PIB Headquarters

GST Rate Rationalisation: How Tamil Nadu Will Benefit

Posted On:

23 SEP 2025 3:22PM by PIB Delhi

Key Takeaways

- GST cuts to 5% or nil across textiles, handicrafts, coir, food and fisheries will lower consumer prices by 6–11%.

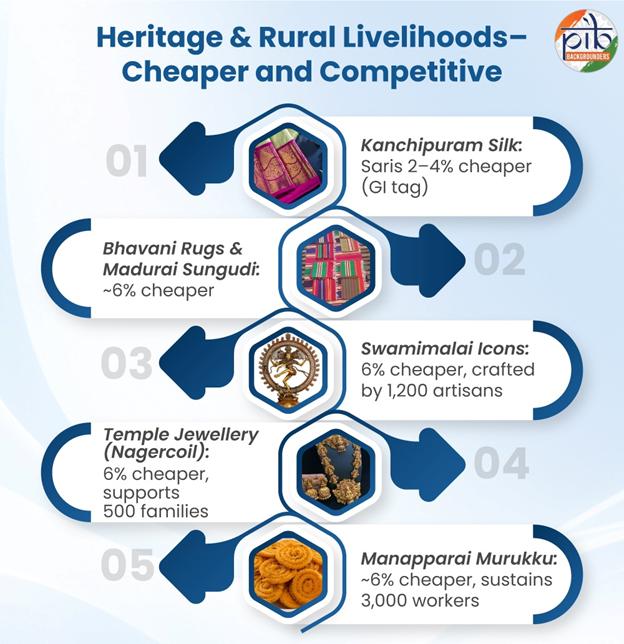

- Traditional sectors like Kanchipuram silk, Bhavani rugs, Swamimalai icons and Manapparai murukku to gain renewed competitiveness.

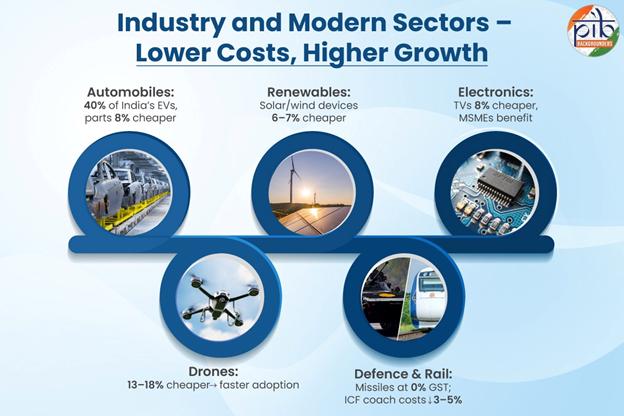

- Large industries in automobiles, renewable energy, electronics and defence to benefit from lower input costs.

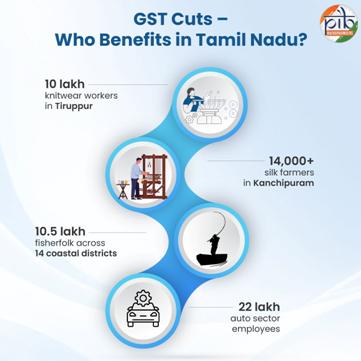

- Around 10 lakh jobs in Tiruppur knitwear, 22 lakh in automobiles, and 10.5 lakh fisherfolk to see direct impact.

|

Introduction

The GST Council has recently reduced tax rates across a wide range of products. These changes will bring direct benefits to Tamil Nadu, a state that combines traditional handloom and handicrafts with strong industrial clusters and modern sectors such as automobiles, electronics, renewable energy, and defence.

With lower GST rates, consumer goods will become cheaper, MSMEs will gain better margins, exporters will be more competitive, and large industries will find it easier to expand. The impact will be widespread, from the knitwear workers of Tiruppur to the weavers of Kanchipuram, the coir artisans of Pollachi, the fisherfolk of Nagapattinam, the auto workers of Sriperumbudur, and the engineers of Avadi.

Textiles and Handlooms

Tamil Nadu’s textile industry is not only one of the largest in India but also one of the most labour-intensive. It sustains millions of livelihoods across districts such as Tiruppur, Erode, Karur, Salem and Kanchipuram, and contributes significantly to India’s exports.

