Ministry of Communications

Highlights of Telecom Subscription Data as on 30th April 2025

Posted On:

29 MAY 2025 1:44PM by PIB Delhi

Highlights of Telecom Subscription Data as on 30th April 2025

|

Particulars

|

Wireless

|

Wireline

|

Total

(Wireless+

Wireline)

|

|

Broadband Subscribers (Million)

|

901.67*

|

41.41

|

943.09

|

|

Urban Telephone Subscribers (Million)

|

633.29*

|

33.90

|

667.19

|

|

Net Addition in April 2025 (Million)

|

0.72

|

0.36

|

1.08

|

|

Monthly Growth Rate

|

0.11%

|

1.07%

|

0.16%

|

|

Rural Telephone Subscribers (Million)

|

533.14*

|

3.51

|

536.65

|

|

Net Addition in April 2025 (Million)

|

1.95

|

0.01

|

1.96

|

|

Monthly Growth Rate

|

0.37%

|

0.33%

|

0.37%

|

|

Total Telephone Subscribers (Million)

|

1166.43*

|

37.41

|

1203.84

|

|

Net Addition in April 2025 (Million)

|

2.68

|

0.37

|

3.05

|

|

Monthly Growth Rate

|

0.23%

|

1.00%

|

0.25%

|

|

Overall Tele-density@ (%)

|

82.54%

|

2.65%

|

85.19%

|

|

Urban Tele-density@ (%)

|

124.78%

|

6.68%

|

131.46%

|

|

Rural Tele-density@ (%)

|

58.87%

|

0.39%

|

59.26%

|

|

Share of Urban Subscribers

|

54.29%

|

90.61%

|

55.42%

|

|

Share of Rural Subscribers

|

45.71%

|

9.39%

|

44.58%

|

- In the month of April 2025, 13.48 million subscribers submitted their requests for Mobile Number Portability (MNP).

- The number of active wireless (Mobile) subscribers (on the date of peak VLR#) in April 2025 was 1072.73 million.

__________________________________________________________________________________________________________________

Note:

- * Wireless includes 5G FWA (Fixed Wireless Access) subscription also.

- @ Based on the projection of population from the ‘Report of the Technical Group on Population Projections for India and States 2011 – 2036’.

- # VLR is acronym of Visitor Location Register. The dates of peak VLR for various TSPs are different in different service areas.

- Information in this Press Release is based on the data provided by the Service Providers.

-

- Broadband Subscribers

- As per information received from 1462 operators in April 2025, in comparison to 1206 operators in March 2025, the total Broadband Subscribers decreased from 944.12 million at the end of March 2025 to 943.09 million at the end of April 2025 with a monthly growth rate of -0.11%. Segment-wise broadband subscribers and their monthly growth rates are as below: -

Segment–wise Broadband Subscribers and Monthly Growth Rate in the month of April 2025

|

Segment

|

Subscription

|

Subscribers

(in million)

|

% Change

|

|

Mar-25

|

Apr-25

|

|

Wired subscribers

|

Fixed (wired) Broadband

(DSL, FTTx, Ethernet/LAN, Cable Modem, ILL)

|

41.39

|

41.41

|

0.07%

|

|

Wireless Subscribers

|

Fixed Wireless Broadband

(5G FWA, Wi-Fi, Wi-Max, Radio, Satellite)

|

4.89

|

4.87

|

-0.55%

|

|

Mobile Broadband

(Handset/Dongle based)

|

897.84

|

896.81

|

-0.12%

|

|

Total Broadband Subscribers

|

944.12*

|

943.09*

|

-0.11%

|

* This report has been prepared considering the last reported (November 2024) internet subscription data submitted by M/s Reliance Jio Infocom Ltd. and M/s Bharti Airtel Ltd., as they did not submit the required data in the prescribed report format since December 2024.

As on 30th April 2025, top five Broadband

(Wired + Wireless) Service providers

|

S.N.

|

Name of the Service Provider

|

Subscriber base

(In million)

|

-

|

Reliance Jio Infocomm Ltd

|

476.58*

|

-

|

Bharti Airtel Ltd.

|

289.31*

|

-

|

Vodafone Idea Ltd.

|

125.63

|

-

|

Bharat Sanchar Nigam Ltd.

