PIB Headquarters

Code on Social Security, 2020: Towards Universal and Inclusive Social Protection

Posted On:

22 NOV 2025 9:56AM by PIB Delhi

Key Takeaways

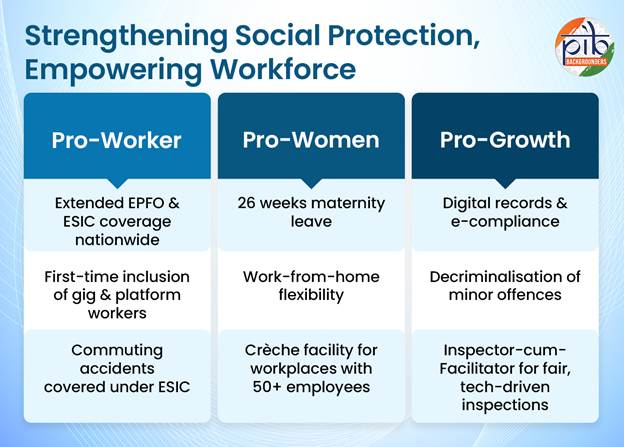

- The code merges nine existing Social Security Acts into one framework, ensuring universal social protection for organized, unorganized, gig, and platform workers.

- Extends EPFO and ESIC coverage nationwide, bringing more establishments and workers under social security benefits.

- Recognizes Gig and Platform workers for the first time and establishes a Social Security Fund for their welfare.

- Strengthens women-centric provisions including 26 weeks of maternity leave, work-from-home option, and crèche facilities.

- Promotes ease of doing business through digital records, decriminalization and compounding of offences, and a transparent, technology-driven Inspector cum facilitator system.

|

Introduction

The Code on Social Security, 2020 represents a significant reform in India’s labour welfare framework, aimed at ensuring comprehensive and inclusive social protection for all sections of the workforce. It consolidates nine existing social security laws into a single, streamlined framework that extends coverage to organized, unorganized, gig, and platform workers alike.

By bringing diverse labour laws under one umbrella, the Code seeks to simplify compliance, enhance efficiency, and expand access to benefits such as life and disability insurance, health and maternity care, provident fund, and gratuity. It also introduces digital systems and transparent facilitation mechanisms to strengthen implementation and support both employers and employees.

Pro-Worker Provisions

1. Gratuity to Fixed-Term Employees

Under Section 53 of the code, the Government has redcued the eligibility requirement for gratuity for Fixed Term Employees (FTEs) from five years to one year. In case where the employee completes one year of continuous service, gratuity shall be applicable on proportionate basis.

2. Inclusion of Gig and Platform Workers

For the first time in the country, social security benefits have been extended to unorganised, gig and platform workers under Sections 113 & 114 of the Code on Social Security, 2020. The code also addressed the gap and includes defintion of aggregator (digital intermediary). This shall benefit such workers directly.

The Code covers following measures to extend welfare benefirs to a large domain of workers:

- Establishment of a National Social Security Board to advise the Government for formulating and monitoring suitable schemens for different sections of workers in the unorganised , gig and platform sectors.

- Provision for State Unorganised workers Social Security Board that will advise the state governments about suitable schemes for unorganised workers, gig and platform workers, covered under Section 6(9).

- Creation of a Social Security Fund based on contributions from the Central & State Governments , collected from Corporate Social Responsibility, fines colleceted due to compounding etc. This fund will be used to provide benefits such as life insurance, disability cover, health and maternity benefits, and provident fund schemes for these workers.

- Section 13 has also been envisaged for entrustment of additional functions to social security organisations , for future requirements.

|

3. Universal Coverage under EPFO

The Employees Provident Fund & Miscellaneous Provisions Act, 1952, valid for the establishments mentioned in Schedule 1 of the Act, has been removed under the code.

Now, the Code on Social Security, 2020 extends the coverage of the Employees’ Provident Fund (EPF) with the provisions applying to all establishments that have 20 or more employees, regardless of the type of industry.

More workplaces and workers will be covered under the Provident Fund system, allowing a larger number of employees to receive social security benefits like retirement savings. Since applicability issue is resolved, it shall reduce litigation.