Tiruppur Knitwear: Known as the “Knitwear Capital of India,” Tiruppur alone employs about 10 lakh people and contributes nearly 90% of India’s cotton knitwear exports, worth around USD 1 billion. The city has more than 1,300 exporting units, supplying garments to large global retailers. With GST reduced from 12% to 5% on low-value apparel, embroidery and accessories, costs are expected to fall by 6–11%. This helps MSMEs improve their margins, makes exports to the US and Europe more competitive, and ensures that India retains its edge in global knitwear markets.

Kanchipuram Silk: The sector supports thousands of family weavers and over 14,000 silk farmers, many of whom are already engaged in expanding sericulture in the State. Kanchipuram saris, which enjoy GI-tag status, are world-renowned for their durability and lustrous finish. The industry depends heavily on zari, sourced from Surat and the Tamil Nadu Zari Factory. A reduction in GST on zari from 12% to 5% will cut raw material costs by around 7%, bringing down the final price of a sari by 2–4%.

Other Handloom Products: Bhavani Jamakkalam rugs (Erode) and Madurai Sungudi sarees, both GI-tagged, will also become about 6% cheaper. These crafts are deeply rooted in community traditions and provide steady employment in rural households. The GST cuts will make such products more affordable for domestic buyers while also boosting their competitiveness in niche export markets.

Handicrafts and Heritage Industries

Tamil Nadu’s handicrafts are world famous for their artistry, cultural symbolism and heritage value. They provide employment to thousands of families, many of whom pass down traditional skills through generations.

Swamimalai Bronze Icons: Around 1,200 artisans in Thanjavur district create icons using the ancient lost-wax method. The sector also sustains exports worth ₹20–30 crore annually, particularly to Europe and the US. With GST cut to 5%, products will be about 6% cheaper, benefiting temple boards, collectors, and museums in India and abroad.

Temple Jewellery (Nagercoil): A GI-tagged craft rooted in Kanyakumari district, supporting around 500 Kammalar/Vishwakarma artisan families through small workshops and seasonal demand. With GST reduced from 12% to 5%, finished pieces will be about 6% cheaper, making accessories for Bharatanatyam, weddings, and diaspora markets more affordable.

Brass, Stone and Wood Crafts: Artisans in Thanjavur, Kumbakonam and Mamallapuram produce brass idols, Tanjore paintings, wood statues and stone carvings. A 6–7% price drop will help in tourist sales, and e-commerce platforms, expanding their reach to both domestic and global buyers.

Traditional Dolls and Toys: Produced in Thanjavur, Salem and Kancheepuram, these handmade toys often peak in demand during festivals. With GST reduced to 5%, they gain better competitiveness against imported plastic toys, ensuring continued support for small artisan families.

Coir Industry

Pollachi, Kangeyam and Cuddalore are major coir belts in Tamil Nadu. This sector, which is highly labour-intensive, is dominated by women and OBC artisan families engaged in fibre extraction and spinning. With GST reduced from 12% to 5%, coir mats, ropes and geo-textiles will now be 6–7% cheaper. This improves competitiveness for exports to the USA and Europe while also making coir-based products more affordable in domestic markets. With increasing use of coir in infrastructure projects, the sector has new opportunities for expansion.

Processed Foods and Dairy

Food processing and dairy are critical to Tamil Nadu’s rural economy, as they provide income to farmers, small processors and women workers.

Packaged Foods: Biscuits (18%→5%), namkeens and sauces (12%→5%), and dairy products like paneer, UHT milk and butter (moved to nil or 5%) will become 4–11% cheaper. This will provide relief to consumers while also supporting demand for MSMEs and cooperatives engaged in food production.

Aavin Dairy: Aavin procures 36–37 lakh litres of milk daily from about 5 lakh farmers. Lower GST on dairy products strengthens this cooperative network, anchors rural incomes, and ensures that consumers benefit from lower retail prices.

Manapparai Murukku: This GI-tagged snack from Tiruchirappalli, made by around 500 units employing 2,000–3,000 workers, will now be about 6% cheaper. This will help small processors compete with large branded snacks and also tap diaspora markets in the Gulf and elsewhere.

Fisheries

Tamil Nadu has a marine fisherfolk population of 10.48 lakh spread across 14 coastal districts. With strong domestic demand and exports worth ₹6,957 crore in 2022–23, the sector is vital to the State’s economy. With GST on processed fish and seafood reduced from 12% to 5%, products will be 6–7% cheaper. This supports small processors, many of whom employ women in cleaning and packaging, as well as exporters targeting the USA, Europe and Middle East. Districts such as Thoothukudi, Nagapattinam, Ramanathapuram and Cuddalore stand to gain the most.