|

34.26

|

-

|

Atria Convergence Technologies Limited

|

2.30

|

|

Market Share of Top Five Broadband (Wired+Wireless)

|

98.41%

|

*As per reported data of November,2024

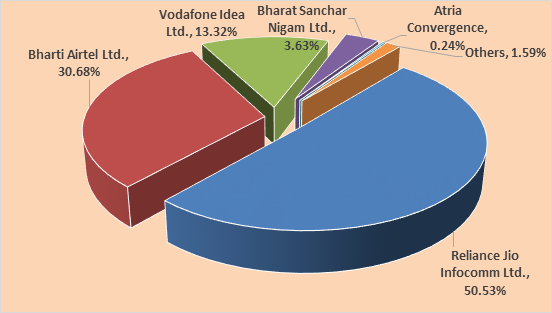

- The graphical representation of the service provider-wise market share of broadband services is given below: -

Service Provider-wise Market Share of Broadband

(wired + wireless) Services as on 30th April, 2025

As on 30th April, 2025, Top Five Fixed (Wired) Broadband Service providers

|

S.N.

|

Name of the Service Provider

|

Subscriber base

(In million)

|

-

|

Reliance Jio Infocomm Ltd

|

11.48*

|

-

|

Bharti Airtel Ltd

|

8.55*

|

-

|

Bharat Sanchar Nigam Ltd

|

4.32

|

-

|

Atria Convergence Technologies Limited

|

2.30

|

-

|

Kerala Vision Broadband Ltd

|

1.33

|

|

Market Share of Top Five Fixed (Wired) Broadband Service Providers

|

67.56%

|

*As per reported data of November, 2024

As on 30th April, 2025, top five Wireless (Fixed wireless & mobile) Broadband Service providers

|

S.N.

|

Name of the Service Provider

|

Subscriber base

(In million)

|

-

|

Reliance Jio Infocomm Ltd

|

465.10*

|

-

|

Bharti Airtel Ltd

|

280.76*

|

-

|

Vodafone Idea Ltd

|

125.63

|

-

|

Bharat Sanchar Nigam Ltd

|

29.94

|

-

|

IBus Virtual Network Services Private Limited

|

0.09

|

|

Market Share of Top Five Wireless Broadband Service Providers

|

99.98%

|

*As per reported data of November, 2024

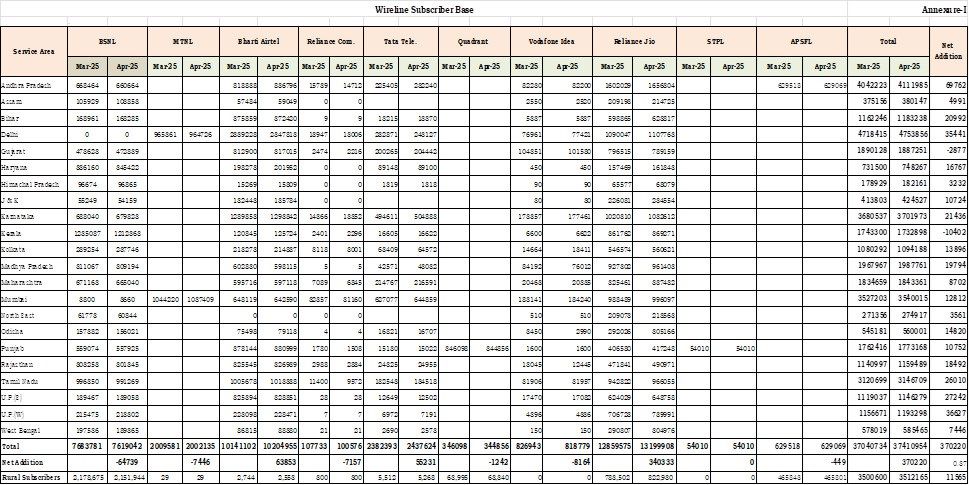

- Wireline Subscribers

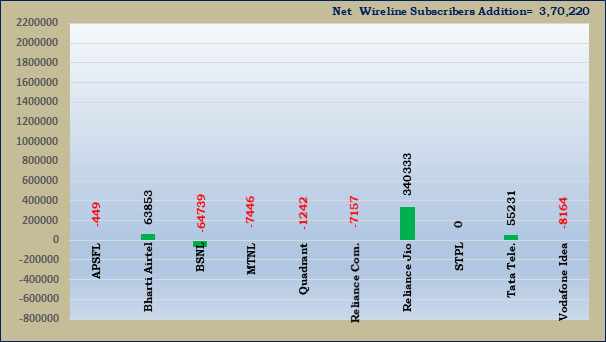

- Wireline subscribers increased from 37.04 million at the end of March-25 to 37.41 million at the end of April-25. Net increase in the wireline subscriber base was 0.37 million with a monthly growth rate of 1.00%.

