Economy

India’s Labour Reforms: Simplification, Security, and Sustainable Growth

Posted On:

21 NOV 2025 4:40PM

Key Takeaways

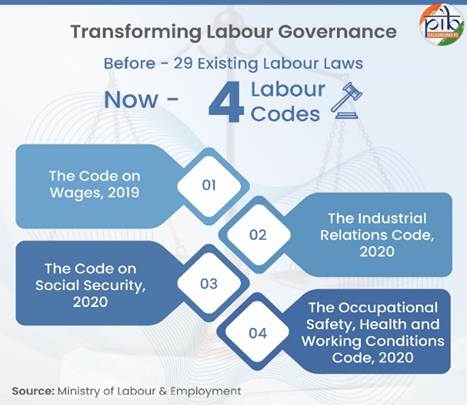

- The Government has consolidated 29 labour laws into four comprehensive Labour Codes.

- The four Labour Codes include the Code on Wages, 2019, the Industrial Relations Code, 2020, the Code on Social Security, 2020 and the Occupational Safety, Health and Working Conditions Code, 2020.

- The historic reform streamlines compliance, modernizes outdated provisions, and creates a simplified, efficient framework that promotes ease of doing business while safeguarding workers’ rights and welfare.

|

Labour at the Core of India’s Growth

The empowerment of labour forms the cornerstone of an empowered, prosperous, and Aatmanirbhar India. Reflecting this vision, employment in India has shown remarkable growth- rising from 47.5 crore in 2017–18 to 64.33 crore in 2023–24, a net addition of 16.83 crore jobs in just six years. During the same period, the unemployment rate declined sharply from 6.0% to 3.2%, and 1.56 crore women entered the formal workforce, underscoring the Government’s emphasis on inclusive and sustained labour empowerment. The positive outlook of the labour market has also led to a broader socio-economic transformation, mirrored by declining proportion of people below the international poverty line. Additionally, India’s social protection system has expanded rapidly to become one of the largest globally.

Labour is a key driver of economic growth and development. In order to simplify and strengthen the framework governing workers’ rights, the Government consolidated 29 labour laws into four comprehensive Labour Codes- namely, the Code on Wages, 2019, the Industrial Relations Code, 2020, the Code on Social Security, 2020 and the Occupational Safety, Health and Working Conditions Code, 2020. This historic reform ensures that workers gain easier access to security, dignity, health, and welfare measures, reinforcing India’s commitment to a fair and future-ready labour ecosystem.

Rationale Behind Codification of Existing 29 Labour Laws

Reforms in labour laws are an ongoing process. The Government continuously works to modernize and streamline the legislative framework in line with the evolving economic and industrial landscape of the country. The codification of 29 existing labour laws into four Labour Codes was undertaken to address long-standing challenges and make the system more efficient and contemporary. The codification aims to enhance ease of doing business, promote employment generation, ensure safety, health, social & wage security for every worker.

The key reasons behind this reform include:

- Simplifying compliance: Multiplicity of laws leads to difficulty in compliance.

- Streamlining enforcement: Multiplicity of authorities in different labour laws led to complexity and difficulty in enforcement.

- Modernizing outdated laws: Most labour legislations were framed during the pre-Independence era, necessitating alignment with today’s economic realities and technological advancements.

Formulation of 4 Labour Codes

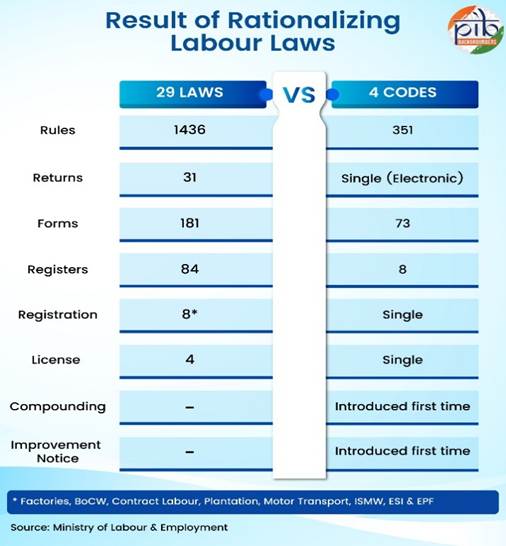

An important reason of rationalizing labour laws via codification was to simplify the registration, licensing framework by introducing the concept of a Single Registration, Single License, and Single Return, thereby reducing the overall compliance burden to spur employment.

