PIB Headquarters

Electronics Development Fund

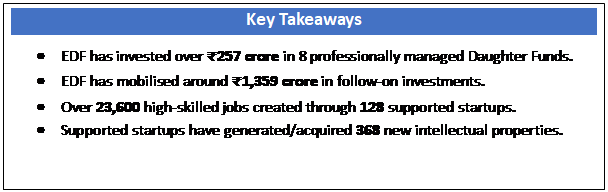

With ₹257.77 crore invested, the Fund has supported 128 startups nationwide

Posted On:

15 NOV 2025 10:25AM by PIB Delhi

Introduction

India’s electronics sector has witnessed a remarkable transformation in recent years, driven by a series of government initiatives and industry reforms. The country is steadily emerging as a global hub for electronics design and manufacturing, a sector marked by rapid technological change and innovation.

To strengthen this momentum and nurture a robust innovation ecosystem, the Government of India launched the Electronics Development Fund (EDF) on 15 February 2016. The Fund aims to promote research, development, and entrepreneurship in the fields of electronics, nano-electronics, and information technology.

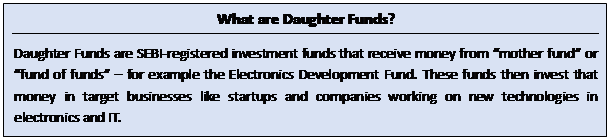

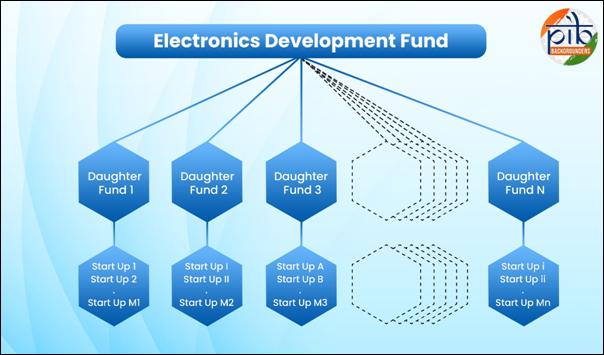

The EDF functions as a Fund of Funds, designed to invest in professionally managed Daughter Funds such as early-stage angel and venture funds. These Daughter Funds, in turn, provided risk capital to startups and companies developing new technologies. By doing so, the EDF played a crucial role in building a self-sustaining electronics ecosystem that encourages innovation, product design, and intellectual property creation within the country.

Goals and Strategic Objectives

EDF has been established to create a strong foundation for innovation and research in India’s electronics and information technology sectors. It aims to strengthen the ecosystem by supporting funds that provide risk capital to startups and companies engaged in developing cutting-edge technologies.

Key objectives include:

- Promote Innovation and R&D: To foster research and development in electronics, nano-electronics, and information technology by supporting market-driven and industry-led innovation.

- Support Daughter Funds: To invest in professionally managed Daughter Funds such as early-stage angel and venture funds that, in turn, provide capital to startups and technology ventures.

- Encourage Product and Technology Development: To nurture entrepreneurship by supporting companies involved in the creation of new products, processes, and technologies within the country.

- Strengthen Domestic Design Capabilities: To enhance India’s capacity for indigenous design and development in the Electronics System Design and Manufacturing (ESDM) sector.

- Build a National IP Resource Pool: To generate a strong base of intellectual property in key technology areas and encourage ownership of innovation within India.

- Facilitate Strategic Acquisitions: To enable acquisition of foreign technologies and companies where such products are imported in large volumes, promoting self-reliance and reducing import dependence.

Salient Operational Features of the Fund

The Electronics Development Fund (EDF) operates through a flexible and professionally managed structure designed to promote efficient investment and innovation in the electronics and IT sectors. Its framework ensures transparency, market responsiveness, and strategic allocation of funds.

Each Daughter Fund supported under the scheme is required to be registered in India and comply with all applicable laws and regulations, including the SEBI (Alternative Investment Funds) Regulations, 2012, as Category I or Category II AIFs. This ensures that all participating funds operate within a well-defined regulatory framework while aligning with EDF’s broader goal of fostering research, entrepreneurship, and technological advancement.

Main Features:

- EDF participates in Daughter Funds on a non-exclusive basis, allowing wider collaboration and participation across the industry.

- The share of EDF in a Daughter Fund’s total corpus is determined by market requirements and the capacity of the Investment Manager to administer the fund in accordance with EDF’s policy guidelines.

- EDF generally maintains a minority participation in each Daughter Fund, encouraging greater private investment and professional fund management.

- Investment Managers of Daughter Funds are given flexibility and autonomy to raise corpus, make investments, and monitor portfolio performance.

- EDF participation is available across the entire value chain of electronics, information technology, and related ecosystems, ensuring comprehensive sectoral coverage.

- The final selection of Daughter Funds is carried out after detailed due diligence by the Investment Manager.

Achievements and Impact

The Electronics Development Fund (EDF) has made remarkable progress in nurturing India’s innovation ecosystem. EDF has drawn a total of ₹216.33 crore from its contributors, including ₹210.33 crore from MeitY.

The supported startups operate in frontier areas such as Internet of Things (IoT), Robotics, Drones, Autonomous Vehicles, HealthTech, Cyber Security, and Artificial Intelligence and Machine Learning, positioning India as a hub for advanced technological innovation.

|

S. No.

|

Name of Daughter Fund

|

Amount Invested by EDF (₹ crore)

|

Daughter Fund Investment (₹ crore)

|

Total No. of Startups Funded

|

|

1

|

Unicorn India Ventures Trust

|

15.82

|

63.64

|

17

|

|

2

|

Aaruha Technology Fund - 1

|

6.75

|

26.22

|

13

|

|

3

|

Endiya Seed Co-creation Fund

|

30.00

|

137.03

|

12

|

|

4

|

Karsemven Fund

|

24.00

|

83.43

|

17

|

|

5

|

pi Ventures Fund 1

|

15.00

|

186.53

|

15

|

|

6

|

YourNest India VC Fund II

|

43.15

|

185.54

|

19

|

|

7

|

Ventureast Proactive Fund - II

|

97.75

|

425.7

|

18

|

|

8

|

Exfinity Technology Fund Series II

|

25.30

|

227.68

|

17

|

|

Total

|

|

257.77

|

1335.77

|

128

|

As on 30 September 2025:

- EDF has invested ₹257.77 crore in eight Daughter Funds.

- These Daughter Funds have made further investments of ₹1,335.77 crore across 128 startups and ventures.

- The supported startups have created over 23,600 jobs in high-technology sectors.

- A total of 368 Intellectual Properties (IPs) have been created or acquired by the supported startups.

- Out of the 128 supported startups, Daughter Funds have exited from 37 investments.

- The cumulative returns received by EDF from exits and partial exits stand at ₹173.88 crore.

Conclusion

The Electronics Development Fund has played a pivotal role in nurturing innovation and entrepreneurship in India’s electronics and IT sectors. By enabling access to risk capital, it has supported startups working on advanced technologies and contributed to expanding domestic design and intellectual property creation. The Fund’s transparent and professionally managed framework has helped build confidence among investors and strengthened the foundation for a vibrant, self-reliant electronics ecosystem in the country.

References:

MEITY:

Click here to download PDF

****

SK/SA

(Release ID: 2190256)

Visitor Counter : 3372