- The Overall wireline Tele-density in India increased from 2.62% at the end of March-25 to 2.65% at the end of April-25. Urban and Rural Wireline Tele-density were 6.68% and 0.39%, respectively, during the same period. The share of urban and rural subscribers in total wireline subscribers were 90.61% and 9.39% respectively at the end of April, 2024.

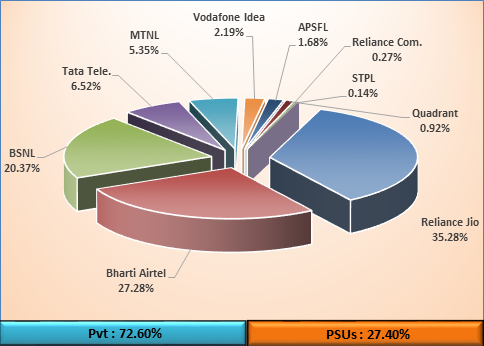

- BSNL, MTNL, and APSFL, the three PSU access service providers, held 27.40% of the wireline market share as on 30th April 2025. Detailed statistics of the wireline subscriber base are available at Annexure-I.

Access Service Provider-wise Market Share of Wireline Subscribers

as on 30th April, 2025

Access Service Provider-wise Net Addition/Decline in wireline Subscribers during the month of April, 2025

- Wireless (Mobile + 5G FWA) Subscribers

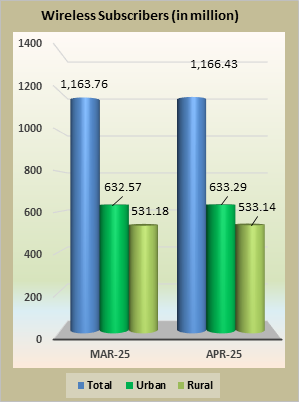

- Total wireless (mobile + 5G FWA) subscribers increased from 1,163.76 million at the end of March-25 to 1,166.43 million at the end of April-25, thereby registering a monthly growth rate of 0.23%. Total Wireless subscription in urban areas increased from 632.57 million at the end of March-25 to 633.29 million at the end of April-25. The subscription in rural areas also increased from 531.18 million to 533.14 million during the same period. The monthly growth rate of urban and rural wireless subscriptions was 0.11% and 0.37%, respectively.

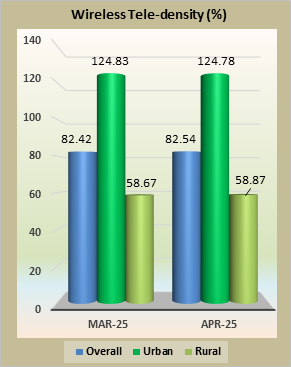

- The Wireless Tele-density in India increased from 82.42% at the end of March-25 to 82.54% at the end of April-25. The Urban Wireless Tele-density decreased from 124.83% at the end of March-25 to 124.78% at the end of April-25. The Rural Tele-density increased from 58.67% to 58.87% during the same period. The share of urban and rural wireless subscribers in the total number of wireless subscribers was 54.29% and 45.71%, respectively, at the end of April-25.

- The details of Wireless (mobile and 5G FWA) subscribers are detailed below:

