Ministry of Finance

FROM STABILITY TO NEW FRONTIERS, INDIA’S SERVICES EXPORTS GROWTH MORE THAN DOUBLED FROM 7.6% IN THE PRE-PANDEMIC PERIOD (FY16-FY20) TO 14% DURING FY23-FY25

THE FY26 WITNESSED ACROSS-THE-BOARD EXPANSION IN SERVICES. BUOYANT GROWTH IN THE SERVICES SECTOR AT 9.1% HAS BEEN THE MAJOR DRIVER FOR GVA

MEDIA, ENTERTAINMENT AND SPACE TECHNOLOGIES EMERGE AS NEW GROWTH FRONTIERS OF SERVICES SECTOR

ORANGE ECONOMY, OCEAN COMMERCIALISATION, DATA CENTERS, CONCERT ECONOMY, DEVELOPMENT TO ENSURE SERVICES REMAIN POWERFUL ENGINE OF GROWTH IN YEARS AHEAD

Posted On:

29 JAN 2026 2:07PM by PIB Delhi

India’s Services sector has become the principal engine of economic growth, resilience, and structural transformation. Against a backdrop of global uncertainty and subdued global industrial activity, the sector has emerged as a stabilising force, contributing more than half of India’s Gross Value Added (GVA) and serving as a major driver of exports and employment.

India is the world’s seventh-largest exporter of services, with its share in global services trade more than doubling from 2% in 2005 to 4.3% in 2024. “The Services sector, acting as a high-growth, low-volatility anchor, marked 7-8% growth year after year, in sharp contrast to the more pronounced cyclical fluctuations observed in agriculture and industry,” states the Economic Survey 2025-26 tabled in the Parliament today by Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman.

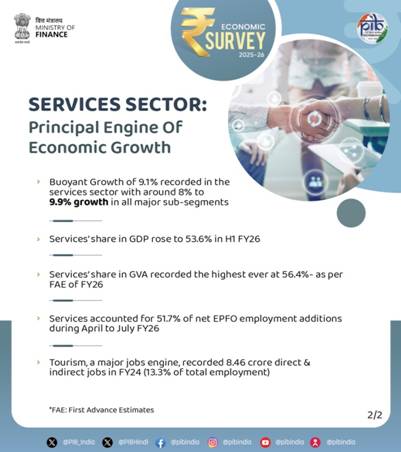

The FY26 witnessed across-the-board expansion in services. Buoyant Growth in the Services Sector at 9.1% has been the major driver for GVA growth in the First Advance Estimates (FAE) for FY 26, with around 8% to 9.9% growth in all major sub-segments.

GLOBAL TRENDS & INDIA’S EXPERIENCE:

The COVID-19 pandemic severely disrupted contact-intensive services, such as tourism, hospitality, and transport, while accelerating the expansion of digitally delivered services, including IT, finance, and professional services. In 2024, the share of services trade in GDP rose relative to pre-pandemic levels, signaling a gradual, though uneven, rebalancing of global trade towards services.

This growing role of services in global trade has been mirrored by a corresponding shift in capital allocation. Services accounted for an average 53.5% of global FDI during 2022-2024, up from 50.9% in the pre-pandemic period, with inflows becoming increasingly concentrated. Energy and gas supply, information and communication, construction, and transportation together absorbed over 88% of services FDI, compared to 75.5% in pre-pandemic era.

India’s experience broadly mirrors global trends. Services-sector FDI was 80.2% of total FDI during FY23-FY25, up from 77.7% in the pre-pandemic period (FY16-FY20). These inflows went to information and communication services (25.8%) and professional services (23.8%), reflecting our strength in digital and knowledge-intensive activities; along with Finance and insurance (14.2%), energy and gas (12.8%), and trading (12.2%), these segments accounted for nearly 89% of services FDI, highlighting the dominance of digital, skill-intensive, and infrastructure-linked services in India’s investment profile.

The Economic Survey data reveals that ‘financial, real estate, and professional services’ sector remains the key driver of service growth supported by sustained demand for credit, business services, and real estate-linked activities. ‘Public administration, defence and other services’ have also continued to expand at a pace above pre-pandemic trends, underpinned by steady public spending and service delivery. In contrast, ‘trade, hospitality, transport, communication and related services’ have seen a more gradual normalisation, with growth broadly close to pre-pandemic averages.

Average growth in Services exports more than doubled from 7.6% in the pre-pandemic period (FY16-FY20) to 14% in FY23-FY25, reflecting strong and broad-based global demand for Indian services. Despite competitive conditions in global services markets and heightened policy uncertainty, services export growth moderated to 8% during FY26 (April-November).

Software services, accounting for over 40% of total services exports, remain the primary growth driver, expanding at an average rate of 13.5% per cent during FY23-FY25 compared to 4.7% in FY16-FY20, supported by strong global demand for digital services. Professional and management consulting emerged as the second-largest contributor, growing at 25.9%, resulting in an increase in their share from 10.5% in FY16- FY20 to 18.3% in FY23-FY25.

India’s Services exports share in GDP averaged 9.7% during FY23-FY25, up from 7.4% in the pre-pandemic period. Amid subdued global goods trade due to policy uncertainty and geopolitical disruptions, services exports have provided a critical buffer. This role has strengthened further in H1 FY26, with the share of services exports in GDP rising to 10%, from 9.7% in H1 FY25.

