Ministry of Agriculture &

Farmers Welfare

New GST rates will prove to be a boon for farmers

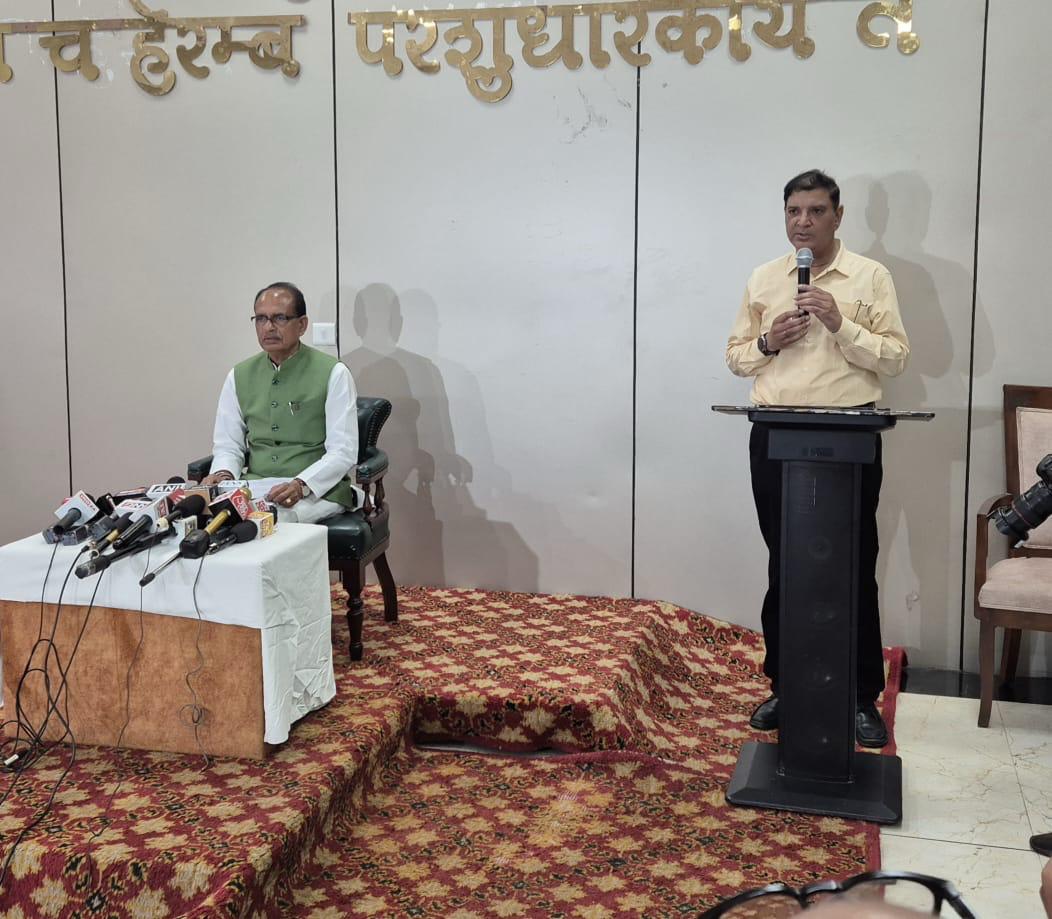

Press conference of Union Agriculture and Rural Development Minister Shri Shivraj Singh Chouhan

प्रविष्टि तिथि:

06 SEP 2025 8:41PM by PIB Delhi

The new GST rates and slabs will have a wide-scale impact on the agriculture sector. This will especially benefit small and medium farmers, due to reduced GST rates on agricultural equipment, the cost of agriculture will decrease and farmers' profits will increase. This view was expressed by Union Agriculture and Rural Development Minister Shri Shivraj Singh Chouhan in a press conference held in Bhopal today.

Shri Shivraj Singh Chouhan said that GST on bio-pesticides and micro-nutrients has been reduced, which will benefit farmers. Also, the trend of farmers towards bio-fertilizers from chemical fertilizers will definitely increase. In the dairy sector, there will now be no GST on milk and cheese. This will not only benefit the common man, but farmers, cattle breeders and milk producers will also benefit.

