PIB Headquarters

GST Rate Rationalisation: Expanding Opportunities for Bihar

Posted On:

27 SEP 2025 4:40PM by PIB Delhi

Key Takeaways

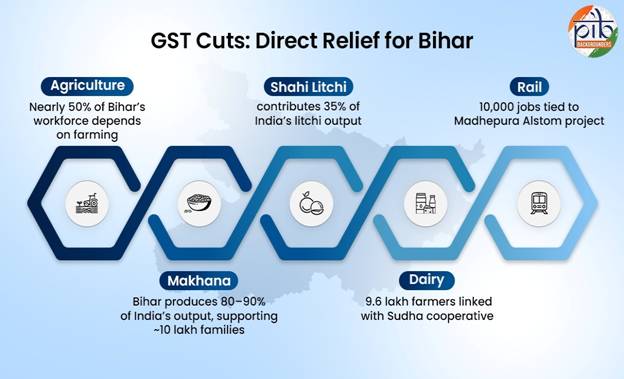

- Agriculture boost with Makhana, Shahi Litchi and processed foods gaining from GST cuts, benefitting lakhs of farmers and MSMEs.

- Dairy relief as Sudha’s 9.6 lakh farmers supported through GST-free milk and paneer and lower rates on ghee, butter and ice-cream.

- Handlooms and crafts like Bhagalpuri silk, Madhubani art, Sujini and Patharkatti stone carving made more competitive.

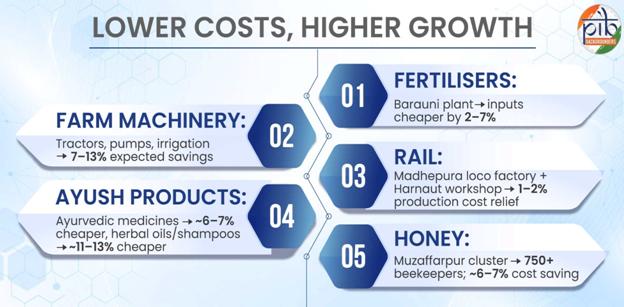

- Farmers to benefit from cheaper fertilisers, micronutrients and machinery with 7–13% expected cost savings.

- Industry push with rail hubs, AYUSH products and honey clusters seeing 6–13% relief in costs.

|

Introduction

Bihar’s economy, rooted in agriculture, handlooms, handicrafts and food processing, is among the prominent beneficiaries of the recent GST rate rationalisation. From makhana farmers in Mithila to silk weavers in Bhagalpur, dairy producers linked with Sudha, and engineers at Madhepura’s rail factory, the reforms are expected to reach across the state’s traditional and modern sectors alike.

By lowering tax rates, the changes are expected to ease the burden on consumers, support rural livelihoods, strengthen MSMEs, and enhance competitiveness in exports. The impact will be visible across agriculture, handlooms, handicrafts, dairy, fertilisers, rail manufacturing, bamboo and cane crafts, and emerging areas such as AYUSH and honey.

Agriculture and Food Processing

Agriculture continues to be the backbone of Bihar, employing nearly half of the state’s workforce. With several of its signature products brought under lower GST slabs, farmers and processors are expected to benefit from reduced tax incidence and improved market access.

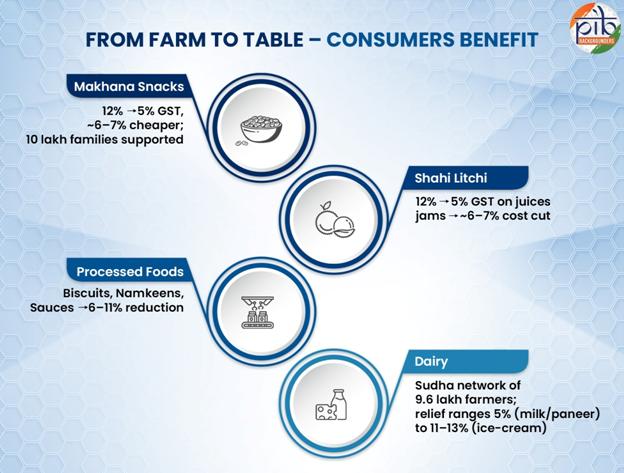

Bihar produces 80–90% of India’s makhana, sustaining about 10 lakh families engaged in cultivation and processing. The crop is concentrated in northern Bihar’s Mithilanchal region, grown in pond networks across Darbhanga, Madhubani, Purnea, Katihar, Saharsa and adjoining districts. With GST on makhana-based snacks reduced from 12% to 5%, processors and exporters are expected to gain from an effective cost reduction of about 6–7%, making the product more competitive in both domestic and overseas markets.

Muzaffarpur’s GI-tagged Shahi Litchi, also grown in Vaishali, Champaran, Sitamarhi and Samastipur, sustains thousands of small farmers and seasonal workers. Bihar accounts for nearly 35% of India’s litchi output. With GST on juices, jams and pickles reduced from 12% to 5%, there is an expected cost saving of 6–7%, encouraging more local processing and supporting access to niche markets in the Gulf.

