PIB Headquarters

From Savings to Strength: Empowering India’s Girls Through Sukanya Samriddhi Yojana

Posted On:

21 JAN 2026 12:40PM by PIB Delhi

Key Takeaways

· The Sukanya Samriddhi Yojana was launched on 22 January 2015 under the Government’s Beti Bachao, Beti Padhao campaign.

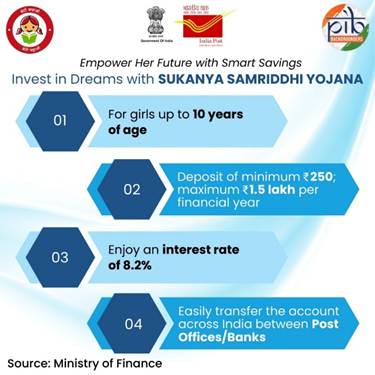

· It is a small savings scheme notified by the Government of India, under which deposits earn interest at rates notified by the Government from time to time and the amounts are payable in accordance with the Scheme rules. Currently, interest rate under SSY is 8.2%.

· Since inception, over 4.53 crore accounts have opened and total deposits amount to more than ₹3.33 lakh crores (as of December 2025).

|

Empowering Daughters: The Vision Behind Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana (SSY) shines as a powerful symbol of hope and empowerment for millions of young girls across India, reflecting the Government’s deep-rooted commitment to nurturing their dreams and securing their futures. Launched on 22 January 2015 under the Beti Bachao, Beti Padhao campaign, the scheme was envisioned as more than just a savings initiative. It was designed as a bridge between financial security and social transformation. By encouraging families to plan early for their daughters’ education and well-being, SSY has helped instill a sense of confidence, inclusion, and long-term progress at the grassroots level.

As the SSY completes 11 years on 22 January 2026, it stands as a testament to the collective faith of millions of families in the promise of their daughters. Since inception, over 4.53 crore accounts have opened. Each account tells a story of belief in a girl child’s potential, reinforcing the idea that empowering one girl strengthens families, communities, and ultimately the nation itself- making SSY a nationwide movement towards equality and opportunity.

Securing the Future of Girls: How Sukanya Samriddhi Yojana Works

DID YOU KNOW?

The current interest rate in the SSY scheme of 8.2%[1] per annum is among the highest for savings instruments dedicated to daughters!

|

The SSY Scheme is a low-risk deposit scheme with the Government guaranteeing the principal amount and the interest payment as per the rates decided each quarter and paid annually.

The scheme carries both economic and social significance, it is not merely a financial investment, but a catalyst for securing a bright and prosperous future for the girl child. It is meant to meet the education and marriage expenses of a girl child. By advancing her education, financial security, and agency, the initiative strengthens women’s empowerment and contributes to the vision of an Atmanirbhar in the future.

What is SSY account and who can open it?

A SSY account is an account that holds the funds deposited towards the SSY scheme. Parents or legal guardians can open an account for their Indian girl child at any India Post office or branch of any Public Sector Bank and authorised Private Sector Banks (HDFC Bank, Axis Bank, ICICI Bank and IDBI Bank).

- The account may be opened anytime from the birth of the girl child until she attains the age of 10 years.

- Only one SSY account is permitted per girl child, and a family can open accounts for a maximum of two girl children. However, more than two accounts are allowed in cases of twins or triplets, subject to submission of an affidavit along with the relevant birth certificates.

- The account is transferable to any location within India.

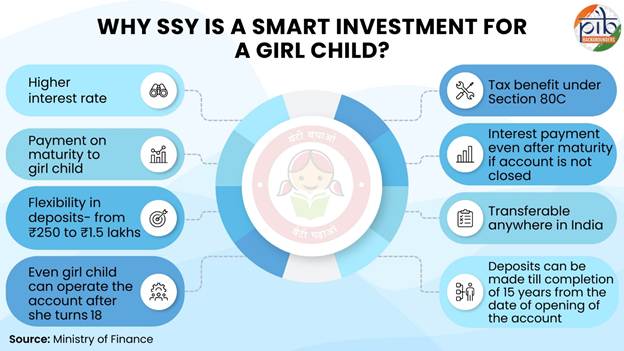

Notably, the account is managed by the parent/ guardian until the girl child reaches the age of eighteen. This allows the guardian to oversee the savings and ensure that the funds are utilized effectively for the child’s education and future needs. Upon turning eighteen, the account holder can take control of the account herself by submitting the necessary documents.

Which documents are required for opening an account?

To open a SSY account, four key documents are required-

- Sukanya Samriddhi Account Opening Form, available at banks/ post-office

- Birth certificate of girl child

- Aadhaar Number issued by the Unique Identification Authority of India

- Permanent Account Number or Form 60 as defined in the Income Tax Rules

How much deposit is required for SSY account?

DID YOU KNOW?

