PIB Headquarters

GST Rationalistaion: Cultivating Growth, Crafting Prosperity in Mizoram

Posted On:

13 OCT 2025 4:06PM by PIB Delhi

Key Takeaways

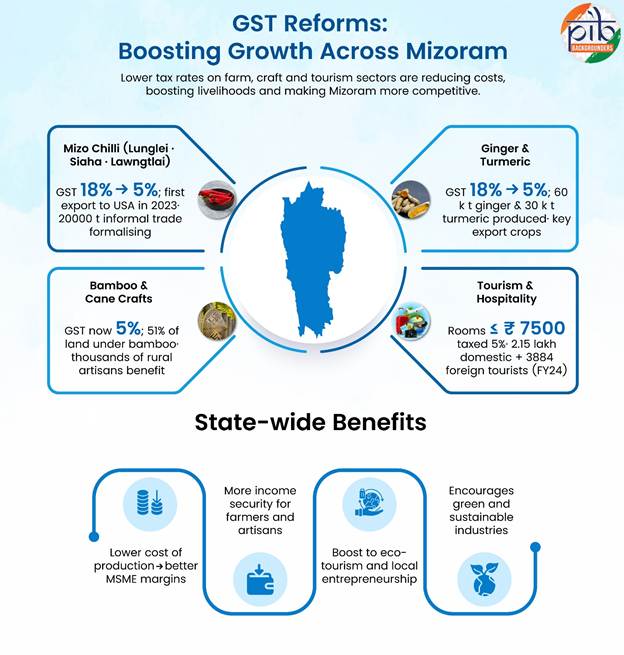

- GST cut from 18% → 5% on processed Mizo Bird’s Eye Chilli, ginger and turmeric to benefit farmers and promote exports.

- Processed fruit products, including passion fruit juice and pulp, now taxed at 5%, creating jobs in local food units.

- All bamboo and cane products brought under a 5% GST slab, supporting rural artisans and eco-friendly livelihoods.

- Hotel rooms up to ₹7,500/night taxed at 5%, making Mizoram more attractive for travellers and boosting employment.

|

Introduction

Mizoram’s economy is deeply rooted in its land and forests, from organic spices and horticultural crops to bamboo crafts and eco-tourism. The state’s unique terrain and traditional farming practices give its products a distinct identity, with the Mizo Bird’s Eye Chilli recognised as a Geographical Indication (GI) product for its distinctive quality and flavour. The recent GST rate rationalisation provides a timely boost to these sectors, reducing tax burdens and improving income opportunities for farmers, artisans and entrepreneurs across the state.

By lowering GST on key items, such as Mizo chilli, ginger, turmeric, bamboo and cane products, processed fruits, and tourism services, the reforms will make Mizoram’s goods more affordable and competitive while supporting employment across rural and semi-urban areas.

Mizo Chilli (Bird’s Eye)

The Mizo Bird’s Eye Chilli, a GI-tagged organic crop, is one of the most distinctive agricultural products of the state. It is mainly grown in the districts of Lunglei, Siaha and Lawngtlai, where the climate and soil are ideal for its cultivation. Farmers traditionally grow this crop through jhum (slash-and-burn) cultivation, making it an integral part of Mizoram’s farming culture and household income.

Mizoram produced about 10,918 metric tonnes of Mizo chilli in 2020–21. A study conducted in Aizawl district during 2017–18 estimated an average gross income of ₹1.57 lakh per hectare, underlining its economic importance for small farmers.

The chilli is also finding new global markets, the state recorded its first official export of 7.5 metric tonnes to the United States in March 2023, while around 20,000 tonnes are estimated to be traded annually to Bangladesh and neighbouring states through informal channels. Small food processing and pickle units linked to the chilli also provide employment opportunities, typically engaging around 10 to 12 persons per unit.

With GST reduced from 18% to 5% on processed and packaged chilli products, farmers and processors are expected to benefit directly. The lower rate will make packaged chilli more affordable in domestic markets, promote branding and value addition, and strengthen Mizoram’s export competitiveness. The reform will also help shift a significant portion of informal cross-border trade into the formal economy, ensuring better income security for farmers and small entrepreneurs.

