PIB Headquarters

Union Budget FY 2026-27: Strengthening Capital Goods Sector

Posted On:

03 FEB 2026 2:45PM by PIB Delhi

Key Takeaways

- Government capital outlay rose 4.2× from ₹2.63 lakh crore in FY18 to ₹11.21 lakh crore in FY26 (BE)

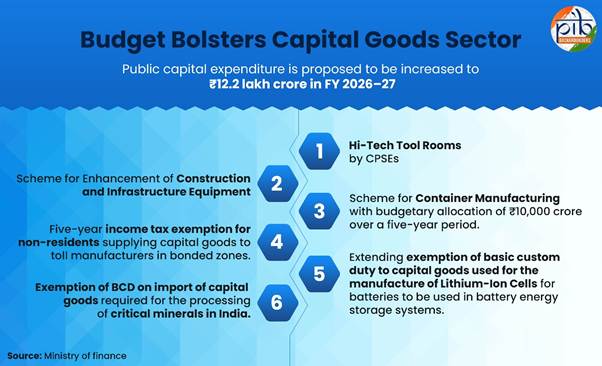

- Union Budget FY 2026-27 announces public capital expenditure at ₹12.2 lakh crore

- Capital goods under IIP grew 8.1% YoY in December 2025

- ₹10,000 crore Container Manufacturing Scheme and new CIE & Hi-Tech Tool Room initiatives announced

- Five-year tax exemptions for toll and electronics manufacturing, along with customs duty exemptions for capital goods in various sectors

|

|

Introduction

India’s capital goods sector is a strategic cornerstone in India’s industrial policy, supported by government infrastructure investments and a strong manufacturing push. The sector is a critical driver of infrastructure expansion, industrial capacity creation, and technological advancement across the economy.

With a view to building high-precision manufacturing capacity, promoting technologically advanced equipment, and creating globally competitive industrial ecosystems, the capital goods sector has remained a key focus of government policy. Given its critical importance to the country’s economic development, the sector’s expansion has been consistently supported through targeted incentives and strengthened regulatory frameworks. The Union Budget 2026-27 further reinforces this direction, emphasising the need to support a rapidly expanding economy characterised by rising trade volumes and increasing capital requirements.

Guided by the framework of three kartavyas, the Union Budget identifies its first priority as accelerating and sustaining economic growth by proposing interventions in various key areas. Capital goods development remains a key component of the strategy, with continued emphasis on sector-specific schemes and sustained capital expenditure aimed at strengthening domestic manufacturing capabilities and infrastructure creation.

The proposed measures seek to boost investment, enhance domestic capacity, and support long-term economic growth in the Capital Goods sector.

|

Capital Goods

“Capital Goods” means any plant, machinery, equipment or accessories required for manufacture or production, either directly or indirectly, of goods or for rendering services, including those required for replacement, modernisation, technological up-gradation or expansion.

Capital goods may be used in manufacturing, mining, agriculture, aquaculture, animal husbandry, floriculture, horticulture, pisciculture, poultry, sericulture and viticulture as well as for use in services sector.

|

Capital Goods Sector Strengthening India’s Growth Engine

The capital goods sector plays a vital role in India’s economic strategy by supporting large-scale manufacturing and infrastructure projects. Driven by rapid urbanization, ongoing infrastructure investments, and strong policy support, the sector is set to foster long-term industrial growth and strengthen India’s standing in the global economy.

Capital goods are widely regarded as foundational to strengthening domestic manufacturing capacity. The sector also exerts a strong multiplier effect on the economy, significantly influencing growth and employment across user industries by supplying critical inputs such as machinery and equipment to the entire manufacturing ecosystem, as well as to other related sectors.

Role of Capital Goods in Industrial Growth

India’s industrial growth momentum in FY26 has become more broad-based, with manufacturing emerging as a major driver and gaining further pace during the year. The Economic Survey 2025-26 notes that manufacturing GVA growth accelerated in FY26, reaching 7.72% in Q1 and 9.13% in Q2, supported largely by ongoing structural transformations within the sector.

Further, the Index of Industrial Production (IIP) registered a growth of 7.8% in December 2025, supported by broad-based expansion in manufacturing (8.1%) and continued growth in mining (6.8%). A key contributor to this performance was the capital goods segment under the use-based classification, which recorded an 8.1% year-on-year increase during the same period.

The export performance of the capital goods sector since FY22 has been closely linked to the expansion of domestic production capacity and the strengthening of investment activity within the economy. Exports recorded steady growth, increasing to ₹33,356 crore in FY25 from ₹31,621 crore in FY24. Similarly, production also witnessed a notable rise, reaching ₹2,05,194 crore in FY25 compared with ₹1,85,858 crore in the previous financial year. On the import front, merchandise imports rose by 6.3% year-on-year in FY25 to reach USD 721.2 billion, driven largely by stronger demand for critical intermediate goods and capital equipment, reflecting resilient domestic demand. Further, capital goods imports expanded by 6.6% in Q1 FY26 and further accelerated to 9.2% in Q2 FY26. The overall dual trends highlights sustained domestic investment activity as well as reliance on technologically advanced machinery sourced from abroad.