Bihar’s MSME clusters in Patna, Hajipur and Bhagalpur handle a wide variety of processed foods, with micro-units and women-led SHGs engaged in snacks, pickles, bakery and sauces. Brands like Sudha cater to Bihar and East India, while makhana-based products are reaching pan-India markets. Bhagalpur industrial estate alone hosts over 40 food and agro units, with new food park and bottling projects adding jobs. With GST on biscuits cut from 18% to 5% and on namkeens and sauces from 12% to 5%, prices are expected to fall by 6–11%, supporting demand and strengthening MSME margins.

Dairy

A backbone of Bihar’s rural economy, the dairy sector sustains about 9.6 lakh mostly marginal farmers through COMFED (Sudha), with strong participation of women in collection and SHGs. Processing, chilling, transport and retail provide thousands of jobs across the state, anchored in hubs like Patna and Barauni. With UHT milk and paneer now GST-free, ghee and butter cut from 12% to 5%, and ice-cream from 18% to 5%, products are expected to be 5–13% cheaper. These cuts will ease working capital pressures on dairies, strengthen cooperative networks, and improve affordability for households across Bihar and East India.

Handlooms and Handicrafts

Bihar’s cultural heritage is embodied in its handlooms and handicrafts, many of which hold GI status and sustain rural and artisan households.

Bhagalpuri Silk

Known as the “Silk City,” Bhagalpur is home to nearly 30,000 weavers operating about 25,000 looms, along with thousands more in reeling, dyeing and allied activities. Together, the sector supports over 1 lakh livelihoods, particularly among the Ansari (Julaha) Muslim and Tanti (SC) weaving communities. Sarees, stoles and fabrics from Bhagalpur are sold widely across India through boutiques and emporia.

Nearly half of Bhagalpur’s silk output is exported, reaching buyers in the US, Europe and East Asia. Renowned for elegant Tussar silk sarees and scarves, Bhagalpuri silk has long been associated with quality, worn by Indian royalty and embraced by leading fashion designers. With GST on zari and hand-crafted shawls reduced from 12% to 5%, finished products are expected to be 2–3% cheaper. This not only makes sarees more affordable for households but also strengthens competitiveness in high-value domestic and export markets.

Produced across Madhubani, Darbhanga and parts of Samastipur and Sitamarhi, this globally renowned art form sustains thousands of women-led artisan households in the Mithila region. In hubs such as Jitwarpur, nearly 70% of families depend on painting sales, with many artists from low-income backgrounds. The sector has also seen participation through over 5,000 applications for artisan credit cards in Madhubani, highlighting its livelihood importance.

Madhubani paintings are widely sold at fairs, state emporiums and online platforms, and feature in domestic décor, institutional projects and tourism circuits. Internationally, they reach boutique buyers in the US, Europe and Japan, with works showcased in embassies, cultural centres and museums such as the Victoria & Albert Museum in London. With GST reduced from 12% to 5%, artworks are expected to be about 6–7% cheaper, improving affordability for buyers and enhancing income stability for artisans.

Centred in Bhusra village of Muzaffarpur and a few parts of Madhubani, Sujini embroidery is practiced exclusively by women artisans organised in rural self-help groups. What began as a tradition of quilting old saris has grown into a source of supplementary income for about 600 women across 20+ villages. The craft received a GI tag in 2006, helping raise its profile in domestic and international markets.

Sujini products such as quilts, wall hangings and apparel are sold through state handicraft emporiums, exhibitions and online platforms, with limited exports to Japan, Europe and the US via fair-trade organisations and craft museums. With GST reduced from 12% to 5%, prices are expected to fall by around 7%, improving sales and enabling higher payouts to the women’s cooperatives engaged in this folk craft.

Sikki Grass Handicrafts

The Mithila region of north Bihar, especially villages like Raiyam in Madhubani and parts of West Champaran, is known for its Sikki grass craft. Women artisans, including Maithil and Tharu communities, harvest the “golden grass” (Sikki) from wetlands to weave baskets, boxes, and dolls. Though only a few hundred artisans remain active today, the craft holds strong cultural value—ornate sindoor boxes made of Sikki are a traditional feature in Maithil weddings.

Recognised with a GI tag in 2018, the sector has gained visibility, with artisans like Meera Devi receiving national awards and international appreciation, including a UNESCO Seal of Excellence. With GST reduced from 12% to 5%, Sikki items are expected to be about 7% cheaper, offering modest relief to artisans and improving their competitiveness against low-cost plastic alternatives.

Patharkatti Stone Craft

The Patharkatti cluster in Gaya, known for its blue-black granite carvings, sustains around 650 artisans across 500 families. The craft, practiced for over 300 years, earned a GI tag in 2025, boosting its recognition. Artisans carve idols of Buddha, Mahavira and decorative pieces, sold in temples, fairs and tourist markets.

