PIB Headquarters

Labour Codes Transform BOCW Welfare Architecture

प्रविष्टि तिथि:

04 DEC 2025 2:17PM by PIB Delhi

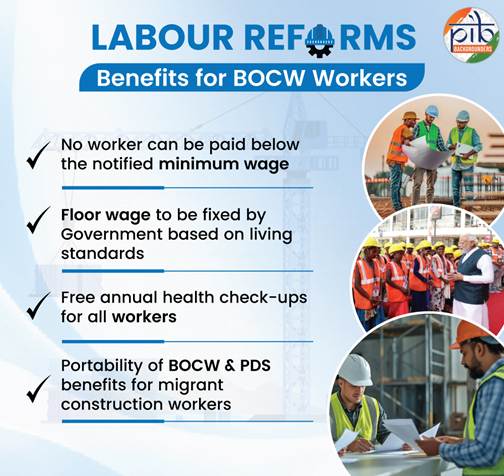

- No employer shall pay any employee less than the minimum wage.

- Fixed Floor wages and provisions for timely wage payment.

- Free annual health check-ups, portability of benefits to migrant workers and Prohibition of Gender Discrimination.

- Formalization through appointment letters

- Universal coverage of all establishments for health & safety of workers and Welfare schemes for unorganized workers

|

Four Codes. One Streamlined System

With the latest Labour Reforms, India has strengthened labour governance across sectors. The Labour Codes viz. The Code on Wages 2019, The Industrial Relations Code 2020, The Code on Social Security 2020, and The Occupational Safety, Health and Working Conditions Code 2020 (OSH), hold particular importance for the workers in the Building and Other Construction Workers (BOCW) sector, given its large workforce and the complex, site-based nature of construction activity. The reforms bring wage protection, workplace safety, social security, and formal documentation under one integrated approach. As a result, the construction workers can expect more consistent working standards, improved access to welfare measures, and better recognition of their role in India’s development journey.

Stronger Welfare for BOCW Workers

The Labour Codes create a consolidated safety net for India’s construction workforce by introducing a strengthened welfare framework for BOCW workers, improving workplace conditions and ensuring more protections.

The reforms enhance income stability, ensure timely wages, reducing worker vulnerabilities and strengthening financial security across the sector.

- Universalization of minimum wages: No employer shall pay any employee less than the minimum wage notified by the Government. Minimum wages, earlier applicable only to “scheduled employments,” now apply to all categories of employees. The Government shall revise or review these rates at intervals not exceeding five years. Minimum wages will be fixed for time-work and piece-work across hourly, daily, or monthly wage periods, based on the worker’s skill level and the nature of work.

- Floor Wage: A fixed floor wage will be determined by the Government, based on living standards of an employee such as food and clothing and will revise it at regular interval. The minimum rates of wages fixed by the appropriate Government (Centre/State) shall not be less than the 'Floor Wage'. If the minimum rates of wages fixed by the appropriate Government earlier were higher than "floor wage", then the same shall not be reduced.

- Overtime Wages: Any work performed beyond normal working hours must be compensated at not less than twice the regular wage rate.

- Time Limit for Payment of Wages: The employer shall pay Wages under the following prescribed timelines:

|

Sl.

|

Type of Employee

|

Time Limit for Payment of Wages

|

|

1.

|

Daily-wage employee

|

End of the shift

|

|

2.

|

Weekly-rated employee

|

Before the weekly holiday

|

|

3.

|

Fortnightly-rated employee

|

Within 2 days of the end of the

fortnight

|

|

4.

|

Monthly-rated employee

|

Within 7 days of the next month

|

|

5.

|

On termination or resignation

|

Within 2 working days

|

- Responsibility for Payment of Dues: The employer is responsible for paying wages to every employee. If employer fails to make payment of dues, then the company or firm or association or any other person who is the proprietor of the establishment shall be responsible for such unpaid wages.

- Timely Payment of Wages: Provisions for timely wage payment and un-authorised deductions from wages now apply to all employees, irrespective of wage level (earlier applicable only to employees earning up to ₹24,000 per month).

- Limitation period: The period of limitation for filing of claims by an employee has been enhanced to three years -as against the existing window of six months to two years.

- Fixing Hours of Work: The number of normal working hours are now limited to prevent employee from being overworked without adequate compensation. No employee shall be required to work for more than 8 hours a day or 48 hours a week.

Employee Safety, Health & Welfare

Stronger safety norms and improved welfare provisions create safer worksites and healthier working conditions, reinforcing long-term well-being and dignity for workers.

- Accidents while commuting included under the employee’s compensation: Accidents occurring while commuting from his residence to the place of employment for duty or returning after performing duty, are now covered under employee’s compensation.

- Free annual health check-ups: All employees will be given free annual health check-ups.

- Universal coverage of all establishments for health & safety of workers: The OSH Code extends health and safety provisions to workers across all sectors.

- Health, safety and welfare facilities: The Government will prescribe uniform provisions for cleanliness, drinking water, toilets, rest rooms in factory mines (employing 50 or more workers) and canteens in the establishments (employing 100 or more workers) including contract labour.

- Welfare schemes: Welfare schemes for unorganized workers, such as life disability cover, health and maternity benefit and old age protection etc.

Employee Rights & Formalisation

The shift towards formalization- through appointment letters, and transparent records empowers workers with clearer rights, and healthy employment conditions.

- Formalization through appointment letters: Every employee will be given appointment letters in the prescribed format specifying the details of the employee, designation, category, details of the wages, details of social security etc.

- Expansion of “Family” definition: In case of a female employee, the definition of “family” also includes her parents-in-laws (mother-in-law and father-in-law) based on the income prescribed by the Government.

Welfare of the Migrant Workers

Enhanced portability of benefits ensures migrant workers retain access to a more inclusive labour ecosystem.

- Inter‑ State migrant worker: The definition of Inter State Migrant Workmen has been widened to include those employed directly or through contractor and also covers workers who migrate on their own. The migrant construction workers will also get the portability of benefits under BOCW Cess fund and PDS ration.

Equality & Non-Discrimination

Stricter non-discrimination norms advance fairness at the workplace, promoting equitable treatment for all workers and strengthening a culture of dignity and equal opportunity.

· Prohibition of Gender Discrimination: Employers shall not discriminate based on the grounds of gender in matters relating to recruitment, wages, or conditions of work for the same or similar nature of work.

A Safer, Secure BOCW Workforce

The labour reforms introduce greater clarity in wages, stronger health and safety safeguards, and improved access to formal employment and welfare systems. This progress has enhanced worker protection nationwide, strengthening social protection & welfare of workers in the BOCW sector. By embedding transparency, legal accountability, and universal coverage into the system, the reforms mark a meaningful step toward safer worksites, empowered workers, and enhanced dignity at work.

Click here for pdf file.

****

M

(रिलीज़ आईडी: 2198662)

आगंतुक पटल : 224