST Subscriber Base

On 1 July 2025, the Goods and Services Tax (GST) completed eight years. Introduced in 2017, GST replaced a web of indirect taxes with a unified system, simplifying compliance, reducing costs, and enabling seamless movement of goods across states.

India follows a four-slab structure of 5%, 12%, 18% and 28%, decided by the GST Council. Today, there are over 1.52 crore active GST registrations, with Uttar Pradesh, Maharashtra, Gujarat, Tamil Nadu, and Karnataka together accounting for nearly half. Encouragingly, 20% of taxpayers include at least one-woman member, and 14% are entirely women-owned, reflecting rising formalisation and inclusivity.

GST has also promoted price convergence across states, strengthening its role as a national equaliser. Looking ahead, next-generation reforms will be launched in October 2025, aimed at reducing taxes on essentials, easing MSME compliance, and creating a more transparent, citizen-friendly tax system.

Capital Expenditure (CAPEX)

Capital expenditure (CAPEX) plays a crucial role in contributing to national investment and enhancing the stock of physical assets within the economy. It leads to the creation of long-term assets, which not only generate revenue for many years but also improve the overall operational efficiency of economic activities. CAPEX is fundamental to expanding production capacity, thereby serving as a catalyst for accelerated economic growth. This growth, in turn, supports job creation and enhances labour productivity. In 2024-25, CAPEX was ₹10.52 trillion, surpassing revised estimates.

Notably, the quality of expenditure, measured as the ratio of capital expenditure to revenue expenditure, has remained higher than 0.27 for the past three years, almost double the pre-COVID average. Union government CAPEX was up 8.2% in July-November 2024 and is expected to pick up further pace.

From the angle of aggregate demand in the economy, Real Private Final Consumption Expenditure (PFCE) numbers have been impressive. PFCE is the total value of goods and services purchased by resident households and non-profit institutions serving households, adjusted for inflation to show the actual volume of consumption rather than just price changes. On the same lines, Government Final Consumption Expenditure (GFCE), which depicts the government's spending on goods and services used to directly satisfy the collective needs of its population has bounced back.

- PFCE has reported 7.0% growth rate during Q1 of FY 2025-26 as compared to the 8.3% growth rate in the prior corresponding period, driven by a rebound in rural demand.

- GFCE registering 9.7% growth rate in nominal terms during Q1 of FY 2025-26, over the growth rate of 4.0% in Q1 of FY 2024-25.

Rebounding rural demand augurs well for consumption. Investment activity is expected to pick up, supported by higher public capex and improving business expectations.

Easing Consumer Price Index (CPI)

Inflation is an increase in the average price of goods and services in terms of money and is measured on the basis of two indicators in India, Wholesale Price Index (WPI) and Consumer Price Index (CPI). WPI measures the average change in prices of goods before reaching the consumer and is calculated on the basis of wholesale price of Primary articles, fuel & power and manufactured products. On the other hand, CPI measures change in price of goods that people buy for daily use such as food and beverages, clothing and footwear, housing, fuel and light and others.

In India, the situation of inflation has shown consistent improvement. In July 2025, India’s inflation depicted a clear decline which suggests an increase in the purchasing power providing relief to households and indicating stability in the economy.

|

INFLATION

|

YoY Growth (%)

|

|

Q1 FY25

|

Q4 FY25

|

Q1 FY26

|

July-2025

|

|

CPI Inflation

|

4.9

|

3.7

|

2.7

|

1.55

|

|

Food Inflation

|

8.9

|

4.1

|

0.6

|

-1.76

|

|

Core Inflation

|

3.1

|

3.9

|

4.3

|

3.9

|

-

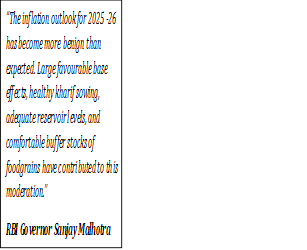

“The inflation outlook for 2025-26 has become more benign than expected. Large favourable base effects, healthy kharif sowing, adequate reservoir levels, and comfortable buffer stocks of foodgrains have contributed to this moderation.”

RBI Governor Sanjay Malhotra

|

Year-on-year inflation rate based on CPI for the month of July, 2025 over July, 2024 is 1.55%. There is decline of 55 basis points in headline inflation of July, 2025 in comparison to June, 2025. It is the lowest year-on-year inflation rate after June, 2017.

- In July 2025, food prices were 1.76% lower compared to July 2024, called negative inflation or deflation in food prices. Rural areas saw a 1.74% drop and urban areas saw a 1.90% drop. Compared to June 2025, food inflation dropped by 75 basis points, meaning prices fell faster in July.