|

The second National Commission on Labour had recommended that the existing Labour Laws should be broadly grouped into four/ five Labour Codes on functional basis. Accordingly, the Ministry of Labour & Employment started the exercise to rationalize, simplify and amalgamate the relevant provisions of the labour laws in four codes. The four Labour Codes were enacted after the deliberations held in the tripartite meeting of the Government, employers’, industry representatives and various trade unions during 2015 to 2019. The Code on Wages, 2019 was notified on 8th August, 2019 and the remaining three Codes were notified on 29th September, 2020.

Code 1: The Code of Wages, 2019

The Code on Wages, 2019 seeks to simplify, consolidate, and rationalize the provisions of four existing laws- The Payment of Wages Act, 1936; The Minimum Wages Act, 1948; The Payment of Bonus Act, 1965; and The Equal Remuneration Act, 1976. It aims to strengthen workers’ rights while promoting simplicity and uniformity in wage-related compliance for employers.

MAJOR HIGHLIGHTS

Universal Minimum Wages: The Code establishes a statutory right to minimum wages for all employees across both organized and unorganized sectors. Earlier, the Minimum Wages Act applied only to scheduled employments covering ~30% of workers.

Introduction of Floor Wage: A statutory floor wage shall be set by the Government based on minimum living standards, with scope for regional variation. No state can fix minimum wages below this level, ensuring uniformity and adequacy nationwide.

Criteria for Wage Fixation: Appropriate Governments will determine minimum wages considering workers’ skill levels (unskilled, skilled, semi-skilled and highly skilled), geographic areas, and job conditions such as temperature, humidity, or hazardous environments.

Gender Equality in Employment: Employers shall not discriminate on the basis of gender, including transgender identity, in recruitment, wages, and employment conditions for similar work.

Universal Coverage for Wage Payment: Provisions ensuring timely payment and preventing un-authorized deductions will apply to all employees, irrespective of wage limits (currently applicable only to employees earning up to ₹24,000/month).

Overtime Compensation: Employers must pay all employees overtime wages at least twice the normal rate for any work done beyond the regular working hours.

Responsibility for Wage Payment: Employers, including companies, firms, or associations, shall pay wages to employees employed by them. Failure to do so makes the proprietor/ entity liable for unpaid wages.

Inspector-cum-Facilitator: The traditional role of “Inspector” is replaced with “Inspector-cum-Facilitator,” emphasizing guidance, awareness, and advisory roles alongside enforcement to improve compliance.

Compounding of Offences: First-time, non-imprisonable offences can be compounded by paying a penalty. Repeat offences within five years, however, cannot be compounded.

Decriminalization of Offences: The Code replaces imprisonment for certain first-time offences with monetary fines (up to 50% of the maximum fine), making the framework less punitive and more compliance-oriented.

Code 2: The Industrial Relations Code, 2020

The Industrial Relations Code (IR Code) has been prepared after amalgamating, simplifying and rationalizing the relevant provisions of the Trade Unions Act, 1926, the Industrial Employment (Standing Orders) Act, 1946 and the Industrial Disputes Act, 1947. The Code acknowledges the fact that survival of worker depends upon survival of industry. In this backdrop, it simplifies laws related to trade unions, conditions of employment in industrial establishment or undertaking, investigation and settlement of industrial disputes.

MAJOR HIGHLIGHTS

Fixed Term Employment (FTE): Allows direct, time-bound contracts with full parity in wages and benefits; gratuity eligibility after one year. The provision reduces excessive contractualization and offers cost efficiency to employers.