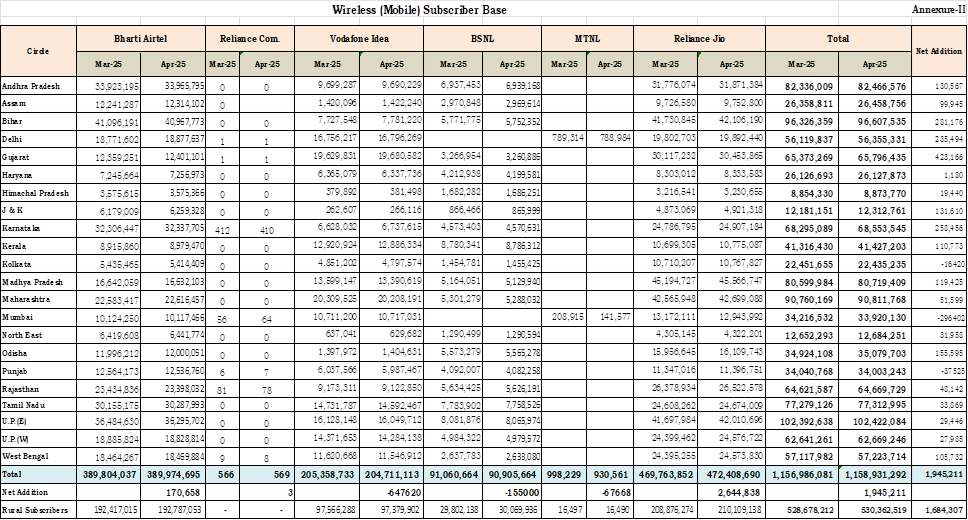

(A) Wireless (mobile) subscriber

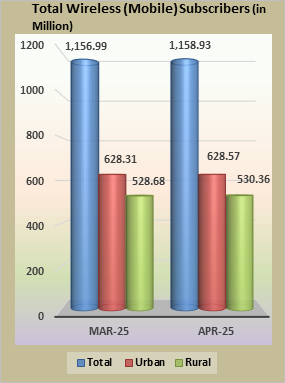

- Total wireless (mobile) subscribers increased from 1,156.99 million at the end of March-25 to 1,158.93 million at the end of April-25, thereby registering a monthly growth rate of 0.17%. Wireless (mobile) subscription in urban areas increased from 628.31 million at the end of March-25 to 628.57 million at the end of April-25 and wireless (mobile) subscription in rural areas also increased from 528.68 million to 530.36 million during the same period. Monthly growth rate of urban and rural wireless (mobile) subscription was 0.04% and 0.32% respectively.

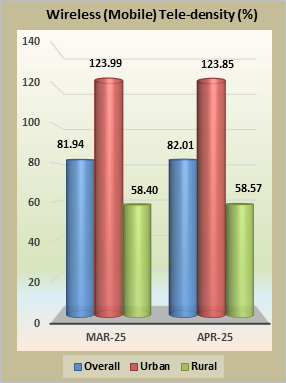

- The Wireless (mobile) Tele-density in India increased from 81.94% at the end of March-25 to 82.01% at the end of April-25. The Urban Wireless Tele-density decreased from 123.99% at the end of March-25 to 123.85% at the end of April-25 and Rural Tele-density increased from 58.40% to 58.57% during the same period. The share of urban and rural wireless (mobile) subscribers in total number of wireless (mobile) subscribers was 54.24% and 45.76% respectively at the end of April 2025.

Detailed statistics of wireless (mobile) subscriber base are available at Annexure-II.

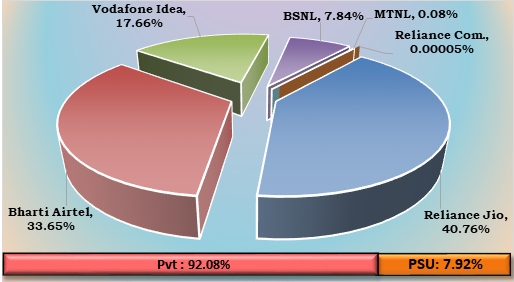

• As on 30th April 2025, the private access service providers held 92.08% market share of the wireless (mobile) subscribers, whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 7.92%.

- The graphical representation of access service provider-wise market share and net additions in wireless (mobile) subscriber base are given below: -

Access Service Provider-wise Market Shares in term of Wireless (Mobile) Subscribers as on 30th April 2025

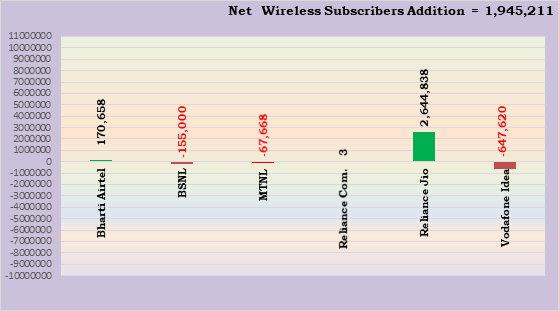

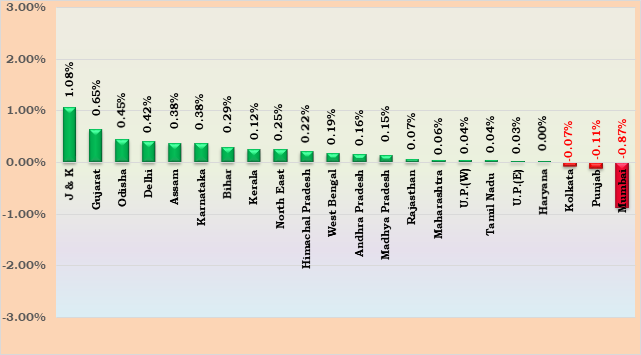

Net Addition/ Decline in Wireless (Mobile) Subscribers of Access Service Providers in the month of April, 2025

Growth in Wireless (Mobile) Subscribers

Major Access Service Provider-wise Monthly Growth/ Decline Rate of Wireless Subscribers in the month of April, 2025

