Technology

Mobiles- Catalysts of India’s Digital Rise

Posted On: 18 SEP 2025 1:22PM

Key Takeaways

· Smartphone exports surpassed ₹1 lakh crore in just the first five months of FY 2025-26- a 55% jump over the same period last year.

· In Q2 2025, India overtook China to become the top smartphone exporter to the United States.

· India’s mobile manufacturing industry has scaled rapidly- from just 2 units in 2014 to over 300 units today.

·

|

“India has become a key hub for mobile phone manufacturing, with exports now reaching global markets”- PM Narendra Modi

18 September, 2025

Introduction

On 31st July 1995, India heard its first-ever mobile ring- a sound that marked the dawn of a digital era. The historic call connected the then Union Minister of Communications Shri Sukh Ram in Delhi with West Bengal Chief Minister Shri Jyoti Basu in Kolkata. What seemed like just a simple conversation was, in fact, the beginning of a communication revolution that would transform how 1.4 billion Indians connect, work, and dream today.

From receiving calls to participating in social media, entertainment to studies, banking to a host of other activities, made possible by super-cheap data, India has seen a telecom revolution. With 85.5% of Indian households having at least one smartphone, mobile phones have become India's bank, classroom, television. In rural regions, farmers are leveraging mobile-based tools such as the Digital Crop Survey to conduct ground surveys, while also accessing vital information and services through platforms like the mKisan Portal and the National Pest Surveillance System (NPSS) app, including market prices, weather updates, advisories, and pest alerts.

According to the Comprehensive Modular Survey: Telecom (January–March 2025), nearly 96.8% of rural residents aged 15–29 used mobile phones during this period for personal calls and/or internet access, while the corresponding figure in urban areas stood at 97.6%.

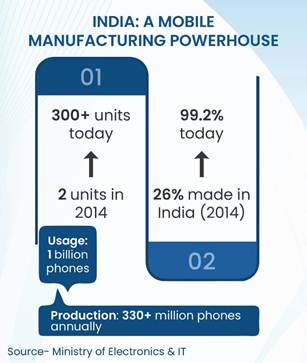

A decade ago, the Indian mobile market relied heavily on imports, but now, India has made significant progress in overall electronics manufacturing and export. Key sub segments of electronics include mobile and smartphones. India is the world’s second largest mobile manufacturing country. The facts are outstanding- in 2014, India had only 2 mobile manufacturing units but fast forward to today, the nation boasts over 300 manufacturing units, underscoring a significant expansion in this vital sector.

Mobile- From Device to Driver of Development

India is the third largest digitalised country in the world in terms of economy-wide digitalization, and 12th among the G20 countries in the level of digitalisation of individual users. India’s digital economy is set to grow nearly twice as fast as the overall economy, contributing almost one-fifth of national income by 2029-30, surpassing agriculture and manufacturing. Growth is likely to be led by digital platforms and wider adoption of digitisation tools across sectors.

The electronics sector, a vital pillar of the digital economy, is witnessing rapid transformation. Driven by iconic initiatives such as Make in India, the country is building a strong domestic electronics base, attracting major investments, and boosting local production. Exports have surged, even outpacing traditional sectors like textiles, while government support and expanding manufacturing capacity are positioning India as a global hub.

Smartphones continue to empower individuals and businesses, facilitate access to information and services, and foster a more digitally connected and inclusive society. The overall picture is also bright- for instance, India’s mobile phone manufacturing sector has generated over 12 lakh jobs over the past decade, uplifting families and strengthening India’s socio-economic fabric.

India’s smartphone market is evolving rapidly, with consumer preferences increasingly leaning toward 5G adoption and premium features. According to a market research, 5G smartphone shipments surged to 82% of total shipments last year, reflecting a remarkable 49% YoY growth. Mid-range devices priced between ₹10,000–13,000 continue to see strong demand, expanding the base for high-performance yet affordable smartphones.

At the same time, the premium segment (above ₹25,000) witnessed robust growth, posting a 26% YoY increase, as consumers embrace high-performance devices as lifestyle statements. This dynamic demonstrates India’s market adaptability, with growth spanning across premium, mid-range, and value segments, catering to a diverse and increasingly tech-savvy consumer base.

Made in India: Powering Mobile Manufacturing Boom

India has set a target of achieving over $7 trillion GDP by 2030[1], for which growth in the digital sector and an increase in exports is crucial. In these two areas, electronics manufacturing, led by mobile and smartphone production, will play a critical role.

|

From toys to mobile phones, defence equipment to EV motors, production is shifting back to India. The government’s 'Make In India' vision and Production Linked Incentive (PLI) Scheme aim to make India a global manufacturing hub, and are driving self-reliance, boosting production, and creating jobs, thereby contributing significantly to the nation's economic fortitude.