Total deposits in SSY accounts have crossed ₹ 3,33,000 crore! (December 2025)

|

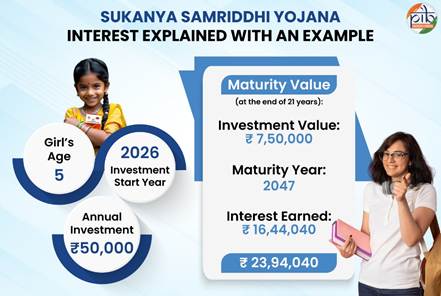

Parents and guardians can start with a minimum initial deposit of ₹250 in the SSY account, and subsequent deposits can be made in multiples of ₹50, provided that at least ₹250 is deposited in a financial year. The total annual deposit limit is capped at ₹1,50,000- any excess amount will not earn interest and will be returned.

Deposits can be made for a period of up to fifteen years from the account opening date.

How is interest calculation done?

Calculated every month, the interest is added to the account at the end of each financial year. Even if the account is transferred to another bank or post office during the year, the interest is still credited at the end of the financial year, ensuring steady and secure growth of the savings for the girl child.

How does one withdraw money from the SSY account?

An account holder may withdraw up to 50% of the balance available at the end of the preceding financial year for educational purposes. This facility becomes available once the account holder attains the age of eighteen or passes the tenth standard, whichever occurs earlier. To apply, the account holder must submit a formal application supported by relevant documents, such as a confirmed admission offer or a fee slip issued by the educational institution specifying the required expenses.

The withdrawal may be taken either as a lump sum or in installments, subject to a maximum of one withdrawal per year for a period of up to five years. In all cases, the withdrawn amount must not exceed the actual fees and charges indicated in the submitted documents.

When does the SSY account mature? Can one close it early?

The SSY account matures upon the completion of twenty-one years of its opening date. Early closure of the account is allowed only under specific conditions:

|

When the account holder intends to marry before the account reaches maturity

|

- The account holder must submit an application along with a declaration on non-judicial stamp paper, duly attested by a notary, and proof of age confirming that they will be at least eighteen years old on the date of marriage.

- The account may be closed only within one month prior to the marriage or within three months after the marriage. Upon approval, the account holder may apply to withdraw the balance along with the applicable interest, ensuring timely access to funds.

|

|

In the event of the account holder’s death

|

- The account may be closed immediately upon submission of an application and the death certificate issued by the competent authority.

- The balance, together with interest accrued up to the date of death, will be paid to the guardian.

- Interest for the period between the date of death and the account’s closure will be calculated at the rate applicable to Post Office Savings Accounts.

|

However, premature closure is not permitted within the first five years from the date of account opening.

Why Sukanya Samriddhi Yojana Is a Smart Choice for the Girl Child

A renowned government-backed savings scheme, the SSY is aimed at building long-term financial security for the girl child by offering high returns, tax benefits, and flexible withdrawal options for education and future needs. It offers several benefits designed to secure the financial future of a girl child-

The scheme provides an attractive interest rate, which is periodically notified by the Ministry of Finance, helping savings grow steadily over time.

Investments made under the scheme qualify for tax benefits under Section 80C of the Income Tax Act, 1961.

Deposit range is large, with a minimum annual contribution of ₹250 and a maximum of ₹1.5 lakh. Besides, partial withdrawal facility can be availed.

Even if the account is not closed at maturity, it continues to earn interest at the rate applicable to Post Office Savings account.

A Scheme That Grows with Her

The Sukanya Samriddhi Yojana stands as a meaningful step toward building a secure and empowered future for girls in India. By encouraging long-term savings and placing education and financial independence at the forefront, the scheme promotes both economic responsibility within families and broader social progress.

The consistent rise in account adoption highlights the growing trust in and impact of this initiative. As India advances toward greater gender equality and inclusion, SSY plays a vital role in ensuring that every girl is supported with the resources and confidence she needs to grow, succeed, and realize her full potential.

References

Ministry of Finance

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2094807®=3&lang=2#:~:text=Maturity%20of%20the%20account,access%20to%20funds%20when%20needed.

https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=1778546®=3&lang=2

https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=1990745®=3&lang=2

https://static.pib.gov.in/WriteReadData/specificdocs/documents/2022/jan/doc20221207101.pdf

Prime Minister's Office

https://www.pib.gov.in/PressReleseDetail.aspx?PRID=2191605®=3&lang=1

Directorate of Small Savings, Govt. of Assam

https://smallsavings.assam.gov.in/portlets/take-care-with-sukanya-samriddhi-account

https://finance.assam.gov.in/portlets/sukanya-samriddhi-for-your-girl-child

Government of Uttar Pradesh, Moradabad Division

https://moradabaddivision.nic.in/scheme/sukanya-samriddhi-yojana/

Sansad.in

https://sansad.in/getFile/loksabhaquestions/annex/178/AU767.pdf?source=pqals

https://sansad.in/getFile/loksabhaquestions/annex/184/AU3747_MIzukL.pdf?source=pqals

mygov.in

https://transformingindia.mygov.in/scheme/sukanya-samriddhi-yojana/#intro

State Bank of India

https://www.sbisecurities.in/calculators/sukanya-samriddhi-yojana

https://sbi.bank.in/web/personal-banking/investments-deposits/govt-schemes/sukanya-samriddhi-yojana

Others

https://www.ibef.org/news/over-us-36-72-billion-deposited-in-banks-under-sukanya-samriddhi-scheme-prime-minister-mr-narendra-modi

Click here for pdf file.

***

PIB Research

(Release ID: 2216748)

Visitor Counter : 989