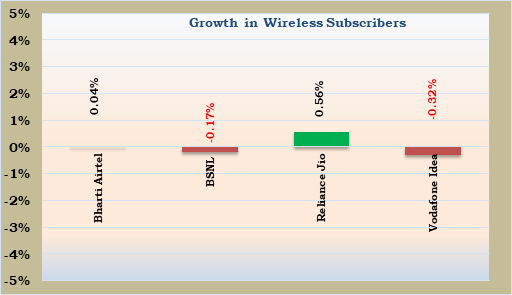

Service Area-wise Monthly Growth/ Decline Rate of Wireless (Mobile) Subscribers in the month of April, 2025

- Except Kolkata, Punjab and Mumbai, all other service areas have shown growth in their wireless (mobile) subscribers during the month of April-25.

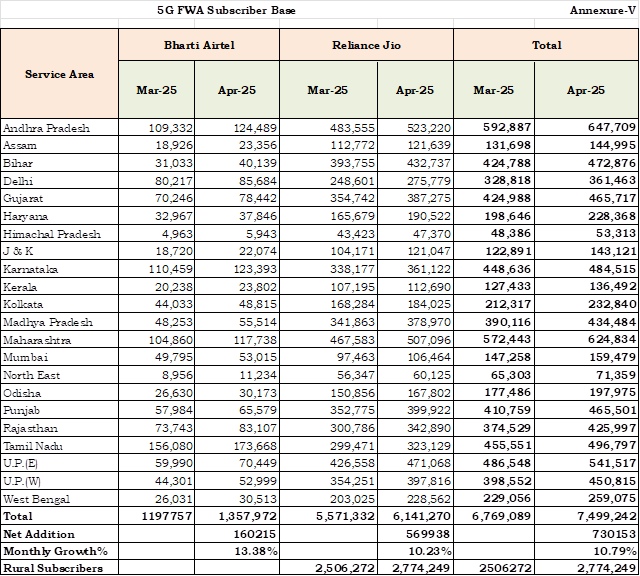

(B) Wireless (5G FWA) subscribers

- Total wireless (5G FWA) subscribers increased from 6.77 million at the end of March-25 to 7.50 million at the end of April-25 with subscriptions in urban and rural areas of 4.72 million and 2.77 million, respectively

- The share of urban and rural wireless (5G FWA) subscribers in the total number of wireless (5G FWA) subscribers was 63.01% and 36.99%, respectively at the end of April-25. Detailed statistics of the wireless (5G FWA) subscriber base is available at Annexure-V.

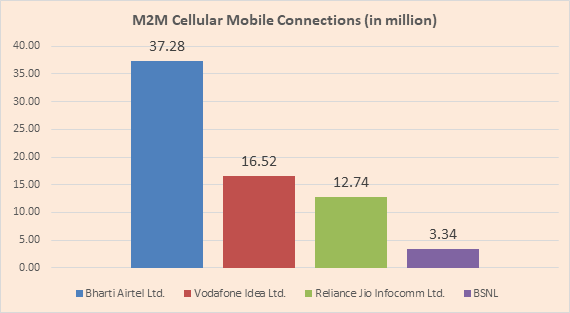

- M2M cellular mobile connections

The number of M2M cellular mobile connections increased from 66.54 million at the end of March-25 to 69.87 million at the end of April-25.

Bharti Airtel Limited has the highest number of M2M cellular mobile connections of 37.28 million with a market share of 53.35%, followed by Vodafone idea Limited, Reliance Jio Infocomm Limited and BSNL with market share of 23.64%, 18.24% and 4.77% respectively.

- Total Telephone Subscribers

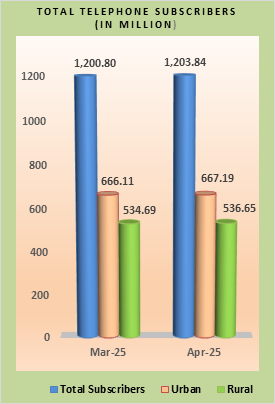

- The number of total telephone subscribers in India increased from 1,200.80 million at the end of March-25 to 1,203.84 million at the end of April-25, thereby showing a monthly growth rate of 0.25%. Urban telephone subscription increased from 666.11 million at the end of March-25 to 667.19 million at the end of April-25 and the rural subscription also increased from 534.69 million to 536.65 million during the same period. The monthly growth rates of urban and rural telephone subscription were 0.16% and 0.37% respectively during the month of April, 2025.