Ginger and Turmeric

Ginger and turmeric are among Mizoram’s most important cash crops and exportable commodities. Cultivated across the state, these spices form a major part of local farming incomes.

Mizoram’s total horticultural output was estimated nearly 708 thousand metric tonnes in 2023–24, which includes a substantial contribution from spices. In 2024–25, the state produced over 60,000 tonnes of ginger and nearly 30,000 tonnes of turmeric, reflecting the steady growth of spice cultivation in Mizoram’s hilly terrain and favourable climate. Together, these crops account for a major share of the state’s spice trade and are increasingly being promoted for export potential. Total merchandise exports from Mizoram stood at US$ 0.22 million in FY 2024–25 (up to February), with spices forming an important component of that basket.

With GST reduced from 18% to 5% on processed and packaged products, value-added spice producers will benefit from lower input costs and better market access. The change is also expected to make Mizoram’s organic spices more competitive in both domestic and export markets, where consumer demand for natural and chemical-free produce continues to grow.

Passion Fruit

Mizoram is India’s third-largest producer of passion fruit, and cultivation is expanding rapidly due to favourable climatic conditions. In 2023–24, the state produced over 3.4 lakh tonnes of fruits, including passion fruit, spread across nearly 69,000 hectares. Passion fruit processing has created new entrepreneurial opportunities in juice and concentrate production, offering additional income for farmers and women’s groups.

The reduction of GST on processed fruit products from 12–18% to 5% will make passion fruit juice and allied products more affordable and marketable. The reform is expected to encourage the growth of small-scale processing units, create local jobs, and help Mizoram tap into the growing national demand for health-oriented fruit beverages.

Bamboo and Cane Crafts

Bamboo is deeply woven into Mizoram’s culture and economy. With nearly 51% of the state’s land area covered in bamboo, the material forms the backbone of the state’s handicraft and cottage industries. From furniture and household décor to baskets and utility products, bamboo and cane crafts reflect both the creativity and sustainability of Mizo artisans.

These crafts are a vital source of income for rural households and play an important role in youth employment across the state. The sector continues to receive support under various government programmes aimed at improving design, skill development and value addition, helping artisans reach wider domestic and export markets.

Under the new GST structure, bamboo furniture and all bamboo or cane handicraft products are now taxed at a uniform rate of 5%, down from the earlier higher slabs. The reduced rate will make bamboo products more affordable, stimulate domestic demand and enhance Mizoram’s competitiveness in the national handicraft market. With India’s bamboo industry valued at nearly ₹24,000 crore (in 2019), this reform opens up new opportunities for Mizoram’s artisans, promoting green livelihoods and sustainable rural growth.

Tourism and Hospitality

Tourism is fast emerging as a key engine of growth and employment in Mizoram. Blessed with scenic hills, lush forests and a vibrant cultural heritage, the state is positioning itself as a major destination for eco-tourism and adventure travel. Visitors are drawn to its serene landscapes, traditional festivals and community-based homestays that reflect the warmth and hospitality of Mizo culture.

A 2014–15 government survey identified 4,038 employees working across 161 accommodation units in the state, reflecting the growing importance of tourism as a livelihood source. In 2023–24, Mizoram received 215,265 domestic and 3,884 foreign tourists, and the sector continues to generate both direct and indirect employment through hotels, tour operations, handicrafts, food services and transport.

With rooms priced up to ₹7,500 now taxed at just 5%, and lower input costs for service providers, the reforms will make travel to Mizoram more affordable for visitors. The move is expected to encourage higher occupancy, promote local entrepreneurship in the hospitality sector and generate more employment for the youth in rural and urban centres alike.

Conclusion

The GST reforms offer broad-based benefits to Mizoram’s economy, from farmers cultivating GI-tagged Mizo chillies and spices to artisans crafting bamboo furniture and entrepreneurs in the tourism sector. Lower tax rates will reduce costs, boost domestic consumption, and strengthen the competitiveness of Mizoram’s natural and handmade products in wider markets.

By combining traditional strengths with new opportunities in agri-processing, handicrafts and eco-tourism, these reforms will help sustain livelihoods, promote value addition and support Mizoram’s path toward inclusive and sustainable growth.

Click here to see pdf

****

VV/M

(Release ID: 2178461)

Visitor Counter : 802