PIB Headquarters

Tripura’s Economic Threads Strengthened by GST Cuts

Posted On:

23 OCT 2025 10:15AM by PIB Delhi

Key Takeaways

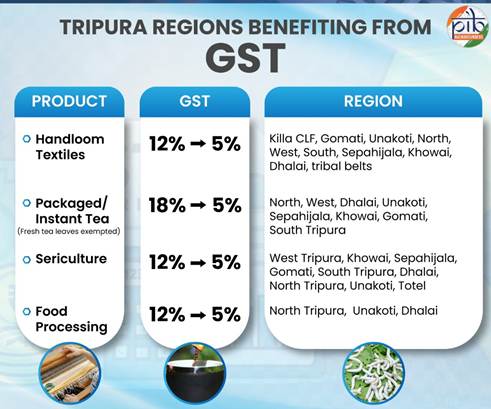

- The GST cuts from 12% to 5% boost the competitiveness of Tripura’s handlooms, tea, sericulture, and food processing sectors, driving rural livelihoods and expanding market reach.

- Handloom textiles: GST on handloom fabrics and stitched apparel has been reduced from 12%→5%, benefiting 1.37 lakh+ households.

- Tea: GST on packaged/instant tea has been reduced from 18% to 5%, aiding 54 estates and 2,755 small growers.

- Sericulture: GST on silk handicrafts is down from 12% to 5%, supporting 15,550 farmers.

- Food Processing: For juices (incl. Queen Pineapple), GST has been lowered from 12% to 5%, supporting ~2,848 processing units.

|

Introduction

Located in northeast India, Tripura is known for its scenic landscapes, vibrant culture, and rich heritage. Tripura is endowed with ecological wealth: ~60% of its area is under forest cover, while ~24% is cultivated land. Often called the “Daughter of Mother Nature”, Tripura’s economy continues to rely heavily on agriculture and allied activities. Its agro-ecological conditions are ideally suited for diverse horticultural crops such as pineapple, jackfruit, and other tropical fruits. The state is also a notable producer of tea and has strong potential in sericulture, owing to its favorable climate and traditional silk-rearing practices. Additionally, craftsmanship in Tripura's handlooms, handicrafts and traditional arts is eminent.

Notably, these sectors are witnessing new opportunities with lower GST rates revitalizing growth and competitiveness. Reduced tax slabs for handloom textiles, stitched apparel, few forms of tea, and sericulture products support local artisans, weavers, and farmers expand market reach while ensuring affordability for consumers. By easing tax burdens and promoting local value addition, the GST reforms are strengthening Tripura’s rural economy, supporting employment, and reinforcing its position as a key contributor to India’s northeast development story.

Handloom Textiles

Handloom textiles is a well-recognized industry in Tripura. The traditional “Risa” and Tripura Pachra–Rignai have earned the significant Geographical Indication (GI) tag status. Notably, Tripura has more than 1.3 lakh households involved in handloom work.

Tripura Risa Textile

The Tripura Risa Textile, a GI-tagged product, is rooted in the traditions of the Tripuri tribal communities. Its weaving is widely practiced across tribal belts, particularly led by the Killa Mahila Cluster Level Federation (CLF) in the Gomati district. Tribal women-led and household-based, the craft relies on loin or backstrap looms.

The Risa itself holds cultural significance- it is a customary handwoven cloth used as a headgear, stole, or upper garment for women, and is also offered as a token of respect and honor to distinguished guests in Tripura. Supported and promoted by the Tripura Rural Livelihood Mission, Risa textiles primarily cater to domestic markets, symbolizing both identity and livelihood for the state’s tribal women.

Recent GST revisions further boost this traditional craft, with fabrics now taxed at around 5%, and stitched apparel priced up to ₹2,500 moved to the 5% slab from the earlier 12%. This 7-percentage-point reduction (12%→5%) for stitched Risa-based apparel (₹1,001–₹2,500 range) helps make Tripura’s indigenous textiles more competitive and accessible, enhancing income opportunities for rural women while preserving the state’s cultural heritage.

Tripura Pachra–Rignai Textile

The Tripura Pachra–Rignai Textile (GI-tagged) is woven across the tribal belts of Gomati, Unakoti, North, West, South, Sepahijala, Khowai, and Dhalai districts. Crafted by Tripuri women on loin or backstrap looms, these textiles form an integral part of Tripura’s cultural identity. The Rignai (a skirt) and Pachra (a wrap/overskirt) are symbols of tradition and worn daily as well as during ceremonies.

The market remains largely domestic, with sales done primarily through Purbasha and the Tripura Handloom & Handicrafts Development Corporation (THHDC), and at regional craft fairs, with a growing niche presence on curated online platforms.