Re-skilling Fund: To train retrenched employees, this fund has been set up from the contribution to be made by an industrial establishment for an amount equal to 15 days' wages for every worker retrenched. This is in addition to retrenchment compensation. The amount will be credited to the workers account within 45 days of retrenchment.

Trade Union Recognition: Unions with 51% membership get recognition as the Negotiating Union; otherwise, a Negotiating Council is formed from unions, not less than 20% membership of trade union. Such an arrangement strengthens collective bargaining.

Expanded Worker Definition: Covers sales promotion staff, journalists, and supervisory employees earning up to ₹18,000/month.

Broader Definition of Industry: Includes all systematic employer-employee activities, regardless of profit or capital, widening access to labour protections.

Higher Threshold for Lay-off/Retrenchment/Closure: Approval limit raised from 100 to 300 workers; States may enhance the limit further. The provision will simplify compliance and contribute to formalization.

Women’s Representation: Ensures proportional representation of women in grievance committees for gender-sensitive redressal.

Standing Orders Threshold: Raised from 100 to 300 employees, easing compliance and enabling flexible workforce management.

Work-from-Home Provision: Permitted in service sectors by mutual consent, improving flexibility.

Industrial Tribunals: Two-member tribunals consisting of judicial and administrative member for quicker dispute resolution.

Direct Tribunal Access: Parties may approach tribunals directly after failed conciliation within 90 days.

Notice for Strikes/Lockouts: Mandatory 14-day notice for all establishments to promote dialogue and minimize disruptions.

Expanded Definition of Strike: Includes "mass casual leave also within its ambit” to prevent flash strikes and ensure lawful action.

Decriminalization & Compounding: Minor offences made compoundable with monetary penalties, promoting compliance over prosecution.

Digital Processes: Enables electronic record-keeping, registration, and communication for transparency and efficiency.

Code 3: The Code on Social Security, 2020

The Code on Social Security incorporates existing nine Social Security Acts viz; The Employee's Compensation Act, 1923; The Employees' State Insurance Act, 1948; The Employees' Provident Funds and Miscellaneous Provisions Act, 1952; The Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959; The Maternity Benefit Act, 1961; The Payment of Gratuity Act, 1972; The Cine-Workers Welfare Fund Act, 1981; The Building and Other Construction Workers' Welfare Cess Act, 1996 and; The Unorganised Workers' Social Security Act, 2008. The Code extends social security to all workers- including unorganized, gig, and platform workers-covering life, health, maternity, and provident fund benefits, while introducing digital systems and facilitator-based compliance for greater efficiency.

MAJOR HIGHLIGHTS

Expanded ESIC (Employees' State Insurance) Coverage: ESIC now applies pan-India, eliminating the criteria of “notified areas.” Establishments with fewer than 10 employees may voluntarily opt in with mutual consent of employers and employees. Coverage would be mandated for hazardous occupation and extended to plantation workers.

Time-bound EPF (Employees’ Provident Fund) Inquiries: A five-year limit has been set for initiating EPF inquiries and recovery proceedings, to be completed within two years (extendable by one). Suo-moto reopening of cases has been abolished, ensuring timely resolution.

Reduced EPF Appeal Deposit: Employers appealing EPFO orders now need to deposit only 25% of the assessed amount (down from 40–70%), reducing financial burden and ensuring ease of business and access to justice.

Self-assessment for Construction Cess: Employers can now self-assess cess liabilities in respect to Building and Other Construction Work, previously assessed by the notified Government authority. It reduces procedural delays and official intervention.

Inclusion of Gig and Platform Workers: New definitions are included- “aggregator,” “gig worker,” and “platform worker” to enable social security coverage. Aggregators to contribute 1- 2% of annual turnover (capped at 5% of payments to such workers).

Social Security Fund: A dedicated fund to finance schemes for unorganised, gig, and platform workers, covering life, disability, health, and old-age benefits has been proposed. The amount collected through the compounding of offences will be credited to this Fund and used by the Government.

