Special Service and Features

RBI leaves policy rates unchanged, accommodative stance of monetary policy to revive growth and mitigate impact of COVID-19

RBI Projects GDP growth at 10.5% for FY 2021-22

Indicators suggest that the list of normalizing sectors is expanding: RBI

Posted On:

05 FEB 2021 4:49PM by PIB Mumbai

Mumbai, February 5, 2021

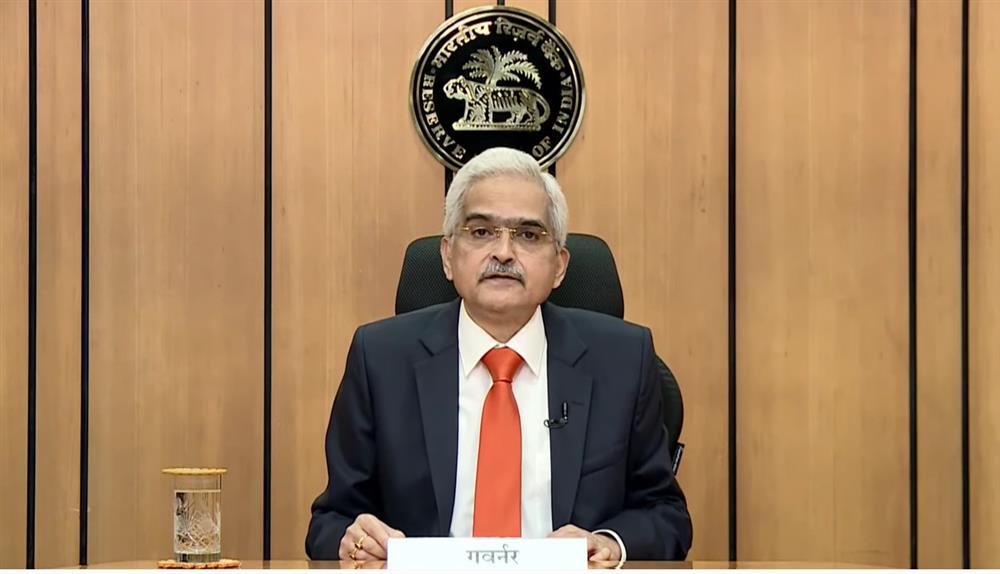

The Monetary Policy Committee (MPC) has voted unanimously to leave the Repo Rate unchanged at 4%, stated Governor of the Reserve Bank of India (RBI), Shri Shaktikanta Das in his Monetary Policy Statement today. He further stated, Reverse Repo Rate will remain unchanged at 3.35% and the Marginal Standing Facility Rate and Bank Rate will also remain unchanged at 4.25%. The RBI Governor further noted that accommodative stance of the Monetary Policy will continue as long as necessary through the current FY and into the next year to revive growth on a durable basis and to mitigate the impact of COVID-19. He also said, the stance of liquidity management will also continue to be accommodative and completely in consonance with the stance of monetary policy.

Growth and Inflation:

- The Outlook on Growth has improved significantly with positive growth impulses becoming more broad-based and the rollout of vaccination programme in the country is auguring well for the end of the pandemic.

- For the first time during COVID-19 period, inflation has eased below the upper tolerance level of 6%.

- Indicators suggest that the list of normalizing sectors is expanding. Going ahead, the factors that could shape the food inflation trajectory in the coming months are all indicative of a stable near term outlook.

- GDP Growth is projected at 10.5% in 2021-22 in the range of 26.2% - 8.35% in H1 (first half) and 6% in Q3 (third quarter) of FY 2021-22.

- Projection for CPI Inflation Rate has been revised to 5.2 % for Q4 (Jan to March) of current FY (2020-21), 5.2 to 5% for H1 (First Half) of FY 2021-22 and 4.3% for Q3 of 2021-22.

The RBI Governor stated that RBI will persevere with its paramount objective of reviving the economy with measures relating to: (i) enhancing liquidity support to targeted sectors and liquidity management; (ii) regulation and supervision; (iii) deepening financial markets; (iv) upgrading payment and settlement systems; and (v) strengthening consumer protection. The additional measures taken for these purposes are as follows:

- Banks will provide funds under the Tap Targeted Long Term Repo Operations (TLTRO) scheme to NBFCs for incremental lending to the specified stressed sectors.

- CRR will be gradually restored in two phases in a non-disruptive manner to 3.5 per cent effective from March 27, 2021 and 4.0 per cent effective from May 22, 2021.

- Banks will be allowed to avail of funds under the marginal standing facility (MSF) by dipping into the Statutory Liquidity Ratio (SLR) up to an additional one per cent of net demand and time liabilities (NDTL), ), i.e., cumulatively up to 3 per cent of NDTL for a further period of another six months, i.e. up to September 30, 2021.