Today is the great festival of Anant Chaturdashi and we will bid farewell to Ganpati Bappa. My prayer to him is that happiness, prosperity and prosperity should come in the lives of the people of the country.

The lives of the people should become better. For this, the NDA government under the leadership of Prime Minister Narendra Modi is constantly making efforts.

The government and the Prime Minister are trying to ensure that there are no difficulties in the life of the common man. From the ramparts of the Red Fort, he had told the country that next generation reforms will be brought in GST and those reforms will bring great relief to the people.

As a farmer and Agriculture Minister, I thank Prime Minister Narendra Modi. Our resolution is to reduce the cost of production in agriculture and increase production. If production increases and cost decreases, then the farmer's profit in farming will increase.

If we look at the reforms that have been made in GST, then the farmers of the country are going to get great benefits from them. Some companies have started it. The reduction of GST to 5% on agricultural equipment, be it tractor, harvester, rotavator, of different types, will prove to be a boon for the farmers.

The size of the landholdings of the farmers of our country is small. That is why we are trying to integrate farming, which means that the farmer should be involved in farming and do some other work of the allied sector.

Like animal husbandry, beekeeping, fish farming, agro-forestry, sheep-goat rearing, poultry farm, if you look at the overall sector because agriculture and animal husbandry are complementary to each other. The exemption given in GST on that will also prove to be a boon for our agriculture and farmers.

If we look at the rural sector related to this, then women self-help groups are working on a large scale in the work of handicrafts, leather goods, milk products. Which has made many sisters Lakhpati Didi. Their life will also be better with this exemption in GST, income will increase and the movement of Lakhpati Didi will also get new strength.

If we look at the GST reforms, as an example, if a tractor used to cost Rs 9 lakh and was bought for Rs 9 lakh, then now the farmer will save Rs 65 thousand on it.

If the tractor is of 35 HP which used to cost around 5 lakh 80 thousand rupees, then there will be a saving of 41 thousand rupees on buying a tractor, 45 thousand rupees will be saved on a 45 HP tractor, 53 thousand rupees will be saved on a 50 HP tractor and about 63 thousand rupees will be saved on a 75 HP tractor, so if we look at the savings on the tractor itself, farmers will save from 25 thousand to 63 thousand rupees.

Now there will be no GST on milk and cheese in the dairy sector, this will not only benefit the common man, but its demand will also increase and those who buy milk and prepare dairy products will also be benefited and farmers who are milk producers, cattle rearers will also directly benefit.

GST has been reduced on butter, ghee, so definitely these indigenous products will start selling more, GST has also been reduced on milk cans, the dairy sector will also get its benefit and if the dairy sector progresses, then farmers and cattle rearers will directly progress.

There are 12 biological pesticides and micronutrients on pesticides and micronutrients, GST has been reduced on them as well. This will benefit natural farming and organic farming as the price of organic inputs will be less and the tendency of farmers to move from chemical fertilizers to organic fertilizers will definitely increase.

GST on fertilizers like ammonia, sulphuric acid, nitric acid has also been reduced from 18% to 5%. These are the raw materials used to prepare fertilizers, so their prices will definitely come down and farmers will also benefit from that.

Shri Chauhan said that the Central Government has reduced the GST rate on agricultural equipment from 18% to 5%, due to which agricultural equipment and other items will become cheaper.

For example, 35 HP tractor - earlier Rs. 6,50,000, now Rs. 6,09,000 (approximate), saving Rs. 41,000

45 HP tractor - earlier Rs. 7,20,000, now Rs. 6,75,000, saving Rs. 45,000. 75 HP Tractor - Earlier Rs. 10,00,000, Now Rs. 9,37,000, Saving Rs. 63,000 50 HP Tractor - Earlier Rs. 8,50,000, Now Rs. 7,97,000, Saving Rs. 53,000 Power Tiller 13 HP - Earlier Rs. 20,357, Now Rs. 8,482, Saving Rs. 11,875 Multi Crop Thresher – 4 Tonne - Earlier Rs. 24,000, Now Rs. 10,000, Saving Rs. 14,000 Paddy Planting Machine - (4 Row – Walk Behind) - Earlier Rs. 26,400, Now Rs. 11,000, Saving Rs. 15,400 Power Weeder – 7.5 HP - Earlier Rs. 9,420 Now Rs 3,925, saving Rs 5,495 Seed Cum Fertilizer

I am telling you the estimated price of power tiller.. Roughly, a 13 HP power tiller costs around Rs 1 lakh 69 thousand 643. There will be a saving of around Rs 11 thousand 875 in that.

