PIB Headquarters

From Spices to Seafood: GST Reforms to Boost Kerala’s Economy

Posted On:

08 OCT 2025 10:28AM by PIB Delhi

Key Takeaways

- 5% GST on cashew & coir products to benefit over 6.7 lakh workers across Kerala

- Food processing, employing 29.5% of Kerala’s workforce, gains from reduced rates on pineapple, mango, and banana-based products

- 1.049 million fisherfolk and 4.18 lakh tea workers set to gain with 5% GST on processed seafood & tea

- GST cuts reduce costs by ~6-11% across spices, coffee, processed fruits & dry fruits

- Tourism and Ayurveda set to expand under 5% GST, making Kerala more affordable for global visitors

|

Introduction

Kerala, often celebrated as “God’s Own Country”, is deeply rooted in agriculture, marine resources, plantation crops, and artisanal production, with each sector supporting numerous livelihoods. The recent GST reforms, which bring significant rate reductions across key industries, are expected to make products and services more affordable, enhancing export competitiveness, and strengthening income opportunities across value chains.

From the spice gardens of Idukki and Wayanad to the coir factories of Alappuzha, fisheries clusters of Kochi & Kannur to the cashew corridor of Kollam, all of Kerala is set to gain. Beyond goods, the reforms extend to services, with tourism, Ayurveda, and wellness industries witnessing tax relief that enhances affordability and global appeal.

Together, these reforms ensure that the benefits of growth reach both producers and consumers, revitalizing Kerala’s traditional strengths while paving the way for inclusive economic growth.

Agriculture & Agro-processing

Cashew processing -roasted/ salted/ coated nuts

Kerala’s cashew processing industry is centered around Kollam cashew corridor employing around 3 lakh workers, engaged in shelling, peeling, and grading across micro-units and cooperatives. The reduction of GST on cashew processing from 12%/ 18% to 5% brings ~6-11% cost reduction, based on earlier slab.

The sector caters to domestic snacking and gifting markets, with products now more affordable under the revised GST rates. Private-label contracts continue to drive exports to GCC, US, and EU retail markets. The rate cut strengthens Kerala’s cashew processors by improving margins and competitiveness.

Wayanad Robusta Coffee

With the GST rate on instant coffee and preparations reduced from 18% to 5%, Kerala’s Wayanad coffee belt is poised to become stronger and more competitive. Coffee production in Kerala is dominated by small and marginal farmers who manage mixed cropping farms. The sector employs roughly 50,000 workers involved in harvesting and pulping, as well as small-scale entrepreneurs and roasters producing instant coffee mixes/ coffee-based preparations.

The new GST rates are expected to bring ~11% cost reduction. In 2023-24, Kerala produced 70,354 metric tons of coffee, with Wayanad being the largest producing district. Kerala is also a major contributor to India’s overall coffee exports. The GST reduction will make Kerala’s GI-tagged Robusta coffee more competitive in both domestic and export markets.

