PIB Headquarters

GST Reforms: Powering Punjab’s Growth & Livelihoods

Posted On:

07 OCT 2025 11:44AM by PIB Delhi

Key Takeaways

- In Punjab, a GST cut from 12% to 5% spans textiles, handicrafts, footwear, metal ware, dairy, agro products, and bicycles, making goods more affordable and competitive.

- For food and agro products, a 6–7% drop in retail prices drives affordability and strengthens market position.

- Renowned items like phulkari embroidery employ ~20,000 artisans whereas bicycles sector employ 40,000+ personnel, geared up for reform gains.

|

Introduction

The recent GST reforms ease the tax burden on essential goods and services, aiming to spur demand, enhance competitiveness, and create growth and employment opportunities. In Punjab, located in India’s northwest, agriculture remains the backbone of the state economy, complemented by industries such as textiles, handicrafts, metal ware, and agro-based products. The reforms make these goods more affordable and competitive, aligning closely with the state’s development priorities- from strengthening its agricultural foundation to promoting manufacturing and export-oriented sectors.

Textiles & Apparel

Punjab boasts a robust textile ecosystem, with the entire value chain present- from raw material availability to apparel production. The state is also an exporter of apparel, wherein products with phulkari embroidery, woollen shawls & stoles, hand-block printed fabric, and women’s cotton kurtas provide livelihoods to countless artisans and appeal to diverse markets. With GST on textiles reduced from 12% to 5%, Punjabi textiles become more affordable and competitive across domestic and global markets. Further, this tax relief will lower costs, stimulate demand, boost sales, and strengthen exports, directly uplifting artisans and weavers who form the backbone of the industry.

Phulkari, a GI-tagged craft predominantly practiced in Amritsar and Patiala, is sustained largely by women-led artisan households. Around 20,000 artisans are engaged in creating these traditional embroidered garments, which find a strong market among ethnic wear labels, bridal boutiques, and handicraft exporters. Beyond domestic demand, Phulkari has carved a niche in global markets such as the US, Canada, and the UK, where it is highly valued for its cultural and aesthetic appeal.

The recent GST reduction from 12% to 5% has given the industry a much-needed boost. By lowering the overall product cost, these reforms make Phulkari more competitive in both domestic and international markets. The price advantage not only widens consumer reach but also strengthens artisan incomes by driving higher sales volumes and improving export prospects.

Small-scale weavers and textile cooperatives in Ludhiana and Amritsar are the backbone of Punjab’s woollen shawl and stole industry. Employing nearly 25,000 workers, this sector caters to diverse markets- from retail apparel and gifting to steady demand in exports. Winterwear brands and online platforms have keen interest in these products, which hold a distinct position in seasonal apparel exports.

The GST drop from 12% to 5% is a game-changer for this sector. Lowering prices makes woollen shawls and stoles more affordable for end-consumers, while simultaneously enhancing the products’ competitiveness in both domestic and international markets. This tax relief is expected to stimulate demand, expand export opportunities, and drive stronger sales volumes. Most importantly, it secures the livelihoods of thousands of weavers and cooperatives while preserving one of Punjab’s most iconic textile traditions.

Hand-block Printed Fabric

Hand-block printed fabric, crafted largely by Muslim artisans and printers- many from women-led households, thrives across Malerkotla and Ludhiana. Employing nearly 10,000 people across its value chain, this craft supplies to fabric boutiques and garment brands, and is used by designers, and direct-to-consumer labels. It also has moderate presence in export markets.

The falling GST rates from 12% to 5% offers a crucial boost to the sector. Lower taxation makes hand-block printed fabrics more affordable and attractive to buyers, thereby widening demand across domestic retail and export channels. Beyond market expansion, the reforms incentivize formalisation in the sector, bringing small-scale weavers and printers into the formal economy. The price advantage translates into better income security for artisans, helping sustain women-led enterprises while preserving this intricate craft tradition of Punjab.

Women’s cotton kurta production in Punjab is driven by textile MSMEs and women-led tailoring units concentrated in Ludhiana and Patiala. The sector employs over 20,000 workers and caters to a wide customer base, ranging from domestic fashion retailers and e-commerce platforms to direct-to-consumer (D2C) apparel brands. Additionally, boutique labels in international markets source these kurtas, adding to the export potential of the industry.

