Ministry of Finance

A CALIBERATED FISCAL STRATEGY HAS ANCHORED ECONOMIC STABILITY AMID GLOBAL ECONOMIC TURBULENCE: ECONOMIC SURVEY 2025-26

SUSTAINED INCREASE IN CAPEX AND RESILIENT REVENUE MOBILISATION KEY TO FISCAL CONSOLIDATION

SASCI SCHEME HELPS STATES TO MAINTAIN MAINTAIN CAPITAL EXPENDITURE AT 2.4%; ₹4.5 LAKH CRORES ALLOCATED TO STATES IN LAST 5 YEARS

FISCAL DEFICIT BUDGETED AT 4.4% OF GDP IN FY26, DOWN FROM 4.8% IN FY25

REVENUE DEFICIT AT ITS LOWEST SINCE FY09, BUDGETED AT 0.8 % IN FY26

BETTER COLLECTION EFFICIENCY AND CURBING LEAKAGES THROUGH TECHNOLOGY-DRIVEN MEASURES HELPS INCREASE REVENUE RECEIPTS TO 11.6% IN FY25

REVENUE EXPENDITURE MODERATES FROM 13.6 % OF GDP IN FY22 TO 10.9% IN FY25

EFFECTIVE CAPITAL EXPENDITURE INCREASES FROM 2.7 % IN PRE-COVID PERIOD TO 4.3% IN FY26

DEBT TO GDP RATIO DOWN TO 55.7% IN FY25, ON TARGET TO ACHIEVE AROUND 50% BY FY31

INCOME TAX FIILING RISES TO 9.2 CRORE IN FY25 FROM 6.9 CRORE IN FY22

SHARE OF DIRECT TAX IN TOTAL TAX INCREASES TO 58.2% IN FY25 FROM 51.9 % DURING PRE-COVID PERIOD

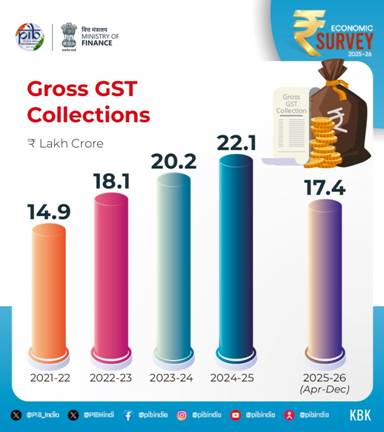

GROSS GST REVENUE AT ₹17.4 LAKH CRORE IN FY26 (APR-DEC) AGAINST ₹16.3 LAKH CRORE IN FY25 (APR-DEC)

प्रविष्टि तिथि:

29 JAN 2026 2:17PM by PIB Delhi

Economic Survey 2025-26 tabled in parliament today by the Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, highlights that India’s Economy stands out in the present era of global economic turbulence due to its macroeconomic stability. It has been possible due to our calibrated fiscal strategy, reduction in fiscal and revenue deficits. Resilient revenue mobilization and reorientation of revenue towards capital expenditure further added to our economic strength. Centre’s prudent fiscal management has strengthened credibility and reinforced confidence in India’s macroeconomic and fiscal framework. States are a major partner in this journey of economic consolidation.

A predictable and credible fiscal trajectory by the Centre over the past years has anchored overall macroeconomic stability by balancing growth imperatives with fiscal sustainability. Centre’s fiscal consolidation experience underscores the value of clearly defined fiscal targets alongside retained flexibility, thereby allowing fiscal policy to support rather than constrain growth during periods of uncertainty. States are a major partner in this journey of economic consolidation. The scheme of Special Assistance to States for Capital Expenditure (SASCI) is helping create long term assets on interest free loans. The scheme strikes balance between reform linked investments and investments based on state’s priority, enabling a sustained CAPEX environment in the country.

Fiscal prudence sustaining economic stability

The fiscal deficit is budgeted at 4.4% of GDP in FY26 down from 4.8% in the previous financial year. Over the same period, the revenue deficit as a proportion of GDP narrowed steadily, reaching its lowest level of 0.8% in FY26, since FY09, thereby leaving a greater allocation for capital expenditure and reflecting a sustained improvement in the quality of expenditure. The Revenue expenditure moderated from 13.6% of GDP in FY22 to 10.9% in FY25, thereby creating space for more productive capital expenditure. Expenditure on major subsidies was rationalized from 1.9 % in FY22 to 1.1% in FY26, even as food security was ensured by the Centre to about 78.9 crore beneficiaries as of October 2025. The direct tax base expanded steadily, with income tax return filing increasing from 6.9 crore in FY22 to 9.2 crore in FY25. Higher return filings reflect improved compliance, greater use of technology in tax administration, and a growing number of individuals entering the tax net as their incomes rise.

Sustained revenue mobilization

Centre’s revenue receipts strengthened from an average of about 8.5% of GDP in FY16–FY20 to around 9.1% in FY22–FY25 (PA). This improvement was driven by buoyant non-corporate tax collections, which rose from about 2.4% of GDP pre-pandemic to around 3.3 % post-pandemic. By enhancing collection efficiency and curbing revenue leakages through technology-driven measures, the Centre’s revenue receipts rose to 9.2% of GDP in FY25 (PA). Non-intrusive Usage of Data to Guide and Enable (NUDGE), a data driven behavioral change measure of Income Tax Department, focused on influencing taxpayer behavior through data-driven insights and information rather than litigation or coercive enforcement. This has emerged as a powerful tool for improving tax compliance.