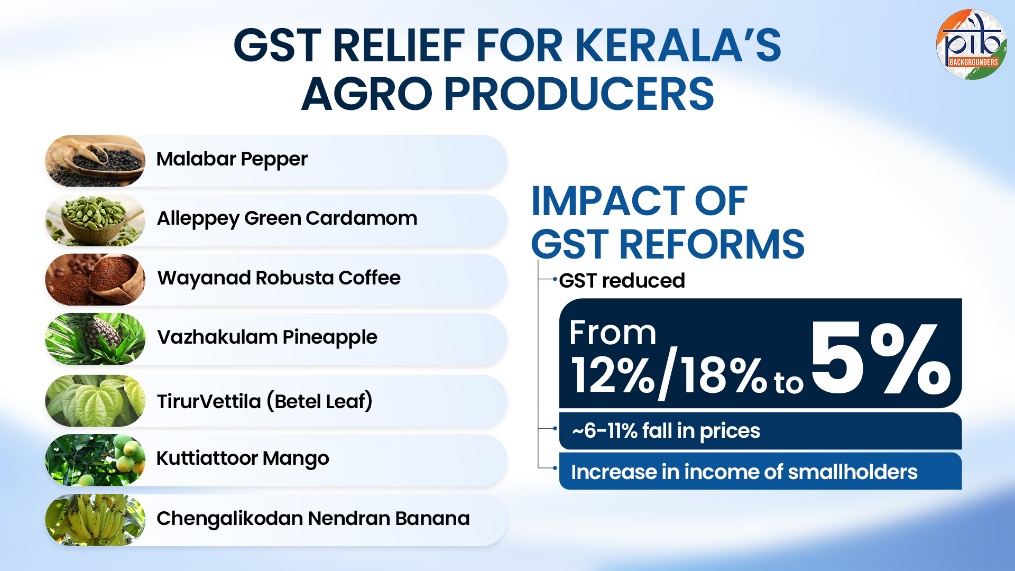

Malabar Pepper

The reduction of GST on Malabar Pepper from 18% to 5% is expected to bring ~11% cost reduction, offering substantial relief to Kerala’s spice economy. Cultivated mainly by small and marginal hill farmers across Wayanad, Kozhikode, and Kannur, pepper farming supports seasonal labourers and women engaged in cleaning, drying, and packing of the spice.

As one of Kerala’s most valuable GI-tagged products, Malabar Pepper is a key component in masala blends and spice extracts. In 2022-23, India’s total pepper exports were valued at USD 87 million, with a major share originating from Kerala and supplied to EU and US oleoresin buyers. The GST reforms are expected to make Kerala’s pepper more price-competitive in global markets and strengthen the position of smallholder farmers within the spice value chain.

Alleppey Green Cardamom

Cultivated mainly by small growers in the Idukki plantations, Kerala’s GI-tagged green cardamom sustains a network of smallholder clusters, drying and curing operators, and a workforce engaged in grading, packing, and processing of cardamom oleoresin/ essential oil and masala mixes. The Alleppey Green is a well-known origin/ brand of green cardamom in the state.

The reduction of GST on extracts/ masala mixes from 18% to 5% is expected to result in an 11% cost reduction, providing a strong boost to Kerala’s spice economy. In 2023, India’s total cardamom exports were valued at USD 102.43 million, with a major portion originating from Kerala. With reduced GST, exporters can offer more competitive pricing, whereas smallholders, labourers, and processors can benefit from better income security.

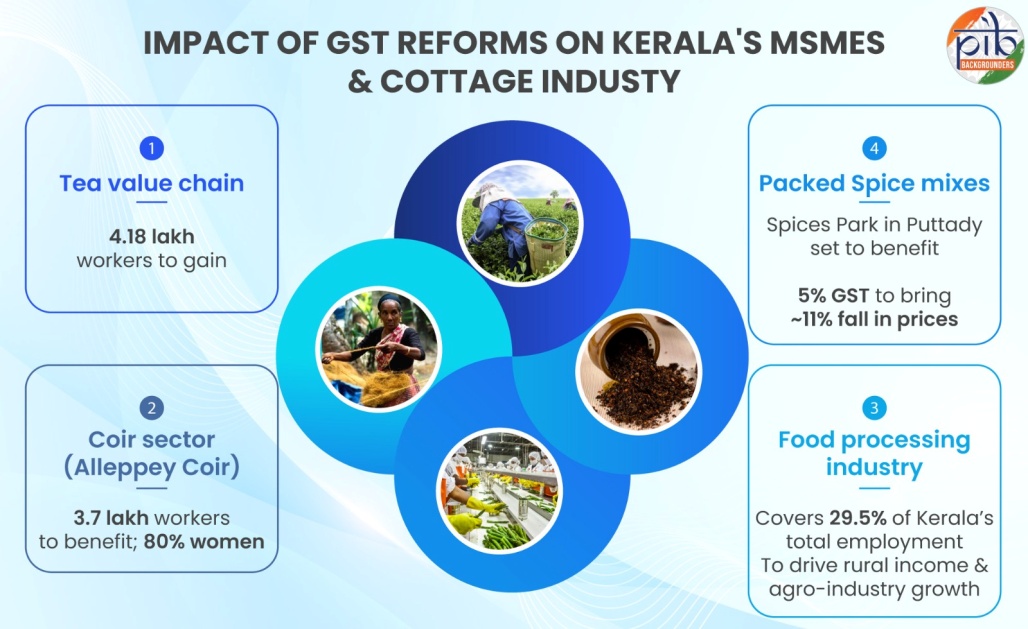

Vazhakulam Pineapple

The reduction of GST on processed pineapple products from 12% to 5% is set to deliver a significant boost to Kerala’s GI-tagged Vazhakulam pineapple cluster, especially in the Ernakulam and Thrissur regions. The industry comprises of smallholder farmers in these clusters, supported by day labourers involved in harvesting and packaging, as well as other staff employed in small processing units and FPO/ cooperative factories. The food processing sector accounts for 29.5% of Kerala’s total employment, reflecting its socio-economic importance.