The GST rate cut from 12% to 5%is a strong enabler for this segment. By lowering overall production and retail costs, the reform makes cotton kurtas more affordable for consumers while enhancing their competitiveness in both domestic and global markets. This price advantage drives higher sales volumes, stimulates demand on online and offline platforms, and opens greater opportunities in exports. Moreover, the reduction supports better income flows for artisans and tailoring units, encourages sector formalisation, and helps bring down MRPs- strengthening Punjab’s cotton apparel industry in a fast-growing fashion economy.

Footwear

The Punjabi Jutti, a traditional footwear, is crafted by skilled leather artisans and family-run units primarily in Patiala, Amritsar, and Fazilka. Employing around 15,000 workers across key clusters, the industry serves diverse markets- from ethnic fashion and wedding wear to souvenirs and designer brands. Boutique exports reach destinations like the UK and Canada, showcasing this craftsmanship globally.

The GST reduction from 12% to 5% provides a significant boost to this sector. By lowering the overall cost, the reform makes Punjabi Juttis more affordable and competitive in both domestic and international markets, stimulating demand. Importantly, it strengthens the viability of artisan livelihoods, supports small-scale leather units, and enhances the sustainability of this traditional craft while expanding market reach and export potential.

Handicrafts & Wooden Products

Punjab is known for its handicrafts and wooden products, which are acclaimed world over. These products now benefit from GST reduction from 12% to 5%. Lower costs make them more affordable for consumers, boost sales, expand market reach, and strengthen artisan livelihoods, while preserving traditional craftsmanship.

Handcrafted Wooden Products

In Hoshiarpur and Patiala, traditional carpenters and artisan families craft exquisite handcrafted wooden products, employing around 8,000 craftsmen. These creations primarily serve the luxury furniture and heritage home décor markets, attracting buyers such as boutique stores, architects, and exporters. The segment also has potential in the global design markets.

The recent GST reduction from 12% to 5% provides a major boost to the industry. By lowering production costs, the reform enhances the competitiveness of MSMEs, makes products more affordable, stimulates domestic and international demand, and drives higher sales volumes. Importantly, it also supports artisan livelihoods, preserves traditional woodworking skills, and strengthens Punjab’s position in the global luxury and heritage décor market.

In Amritsar, small-scale artisans, many of them women, craft traditional wooden lacquer toys, employing around 3,000 skilled workers. These toys cater to ethnic toy markets, handicraft fairs, exhibitions, and toy stores, with potential in niche handcrafted toy exports.

The GST drop from 12% to 5% has given the industry a significant boost. By lowering costs, the reform enhances price competitiveness, making products more affordable for buyers and stimulating demand. It also strengthens artisan livelihoods, supports small-scale production units, and helps preserve this culturally rich craft, while expanding opportunities in both domestic and international markets.

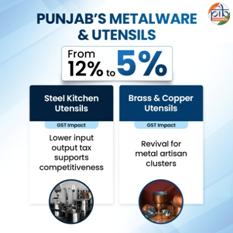

Metalware & Utensils

Punjab is famous for the traditional techniques of manufacturing brass and copper utensils. Additionally, the state also has a steel kitchen utensils industry. Most of the metal ware and utensils industry has witnessed a GST rate reduction from 12% to 5%, which supports competitiveness and helps metal artisan clusters.

Jalandhar and Ludhiana host a thriving cluster of MSMEs that manufacture stainless steel wares for households, commercial kitchens, retail outlets, and online platforms. Employing over 25,000 workers, the industry also contributes to exports of small appliances, making it an essential part of Punjab’s industrial base.

The GST reduction from 12% to 5% has provided strong relief to the sector. Lower input and output taxes ease the cost burden on manufacturers, improving overall competitiveness. This reform makes stainless steel wares more affordable for consumers, encourages greater sales through both offline and online channels, and enhances export potential. At the same time, it supports MSME viability, safeguards employment, and strengthens Punjab’s position as stainless steel products maker.