Expanded Definition of Dependents: Coverage extended to maternal grandparents and in case of female employees it also includes dependent parents-in-law, broadening family benefit access.

Uniform Definition of Wages: “Wages” now include basic pay, dearness allowance, and retaining allowance; 50% of the total remuneration (or such percentage as may be notified) shall be added back to compute wages, ensuring consistency in calculating gratuity, pension, and social security benefits.

Commuting Accidents Covered: Accidents during travel between home and workplace are now deemed employment-related, qualifying for compensation.

Gratuity for Fixed-Term Employees: Fixed-term employees become eligible for gratuity after one year of continuous service (earlier five years).

Inspector-cum-Facilitator System: Introduces randomized web-based, algorithm-driven inspections for transparency and wider compliance. Inspectors now act as facilitators to support adherence and reduce harassment.

Decriminalization & Monetary Fines: The code has replaced imprisonment with monetary fines for certain offences. The employer will be given mandatory 30 days’ notice for compliance before taking any legal action.

Compounding of Offences: First-time offences punishable with fines are compoundable- for fine-only: 50% of maximum fine and for fine/imprisonment cases: 75% of maximum fine- reducing litigation and improving ease of doing business.

Digitization of Compliance: Mandates electronic maintenance of records, registers, and returns, cutting costs and improving efficiency.

Vacancy Reporting: Employers shall report vacancies to specified career centres before recruitment, promoting transparency in employment opportunities.

Code 4: The Occupational Safety, Health and Working Conditions Code 2020

The Code has been drafted after amalgamation, simplification and rationalization of the relevant provisions of the 13 Central Labour Acts- The Factories Act, 1948; The Plantations Labour Act, 1951; The Mines Act, 1952; The Working Journalists and other Newspaper Employees (Conditions of Service and Miscellaneous Provisions) Act, 1955; The Working Journalists (Fixation of Rates of Wages) Act, 1958; The Motor Transport Workers Act, 1961; The Beedi and Cigar Workers (Conditions of Employment) Act, 1966; The Contract Labour (Regulation and Abolition) Act, 1970; The Sales Promotion Employees (Conditions of Service) Act, 1976; The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979; The Cine-Workers and Cinema Theatre Workers (Regulation of Employment) Act, 1981; The Dock Workers (Safety, Health and Welfare) Act, 1986 and; The Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996.

The Code balances the twin objectives of safeguarding worker rights and safe working conditions, and creating a business-friendly regulatory environment. This will spur economic growth and employment thereby, making India’s labour market more efficient, fair, and future-ready.

MAJOR HIGHLIGHTS

Unified Registration: A uniform threshold of 10 employees is set for electronic registration. One registration for an establishment has been envisaged in place of 6 registrations in the Acts. This will create a centralised database and promote ease of doing business.

Extension to Hazardous Work: The Government can extend the Code’s provisions to any establishment, even with one employee, engaged in hazardous or life-threatening occupations.

Simplified Compliance: Introduces one license, one registration, one return framework for the establishments, reducing redundancy and compliance burden.

Wider Definition of Migrant Workers: The definition of inter-state migrant workers (ISMW) now covers workers employed directly, through contractors, or migrate on their own. Establishments must declare the number of ISMW. Benefits include: a lump-sum annual travel allowance to native place once in 12 months and portability of public distribution system and social security benefits across states along with access to a toll-free helpline.

Health and Formalization: Free annual health check-ups for employees,

Formalization via appointment letters: Appointment letters specifying job details, wages, and social security will be given to enhance transparency and accountability.

Women’s Employment: Women can work in all types of establishments and during night hours (before 6AM, beyond 7PM) with consent and safety measures, fostering equality and inclusion.

Expanded Media Worker Definition: “Working journalists” and “cine workers” now include employees in electronic media and all forms of audio-visual production.

National Database for Unorganised Workers: A national database to be developed for unorganized workers including migrants to help migrant workers get jobs, map their skills and provide other social security benefits.

Victim Compensation: Courts can direct at least 50% of fines imposed on offenders to be paid as compensation to victims or their legal heirs in case of injury or death.