- This -1.76% is the lowest food inflation rate since January 2019, indicating that food prices haven’t been this low in over six years.

Notably, the RBI follows a policy of flexible inflation targeting as its primary monetary policy framework, whereby RBI targets CPI inflation to be maintained at 4% with a tolerance band of ±2 percentage points (i.e., the target range is 2% to 6%). Over the past three quarters, the CPI inflation rate has been within the RBI's tolerance band of 4% ±2%.

India’s job market has undergone a profound transformation, mirroring the country’s economic evolution from a largely agrarian economy in the pre-independence era to a globally integrated, technology-driven one today. Over the decades, employment patterns have shifted in tandem with structural changes in the economy, with the workforce gradually moving from agriculture to industry and, more recently, to services and knowledge-based sectors.

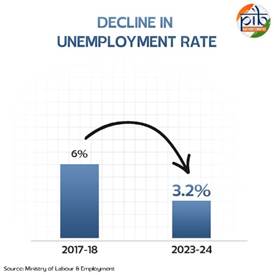

India’s employment has surged, with 17 crore jobs created in the past decade, reflecting the government’s focus on youth-centric policies and its Viksit Bharat vision.

The Labour Force Participation Rate (LFPR) for individuals aged 15 years and above has increased from 49.8% in 2017–18 to 60.1% in 2023–24. Notably, female LFPR increased from 23.3% in 2017-18 to 41.7% in 2023-24. This shows enhanced participation of women in economic activities across various categories, including rural and urban. Rural India shows 96% rise in female employment whereas urban areas reflect 43% growth.

More recently, in quarter April-June 2025, LFPR for persons aged 15 years and above was 55.0%, with 57.1% in rural areas and 50.6% in urban areas. In July 2025, LFPR among persons of age 15 years and above was 54.9% as compared to 54.2% during June 2025.

In this quarter, the agriculture sector engaged the majority of rural workers (44.6% of men and 70.9% of women), while the tertiary sector was the largest source of employment in urban areas (60.6% of men and 64.9% of women). On average, 56.4 crore persons (aged 15 years and above) were employed in the country during this quarter, of which 39.7 crore were men and 16.7 crore were women.

Besides, self-employment dominated in rural areas (55.3% of men and 71.6% of women), while regular wage/salaried employment was predominant in urban areas (47.5% of men and 55.1% of women).

Additionally, there has been an impressive decline in the Unemployment Rate (UR), that dipped sharply from 6.0% in 2017–18 to 3.2% in 2023–24. This indicates stronger workforce absorption into productive employment. In the same time frame, youth unemployment rate declined from 17.8% to 10.2%, placing it below the global average of 13.3%, as reported in the ILO’s World Employment and Social Outlook 2024.

More recently, unemployment rate among persons of age 15 years and above declined to 5.2% in July 2025 from 5.6% in June 2025. In the April – June 2025 quarter, the overall rural unemployment rate dipped at 4.8% compared to the 6.8% observed for the urban areas.

Job creation in the agricultural sector and services sector has increased to 19% and 36%, respectively in the last decade. In the manufacturing sector, job creation stood at 6% between 2004 and 2014, while it rose to 15% in the last decade.

Investments & Capital Flows

India has rapidly emerged as a top global destination for Foreign Direct Investment (FDI), powered by a decade of structural reforms, investor-friendly policies, and rising competitiveness. Backed by improvements in global rankings and strategic initiatives, investor confidence has strengthened. India witnessed a historic $81 billion worth of foreign investments in FY24-25 alone.

The Government now targets annual FDI inflows of US$ 100 billion, up from the five-year average of over US$ 70 billion, as India positions itself as a global investment hub amid shifting supply chains.

Cumulative FDI inflows touched ₹89.85 lakh crore (US$ 1.05 trillion) between April 2000 and December 2024- nearly 20 times higher than FY01. Notably, FDI equity inflows surged 27% YoY to ₹3.40 lakh crore (US$ 40.67 billion) in April–December 2024, reflecting robust investor confidence. Reforms like FDI liberalisation in key sectors, GST, and Make in India have been key drivers of this growth.

Besides, India's financial markets have demonstrated notable resilience, primarily driven by strong domestic investor participation.

|

DOMESTIC INSTITUTIONAL INVESTORS (DII)

|

FOREIGN INSTITUTIONAL INVESTORS (FIIS)

|

|

DIIs remained large net buyers, purchasing equity worth ₹44,269 crores between June 16, 2025 to July 15, 2025.

|

FIIs undertook comparable net purchases of equities worth ₹33,336.8 between June 16, 2025 to July 15, 2025.

|

Additionally, India’s foreign exchange reserves stood at USD 695.5 billion as of July 18, 2025, having briefly crossed the USD 700 billion mark in the week ending June 27, 2025.