The machine for planting paddy costs Rs 2 lakh 20 thousand. There will be a saving of Rs 15 thousand 400 in that.

Multi-crop thresher with which different crops are harvested. There will be a saving of around Rs 14 thousand on that.

7.5 HP power weeder which removes grass and prepares.. It costs around Rs 78 thousand, there will be a saving of Rs 5 thousand 495 in that.

Seed cum fertilizer drill costs Rs 1 lakh 50 thousand, there will be a saving of around Rs 10 thousand 500 in that.

Similarly, if we talk about 14 feet cutter bar in combined harvester, there will be a saving of 1 lakh 87 thousand 500.

Straw Reaper – It costs 3 lakh 12 thousand 500 rupees, there will be a saving of 21 thousand 875 rupees.

Super Seeder – 16 thousand 875 rupees will be saved

Happy Seeder – It costs around 1 lakh 51 thousand, there will be a saving of around 10 thousand 600 in it.

Mulcher – which cuts the straw and leaves it on top, it costs around 1 lakh 65 thousand rupees, there will be a saving of about 11 thousand 500 rupees in it.

There is a great need for automatic planters so that seeds can be sown at equal distances. This costs around Rs. 4 lakh 68 thousand 700, there will be a saving of around Rs. 32 thousand 800 on this.

We have calculated the prices of different things in the same way. Because it is not completely clear what benefits will accrue from 12% to 5%, but I have tried to explain this saving of farmers.

It has now become necessary to do value addition of fruits and vegetables, process them. GST has also been reduced on preserved vegetables, fruits, dry fruits prepared through this processing, the benefit of which will directly go to the farmers.

Cold storage, food processing will also definitely benefit from this. Similarly, our fish producing farmers, fish farming is done in a large part of the country, not only in the seas, now fish farming is being done on a large scale by making ponds in farms as well, so on this too the tax rate on prepared or preserved fish has been reduced, due to this also the farmers engaged in fish farming across the country will benefit, similarly GST on natural honey will also be reduced, honey producing farmers will get its direct benefit.

Another benefit for farmers is that GST on energy based equipment has been reduced from 12% to 5%. This will make research based equipment cheaper because efforts are also being made to make farmers energy providers. Research based equipment will also benefit them. Similarly, GST has been reduced on drip irrigation etc. They will become cheaper and will be easily accessible to farmers. If farmers use them, water will also be saved, production will increase and farmers' profit will increase.

The GST on cement and iron has been reduced for rural India, which will also make building houses under Pradhan Mantri Awas Yojana cheaper. Because the prices of cement and iron will be low, it will also be easier for the poor to build houses. The infrastructure that is built in rural areas.

The cost of schools, Anganwadis, Panchayat Bhawans will also definitely reduce. The biggest benefit will be to the economy, the challenges that the country is facing today, we have to strengthen our economy further. Therefore, these lower prices will definitely increase the demand.

The reforms have brought great relief to the farmers. Many types of exemptions have been given in the new provisions, which will prove to be a boon for farmers and lakhpati didis.

With the increase in demand, more money will come into the market, which will definitely strengthen our economy. Therefore, for these steps that have changed the picture of rural India, for these decisions, I thank Prime Minister Shriman Narendra Modi from the bottom of my heart.

This will also give a boost to our natural farming, organic farming and especially we want to take the country towards integrated farming. This is not just the farming of fruits, vegetables or grains, along with that, the farmers engaged in other works will also get a boost. Many thanks to the Prime Minister for this revolutionary suggestion, gratitude to the Finance Minister!

(For more information, click here)

****

RC/KSR/AR

(रिलीज़ आईडी: 2164420)

आगंतुक पटल : 1300