The Vazhakulam pineapple market currently dispatches 1,500 tonnes of fruit daily, catering to a domestic share of nearly 98%, while exports of fresh and dried pineapples from Kerala account for 44% of India’s total trade in this segment.

With the new GST rate of 5%, costs are expected to fall by around 6.25%. This reduction will make pineapple-based products such as pulp, jam, and canned fruit more affordable in domestic markets and more competitive internationally.

TirurVettila (Betel Leaf)

The Tirur Vettila (Betel Leaf) from Malappuram’s Tirur is set to receive a strong push under the new GST structure, with rates on value-added mouth fresheners and pastes reduced from 18% to 5%. The crop is primarily cultivated by smallholder vine growers working on family farms, supported by daily-wage harvesters and seasonal packers.

The demand comes mainly from northern Indian states, where betel products remain popular, while e-commerce platforms continue to widen market reach. The new rates reduce cost by ~11% for value-added products such as mouth fresheners and pastes.

Kuttiattoor Mango

Kuttiattoor Mango is a GI-tagged produce cultivated by small orchard owners with 1-3 acres of land and supported by daily labourers during harvest. Processing is carried out by micro-processors for jams and pickles.

The reduction of GST on jams/ pulp/ pickles from 12% to 5% is expected to bring about a 6.25% cost reduction, directly benefiting Kannur FPOs & processors. The global processed mango product market was valued at USD 18.81 billion in 2024, indicating the scale of potential demand. Buyers include gourmet and pickle brands, as well as NRK online consumers. The GST cut will help improve margins for the industry and make Kuttiattoor Mango products more competitive in both domestic and export markets.

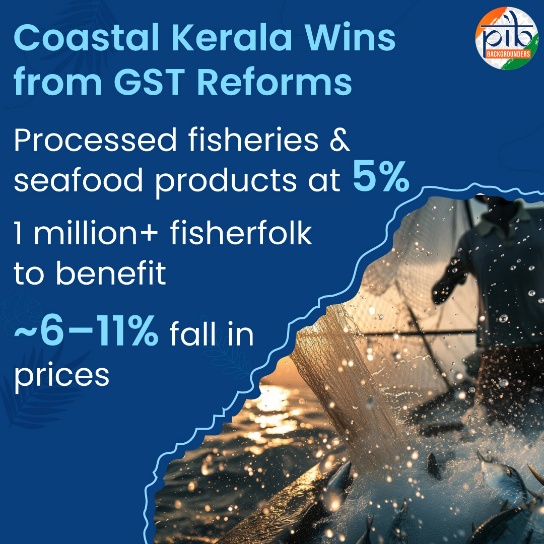

Fisheries & seafood processing

Spread across Kochi, Kollam, Kozhikode, and Kannur, the fisheries sector supports traditional fisherfolk communities. While men are primarily engaged in capture fishing, women play a vital role in post-harvest activities such as drying, peeling, sorting, and packaging. Kerala’s fisherfolk population is estimated at 1.049 million, highlighting the scale of livelihood dependence on this sector.

The reduction of GST on fisheries and seafood processing to 5% is expected to bring about a 6-11% cost reduction, benefiting Kerala’s coastal economy. In 2022-23, the state produced 6.87 lakh tonnes of marine fish, contributing approximately 1.80% to Kerala’s GSDP. The same year, Kerala exported 218,629 tonnes of marine products worth ₹8,285.03 crore. The GST reduction will help enhance export competitiveness and improve income stability in this sector.

MSME & Cottage Industries

Packed Spice mixes

Kerala’s packed spice mix industry, spread across Kochi, Idukki, Wayanad, and Kozhikode, primarily sustains smallholder farmers, with many women workers engaged in drying, cleaning, and sorting of spices. Supported by strong infrastructure such as the Spices Park in Puttady, Kerala remains a pivotal contributor to India’s growing spice economy.

