Ministry of Finance

Aatma Nirbhar Bharat Package – Progress So Far

Finance Minister Smt. Nirmala Sitharaman reviews implementation of Aatma Nirbhar Bharat Package pertaining to Ministries of Finance & Corporate Affairs

Posted On:

01 OCT 2020 5:28PM by PIB Delhi

Hon’ble Prime Minister Shri Narendra Modi on May 12th, 2020, announced the Special economic and comprehensive package of Rs. 20 lakh crore - equivalent to 10% of India’s GDP – to fight COVID-19 pandemic in India. He gave a clarion call for Aatma Nirbhar Bharat or Self-Reliant India Movement. He also outlined five pillars of Aatma Nirbhar Bharat – Economy, Infrastructure, System, Vibrant Demography and Demand.

Following the call of the Hon'ble Prime Minister, Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman laid down the details of the Aatma Nirbhar Bharat Package in a string of press conferences from 13th May to 17th May 2020.

The Ministries of Finance & Corporate Affairs have immediately started implementation of the announcements related to the Economic Package under Aatma Nirbhar Bharat Package (ANBP). Regular reviews and monitoring of the implementation of economic package is being overseen by the Finance Minister personally.

In the latest review pertaining to Ministries of Finance & Corporate Affairs taken by Smt.Nirmala Sitharaman here today, the following progress has been reported so far:

- Rs 3 lakh crore Collateral-free Automatic Loans for Businesses, including MSMEs

To provide relief to the business, additional working capital finance of 20% of the outstanding credit as on 29th February 2020, in the form of a Term Loan at a concessional rate of interest will be provided. This will be available to units with upto Rs 25 crore outstanding and turnover of up to Rs 100 crore whose accounts are standard. The units will not have to provide any guarantee or collateral of their own. The amount will be 100% guaranteed by the Government of India providing a total liquidity of Rs. 3 lakh crore to more than 45 lakh MSMEs.

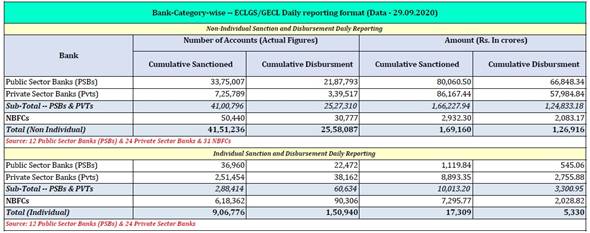

After taking Cabinet approval on 20.05.2020, Department of Financial Services issued Operational Guidelines for the Scheme on 23.05.2020 and Emergency Credit Line Guarantee Scheme (ECLGS) Fund was registered on 26.05.2020. Guidelines amended on 4.8.2020 to include Individual loans for business, enhance loan outstanding ceiling to Rs 50 crore and annual turnover ceiling to Rs 250 crore.

As reported on 29.09.2020, by 12 Public Sector Banks , top 24 Private Sector Banks & 31 NBFCs , the total amount sanctioned to Non -Individual & individuals, under the 100% Emergency Credit Line Guarantee Scheme stands at Rs 1,86,469 crore, of which Rs 1,32,246 crore has already been disbursed to 2,709,027 borrowers.

- Rs 45,000 crore Partial Credit Guarantee Scheme 2.0 for NBFCs, HFCs and MFIs to do fresh lending to MSMEs & individuals

Under Revised Guidelines issued on 17.08.2020, additional 3 months have been allowed, till 19.11.2020, for building portfolio and to increase ceiling for AA/AA- rated bonds from 25% to 50% of total portfolio.

As on 25th September 2020, Banks have approved purchase of portfolio of Rs 25,505 crore and are currently in process of approval/ negotiations for Rs. 3,171 crore. As reported by PSBs on 25th September 2020, portfolio of Rs 16,401 crore has been purchased.

- Rs 30,000 crore Additional Emergency Working Capital Funding for farmers through NABARD

As on 25th September,2020 , Rs. 25,000 crore has been disbursed out of this special facility. Balance amount of Rs. 5,000 crore under Special Liquidity Facility (SLF) allocated to NABARD by RBI for smaller NBFCs and NBFC-MFIs.

NABARD is finalising the operational guidelines to roll out disbursement out of this facility.

- Rs 30,000 crore Special Liquidity Scheme for NBFCs/HFCs/MFIs

SBICAP was assigned to set up a SPV to implement the Scheme. The Scheme was launched through a Press Release dated July 1, 2020. On the same day the regulator RBI also issued a circular to NBFCs and HFCs on the Scheme.

As on 30th September 2020, thirty nine (39) proposals involving an amount of Rs.11,120 crore have been approved. Out of this sanctioned amount, Rs 7,227 crore has been disbursed whereas Rs 182 crore will not be availed. The remaining sanctions of Rs 3,707 crore have lapsed. This Scheme has been closed on 30th September,2020.

- Rs. 1,500 crore Interest Subvention for MUDRA-Shishu Loans

The current portfolio of MUDRA-Shishu loans is Rs 1.62 lakh crore (Maximum loan amount of Rs. 50,000). The Cabinet approved the Scheme on 24.6.2020 and guidelines of the Scheme were issued on 26.6.2020. However, 86% of eligible accounts were on moratorium till 31. 8.2020. Budget allocation of Rs. 1,232 crore made for FY 2020-21 and Rs. 120 crore released to SIDBI on 7th September 2020.