In Jalandhar, artisanal metalware makers craft brass and copper utensils that cater to kitchenware needs, ceremonial items, temple trusts, and boutique buyers. Employing over 5,000 artisans, this traditional craft sustains livelihoods while also finding niche export opportunities in the global wellness and lifestyle sector.

GST rate now at 5% from 12% earlier give the industry a much-needed revival. Lower taxation makes handcrafted brass and copper utensils more affordable for consumers and competitive in wider markets. This reform not only boosts domestic sales and export potential but also strengthens artisan viability, ensuring the growth of Punjab’s centuries-old metalworking clusters.

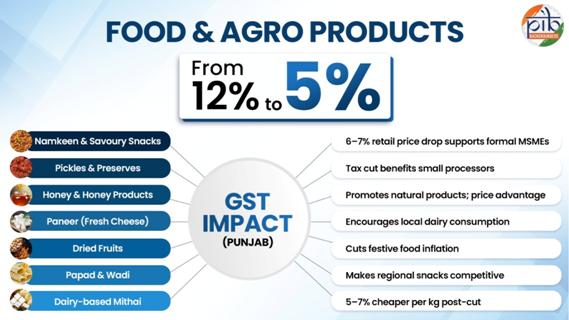

Food & Agro Products

Punjab is a key producer of many agro and food commodities of India. Major commodities include milk, butter, ghee, curd, cheese, UHT milk, infant food, dairy whitener, chocolate etc.

With the GST rate reduced from 12% to 5% on several food and agro products, local and small-scale producers benefit from lower production costs, improved profit margins, and enhanced competitiveness in both domestic and niche export markets. This tax relief encourages greater production, supports livelihoods, and strengthens the state economy, ensuring that traditional products like papad and wadi continue to thrive while sustaining rural employment.

Across Ludhiana and Jalandhar, small-scale snack MSMEs with many women involved, produce namkeen and savoury snacks for the domestic market, supermarkets, and D2C brands, while also supplying to airlines and retailers. The sector employs nearly 30,000 workers in production and distribution, with growing export potential among the Indian diaspora worldwide.

The GST reduction from 12% to just 5%emerges as a game-changer for this industry. The 6–7% drop in retail prices makes products more affordable and competitive, boosting sales volumes in domestic and export markets alike. This reform not only supports the growth and formalisation of MSMEs but also secures better livelihoods for thousands of workers, particularly women.

Across Gurdaspur and Hoshiarpur, Self Help Groups (SHGs) and women-led enterprises produce a wide range of pickles and preserves for specialty food outlets, kirana stores, and ethnic food retailers. The sector engages nearly 10,000 micro-entrepreneurs, and carries strong export potential in diaspora-driven markets.

The GST fall from 12% to 5% offers a significant boost to this cottage industry. Lower taxation makes products more affordable and marketable, expanding sales in both domestic and overseas markets. The reform not only improves competitiveness but also strengthens women’s entrepreneurship, rural incomes, and the formalisation of food-processing MSMEs.

In Hoshiarpur and Pathankot, tribal communities, rural beekeepers, and SHGs are engaged in honey production and allied activities, employing over 15,000 people in apiary and packaging processes. Honey and its value-added products cater to food retail chains, Ayurvedic and wellness markets, and are procured by FMCG firms and e-commerce platforms. With rising demand for natural products worldwide, the segment also carries export potential to the Middle East and USA.

GST rates now at 5%, down from 12% provide a boost to this sector. Lower taxation makes honey and allied products more affordable and competitive, improving margins for small producers while encouraging wider consumption. The reform supports tribal and rural livelihoods, formalises production chains, and strengthens India’s position in the global natural products market.

Across Punjab’s dairy belts, rural producers and milk cooperatives are central to paneer (fresh cheese) production, employing over 40,000 people in milk processing. Paneer is a staple for households, sweet shops, food processors, and the HoReCa(Hotel, Restaurant, and Café/Catering) industry, while exports, though limited, are rising in frozen form.

The GST reduction from 12% to 5%is helpful to this sector. By lowering costs, the reform makes paneer more affordable for end consumers, encourages higher domestic consumption, and strengthens the competitiveness of dairy MSMEs and cooperatives. It also supports income stability for rural producers, expands formalisation of dairy value chains, and aligns with Punjab’s strong tradition of dairy entrepreneurship.