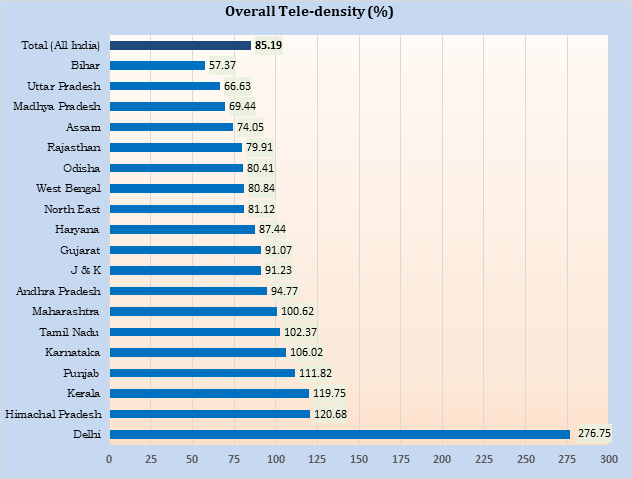

- The overall Tele-density in India increased from 85.04% at the end of March-25 to 85.19% at the end of April-25. The Urban Tele-density increased from 131.45% at the end of March-25 to 131.46% at the end of April-25 and Rural Tele-density also increased from 59.06% to 59.26% during the same period. The share of urban and rural subscribers in total number of telephone subscribers at the end of April-25 were 55.42% and 44.58% respectively.

Overall Tele-density (LSA Wise) – As on 30th April, 2025

- As may be seen in the above chart, eight LSA have less tele-density than the all-India average tele-density at the end of April-25. Delhi service area has the maximum tele-density of 276.75% and the Bihar service area has the minimum tele-density of 57.37% at the end of April-25.

Notes: -

- Population data/projections are available state wise only.

- Tele-density figures are derived from the telephone subscriber data provided by the access service providers and the projection of population from the “Report of the Technical Group on Population Projections for India and States 2011 – 2036.

- Telephone subscriber data for Delhi includes, apart from the data for the State of Delhi, wireless subscriber data for the areas served by the local exchanges of Ghaziabad & Noida (in Uttar Pradesh) and Gurgaon & Faridabad (in Haryana).

- Data/information for West Bengal includes Kolkata, Maharashtra includes Mumbai and Uttar Pradesh includes UPE & UPW service area(s).

- Data/information for Andhra Pradesh includes Telengana, Madhya Pradesh includes Chhatishgarh, Bihar includes Jharkhand, Maharashtra includes Goa, Uttar Pradesh includes Uttarakhand, West Bengal includes Sikkim and North-East includes Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland & Tripura States.

- Category-wise Growth in subscriber base

Circle Category-wise Net Additions in Telephone Subscribers in the month April, 2025

|

Circle

Category

|

Net additions in the month of April 2025

|

Telephone Subscriber base as on 30th April 2025

|

|

Wireline segment

|

Wireless* segment

|

Wireline segment

|

Wireless* segment

|

|

Circle A

|

123033

|

1122724

|

14691279

|

387660891

|

|

Circle B

|

126718

|

731768

|

10326625

|

472204750

|

|

Circle C

|

58320

|

832811

|

3004991

|

193100415

|

|

Metro

|

62149

|

-11939

|

9388059

|

113464478

|

|

All India

|

370220

|

2675364

|

37410954

|

1166430534

|

*Wireless includes 5G FWA subscription also

Circle Category-wise monthly and yearly Growth Rates in Telephone Subscribers in the month of April, 2025

|

Circle Category

|

Monthly growth rate (%)

(March-25 to April-25)

|

Yearly growth rate (%)

(April-24 to April-25)

|

|

Wireline Segment

|

Wireless* Segment

|

Wireline Segment

|

Wireless* Segment

|

|

Circle A

|

0.84%

|

0.29%

|

10.12%

|

-0.19%

|

|

Circle B

|

1.24%

|

0.16%

|

12.25%

|

-0.25%

|

|

Circle C

|

1.98%

|

0.43%

|

11.93%

|

2.18%

|

|

Metro

|

0.67%

|

-0.01%

|

3.89%

|

-1.10%

|

|

All India

|

1.00%

|

0.23%

|

9.19%

|

0.08%

|

*Wireless includes 5G FWA subscription also.

Note: Circle Category-Metro includes Delhi, Mumbai and Kolkata. Data for Chennai has been included in Circle Category-A, as part of Tamil Nadu.

- As can be seen in the above tables, in the wireless segment, during the month of April 2025, on a monthly basis, all circles, except ‘Metro’, have registered a growth in their subscriber bases; on a yearly basis, except Circle ‘C’, all other circles have registered a decline in their subscriber bases.