- Rs 2 lakh crore Concessional credit boost to 2.5 crore farmers through Kisan Credit Cards in a Special Drive

In Phase I, 58.12 lakh KCC cards with KCC limit of Rs. 46,330 crore had been sanctioned.

Under Phase II, as on 25th September 2020, a total number of 83.03 lakh KCC with KCC limit of Rs. 78,999.80 crore has been sanctioned. Following is the break-up of this 80.46 lakh KCC sanctioned in Phase II:

Area in which KCC sanctioned Number of KCC sanctioned

- Crop Loan - 70.31 lakh

- Crop loan with AH or fisheries activities - 1.92 lakh

- Dairy - 2.97 lakh

- Poultry, cattle & sheep rearing, etc - 21,961

- Fisheries -10,622

- Rs 50,000 crore liquidity through TDS/TCS rate reduction

Legislative amendments to give effect to this announcement was incorporated in The Taxation and Other Laws (Relaxation and Amendment of Certain provisions) Bill, 2020 which was introduced in the Lok Sabha on 18th September 2020. After, the assent of Hon’ble President ,The Taxation and Other Laws (Relaxation and Amendment of certain provisions) Act, 2020 has been notified on 29th September,2020.

- Other Direct Tax Measures:

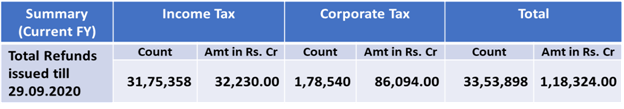

During the Current Financial Year, a number of 33, 53,898 refunds amounting to Rs.1,18,324 crore have been issued. Remaining refunds are under process.

Under the ANBP, the following was announced:

- Due date of all income-tax return for FY 2019-20 will be extended from 31st July, 2020 & 31st October, 2020 to 30th November, 2020 and Tax audit from 30th September, 2020 to 31st October, 2020

- Date of assessments getting barred on 30th September, 2020 will be extended to 31st December, 2020 and those getting barred on 31st March, 2021 will be extended to 30th September, 2021.

- Period of Vivad se Vishwas Scheme for making payment without additional amount will be extended to 31st December, 2020.

Legislative amendments to give effect to these announcements were incorporated in The Taxation and Other Laws (Relaxation and Amendment of Certain provisions) Bill, 2020 which was introduced in the Lok Sabha on 18th September 2020. After, the assent of Hon’ble President , The Taxation and Other Laws (Relaxation and Amendment of certain provisions) Act, 2020 has been notified on 29th September,2020.

- Further enhancement of Ease of Doing business through IBC related measure :

The Government has raised the threshold of default under section 4of the IBC, 2016 to 1 crore (from the existing threshold of Rs 1 lakh) vide Notification dated 24.6.2020.

A special resolution under section 240A of the Code, to provide relief to the MSMEs is being finalized and the same would be notified soon.

Insolvency and Bankruptcy Code (Second Amendment) Act, 2020 has been notified on 23rd September, 2020 with effect from 5th June, 2020 thereby providing insertion of Section 10A in the Insolvency and Bankruptcy Code 2016 (Code) to temporarily suspend initiation of Corporate Insolvency Resolution Process (CIRP) under Sections 7, 9 and 10 of the Code for a period of six months or such further period, not exceeding one year, from 25th March, 2020. The benefit of the proposed suspension will be available to all those defaults of the corporate debtor that occur from 25th March 2020 and till the end of the period of suspension. Further, such defaults arising between the 25th March, 2020 and till the completion of the suspension period will remain as non-est for the purpose of initiation of CIRP under the Code as a permanent carve-out. Section 66 of the Code is also amended to disallow the resolution professional from filing application of action against the directors or partners of the corporate debtor with respect of such default.

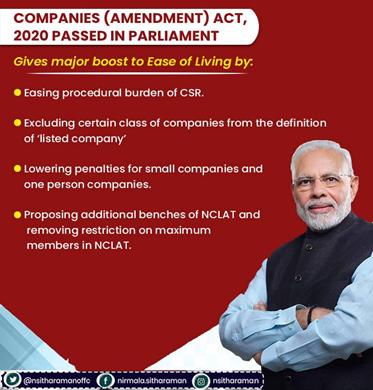

10. Decriminalization of Companies Act defaults

The Companies (Amendment) Bill, 2020, has been passed by Lok Sabha on 19th September, 2020 and by Rajya Sabha on 22nd September, 2020. After, the assent of Hon’ble President , The Companies ( Amendment) Act,2020 has been notified on 28th September, 2020.

- Ease of Doing Business for Corporates :

The Companies (Amendment) Bill, 2020, has been passed by Lok Sabha on 19th September, 2020 and by Rajya Sabha on 22nd September, 2020. After, the assent of Hon’ble President , The Companies ( Amendment) Act,2020 has been notified on 28th September, 2020.

****

RM/KMN

(Release ID: 1660691)

Visitor Counter : 18972