Amritsar and Ludhiana serve as Punjab’s key dry fruit hubs, where wholesale traders and food processors employ nearly 8,000 supply chain workers. Dry fruits are in strong demand for retail consumption, premium gifting, and festive packs, with medium export potential among diaspora markets.

The GST rate cut from 12% to 5% brings significant relief to this segment. By lowering costs, the reform curbs festive food inflation, makes dry fruits more affordable for households, and enhances competitiveness for traders and processors. The reduced tax burden not only stimulates higher seasonal and year-round demand but also strengthens the value chain, supporting jobs and improving margins for MSMEs engaged in this sector.

Firozpur and Amritsar are hubs of Punjab’s papad and wadi industry, where women’s collectives and micro-enterprises employ over 6,000 producers. These traditional home-style snacks cater to domestic grocery markets, ethnic food retailers, and sweet shops, with demand among Indian diaspora communities abroad.

The GST reduction from 12% to 5%gives this sector a strong push, as it makes regional snacks competitive in both local and export markets, stimulating higher demand. The reform also encourages formalisation of women-led micro units, supports income stability, and helps preserve Punjab’s distinctive culinary heritage.

Ludhiana and Amritsar are major centres for dairy-based mithai, produced largely by family-run sweet shops, often women-involved. The sector employs over 10,000 workers and caters to festivals, weddings, gifting markets, tourism, and bulk buyers such as sweet brands, airlines, and retailers. Growing demand also comes from diaspora gift packs, giving the industry both domestic and international traction.

The GST reduction from 12% to 5% provides a significant boost. With prices dropping by nearly 5–7% per kilogram, mithai becomes more affordable for consumers and more competitive for sellers. This not only stimulates festive and tourism-related demand but also supports small sweet makers, encourages formalisation, and strengthens Punjab’s traditional dairy-based delicacies in premium and diaspora markets.

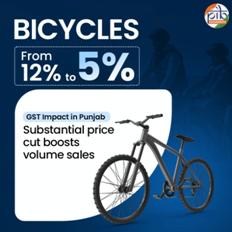

Bicycles

Ludhiana is integral to Punjab’s bicycle manufacturing, with both large-scale factories and small MSME units producing them. The industry employs over 40,000 people directly and indirectly, serving the national demand for school and utility bicycles. Key buyers include school schemes and mobility start-ups. Export opportunities are spread across South Asia and Africa.

The GST reduction from 12% to 5% delivers a substantial price cut, making bicycles more affordable for households and schemes alike. This tax relief is expected to boost volume sales, strengthen competitiveness in export markets, and support job creation across the supply chain- from manufacturing hubs to retail networks.

Conclusion

The recent GST reforms in Punjab, cutting rates from 12% to 5% across textiles, handicrafts, footwear, metalware, food, dairy, and bicycles is vital to the state’s economy. By lowering costs, these measures make products more affordable, boost domestic consumption, expand exports, and enhance competitiveness across key sectors. Importantly, the reforms strengthen livelihoods for thousands of artisans, farmers, and MSME workers, formalise supply chains, and preserve Punjab’s rich cultural and industrial heritage. Together, these changes not only stimulate growth and employment but also reinforce Punjab’s position as a hub of craftsmanship, agriculture, and manufacturing excellence.

References

Punjab.gov.in

https://punjab.gov.in/know-punjab/

hoshiarpur.nic.in

https://hoshiarpur.nic.in/handicraft/

PIB Archives

https://www.pib.gov.in/newsite/PrintRelease.aspx?relid=112387

investpunjab.gov.in

https://investpunjab.gov.in/assets/docs/Agro_and_food_processing_sector.pdf

https://investpunjab.gov.in/assets/docs/japan_textile_english.pdf

commerce.gov.in

https://commerce.gov.in/wp-content/uploads/2020/02/MOC_636016030908099515_Indian_Organic_Sector_Vision_2025_15-6-2016.pdf

Download in PDF

***

SK/M

(Release ID: 2175668)

Visitor Counter : 1006