As per Union Minister Ashwini Vaishnaw, India’s journey in electronics manufacturing has evolved through distinct phases: beginning with finished goods, progressing to sub-assemblies, and now entering the critical phase of deep component manufacturing. The sector is steadily advancing into this third phase, which marks a significant leap in value addition, self-reliance, and ecosystem depth. Total production of electronics has increased from ₹1.9 lakh crore in 2014-15 to ₹11.3 lakh crore in 2024-25.

Mobiles have been the crowning accomplishment of the electronics manufacturing sector boom-

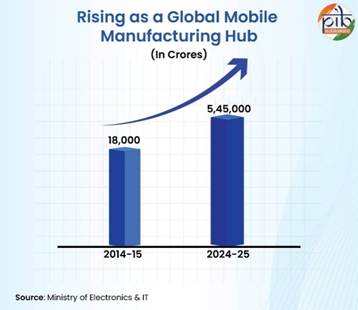

- Production of mobile phones has soared from ₹18,000 crores in 2014-15 to ₹5.45 lakh crore in 2024-25, a 28-fold rise.

- India is the second-largest mobile phone manufacturer globally, with over 300 manufacturing facilities. Tamil Nadu has over 47 manufacturing units of electronics, supported under various schemes of the Ministry of Electronics and Information Technology (MeitY).

- Over 330 million mobile phones a year are being manufactured in India and on average there are about a billion mobile phones in use in India.

India Calling: Mobile Powering Export Growth

DID YOU KNOW?

Smartphones are the fourth largest export item from India.

|

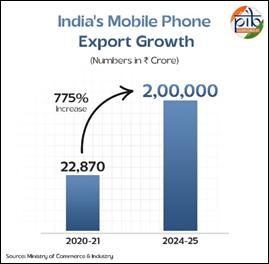

India was 78% import-dependent for mobiles in 2014. The country imported 75% units of the total demand in 2014-15, and now the figure is down to a mere 0.02%. India is building its own electronics industry, with key focus on mobile, to attract big investments and boost local production. As a result, mobile exports are growing.

Electronics industry is the fastest-growing segment among India’s top 30 export categories, and mobiles are an integral part of this upsurge. This shift majorly started with the Phased Manufacturing Programme in 2017 and accelerated with the 2020 PLI scheme, spurring large-scale electronics manufacturing. Subsequently, exports have overtaken domestic consumption, a rare achievement among developing economies.

There has been a consistent positive net export trend w.r.t mobile since 2018-19, indicating long-term structural improvements. India recently overtook China in smartphone exports to the US in Q2 2025.

- Exports of mobile phones grew 127-fold to ₹2,00,000 crore in FY2024-25 vs. ₹1,500 crore in FY2014-15.

- In 2024, Apple exports from India hit a record ₹1,10,989 crore (US$12.8 billion), crossing the ₹1 lakh crore mark with a 42% YoY growth.

- In the first five months of FY 2025-26, India’s smartphone exports crossed the ₹1 lakh crore milestone, a 55% rise against the prior corresponding period wherein it was ₹64,500, majorly catalysed by the PLI Scheme.

Noteworthy advancements have continued. For instance, Foxconn plans to double iPhone output in India by end-2025, targeting 25 to 30 million units to boost exports. Meanwhile, Samsung’s manufacturing facility in Noida has helped push mobile phone exports to a record US$20.4 billion in 2024, up 44% from 2023.

Key Government Initiatives Strengthening Mobile Manufacturing & Export

India has a robust and rapidly growing smartphone market, with even greater opportunities in the global arena. As part of the government’s efforts to boost electronics manufacturing, various schemes and incentives have been introduced. These include incentives for large investments in the value chain and support for the promotion of exports.

Make In India Scheme- Launched in 2014, Make in India aimed to revive growth and transform the nation into a design and manufacturing powerhouse. With a focus on investment, innovation, and world-class infrastructure, it became a cornerstone of the ‘Vocal for Local’ movement, boosting industrial strength and positioning India as a rising global economic leader.

Digital India- Launched in 2015, Digital India is driving inclusion, growth, and transparency through technology. Digital economy contributed to 11.7% of GDP in 2022–23, and is set to reach 13.4% by 2024- 25 and nearly 20% by 2030. Internet users grew from 25.15 cr (2014) to 96.96 cr (2024)- a staggering surge of 285%. 4G reached all of India in 2016 and 5G was launched in Oct 2022, with 4.74 lakh towers in 22 months covering 99.6% of districts. Following suit, Bharat 6G Vision (2023) aims to make India a global leader in 6G by 2030.

Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS)- It provides financial incentives of 25% on capital expenditure to produce specified electronic goods to address critical gaps in the supply chain. The scheme incentivises investments in these areas and helps promote high-value-added manufacturing within the country.

National Policy on Electronics (NPE) 2019: The policy, launched in 2019, aims to position India as a global hub for Electronics System Design and Manufacturing (ESDM). The government has set up a working group to renovate the existing policy and move towards the goal of creating $400 billion in revenue from the ESDM by 2025.

Production Linked Incentive (PLI) Scheme-PLI was launched in April 2020 to lift domestic manufacturing via targeted, performance-based incentives across strategic sectors. It initially began with the Mobile Manufacturing and Specified Electronic Components, Critical Key Starting materials/Drug Intermediaries and Active Pharmaceutical Ingredients and Manufacturing of Medical Devices. Following its early success, the scheme was progressively extended to cover 14 key sectors of the economy. It powers the national goal of Digital India by driving local production of mobile phones, and electronics, making technology more accessible and affordable. PLI Scheme has encouraged major smartphone companies shifting its production to India.

Electronics Components Manufacturing Scheme (ECMS)-Approved in April 2025 with a ₹22,919 crore funding, the ECMS aims to make India Atmanirbhar in the electronics supply chain. It targets ₹59,350 crore investment, ₹4,56,500 crore production, and 91,600 direct jobs (plus many indirect) over its 6-year tenure, while boosting Domestic Value Addition and integrating Indian firms into Global Value Chains. Notably, applications worth over ₹50,000 crore investment have been received for smartphone production by the MeitY.

The Global League of Mobile Makers

Over the past decade, one of India’s greatest journeys has been the surreal transformation from a mobile importer to becoming the world’s second-largest mobile phone manufacturer. The unprecedented gains not only underscore India’s rapid progress in electronics but also cement its emergence as a global hub for both production and exports.

Globally, China and Vietnam are also established leaders in electronics exports, with electronics accounting for about 27% of China’s and 40% of Vietnam’s total exports in 2022. However, India has rapidly carved out its advantage. As global firms look to reduce overdependence on a single country, manage supply chain risks, and navigate geopolitical tensions, India is emerging as a natural choice. This shift- popularly known as the China+1 strategy- is driving companies to diversify their operations into India, positioning it as a competitive and resilient alternative in global electronics manufacturing.

And this is not just theory; the figures have started speaking- China+1 trend is proving beneficial for India as the country closes the gap with China in mobile phone exports. As per the International Trade Centre, in 2023-24, China’s mobile phone exports fell by $3.8 billion and Vietnam’s by $5.6 billion compared to the previous year. At the same time, India’s mobile phone exports gained $4.5 billion, capturing nearly half of the combined decline from both countries.

Outlook- Electronics Powered by Mobile

“India has lifted 800 million people out of poverty in the last 5-6 years through the use of smartphones.”

Dennis Francis, President of the 78th session of the UN General Assembly, during a lecture at the UN’s Food and Agriculture Organisation (FAO).

|

India’s digital economy is expected to grow almost twice as fast as the overall economy, contributing to nearly one-fifth of national income by 2029-30. In particular, as India moves towards a USD 300 billion electronics production target by 2026, its robust policies and skilled workforce are paving the way for sustained growth, positioning the nation as a key player in the global electronics, majorly mobile and semiconductor industry.

It is a sweet success story for visionary initiatives, which has led to an exponential growth in the electronics production from $31 billion to $133 billion in a decade beginning 2014-15.

And the story is poised to continue at mounting paces. India’s exports in FY 2025-26 are likely to exceed those of last year, despite tariffs. For FY 2025-26, the government has set a target of USD 1 trillion of exports. Continuing this trajectory, India is expected to contribute approximately 4-5% of global electronics exports by 2030.

Conclusion

“We're rapidly moving towards being No. 1 in mobile phones manufacturing." PM Narendra Modi.

Mobile phone manufacturing and exports have seen phenomenal growth, redefining the country’s position on the global stage. Central drivers of this progress are government policies, a young demographic, a growing middle class, and rising per capita incomes.

With numerous schemes to support mobile manufacturing processes in India, the country has significantly boosted local manufacturing, exports, and investment. As India moves towards a US$ 300 billion electronics production target by 2026, its robust policies and skilled workforce are paving the way for sustained growth, positioning the nation as a key player in the global mobile and smartphone segment.

References

Ministry of Statistics &Programme Implementation

Ministry of Electronics & IT

PIB Archives

Sansad.in

Investindia.gov.in

Newsonair.gov.in

IBEF

DD news website

Mobiles- Catalysts of India’s Digital Rise

*****

SK/M

(Backgrounder ID: 155232)

Provide suggestions / comments