Sales are primarily driven by temples, tourists and fairs in Bihar, with growing opportunities in overseas markets such as Japan, Thailand and Sri Lanka that value Buddhist art. With GST reduced from 12/18% to 5%, Patharkatti stone items carry an expected 7–13% cost relief, making large idols and sculptures more affordable. This is likely to boost domestic temple demand, improve artisan incomes and open up new export opportunities.

Produced in Vaishali (SFURTI cluster), Madhubani, Jamui and Gaya, bamboo and cane crafts involve several hundred artisans, including many women from OBC/EBC families. The Vaishali cluster alone engages about 330 artisans, making furniture, baskets and décor for domestic buyers, hotels, homestays and online markets, with some niche exports. With GST on bamboo furniture cut from 12% to 5%, products are expected to be 6–7% cheaper, improving affordability and strengthening artisan competitiveness against plastic and metal substitutes.

Fertilisers and Agricultural Inputs

The Barauni urea complex in Begusarai, part of the HURL programme, is a flagship unit with a capacity of 1.27 MMTPA, anchoring Bihar’s industrial belt. It supports thousands of jobs, from ITI and diploma holders in the plant to rural youth engaged as dealers and operators through a statewide agri-input network of cooperatives and retailers.

With GST on ammonia, sulphuric acid and nitric acid reduced from 18% to 5%, and on micronutrients and gibberellic acid from 12% to 5%, input costs are set to ease. This means about 6–7% savings on retail micronutrients. For example, a ₹200 bottle now carries ₹14 less tax, and 2–3% lower costs for finished fertilisers, improving affordability for farmers and strengthening crop productivity.

Agricultural Machinery

Bihar has emerged as a major market for tractors and farm equipment, with nearly 90% of its farmers being small and marginal. Mechanisation was once limited but is now expanding rapidly, with tractor density rising above the national average and thousands of farmers participating in machinery expos and fairs. Demand is particularly strong in grain-producing belts of north and central Bihar, where annual tractor sales run into tens of thousands of units. For many smallholders, access to mechanisation is becoming critical to reducing crop losses and improving efficiency, and even women-led collectives are beginning to purchase tractors and harvesters together.

With GST on tractors, pumps and irrigation equipment reduced to 5% (from 12/18%), and on key parts such as tyres from 18% to 5%, farm equipment is expected to become 7–13% cheaper. For instance, a tractor worth ₹8 lakh now carries about ₹56,000 less tax. This price relief makes mechanisation more accessible, encouraging wider adoption of modern tools, boosting agricultural productivity, and strengthening farmer incomes across the state’s ₹3 lakh crore agriculture sector.

Rail Manufacturing

Bihar hosts the Madhepura electric locomotive factory (Alstom), the Harnaut carriage repair workshop in Nalanda, and the East Central Railway headquarters at Hajipur. The sector employs thousands of technicians and engineers, with the Alstom project alone linked to about 10,000 direct and indirect jobs. The workforce largely comprises ITI and diploma holders from rural OBC/EBC households, alongside skilled migrants, making the sector an important source of technical employment.

With GST on technical textiles, cartons, boxes and adhesives reduced from 12/18% to 5%, daily consumable costs in packaging and shop-floor operations are expected to fall by 6–7%, translating into an overall 1–2% relief in production and maintenance costs. This will improve efficiency in locomotive manufacturing and coach upkeep, strengthening Bihar’s role in Indian Railways’ freight and passenger ecosystem.

Emerging Sectors

Beyond traditional strengths, Bihar’s newer growth sectors are also set to benefit.

AYUSH and Herbal Products

Bihar’s AYUSH sector is supported by small Ayurvedic units in Patna and Gaya, along with women’s SHGs making herbal soaps and oils. Traditional Vaidya families continue to drive local production. With GST on Ayurvedic medicines reduced from 12% to 5% and on herbal shampoos and oils from 18% to 5%, these products are expected to see a cost reduction of 6–13%, improving affordability and expanding markets for SHGs and MSMEs.

The Muzaffarpur honey cluster involves over 750 beekeepers and is one of the key apiculture hubs in the state. Producers, often small farmers and women entrepreneurs, supply to brands such as Dabur and Patanjali while also tapping export channels to the USA and Middle East. With GST reduced to 5%, honey and related products are expected to see a 6–7% cost saving, strengthening cooperatives and rural livelihoods.

Conclusion

The rationalisation of GST rates is expected to create new opportunities across Bihar’s economy. It will ease costs for essentials such as food, dairy, handlooms and handicrafts, while supporting livelihoods in agriculture, weaving, embroidery, bamboo crafts and dairy farming. At the same time, it will strengthen MSMEs in food processing, fertilisers and farm machinery, and reduce costs in sectors such as rail and industrial inputs. Emerging areas including AYUSH and honey are also positioned for growth.

From makhana cultivators and litchi farmers to silk weavers, painters, dairy producers and industrial workers, the benefits are expected to extend across rural and urban Bihar. By reducing the tax burden, improving competitiveness and sustaining livelihoods, the reforms align with the vision of Atmanirbhar Bharat and Viksit Bharat 2047.

Click here to see PDF

****

SK/M

(Release ID: 2172147)

Visitor Counter : 1366