Special Service and Features

UPI-based Digital Payment Products for Feature Phone Users to be launched

RBI leaves Policy Rates Unchanged

Indian economy projected to grow at 9.5% in FY 2021-22: RBI

Posted On:

08 DEC 2021 2:21PM by PIB Mumbai

Mumbai, 08th December 2021

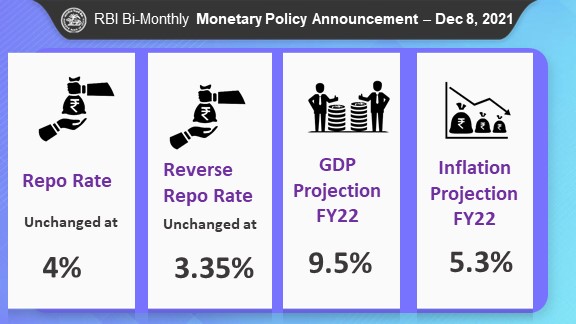

The policy repo rate remains unchanged at 4.0%, Marginal Standing Facility and Bank Rate remain unchanged at 4.25%, and reverse repo rate remains unchanged at 3.35%. This has been announced by the Governor of Reserve Bank of India Shri Shaktikanta Das, in his bi-monthly monetary policy statement, delivered online today, December 8, 2021.

The Governor announced a series of additional measures to stimulate the economy and the financial system.

- Infusion of Capital in overseas branches and subsidiaries of Banks and retention, repatriation and transfer of profits by these entities: To provide operational flexibility, banks will henceforth not need to seek prior approval of RBI for retention, repatriation and transfer of profits from their overseas branches and subsidiaries, provided they meet regulatory capital requirements.

- Discussion Paper on Review of Prudential Norms for Investment Portfolios of Banks: RBI will release a Discussion Paper on Review of Prudential Norms for Investment Portfolios of Banks for public comments. This is being done considering the significant developments in domestic financial markets and global standards/best practices in this area since October 2000, when the current framework was introduced.

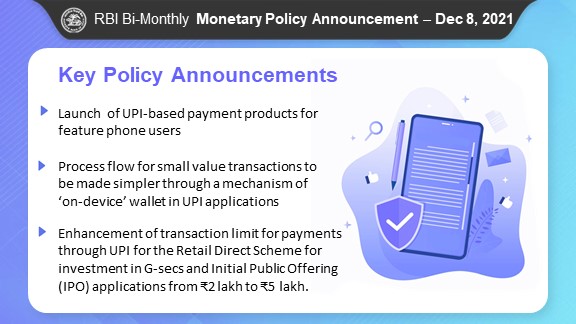

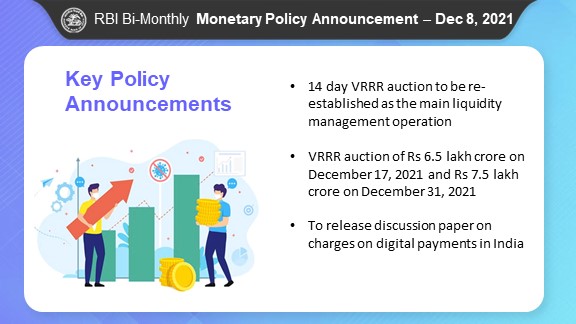

- Discussion Paper on Charges in Payment Systems: RBI will release a discussion paper on various charges in the payment system, in order to have a holistic view of the issues involved such as concerns on reasonableness of charges incurred by customers for digital payments, and of the possible approaches to mitigating the concerns so as to make digital transactions more affordable.

- UPI: Simplification, Deepening and Enhancement of Limits: RBI has announced a set of three measures to further deepen digital payments and make them more inclusive.

- RBI to launch UPI-based payment products for feature phone users, leveraging innovative products from the RBI’s Regulatory Sandbox on Retail Payments

- RBI to simplify the process flow for small value UPI transactions through a mechanism of ‘on-device’ wallet in UPI applications

- RBI to enhance the transaction limit for UPI payments for the Retail Direct Scheme for investment in G-secs and Initial Public Offering (IPO) applications, from ₹ 2 lakh to ₹ 5 lakh

- External Commercial Borrowing (ECB)/Trade Credit (TC) – Transition from LIBOR to Alternative Reference Rate (ARR): Considering the transition away from LIBOR, RBI will issue guidelines enabling use of any widely accepted interbank rate or alternative reference rate for ECBs and Trade Credits.