India’s Growth Story on the World Stage

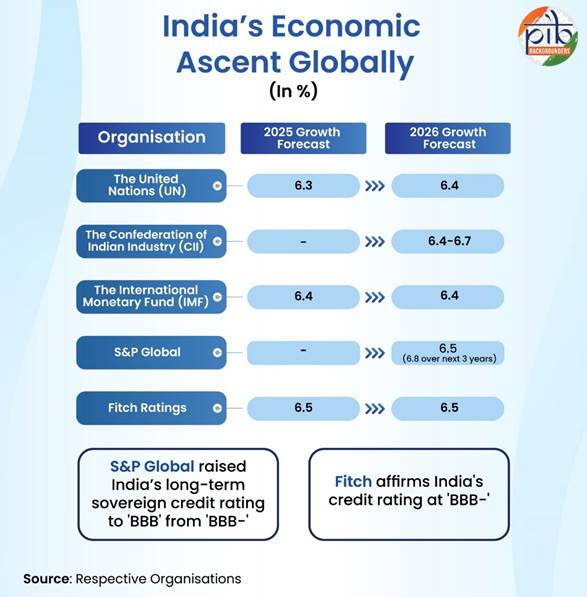

Backed by strong macroeconomic fundamentals, India’s growth journey remains in the global spotlight. While the RBI expects growth pace to continue into 2025–26, other projections echo this optimism. For instance, The United Nations (UN) has forecasted growth of 6.3% in 2025 and 6.4% in 2026, while The Confederation of Indian Industry (CII) places its estimate slightly higher at 6.40 to 6.70%.

The International Monetary Fund (IMF) also followed suit, and revised its forecast for India’s economic growth to 6.4% for both 2025 and 2026. Earlier in its April 2025 World Economic Outlook, IMF had projected India’s GDP growth at 6.2% for 2025 and 6.3% for 2026.

S&P Global raised India’s long-term sovereign credit rating to 'BBB' from 'BBB-', with the short-term rating upgraded to 'A-2' from 'A-3'. The transfer and convertibility assessment has also been improved to 'A-' from 'BBB+', recognising India’s growing financial resilience. S&P had last upgraded India in January 2007 to ‘BBB-’, hence, this rating upgrade comes after an 18-year gap.

As per S&P Global, real GDP growth averaged 8.8% between FY22 and FY24, the highest in the Asia-Pacific region. S&P further projects GDP growth of 6.5 per cent in FY26 and 6.8% over the next three years.

Most recently, Fitch Ratings affirmed India's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'BBB-' with a stable outlook, owing to India’s strengthening record of delivering growth with macro stability and improving fiscal credibility.

India’s steady growth momentum is powered by resilient domestic demand. Rural consumption is strengthening, urban spending is rising, and private investment is gaining pace. Many businesses are operating close to full capacity and expanding further. Meanwhile, public investment-particularly in infrastructure- remains elevated, and stable borrowing conditions are supporting both firms and households in making future-oriented decisions.

Schemes and Initiatives Shaping India’s Economic Rise

Over the past decade, flagship schemes have reshaped India’s economic landscape, strengthening resilience, boosting productivity, and empowering citizens.

The Production Linked Incentive (PLI) Scheme, launched in 2020, has become a game-changer for domestic manufacturing. Covering 14 sectors from electronics to textiles, and backed by a ₹1.97 lakh crore outlay, it has attracted over ₹1.76 lakh crore in investments, enhanced exports, and created jobs- making India a stronger player in global value chains.

The Digital India programme has accelerated connectivity and digital inclusion, expanding internet penetration from 25 crore in 2014 to nearly 97 crore in 2024. With 5G rollout and Bharat 6G vision, India is now the world’s third-most digitalised economy, driving growth through technology-led transformation.

In financial inclusion, the Pradhan Mantri Jan Dhan Yojana (PMJDY) has opened over 56 crore accounts, with 55% held by women. It provides access to banking, credit, insurance, and pensions, forming the backbone for Direct Benefit Transfers and inclusive growth.

The Make in India initiative, launched in 2014, has positioned India as a manufacturing hub with notable successes in railways, defence, toys, and electronics. India is now the world’s second-largest mobile phone manufacturer, with over 300 factories compared to just two in 2014.

Job creation is at the heart of growth, and the PM Viksit Bharat Rozgar Yojana targets 3.5 crore youth by incentivising new employment between 2025 and 2027. Similarly, Skill India Mission has trained over 6 crore citizens through PMKVY, JSS, and apprenticeship schemes, ensuring India’s workforce is future-ready.