Stationery and Education

Sivakasi and Perambur are major hubs for printing and stationery, with tens of thousands of workers engaged in family-run MSMEs. Many women are employed in binding and finishing work. With GST on notebook paper reduced from 12% to nil and on stationery boxes from 12% to 5%, retail prices are expected to drop by 6–11%. This will directly benefit households, schools and state education departments, which procure large quantities at the start of the academic year.

Industry and Engineering

Beyond primary sectors, Tamil Nadu’s strong industrial base will see wide-ranging benefits.

Pumps and Irrigation Equipment: Thousands of MSMEs in Tamil Nadu produce pumps, small engines, sprinklers and irrigation tools. With GST reduced from 28% to 18% on many parts and from 12% to 5% on sprinklers and hand pumps, prices of equipment will fall by 6–8%. This will help small and marginal farmers adopt modern irrigation systems, improving farm productivity.

Automobiles: In 2023, Tamil Nadu accounted for 40% of India’s EV production and employed 22 lakh people in its auto sector. With GST on vehicles and parts reduced from 28% to 18%, the effective tax load will be lower by about 8%. This will make automobiles more affordable for domestic buyers and improve cost competitiveness for manufacturers and exporters.

Renewable Energy: The State has a renewable energy capacity of 34,700 MW, more than half of its total energy mix. This includes 10,500 MW of wind and 7,360 MW of solar. With GST on renewable devices and parts cut from 12% to 5%, project costs will be reduced by 6–7%, improving economics for developers and supporting Tamil Nadu’s green energy targets.

Electronics and Emerging Sectors

Electronics and new-age technologies are also expected to benefit significantly from GST rationalisation.

Electronics: Sriperumbudur, Oragadam, Kancheepuram, and Krishnagiri have emerged as major electronics hubs. With GST on TVs and monitors reduced from 28% to 18% and on silicon wafers from 12% to 5%, consumer prices will come down and MSMEs in the supply chain will see reduced input costs. This strengthens Tamil Nadu’s growing ESDM exports.

Drones and UAVs: GST on drones has been cut to 5% from earlier 18/28%. This makes them 13–18% cheaper, accelerating adoption in agriculture, defence, logistics, mapping and infrastructure monitoring. Tamil Nadu already houses several drone startups in Chennai, Hosur and Coimbatore, making it well-placed to lead this emerging sector.

Defence, Aerospace and Rail Manufacturing

Tamil Nadu hosts one of India’s strongest defence and aerospace corridors, with major facilities in Avadi (Chennai), Coimbatore, Trichy and Salem. The State is home to several PSUs, including DRDO labs, HAL units, the Heavy Vehicles Factory, Combat Vehicles Research and Development Establishment (CVRDE), Engine Factory Avadi, and Ordnance Factory Trichy. Together, these units, along with a growing network of MSMEs, make Tamil Nadu a critical contributor to India’s defence preparedness.

Military Hardware: Missiles, transport aircraft and simulators now attract 0% GST, reducing costs by 18–28%. This strengthens domestic production and supports Atmanirbhar Bharat.

Walkie-Talkies and Radios: With tax reduced from 12% to 5%, defence and police communication equipment will be more affordable.

Testing Equipment and Spares: The 18%→0% GST cut improves budgets for maintenance and R&D, helping defence PSUs and MSMEs lower costs in servicing and precision toolmaking.

Rail Coach Manufacturing: The Integral Coach Factory (Chennai) employs about 8,200 people and is one of the world’s largest rail coach manufacturers. With GST rationalisation on HVAC systems, engines and several input assemblies (28%→18%), coach build costs will come down by 3–5%. This will directly benefit Indian Railways’ capex efficiency, including the production of Vande Bharat, EMU and MEMU coaches.

Conclusion

The GST rationalisation will benefit Tamil Nadu across multiple sectors, from traditional handlooms, handicrafts, coir and fisheries to modern industries like automobiles, electronics, renewable energy and defence. It will reduce consumer prices, improve MSME margins, and make exports more competitive.

By easing costs for both households and industries, the reforms will strengthen rural livelihoods while boosting the State’s position as an industrial hub. With its blend of heritage and modern manufacturing, Tamil Nadu is set to be among the key beneficiaries of the GST cuts, in line with the vision of Atmanirbhar Bharat and Viksit Bharat 2047.

Click here for PDF

***

SK/M

(Release ID: 2170103)

Visitor Counter : 1408