Also, High-frequency indicators suggest healthy investment activity in capital goods. The overall growth in the sector indicates rising industrial activity, reflecting improved performance and expanding economic momentum.

|

High-frequency indicators signalling firming investment momentum (YoY growth, %)

|

|

Indicators

|

Q1 FY26

|

Q2 FY26

|

Q3 FY26

|

Monthly Avg YoY Growth (FY16-FY20)

|

|

Capital Goods Imports

|

6.6

|

9.2

|

13.4

|

7.1

|

|

Capacity Utilisation (in %)

|

74.1

|

74.8

|

NA

|

72.9

|

|

Source: Economic Survey 2025-26

|

|

What are Capital Goods Imports?

Capital goods imports are defined as the aggregate of imports of electric machinery and equipment; base metals excluding iron and steel; industrial machinery, including machinery for dairy and allied uses; machine tools; other construction machinery; project goods; and transport equipment.

|

Government Capex has continued to rise steadily since FY22

The Government’s capital expenditure between FY19 and FY22 spending grew by about 92%, increasing from ₹3.07 lakh crore to ₹5.92 lakh crore. This upward trajectory has continued in subsequent fiscal years, supporting the broader objective of expanding high-quality infrastructure nationwide.

Additionally, the government’s capital outlay has further increased by nearly 4.2 times, from ₹2.63 lakh crore in FY18 to a budgeted ₹11.21 lakh crore in FY26(BE), whereas effective public capital expenditure for FY26 (BE) stands at ₹15.48 lakh crore.

Sectoral Impact of Capital Goods Expansion

India’s expanding capital goods sector is supporting strong growth across several industrial segments. It is experiencing significant attention because of its pivotal role in advancing industrial activity and overall economic development. The sector also encompasses other industries such as, machinery, and construction, which are essential for the country's infrastructure development. For instance, the electrical equipment segment has consistently recorded double-digit output growth in power equipment, driven by strong demand in both domestic and export markets.

Together, these trends highlights that India’s capital goods sector is emerging as a central pillar of its investment-led growth strategy, reinforcing industrial capacity, accelerating infrastructure creation, and sustaining the country’s long-term economic momentum.

Budget Focus on Capital Goods: A Push for the Economy

The Union Budget 2026–27 underscores the capital goods sector as a key driver of India’s growth and industrial transformation. It prioritises expansion of manufacturing capacities in seven strategic and frontier sectors, supported by focused interventions for capital goods. The Budget strengthens the sector’s role across manufacturing, and the energy transition to enhance productivity and quality standards. These measures aim to reinforce domestic capacity while supporting India’s deeper integration with global markets.

Public Capital Expenditure: Infrastructure-led Growth

Reinforcing the role of public investment as a key driver of economic growth, the Budget delivers a strong push to infrastructure development. Public capital expenditure is proposed to be increased by ~9% from FY 2025-26 (Budget Estimates) to ₹12.2 lakh crore in FY 2026–27. Public capex has increased manifold from ₹2 lakh crore in FY 2014-15. This underscores the continued emphasis on infrastructure-led growth, crowding-in of private investment and enhancement of productive capacity across the economy.

Strengthening Manufacturing through Capital Goods Development

Recognising the strong capital goods capability underpins productivity and quality across industries, several targeted interventions have been proposed to build domestic capacity.

- To enhance high-precision manufacturing, Hi-Tech Tool Rooms are proposed to be established by CPSEs (Central Public Service Enterprise) at two locations. These facilities will function as digitally enabled, automated service bureaus, providing localised design, testing and manufacturing of high-precision components at lower cost.

- Further, a Scheme for Enhancement of Construction and Infrastructure Equipment (CIE) is proposed to strengthen domestic manufacturing of high-value and technologically advanced construction and infrastructure equipment. This includes a wide range of equipment, from lifts used in multi-storey buildings and fire-fighting equipment to tunnel-boring machinery for metro projects and high-altitude roads.

- To support logistics and trade infrastructure, the Budget also proposes a Scheme for Container Manufacturing, aimed at creating a globally competitive container manufacturing ecosystem. The scheme has a proposed budgetary allocation of ₹10,000 crore over a five-year period.

Support to Toll Manufacturing and Electronics Manufacturing

To provide a fillip to toll manufacturing in India, the Budget proposes an income tax exemption for a period of five years to any non-resident entity that provides capital goods, equipment or tooling to a toll manufacturer operating in a bonded zone.

In addition, specific support has been extended to toll manufacturing engaged in electronics manufacturing. Under the proposal, a tax exemption is provided to any foreign company supplying capital goods, equipment or tooling to a toll manufacturer located in a bonded zone and engaged in manufacturing electronic goods. The exemption is proposed for five tax years beginning 1st April, 2026.