Recent GST rate rationalizations offer a boost to this traditional sector. Unstitched fabric lengths continue at 5% GST, while stitched apparel priced up to ₹2,500 now attracts a 5% rate, down from 12%. This 7-percentage-point cut for stitched Pachra–Rignai sets (₹1,001–₹2,500 range) significantly enhances their price competitiveness and marketability. By lowering the tax burden, the GST reform supports local artisans, encourages small-scale production, and promotes wider consumer adoption of Tripura’s authentic handwoven textiles while strengthening both rural livelihoods and cultural preservation.

Tea

Tripura produces a diverse range of black CTC, green, and organic teas, cultivated across its major districts- North, West, Dhalai, Unakoti, Sepahijala, Khowai, Gomati, and South Tripura. With 54 tea estates and 2,755 small tea growers, the sector sustains a workforce comprising tribal and local communities, many of whom rely on daily wages and in-kind rations for livelihood support.

Tripura tea is primarily sold through the Guwahati and Kolkata Auction, while a smaller share reaches domestic markets in northern and western India and select local outlets. Notably, the state also exports tea to Bangladesh, the Middle East, and Europe, reflecting its growing quality recognition and market reach.

Recent GST rationalization adds a boost to the sector’s competitiveness. Packaged/instant tea products have seen a GST reduction from 18% to 5%. This move not only reduces production and retail costs but also helps expand market access, making Tripura’s tea more affordable and export-friendly. The reform strengthens the value chain- from small growers and estate workers to processors and distributors- and enhances Tripura’s positioning as an emerging player in India’s tea segment.

Sericulture

The sericulture sector in Tripura holds significant promise, and is a vital livelihood source for many rural households. Spread across West Tripura, Khowai, Sepahijala, Gomati, South Tripura, Dhalai, North Tripura, Unakoti, and Totel districts, small farmer households are actively engaged in both mulberry and non-mulberry silk cultivation. About 15,550 farmers in the state are directly involved in sericulture. Their activities encompass every stage of the silk value chain- from cocoon cultivation, rearing and raw silk production to operating small-scale reeling units, reflecting a strong grassroots ecosystem.

The recent GST rate reduction adds further momentum to this traditional industry. The tax cut from 12% to 5%- roughly a 6.25% effective benefit on eligible handloom and handicraft items- makes silk-based products from Tripura more affordable and market-competitive. This easing of the tax burden helps small producers expand market reach, strengthen income stability, and promote sustainable growth of sericulture as a key pillar of Tripura’s rural economy.

Food Processing

Tripura’s food processing industry is largely driven by small and marginal farmers who form the backbone of the state’s fruit-producing belts. Tripura’s flagship crop is the GI-tagged Tripura Queen Pineapple. Alongside pineapple, farmers also cultivate other tropical fruits such as jackfruit, contributing to both livelihood and agri-based enterprise growth.

At the processing level, micro and small units supported under PM-FME (Pradhan Mantri Formalisation of Micro food processing Enterprises Scheme) and various state initiatives play a central role in adding value and creating local employment. According to the NABARD State Focus Paper 2023–24, Tripura hosts around 2,848 food and agro-processing units across the state. Between FY 2018–19 and FY 2024–25, over 73 metric tons of pineapple were exported to Dubai, Oman, Qatar, and Bangladesh, while approximately 15,000 metric tons were supplied to other Indian states, reflecting the sector’s growing market linkages.

Recent GST revisions further strengthen this value chain. The tax rate on fruit and vegetable juices, including Tripura Queen Pineapple juice, jackfruit, and mixed fruit juices, has been reduced from 12% to 5%: a 7 percentage-point cut. This change significantly lowers output taxes for bottled juices and pulp, making local products more affordable and competitive. By easing tax pressures, the reform encourages processing, packaging, and exports, helping Tripura’s fruit sector evolve from farm-based production to a more value-driven, market-oriented ecosystem.

Conclusion

Lower GST rates infuse new energy into Tripura’s traditional and agri-based sectors, making them more competitive and market-ready. The reduction from 12–18% to 5% across handloom textiles, tea, sericulture, and food processing has eased costs, boosted affordability, and widened market access. From Risa and Pachra–Rignai textiles to Tripura Queen Pineapple products and sericulture industry, these reforms empower tribal women, artisans, and small farmers, while driving value addition and exports. By lightening tax burdens and supporting local enterprise, GST is strengthening Tripura’s rural economy and reinforcing its position as a key growth hub in India’s Northeast.

References

tripura.gov.in

https://tripura.gov.in/sites/default/files/Economic_Review.pdf

incredibleindia.gov.in

https://www.incredibleindia.gov.in/en/tripura

tripuratourism.gov.in

https://tripuratourism.gov.in/geographical_profile.php

ttaadc.gov.in

https://ttaadc.gov.in/sites/default/files/Industries-Administrative-set-up.pdf

ttdcltd.tripura.gov.in

https://ttdcltd.tripura.gov.in/

trlm.tripura.gov.in

https://trlm.tripura.gov.in/newinitiative

Click here to see PDF

SK/M

(Release ID: 2181700)

Visitor Counter : 718