GST 2.0: Making Trade Competitive

The underlying strength of GST revenue is reflected in steady expansion of the tax base with taxpayer numbers increasing from 60 Lakh in 2017 to over 1.5 Crore at present. Gross GST collections during April–December 2025 stood at ₹17.4 lakh crore, registering a year-on-year growth of 6.7 %. GST revenue growth is broadly aligned with prevailing nominal GDP growth conditions. In parallel, high-frequency indicators suggest robust transaction volumes, with cumulative e-way bill volumes during April-December 2025 growing by 21% YoY. The transition to a simplified two-rate structure under GST 2.0 is expected to reduce compliance costs, streamline transactions, and incentivize formalization among small businesses, while enhancing trade competitiveness and supporting domestic manufacturing. It could also lower the cost of living and bolster household consumption.

Non-tax revenues buoyed by rising dividends and profits

The non-tax revenues of the centre, as a percentage of GDP, have broadly remained stable around 1.4% of GDP in post-pandemic period in line with pre-pandemic average, thereby providing steady support to the centre’s revenue receipts. The improved performance of Central Public Sector Enterprises (CPSEs) has also contributed to the Centre’s non-tax revenue. Between FY20 and FY25, net profits and dividends per CPSE increased by 174 % and 69 %, respectively, underscoring improved operational efficiency and prudent capital management, which in turn strengthened the government’s non-tax revenue stream.

Sustained Capital Expenditure Momentum

Giving an impetus to Prime Minister Shri Narendra Modi’s vision of Viksit Bharat, the effective capital expenditure of the Central government increased from an average of 2.7 % of GDP in the pre-pandemic period to about 3.9 % post-pandemic, and to a higher 4% of GDP in FY25. Key infrastructure sectors like Road Transport and Highways, Railways, Airways and Waterways continue to account for over half of the total capital expenditure emphasizing asset creation. Allocation in FY25 towards transfer to states (34.9%), Telecom (24.4%), and Housing and Urban Affairs (19.6%) recorded robust double digit growth YoY.

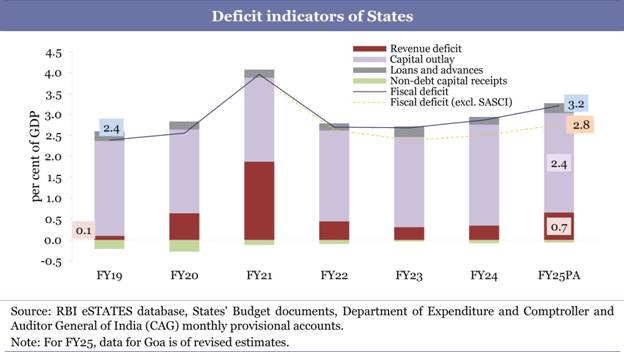

Expanding centre-states transfers through Tax Devolution and Finance commission grants

In the post-COVID era, Centre launched a scheme to incentivize Capital Expenditure of States by giving them long term interest free loans, recognizing its higher multiplier effect and role in crowding in private investments. Through Special Assistance to States for Capital Expenditure (SASCI), the Centre has incentivized States to maintain capital spending at around 2.4% of GDP in FY25 and has allocated total uptake of 4,49,845 crore in last five years. The combined fiscal deficit of State Governments stayed broadly stable at around 2.8 % of GDP in the post-pandemic period, similar to pre-pandemic levels, but has edged up in recent years to 3.2 % in FY25, reflecting emerging pressures on State finances.

The Economic Survey cautions that while the Centre’s incentives are supporting higher State capital outlays in recent years, sustaining growth will depend on complementary discipline within revenue expenditure. The survey points to careful reprioritisation of State’s expenditure and ensure that short-term income support does not erode the investments on which inclusive, medium-term prosperity will rely on.

Debt Profile of the Government

Centre’s public debt management strategy has reinforced the credibility of fiscal policy, even as the global public debt levels have continued to rise. The Government’s medium-term goal to achieve a debt-to-GDP ratio of 50±1% by FY31 reflects a deliberate effort to strengthen overall debt sustainability while preserving policy flexibility in an uncertain global environment. Presently, the debt-to-GDP ratio stands at 55.7 % for FY25, a reduction of 7.1 percentage points since 2020, even while maintaining high public investment.

India’s fiscal model stands out particularly when assessed through the lens of public investment efficiency. In FY24, general government investment was 4 % of GDP, amounting to about one-fifth of total government revenue, much higher than in most peer economies. Any fiscal indiscipline at the State level also casts a shadow on the sovereign borrowing costs. Thus, as the Centre continues fiscal consolidation over the medium term, the general government is also expected to remain on a consolidation trajectory.

The Way Forward

The survey proposes reform to reduce cross-subsidies, stabilize the pipeline for equity monetization by revising the definition of government companies, advance the trust and nudge theory in e-way billing, reap efficiencies in spending, and for effective management of short-term surpluses to achieve further fiscal consolidation.

Looking ahead, ongoing reforms in taxation, including GST 2.0 and personal income tax, are expected to enhance the efficiency of the tax system by simplifying structures, reducing compliance costs, and broadening the tax base, with implications for both economic activity and revenue mobilization.

****

DT/VV/PP

(रिलीज़ आईडी: 2220005)

आगंतुक पटल : 341