- In the Wireline segment, during the month of April-2025, on a monthly and yearly basis, all circles have registered a growth in their subscriber bases.

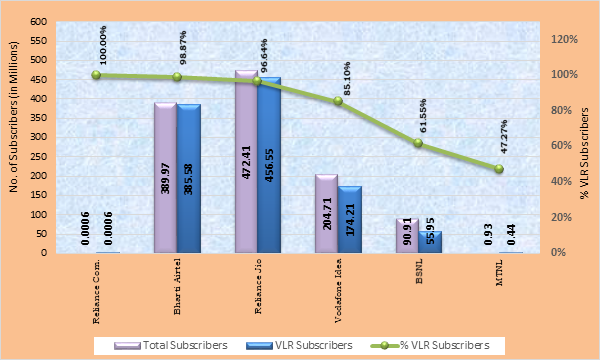

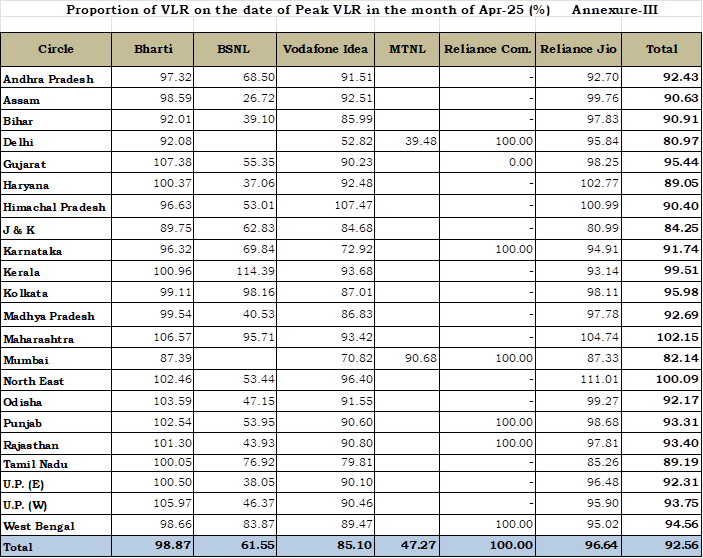

- Active Wireless (Mobile) Subscribers (VLR Data)

|

- Out of the total 1158.93 million wireless subscribers, 1072.73 million wireless subscribers were active on the date of peak VLR in the month of April-25. The proportion of active wireless subscribers was approximately 92.56% of the total wireless subscriber base.

- The detailed statistics on proportion of active wireless subscribers (also referred to as VLR subscribers) on the date of peak VLR in the month of April-25 is available at Annexure-III and the methodology used for reporting VLR subscribers is available at Annexure-IV.

Access Service Provider-wise Percentage of VLR Subscribers

in the month of April, 2025

- Reliance Communication has the maximum proportion (100%) of its active wireless subscribers (VLR) as against its total wireless subscribers (HLR) on the date of peak VLR in the month of April-25. MTNL has the minimum proportion of VLR (47.27%) of its HLR during the same period.

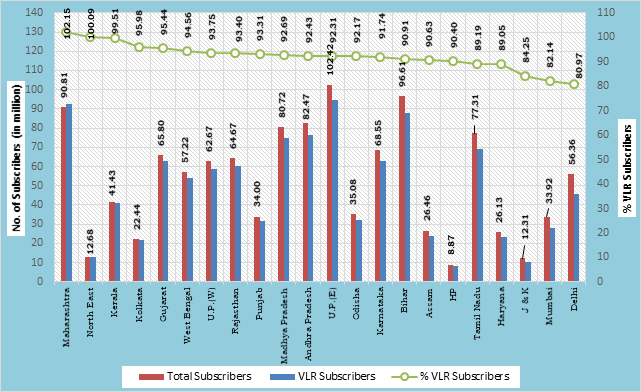

Service Area wise percentage of VLR Subscribers

in the month of April, 2025

- Mobile Number Portability (MNP)

- Mobile number portability (MNP) was implemented in Haryana service area w.e.f. 25.11.2010 and in the rest of the country w.e.f. 20.01.2011. Initially it was available only within the same Licensed Service Area (LSA). Inter-Service Area MNP has been implemented in the country w.e.f. 03.07.2015 allowing the wireless subscribers to retain their mobile numbers when they relocate from one service area to another.

- During the month of April-2025, a total of 13.48 million requests were received for MNP. Out of total 13.48 million, new requests received from Zone-I & Zone-II were 7.60 million and 5.88 million respectively.