The measure aims to reduce the capital investment burden on Indian contract manufacturers, thereby lowering production costs and promoting electronics manufacturing in India. The proposed amendment is applicable up to tax year 2030–31.

Energy Transition and Critical Minerals: Capital Goods Facilitation

In support of energy transition and energy security, the Budget proposes to extend the basic customs duty exemption on capital goods used for manufacturing Lithium-Ion cells for batteries to those used for manufacturing Lithium-Ion cells for battery energy storage systems as well.

Further, the basic customs duty on the import of capital goods required for processing critical minerals in India is proposed to be exempted, with a view to strengthening domestic value chains for critical minerals.

Recent Policy Support Strengthening Capital Goods Sector

The Government’s policy support for the capital goods sector has expanded significantly, with multiple schemes aimed at improving domestic capability and aligning with India’s investment-led growth phase. Some of the recent policy support includes:

Production Linked Incentive (PLI) Schemes

The core objective of the PLI Scheme is to attract investments in key sectors, facilitate the adoption of cutting-edge technologies, enhance operational efficiency, and achieve economies of size and scale, thereby strengthening the global competitiveness of Indian manufacturers. The Economic Survey 2025-26 highlights key sectoral gains such as:

- PLI-Auto Scheme promotes manufacturing of advanced automotive technology vehicles and components. It attracted ₹35,657 crore in investments and created 48,974 jobs till September 2025.

- PLI-Advanced Chemistry Cell (ACC) Scheme aims at localising battery manufacturing, with 40 GWh capacity awarded thus, strengthening India’s EV ecosystem.

|

Rising Impact of PLI Schemes in Strengthening India’s Manufacturing Sector

According to the Economic Survey 2025-2026, an actual investment of over ₹2.0 lakh crore has been realised till September 2025, leading to incremental production/sales of over ₹18.70 lakh crore and employment generation of over 12.60 lakhs (direct and indirect).

Additionally, cumulative incentives of ₹23,946 crore have been disbursed across 12 sectors, with 806 applications approved across all 14 sectors. The PLI Schemes have witnessed exports surpassing ₹8.20 lakh crore, driven by key sectors under the Scheme.

|

Scheme for Enhancement of Competitiveness in the Indian Capital Goods Sector

The Government is undertaking focused measures to strengthen the competitiveness of the capital goods sector through Phase II of the Scheme on Enhancement of Competitiveness in the Indian Capital Goods Sector, introduced in 2022. The scheme covers six major components, including technology identification through innovation portals, setting up Advanced Centres of Excellence (CoEs), establishing Common Engineering Facility Centres (CEFCs), upgrading testing and certification infrastructure, and implementing comprehensive skill development initiatives.

As of November 2025, 29 projects have been approved under Phase II, involving a total project cost of ₹891.37 crore, with a government contribution of ₹714.64 crore. Technologies developed under the scheme have also captured markets in countries such as France, Belgium, and Qatar, demonstrating the sector’s improving global competitiveness.

|

The Scheme for Enhancement of Competitiveness in the Indian Capital Goods Sector is a demand-driven scheme under which industry, in partnership with eminent academic and research institutions, proposes projects for government funding, with the objective of fostering long-term industry–academia collaboration for critical R&D.

|

Conclusion

Building on its kartavya and the government’s resolve to drive comprehensive economic growth and development, the capital goods sector plays a significant role in advancing this agenda. With existing policy support and new measures introduced in the Union Budget 2026-27, the sector is well positioned to make a strong contribution to India’s economic development in the coming years.

References

Ministry of Finance

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2221458®=3&lang=1

https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2219907®=3&lang=2

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2221451®=3&lang=2

https://www.indiabudget.gov.in/doc/budget_speech.pdf

https://www.pib.gov.in/PressReleseDetail.aspx?PRID=2221425®=3&lang=1

Ministry of Commerce & Industry

https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2117968®=3&lang=2

https://content.dgft.gov.in/Website/dgftprod/58357641-6838-401a-b880-7cdec59285c6/FTP2023_Chapter11.pdf

Ministry of Heavy Industries

https://heavyindustries.gov.in/sites/default/files/2025-02/heavy_annual_report_2024-25_final_27.02.2025_compressed.pdf

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2149750®=3&lang=2

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2042179®=3&lang=2

Ministry of Statistics & Programme Implementation

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2219602®=3&lang=2

https://mospi.gov.in/uploads/latestreleasesfiles/1767782498513-GDP%20Press%20Note%20on%20FAE%202025-26.pdf

Central Board of Direct Taxes

https://incometaxindia.gov.in/Documents/Budget2026/FAQs-Budget-2026.pdf

Union Budget FY 2026-27: Strengthening Capital Goods Sector

******

PIB Research

(Release ID: 2222521)

Visitor Counter : 1247