- Scheduled Commercial Banks will be allowed to deduct credit disbursed to ‘New MSME borrowers’ from their net demand and time liabilities (NDTL) for calculation of CRR. For the purpose of this exemption, ‘New MSME borrowers’ would be those who have not availed any credit facilities from the banking system as on January 1, 2021. This exemption will be available for exposures up to ₹25 lakh per borrower for credit extended up to the fortnight ending October 1, 2021.

- Implementation of last tranche of the Capital Conservation Buffer (CCB) of 0.625 per

cent and also the implementation of Net Stable Funding Ratio (NSFR) will be deferred by

another six months from April 1 to October 1, 2021, to enable banks to continue providing the necessary support to the process of recovery.

- The Reserve Bank will come out with a consultative document harmonizing the regulatory frameworks applicable to various regulated lenders (NBFC-Micro Finance Institutions, Scheduled Commercial Banks, Small Finance Banks and NBFC–Investment and Credit Companies) in the microfinance space.

- An Expert Committee (EC) will be constituted to provide a medium term road map for strengthening the Urban Co-operative Banking sector leveraging on the legislative

- Amendments.

- Resident individuals will be permitted to make remittances to International Financial Service Centres (IFSCs) for investment in securities issued by non-resident entities in IFSCs. For this specific purpose, resident individuals would be allowed to open a non-interest bearing Foreign Currency Account (FCA) in IFSCs.

- Retail investors will be given online access to the government securities market – both primary and secondary – directly through the Reserve Bank (‘Retail Direct’).

- Foreign Portfolio Investors (FPI) investment in defaulted corporate bonds will be exempted from the short-term limit and the minimum residual maturity requirement under the Medium-Term Framework.

- Major payment system operators would be required to facilitate setting-up of a centralised industrywide 24x7 helpline for addressing customer queries in respect of various digital payment products and give information on available grievance redress mechanisms.

- A potential area of operational risk is associated with outsourcing by payment system operators (PSOs) and participants of authorized payment systems. To manage the attendant risks in outsourcing and ensure that a code of conduct is adhered to while outsourcing payment and settlement related services, the Reserve Bank shall issue guidelines on outsourcing of such services by these entities

- About 18,000 bank branches are still outside any formal clearing arrangement. It is now

- proposed to bring all these branches under Cheque Truncation System (CTS) clearing by September 2021

- At present, the framework for alternate dispute resolution consists of three separate Ombudsman schemes for banks, NBFCs and non-bank prepaid payment issuers (PPIs). It has been decided to integrate the three Ombudsman schemes and introduce centralised processing of grievances following a ‘One Nation One Ombudsman’ approach. This is intended to make the process of redress of grievances easier by enabling the customers to register their complaints under the integrated scheme, with one centralised reference point. The Integrated Ombudsman Scheme will be rolled out in June 2021.

RBI Governor also stated the following observations:

- RBI's survey points towards improvement in capacity utilization in manufacturing sector

- Consumer confidence is reviving and business expectations of manufacturing services and infrastructure remain upbeat.

- The movement of good and people and domestic trading activity are growing at a robust pace. Electricity and energy demand reflect a broader normalization of economic activities than in December.

- Data for sales and new launches of residential units in major Metro cities reflect a renewed confidence in real estate sector

- Vaccination drive is expected to provide an impetus for the restoration of contact intensive sectors and a leading edge to the Indian pharma Industry in the global market

- FDI and Foreign Portfolio Investment to India have surged in the recent months, reposing faith in the impressive recovery in Indian economy.

- Pace of award of National Highway Project in 2021 has doubled.

- Flow of financial resources to commercial sector has been improving; particularly in respect on non-food, bank credit and via commercial paper, credit by housing finance companies, private placement of corporate bonds and FDI.

- Bank lending survey of RBI suggests further sequential improvement in sentiment on loan demand across all sectors up to Q2 of 2021-22.

- Union Budget 2021 has provided a strong impetus for revival of sectors - health, infrastructure, innovation & research among others. This will have a cascading multiplier effect in improving the investment climate, reinvigorating domestic demand, income and employment.

- Investment oriented stimulus under the Aatma Nirbhar 2.0 and 3.0 given during the peak of the pandemic has started working its way through and is improving the spending momentum along with the quality of public investment.

- Projected increase in capital expenditure in the Union Budget augurs well for capacity creation and crowding in private investment.

- Issuance of Corporate bonds reached a record level in 2020. It has been ₹ 5.8 Lakh Crore during April - December in 2020

RBI Governor's Statement can be accessed here.

***

RT/SC/PK

Follow us on social media:  @PIBMumbai

@PIBMumbai  /PIBMumbai

/PIBMumbai  /pibmumbai

/pibmumbai  pibmumbai[at]gmail[dot]com

pibmumbai[at]gmail[dot]com

(Release ID: 1695518)

Visitor Counter : 1151