- In MNP Zone-I (Northern and Western India), the highest number of requests till date have been received in Uttar Pradesh-East (113.81 million) followed by Maharashtra (91.80 million) service area.

- In MNP Zone-II (Southern and Eastern India), the highest number of requests till date have been received in Madhya Pradesh (89.58 million) followed by Karnataka (74.10 million).

|

Service Area Wise MNP Status

|

|

Zone-I

|

Zone–II

|

|

Service Area

|

Cumulative Number of Porting Requests Till (in Million)

|

Service Area

|

Cumulative Number of Porting Requests Till

(in Million)

|

|

Mar-25

|

Apr-25

|

Mar-25

|

Apr-25

|

|

Delhi

|

53.25

|

53.87

|

Andhra Pradesh

|

72.69

|

73.33

|

|

Gujarat

|

76.11

|

77.03

|

Assam

|

8.20

|

8.30

|

|

Haryana

|

35.19

|

35.58

|

Bihar

|

64.93

|

65.97

|

|

Himachal Pradesh

|

4.68

|

4.74

|

Karnataka

|

73.53

|

74.10

|

|

Jammu & Kashmir

|

3.23

|

3.30

|

Kerala

|

26.34

|

26.58

|

|

Maharashtra

|

90.87

|

91.80

|

Kolkata

|

20.17

|

20.36

|

|

Mumbai

|

36.23

|

36.50

|

Madhya Pradesh

|

88.41

|

89.58

|

|

Punjab

|

36.37

|

36.72

|

North East

|

2.55

|

2.58

|

|

Rajasthan

|

74.56

|

75.23

|

Odisha

|

19.48

|

19.70

|

|

U.P.(East)

|

111.89

|

113.81

|

Tamil Nadu

|

69.33

|

69.96

|

|

U.P.(West)

|

84.03

|

85.44

|

West Bengal

|

66.88

|

67.93

|

|

Total

|

606.43

|

614.03

|

Total

|

512.51

|

518.38

|

|

Total (Zone-I + Zone-II)

|

|

|

1,118.94

|

1,132.41

|

|

Net Addition (April 2025)

|

13.48

|

Contact details in case of any clarification: -

|

Shri Akhilesh Kumar Trivedi, Advisor (NSL-II),

Telecom Regulatory Authority of India

World Trade Centre, Tower-F,

Nauroji Nagar, New Delhi – 110029

Ph: 011-20907758 (S.B. Singh)

E-mail: advmn@trai.gov.in Pr. Advisor (NSL), TRAI

|

Note: Peak VLR figures in some circles of some of the service providers are more than their HLR figures due to a large number of inroamers.

Annexure IV

VLR Subscribers in the Wireless Segment

Home Location Register (HLR) is a central database that contains details of each mobile phone subscriber that is authorized to use the GSM core network. The HLRs store details of every SIM card issued by the service provider. Each SIM has a unique identifier called an International Mobile Subscriber Identity (IMSI), which is the primary key to each HLR record. The HLR data is stored for as long as a subscriber remains with the service provider. HLR also manages the mobility of subscribers by means of updating their position in administrative areas. It sends the subscriber data to a Visitor Location Register (VLR).

Subscriber numbers reported by the service providers is the difference between the numbers of IMSI registered in service provider’s HLR and sum of other figures as given below: -

|

1

|

Total IMSI's in HLR (A)

|

|

2

|

Less: (B = a + b + c + d + e)

|

|

a.

|

Test/Service Cards

|

|

b.

|

Employees

|

|

c.

|

Stock in hand/in Distribution Channels (Active Card)

|

|

d.

|

Subscriber Retention period expired

|

|

e.

|

Service suspended pending disconnection

|

|

3

|

Subscribers Base (A-B)

|

Visitor Location Register (VLR) is a temporary database of the subscribers who have roamed into the particular area, which it serves. Each base station in the network is served by exactly one VLR; hence a subscriber cannot be present in more than one VLR at a time.

If subscriber is in active stage i.e. he is able to send/receive calls/SMSs he is available both in HLR and VLR. However, it may be possible that the subscriber is registered in HLR but not in VLR due to the reason that he is either switched-off or moved out of coverage area, not reachable etc. In such circumstances he will be available in HLR but not in VLR. This causes difference between subscriber number reported by the service providers based on HLR and numbers available in VLR.

The VLR subscriber data calculated here is based on active subscribers in VLR on the date of Peak subscriber number in VLR of the particular month for which the data is being collected. This data is to be taken from the switches having the purge time of not more than 72 hours.

***

Samrat/Allen

(Release ID: 2132280)

Visitor Counter : 720