From January 2022, Liquidity absorption will be mainly through VRRR Auctions

The Governor spoke about RBI’s liquidity measures to support the banking system. He informed that a shift is being made from Fixed Rate Overnight Reverse Repo Window to Variable Rate Reverse Repo Auctions of longer maturity. The 14-day Variable Rate Reverse Repo (VRRR) Auction amounts will be enhanced on a fortnightly basis, to Rs. 6.5 lakh crore on December 17, 2021 and to Rs. 7.5 lakh crore on December 31, 2021. From January 2022 onwards, liquidity absorption will be undertaken mainly through the auction route.

The Governor announced that banks will be given one more option to pre-pay the outstanding fund amount availed under Targeted Long Term Repo Operations (TLTRO 1.0 and TLTRO 2.0).

In line with the proposal to return to the normal Marginal Standing Facility dispensation, the Governor informed that banks will be able to dip up to 2% of Net Demand and Time Liabilities, instead of 3%, for overnight borrowing under MSF, effective from January 1, 2022.

GDP projected at 9.5% and CPI inflation projected at 5.3% in FY 2021-22

The Governor has informed that the economy is projected to grow at 9.5% in the current financial year and inflation for the year is expected to 5.3%.

Gross Domestic Product (GDP) Growth Projections:

- 6.6% in Q3 of 2021-22

- 6.0% in Q4 of 2021-22

- 17.2% in Q1 of 2022-23

- 7.8% in Q2 of 2022-23

Consumer Price Index (CPI) Inflation Rate Projections:

- 5.1% in Q3 of 2021-22

- 5.7% in Q4 of 2021-22

- 5.0% in Q1 of 2022-23

- 5.0% in Q2 of 2022-23

The Governor cited National Statistical Office’s (NSO) recent release and said that it confirms recovery of Indian economy and how all components of GDP have registered year-on-year growth. “Year on Year real GDP grew at 8.4% for Q2 2021-22 and 20.1% in Q1 of 2021-22.” He pointed out several indicators that are showing recovery including consumption demand, government consumption, urban demand, rural demand and farm employment. He informed that according to the Bank, the recovery of the Indian economy is gaining traction, but it is not yet strong enough to be self-sustaining and durable. This underscores the need and significance of continued policy support, he added.

Better Prepared to deal with COVID-19

The Governor was also positive about the recovery of the Indian economy from the challenges posed by the Pandemic. “We are now better prepared to deal with the invisible enemy of COVID-19. Indian economy has hauled itself out of one of the deepest contractions in Q1 of 2020-21.”

The Governor said that the policy measures by the centre, state and RBI has helped in bringing about this outcome. He went on to appreciate all the frontline workers and health care workers whose tireless efforts have helped the recovery of the economy. “Monetary Policy Committee was of the view that the sharp, sustained reduction in new COVID-19 infections and rise in Vaccination coverage are contributing to consumer confidence and business optimism.”

However, he also pointed out the prevailing threats posed by the emerging variants. “Indian economy is relatively well-positioned towards recovery, but not immune to global spill overs or to possible surges of infections from new mutations including Omicron variant.”

In his closing remarks, Shri Das quoted the words of Mahatma Gandhi, “He who strives never perishes. I have implicit faith in that promise.." saying that our efforts have given positive results and that we should continue to work together for a strong, stable and vibrant economy.

The RBI Governor’s statement can be read here.

The Monetary Policy statement can be read here.

Watch the address here.

***

PIB Mumbai | Dhanalakshmi/DJM/PM

Follow us on social media:  @PIBMumbai

@PIBMumbai  /PIBMumbai

/PIBMumbai  /pibmumbai

/pibmumbai  pibmumbai[at]gmail[dot]com

pibmumbai[at]gmail[dot]com

(Release ID: 1779200)

Visitor Counter : 964