Contract Labour Reform: Applicability threshold has been raised from 20 to 50 contract workers. All India license valid for 5 years against work-order based license to be provided to the contractor. For contract labour, beedi and cigar manufacturing and factory: a common license is envisaged and provision of deemed license after expiry of prescribe period is introduced. Moreover, the license shall be auto-generated. Provision of contract labour board has been done away with and provision for appointment of designated authority to advise matters on core and non-core activities is introduced.

Safety Committees: Establishments with 500 or more workers will form safety committees with employer-worker representation, enhancing workplace safety and shared accountability.

National Occupational Safety & Health Advisory Board: A single tripartite advisory board replaces six earlier boards to set national safety and health standards across sectors, ensuring uniformity and quality.

Decriminalisation & Compounding of Offences: Offences punishable by fine only to be compounded by paying 50% of the maximum fine; those involving imprisonment or fine or both by 75%. Criminal penalties (imprisonment) replaced by civil penalties like monetary fines, promoting compliance over punishment.

Revised Factory Thresholds: Applicability increased from 10 to 20 workers (with power) and 20 to 40 workers (without power), reducing compliance burden for small units.

Social Security Fund: Establishes a fund for unorganised workers, financed through penalties and compounding fees, for their welfare and benefit delivery.

Contract Labour- Welfare & Wages: Principal employers to provide welfare facilities like health and safety measures to contract workers. If the contractor fails to pay wages, the principal employer has to pay unpaid wages to the contract labour.

Working Hours & Overtime: Normal working hours capped at 8 hours/day and 48 hours/week. Overtime allowed only with worker consent and paid at twice the regular rate.

Inspector-cum-Facilitator System: Inspectors will now act as facilitators with an objective to help employers comply with law, rules and regulations rather than merely policing them.

The Transformative Power of Labour Codes

India’s new Labour Codes make labour laws simpler, fairer, and more in tune with today’s work environment. They protect workers’ rights, improve safety and social security, make it easier for businesses to comply with rules, and create more job opportunities in a growing economy. The enacted Labour Codes bring out following transformations in the labour market:

- Align labour laws with the current economic scenario by modernizing regulations in accordance with evolving work patterns, technological advancements, and economic realities.

- Ensure the safety, health, social security, and wage security of every worker through a unified and comprehensive framework encompassing all categories of workers.

- Enhance employment opportunities by simplifying procedures and fostering a business-friendly environment that promotes investment and economic growth.

- Facilitate easier compliance by introducing uniform definitions, single registration, single return, and simplified online systems for seamless adherence.

- Encourage the use of technology in the administration of labour laws through digital registration, licensing, and inspections for improved efficiency and transparency.

- Strengthen transparency and accountability in enforcement through online, risk-based inspection mechanisms and objective implementation processes.

- Achieve simplification, harmonization, and rationalization of the regulatory framework by consolidating multiple labour laws into four comprehensive Codes, ensuring consistency and reducing administrative burden.

Conclusion

Establishment of the new Labour Codes marks a transformative step in India’s labour landscape- one that balances the welfare of workers with the efficiency of enterprises. These provisions simplify compliance, promote safety, and ensure fairness in wages. Moreover, these reforms lay the foundation for a more equitable, transparent, and growth-oriented economy. They reaffirm India’s commitment to fostering a modern labour ecosystem that empowers both workers and industry, paving the way for inclusive and sustainable progress.

References

Labour.gov.in

https://labour.gov.in/sites/default/files/labour_code_eng.pdf

https://labour.gov.in/sites/default/files/the_code_on_wages_2019_no._29_of_2019.pdf

Ministry of Labour & Employment

https://www.pib.gov.in/newsite/pmreleases.aspx?mincode=21

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2147928#:~:text=As%20per%20the%20latest%20data,47.5%20crore%20in%202017%2D18

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2160547

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2147160

Click here to see pdf

****

M

(Explainer ID: 156140)

आगंतुक पटल : 28628

Provide suggestions / comments