Ministry of Finance

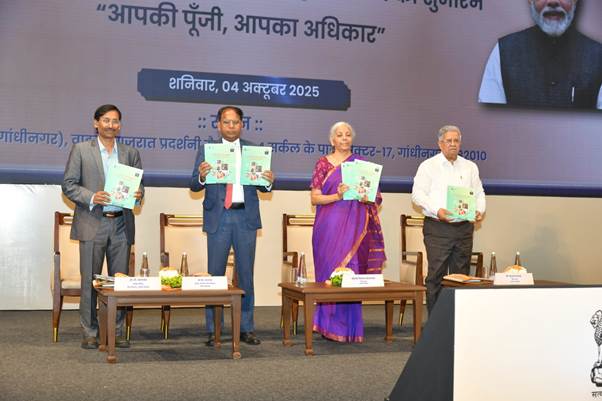

Union Finance Minister Smt. Nirmala Sitharaman launches nationwide financial awareness campaign “आपकी पूँजी, आपका अधिकार” in Gandhinagar today

“Unclaimed deposits not mere entries on paper; they represent the hard-earned savings of ordinary families”- Union Finance Minister

“The 3As Strategy of Awareness, Accessibility and Action to be the guiding principles of the campaign”- Smt. Nirmala Sitharaman

Union Home Minister, Shri Amit Shah in a message lauded the initiative as a collective effort towards strengthening public trust, dignity, and empowerment

“Unclaimed deposits useful for education, empowerment and other financial needs of the beneficiaries”- State Finance Minister, Sh. Kanubhai Desai

“Claims must be processed quickly and fairly to citizens, so that they walk away with clarity and confidence”- Secretary, DFS

Campaign to cover all districts across States and Union Territories from October to December 2025

Digital demonstrations and helpdesks to assist citizens in tracing and claiming unclaimed financial assets

Posted On:

04 OCT 2025 5:13PM by PIB Delhi

The Union Finance Minister Smt. Nirmala Sitharaman launched the nationwide awareness campaign “आपकी पूँजी, आपका अधिकार” in Gandhinagar, Gujarat today. The campaign was launched in the presence of the State Finance Minister, Shri Kanubhai Desai.

Secretary, DFS, Shri M. Nagaraju, Executive Director of the Reserve Bank of India, whole-time members of IRDAI, SEBI, PFRDA, along with senior officials from the Government of India, the State Government, and representatives of leading financial institutions were also present in the event.

Speaking on the occasion, the Union Finance Minister Smt. Nirmala Sitharaman highlighted that the campaign carries a simple but powerful message that every rupee saved by citizens must return to them or their families.

“Unclaimed deposits, insurance proceeds, dividends, mutual fund balances, and pensions are not mere entries on paper; they represent the hard-earned savings of ordinary families — savings that can support education, healthcare, and financial security”, the Finance Minister added.

Further, the Union Finance Minister underlined the importance of the “3 A’s” — Awareness, Accessibility and Action — as the guiding principles of this campaign. Awareness aims to ensure that every citizen and community are informed about how to trace unclaimed assets. Accessibility focuses on providing simplified digital tools and district-level outreach. Action emphasizes time-bound and transparent claim settlements.

“Together, these three pillars will help bridge the gap between citizens and financial institutions, promoting community awareness and ensuring that every individual can reclaim their rightful savings with dignity and ease”, Smt. Nirmala Sitharaman said.

The Finance Minister also acknowledged the proactive role of regional rural banks, particularly, Gujarat Gramin Bank, and other financial institutions, in the recent KYC and re-KYC campaigns, noting that these efforts have strengthened the link between citizens and the formal financial system. “Undertaken across villages and towns, such initiatives have ensured that beneficiaries remain connected to their savings and entitlements, laying a strong foundation for the success of the current campaign”, the Union Minister said.

Smt. Sitharaman urged all institutions to carry forward the same dedication and outreach in this nationwide initiative on unclaimed financial assets, so that no citizen remains separated from their rightful money.

Smt. Nirmala Sitharaman also handed over certificates to beneficiaries who successfully reclaimed their unclaimed deposits from various institutions.

Speaking on the occasion, the State Finance Minister of Gujarat, Shri Kanubhai Desai stated that the launch of this nationwide campaign from Gujarat is a matter of pride for the State and assured full support for its successful execution through active participation and outreach. “The unclaimed deposits are very useful for the education, empowerment and other financial needs of the beneficiaries”, Sh. Kanubhai Desai stated.

The programme also included a message from the Union Home Minister and Lok Sabha Member of Parliament from Gandhinagar, Shri Amit Shah. The Union Home Minister extended his greetings and encouraged citizens to actively participate in the campaign. The message underscored that the initiative goes beyond the return of unclaimed financial assets and embodies a collective effort towards strengthening public trust, dignity, and empowerment.

Speaking on the occasion, Secretary, DFS, Shri M. Nagaraju noted that as of August 2025, more than ₹75,000 crore of unclaimed deposits have been transferred to the RBI’s Depositor Education and Awareness Fund. Further, Sh. Nagaraju added that unclaimed insurance proceeds stand at over ₹13,800 crore, unclaimed balances in mutual funds amount to about ₹3,000 crore, and unpaid dividends worth more than ₹9,000 crore.

“Claims must be processed quickly, fairly and without unnecessary hurdles to citizens, so that they walk away with clarity and confidence”, Secretary, DFS added. Sh. Nagaraju said that the campaign aims to achieve the department’s long standing goal of financial empowerment of every citizen.

Nearly 172 crore shares have been transferred to the Investor Education and Protection Fund so far. The launch builds on India’s broader achievements in financial inclusion — from Jan Dhan Yojana and UPI to Direct Benefit Transfers - by ensuring that citizens not only gain access to financial services but also reclaim what rightfully belongs to them.

With the launch of “आपकी पूँजी, आपका अधिकार” Campaign from Gujarat, the Government reaffirmed its commitment to making financial inclusion meaningful, transparent, and accessible for every household.

To ensure wide participation, the campaign will be conducted across all States and Union Territories during October—December 2025. Digital demonstrations and helpdesks will assist citizens in tracing and claiming their unclaimed financial assets with ease, reflecting the Government’s commitment to citizen-centric governance and its broader vision of enhancing ease of living.

The campaign, coordinated by the Department of Financial Services (DFS), Ministry of Finance, brings together the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), the Insurance Regulatory and Development Authority of India (IRDAI), the Pension Fund Regulatory and Development Authority (PFRDA), and the Investor Education and Protection Fund Authority (IEPFA), alongside banks, insurance companies, mutual funds, and pension institutions on a common platform.

……..

NB/AD

(Release ID: 2174806)

Visitor Counter : 5837