The recent GST reduction on packed spice mixes from 18% to 5% is estimated to reduce prices by ~11%. This will enhance Kerala’s global competitiveness while making its spice products more affordable for consumers.

Tea value chain

The reduction of GST on tea products from 18% to 5% is set to benefit Kerala’s Idukki-Munnar tea estates and Kochi-based packers and auctioneers. The sector employs around 4.18 lakh workers, including plantation labourers engaged in plucking and field maintenance, smallholder growers, factory workers, and brokers.

The total value of plantation crops produced in the state contributes about 23.27% of India’s total export value in this sector. The GST cut reduces the cost of packet/ instant/ RTD tea by ~11%. This will strengthen Kerala’s position within India’s tea industry and ensure sustained livelihood opportunities across its tea-growing regions.

Chengalikodan (Changalikodan) Nendran Banana

The GI-tagged Chengalikodan Nendran Banana, processed mainly in Thrissur, Palakkad, and Kozhikode, supports a network of small farmer families and a large cottage industry of home/ cluster-based chip makers and packers. The industry provides employment in frying, seasoning, packing, and micro logistics, forming a vital part of Kerala’s MSME snack clusters. Valued at around ₹750 crore, Kerala’s banana chips industry caters to airport retail, GCC Indian stores, and tourist markets.

With the GST rate reduced from 12%/ 18% to 5%, costs are expected to fall by ~6-11%, making Kerala’s iconic banana chips more affordable and competitive in domestic and export markets.

Coir Sector

The reduction of GST on the coir sector, including GI-tagged Alleppey Coir GI products such as mats, matting, ropes, and geotextiles, from 18% to 5%, is expected to reduce cost by ~11%. Concentrated in Alappuzha, Kollam, and Perinad-Perumon, the industry supports a wide spectrum of workers, including husk collectors, retting/ de-cortication workers, spinning and weaving units, and factory & export staff. The coir industry employs around 3.7 lakh people, with women making up about 80% of the total workforce.

Kerala accounts for nearly 85% of India’s coir production and serves as a major contributor to the country’s total coir exports. The GST reduction is expected to boost exports and strengthen livelihoods across Kerala’s coir clusters.

Tourism & Ayurveda

Tourism & hospitality

Kerala’s tourism and hospitality sector, majorly covers Kochi, Alappuzha, Kovalam, Varkala, Munnar, and Wayanad, employing a diverse workforce including youth from coastal and highland communities, with women actively engaged in homestays, Ayurveda wellness centres, handicrafts, and food catering. The sector plays a vital role in Kerala’s economy, generating ₹35,168.42 crore in total revenue in 2022.

Hotels and homestays with rates up to ₹7,500 are now taxed at 5% GST, while inputs like toiletries and tableware have seen a rate cut from 18% to 5%, reducing costs by around 11%. These reductions make stays and services more affordable, improving margins for the industry and boosting Kerala’s appeal as a travel destination.

Ayurveda & medicines

Kerala’s Ayurveda and medicine sector, spread across Thrissur, Kottakkal (Malappuram), and Aluva, supports a wide workforce of herb gatherers, manufacturing workers in Ayurvedic product units, therapists and clinic staff in treatment centres. With Ayurvedic drugs, devices, and products now taxed at 5% GST, costs are expected to fall by ~6-11%, improving affordability.

The market covers wellness packages, chronic care, and OTC Ayurveda, catering to domestic patients and foreign wellness tourists. The GST cut is expected to enhance Kerala’s competitiveness as a hub for traditional healthcare and wellness.

Conclusion

The GST reforms will benefit Kerala’s economy, reinforcing the state’s strengths across agriculture, food processing, fisheries, and cottage industries. By reducing tax rates on essential and value-added goods, from spices, coir, and cashew to tea, coffee, and Ayurvedic products, the reforms directly lower production costs while expanding market opportunities. For a state with numerous smallholders, cooperatives, and MSMEs, these changes will bring better margins, increased income, and greater competitiveness both within India and abroad.

Overall, the new GST structure ensures that Kerala’s economic growth is broad-based, reaching the farmer in Idukki, the fisherwoman in Kollam, the weaver in Alappuzha, and the entrepreneur in Kochi.

Click here to see pdf

***

SK/M

(Release ID: 2176100)

Visitor Counter : 1508