Global competitiveness has been enhanced through the Foreign Trade Policy 2023–28, which promotes exports, ease of doing business, and e-commerce, alongside the Export Promotion Mission and Special Economic Zones (SEZs) that have generated investment and employment. Supporting this, the Government e-Marketplace (GeM) has made public procurement more transparent and efficient, with over ₹15 lakh crore in orders.

Infrastructure-led growth has been powered by PM GatiShakti and the National Logistics Policy, improving India’s logistics ranking and enabling seamless connectivity. Alongside, tax reforms like GST and corporate tax rationalisation have simplified compliance and reduced costs, fostering a more business-friendly environment.

Together, these initiatives- spanning manufacturing, digitalisation, financial inclusion, employment, trade, and infrastructure- are driving India’s transformation into a more resilient, self-reliant, and globally competitive economy. They reflect the nation’s clear vision of achieving Viksit Bharat by 2047.

Conclusion

“Today the country is moving at a fast pace towards becoming the third largest economy.”

-PM Narendra Modi

|

Fueled by a young demographic and sustained structural reforms, India is redefining its role in global trade, investment, and innovation. Over the past decade, it has transformed from a dependent economy into a self-reliant, globally competitive powerhouse. At the core of this change is Aatmanirbhar Bharat, driving innovation, entrepreneurship, and technological sovereignty. Initiatives like the PLI schemes, MSME revitalisation, and digital infrastructure expansion are creating a high-growth, high-opportunity economy.

India’s economy grew at a faster than-expected annual rate of 7.8% in the quarter to the end of June, boosted by the manufacturing, construction and service sectors. And looking ahead to FY26, India’s growth outlook is promising. A pickup in private investment, rising consumer confidence, wage growth, and resilient rural demand supported by strong agricultural output are key drivers. Combined with easing food inflation and macroeconomic stability, these factors reinforce India’s medium-term growth potential and global competitiveness.

References

PIB Backgrounders/ Press Release

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154660&ModuleId=3

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=155053&ModuleId=3

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154962&ModuleId=3

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154980&ModuleId=3

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154686&ModuleId=3

https://www.pib.gov.in/FactsheetDetails.aspx?Id=149260

https://www.pib.gov.in/PressReleseDetail.aspx?PRID=2147906

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2161834

https://www.pib.gov.in/pressreleasepage.aspx?PRID=2161516

https://www.pib.gov.in/PressReleseDetail.aspx?PRID=2156749

India Budget

https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap01.pdf

Department of Economic Affairs

https://dea.gov.in/sites/default/files/Monthly%20Economic%20Review%20June%202025_0.pdf

SBI.co.in

https://sbi.co.in/documents/13958/43951007/8%2Byears%2Bof%2BGST_SBI%2BResearch.pdf/266da3f2-1271-e0f2-ac66-22184bf9391e?t=1753163204146

DD News

https://ddnews.gov.in/en/rbi-retains-indias-gdp-growth-forecast-at-6-5-for-fy-2025-26/

Newsonair.gov.in

https://www.newsonair.gov.in/over-11-lakh-aspirants-got-jobs-in-last-16-months-under-rozgar-mela-mansukh-mandaviya/

IBEF

https://www.ibef.org/economy/indian-economy-overview

https://www.ibef.org/economy/foreign-direct-investment

https://www.ibef.org/blogs/special-economic-zones-in-india-catalysts-for-economic-growth-and-global-competitiveness#:~:text=Special%20economic%20zones%20(SEZ)%20are,export%20processing%20zones%20(EPZs).

PMindia.gov.in

https://www.pmindia.gov.in/en/news_updates/highlights-from-the-pms-address-on-the-79th-independence-day/#:~:text=This%20grand%20festival%20of%20Independence,crore%20resolutions%20of%20our%20people.&text=India%20is%20continuously%20strengthening%20the%20spirit%20of%20unity.&text=For%2075%20years%2C%20the%20Constitution,guiding%20us%20like%20a%20lighthouse.

NCPI.org.in

https://www.npci.org.in/what-we-do/upi/product-statistics

pmjdy.gov.in

https://www.pmjdy.gov.in/scheme

gem.gov.in

https://gem.gov.in/

Fitch Ratings

https://www.fitchratings.com/research/sovereigns/fitch-affirms-india-at-bbb-outlook-stable-25-08-2025#:~:text=Fitch%20Ratings%20%2D%20Hong%20Kong%20%2D%2025,%2D'%20with%20a%20Stable%20Outlook.

Click here to see PDF

SK/M

(Explainer ID: 155121)

आगंतुक पटल : 37869

Provide suggestions / comments