NITI Aayog’s findings on state-level and sector-level dynamics says that states like Karnataka, Maharashtra, Tamil Nadu and Telangana together account for nearly 40% of services output, driven by modern, high-productivity services such as IT, finance and professional services, resulting in a concentration of output in highly urbanised states, particularly in southern India. At the same time, important contrasts persist. Bihar, despite low per capita income, derives 58.7% of its GVA from services, largely from low-value-added activities. Kerala, with 64.3% of GSVA from services, remains reliant on traditional segments such as trade, tourism and real estate. In some cases, the services share declined, challenging the notion of one-way transition towards services: Odisha’s services share declined from 38.5% to 34.9%, while Assam’s fell from 46.5% to 34.3% over the period.

SERVICES: KEY EMPLOYMENT DRIVER

The Economic Survey noted that as per PLFS data for the first two quarters of FY26, the share of services in urban employment rose to 61.9%, marginally higher than the FY21- FY22 average of 61.7%, during a period marked by relatively strong services-sector hiring during the pandemic. Consistent with this, EPFO data for April-July FY26 indicate sustained formal job creation, with services accounting for 51.7% of net employment additions, led by expert services, trading and commercial establishments, and cleaning services.

Over 2011-2024, employment elasticity in services stood at 0.43, rising to 0.63 in the post-COVID recovery phase, second only to construction, underscoring the sector’s role as a labour shock absorber.

SUB-SECTORAL PERFORMANCE AND DRIVERS:

Services are getting increasingly integrated into manufacturing through activities such as design, R&D, logistics, software development, and professional services, reflecting the growing “Servicification” of production systems. This is evident in products such as smart devices, automobile, medical equipments/ wearables etc. International experience suggests that this integration is a crucial channel for enhancing value addition, export competitiveness, and employment.

The Economic Survey has revealed that in FY24, travel and tourism contributed 5.22% to GDP, close to pre-pandemic levels, supporting an estimated 8.46 crore direct and indirect jobs (about 13.3% of total employment). Consistent with this growth, foreign exchange earnings from

tourism rose to USD 35.0 billion in 2024, up 8.8% from 2023. Domestic tourism remained the backbone of the sector, with visits increasing by about 17.5% in 2024 over the previous year and by nearly 52.7% during Jan-Sept 2025 compared with the corresponding period last year.

International Tourist Arrivals (ITAs), including foreign tourist arrivals (FTAs) and arrivals of non-resident Indians (NRIs), rose to 20.57 million, an increase of 8.9% over 2023. Growing faster than leisure tourism, Medical and wellness tourism is emerging as a high-potential niche, offering high-value and non-seasonal tourism.

In FY25, the IT and IT-enabled services (IT-ITeS) sector reinforced India’s position as a global technology and innovation hub, supported by continued revenue growth, a rising role of Global Capability Centres (GCCs), and deeper engagement in higher-value, complex technology activities. Nasscom estimates IT&ITeS industry revenues at USD 283 billion in FY25, (including hardware) a year-on-year growth of 5.1% as against 3.9% in FY24. With 1,700+ Global Capability Centres (GCCs) employing about 19 lakh professionals, GCCs are expanding into product, engineering, analytics, cyber-security and AI-enabled functions.

India’s data centre capacity is projected to reach about 8 GW by 2030 from about 1.4GW as of Q2 of 2025. Despite generating nearly 20% of the world’s data, India hosts only about 3% of global data centres, around 150 out of 11,000 worldwide, according to Nasscom, addressing structural constraints such as energy shortages will be critical for India to position itself as a global AI data centre hub.

India’s technology Start-Up ecosystem, the world’s third largest, now comprises about 32,000-35,000 Start-Ups, with over 2,000 added in CY25, including over 900 funded start-ups in CY25. Within this, the Generative AI segment has expanded rapidly, with active GenAI startups rising more than threefold from about 240 in first half of CY24 to over 890 in first half of CY25.

Accounting for around 2% of the global space market valued at about USD 8.4 billion, India commercially launched 393 foreign satellites for 34 countries between 2015 and 2024, earning around USD 433 million, reflecting its cost-effective and reliable capabilities. India’s space sector has emerged as a fast-growing, technology-intensive and increasingly commercial segment of the services economy.

The media and entertainment (M&E) sector has become a significant component of India’s services economy, spanning audio-visual production, broadcasting, digital content, animation and gaming, advertising, and live entertainment. Industry estimates place the sector’s size at around ₹2.5 trillion in 2024, driven by rising incomes, rapid internet penetration and a large domestic market. Digital media emerged as the primary growth engine, contributing approximately one-third of the sector's total revenues. The live-events eco-system part of the Orange Economy and its related tourism spill over is the emerging major trend in the sector. VII.13: Snapshot of GenAI startups landscape

WAY FORWARD:

The Survey lauds notable progress in all the sub sectors of the Services sector, and cautions on important factors on which their growth with depend. Like, for IT and IT-enabled services, the sector’s future hinges on timely re-skilling, the wider diffusion of digital technologies, and the creation of a supportive policy environment for innovation and scaling.

Tourism requires the creation of niche segments, such as long-distance hiking trails, and a national marina development policy to unlock the blue economy. Space and ocean services are poised for rapid expansion through commercialisation and public-private partnerships.

*****

NB/Onkar Nath Pandey/Pankaj Srivastav

(Release ID: 2219981)

Visitor Counter : 334