4. National Registration & Unique Identification

The Government will build a National Database of Unorganized Workers to make it easier to design and deliver social security benefits for specific worker groups. All unorganized, gig, and platform workers will have to register themselves on a National Portal, post which each worker will receive a Unique Identification Number. Verified through Aadhaar, it will be valid across the entire country.

This will ensure that workers, especially migrant workers, can carry their benefits with them even if they move to another place for work.

5. Uniform Definition of “Wages”

A standardized definition of “wages” across all labour laws for social security purposes to be followed. As per the Code, the definition of “Wage” includes basic pay, dearness allowance, and retaining allowance, if any.

If other pay-outs such as bonus, house rent allowance, conveyance allowance, overtime allowance, or commission exceed 50% of the total remuneration (or such percentage as notified by the Government), the excess amount will be added back to wages.

This will increase the wage amount and, in turn, enhance the value of social security benefits such as gratuity, pension, and leave salary, which are linked to wages.

6. Expanded Definition of “Family”

The Code expands the definition of “family” to include the mother-in-law and father-in-law of a woman employee (subject to an income cap). It also includes a minor unmarried brother or sister who is wholly dependent on the insured person, if the parents are not alive.

This expansion increases the coverage of family members eligible for ESIC benefits.

7. Commuting Accidents Covered under Employee’s Compensation

Earlier, accidents that occurred while an employee was travelling between home and the workplace were not treated as work-related, and employees or their families were not eligible for compensation.

The Code on Social Security, 2020 has changed this. Now, any accident that happens while commuting to or from work will be considered as having occurred “in the course of employment.”

Affected employees or their families can receive compensation or ESIC benefits in such cases.

8. Extension of ESIC Coverage

Earlier, ESIC coverage was limited only to certain notified areas. Under the Code, ESIC coverage has now been extended across India by removing this restriction.

Additionally, Voluntary ESIC membership is also allowed for establishments with fewer than 10 employees, if both the employer and employees agree to join.

For hazardous or life-threatening occupations, the minimum limit of 10 workers has been removed. ESIC coverage is now mandatory even for a single worker engaged in such work. ESIC benefits can also be extended to plantation workers if the employer chooses to opt in.

Pro-Women Provisions

1. Maternity Benefit Entitlement

Every woman employee who has worked for at least 80 days in the 12 months before the expected delivery is eligible for maternity benefit equal to her average daily wages during the leave period.

The maximum duration of maternity leave is 26 weeks, of which up to 8 weeks can be taken before delivery.

A woman who adopts a child below 3 months of age or a commissioning mother (a biological mother who uses surrogacy) is entitled to 12 weeks of maternity benefit from the date of adoption or when the child is handed over.

To provide more flexibility to women returning after maternity leave, the Code allows them to work from home, if the nature of work permits.

The employer may permit work from home based on mutual agreement between the employer and the employee.

3. Simplified Certification for proof of Delivery, etc.

Proof of maternity-related conditions such as pregnancy, delivery, miscarriage, or related illness has been simplified under the Code. Medical certificates can now be issued by:

- A registered medical practitioner

- An accredited social health activist (ASHA worker)

- A qualified auxiliary nurse, or

- A midwife

Under Section 64, if the employer does not provide free pre-natal and post-natal care, the woman employee is entitled to a medical bonus of ₹3,500.

After returning to work post-childbirth, a woman employee is entitled to two nursing breaks each day for nursing her child until the child attains 15 months of age.

Every establishment with 50 or more employees must provide a crèche facility within a prescribed distance. This requirement is now gender-neutral and applies to all types of establishments.

- The employer must allow four visits a day by the woman to the crèche which includes the rest intervals.

- Establishments can avail common crèche facility of the Central Government, State Government, municipality or private entity or provided by non-Governmental organisation or by any other organization or group of establishments who may pool their resources for setting up of common crèche in the manner as they may agree for such purpose.

- If a crèche facility is not provided, the employer must pay a crèche allowance not less than ₹500 per month per child (for up to two children).

|

Pro-Growth Provisions

The Code provides for maintaining all records, registers, and returns in electronic form. This will reduce compliance costs for employers and make processes simpler and more efficient.

A five-year limit has been introduced for starting any inquiry under the Employees’ Provident Fund to determine applicability or recover dues. Such inquiries must be completed within two years from the date they begin, with a possible extension of one year if approved by the Central Provident Fund Commissioner (CPFC).

This reform helps improve timely compliance and faster case resolution.

3. Reduced Deposit for Appeals

For filing appeal before tribunal against the order of EPFO officer, the deposit of 25% of the awarded amount determined by the EPFO officer will be required to be deposited by the employer against existing provision of between 40% to 70% of the awarded amount on discretion of the tribunal.

4. Self-Assessment of Cess

New provision of self-assessment of cost of construction and payment of cess thereon for construction of building or other construction works has been introduced. This will enable faster and easier collection of cess, which will be used for the welfare of Building and Other Construction Workers.

As per existing Act, plantation owners are not covered by ESIC Schemes. The Code now gives them the option to join ESIC voluntarily.

6. Decriminalization of Offences

At present, there is no provision for compounding of offences, nor any provision to give notice to an establishment to comply with the laws in case of a violation.

The Code has now mandated that a 30-day notice of improvement be given to the employer in case of any violation, allowing time to rectify non-compliance. This promotes fairness, provides an opportunity for correction, and encourages voluntary adherence rather than punitive enforcement.

Further, the Code has replaced imprisonment with monetary fines for 13 offences, and 7 violations carrying imprisonment of less than one year can now be compounded into penalties or fines.

Replacing criminal penalties with fines reduces the fear of imprisonment, encourages voluntary compliance, reduces litigation, and promotes ease of doing business.

7. Inspector-cum-Facilitator

Under Section 72 of the Code, Inspector cum facilitator in place of inspector and randomized web-based inspection system aims to reduce the traditional “inspector raj,” where inspections were often seen as intrusive and burdensome. Inspectors will now function as facilitators, helping employers comply with laws, rules, and regulations rather than merely policing them.

- Use of technology and clear guidelines make inspections transparent, and encourage compliance through guidance.

- Helps create a harmonious work environment, which benefits both employee and employers and facilitates ease of doing business.

|

8. Compounding of Offences

Compounding of offences through authorized officers is allowed and First-time offences can be settled with fines. The provision, reduces legal burden, speeds up resolution, and promotes ease of doing business.

- First-time offences that are punishable with fines shall be compoundable by paying 50% of the maximum fine.

- Offences punishable with fine or imprisonment or both shall also be compoundable by paying 75% of the maximum fine, making the law less punitive and more compliance-oriented.

- Employers can avoid prolonged litigation by paying a prescribed penalty and ensuring compliance.

|

The provision reduces court burden, provides quick resolution, and encourages businesses to maintain compliance without harsh penalties.

Pro-Employment Provisions

In order to better connect job seekers with employers, Career Centres will be established by the Government that will offer services such as registration, vocational guidance, and job matching. These centres will function as modern employment exchanges through both digital and physical platforms.

Employers are required to report vacancies to these centres, making it easier for job seekers to find employment and thereby promoting overall job growth in the country.

With the Code on Social Security 2020 in place, fixed-term employees are now eligible for gratuity after completing one year of continuous service, a benefit that was earlier available only to permanent employees. Fixed-term employees (employed for a specific duration under a contract) shall be entitled to the same social security benefits (such as gratuity and pension) as permanent employees.

3. Universal Coverage of Workers

The Code broadens social security and employment coverage to categories of workers who were earlier outside the scope of such benefits.

(a) Gig and Platform Workers:

For the first time, these categories have been formally recognised. The Code mandates the framing of social security schemes for them, covering life insurance, disability insurance, health, maternity, and pension benefits. This will help gig and platform workers live with dignity and security.

(b) Unorganised Sector / Self-Employed Workers:

The Code provides for social security schemes for self-employed and unorganised workers, as well as other classes of persons, ensuring their welfare and protection.

Conclusion

The Code on Social Security, 2020 consolidates nine existing labour laws into a single, comprehensive framework. It is a step to ensure universal social protection for all workers by strengthening social welfare coverage for both organized and unorganized workers including gig and platform workers. It also promotes women’s participation in the workforce, and simplifies compliance, thereby enhancing ease of doing business.

The Code reflects the Government’s commitment towards inclusive growth and social security for all, in line with the vision of a Viksit Bharat by 2047.

Click here to see pdf

****

M

(Release ID: 2192795)

Visitor Counter : 13772