Ministry of Finance

Three Jan Suraksha Schemes - Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) complete 10 years of providing social security cover

Cumulative enrolments under PMJJBY have been more than 23.63 crore and an amount of Rs. 18,397.92 crore has been paid as on 23.04.2025

Cumulative enrolments under PMSBY have been more than 51.06 crore and an amount of Rs. 3,121.02 crore has been paid for 1,57,155 claims for the same period

Till 23.04.2025, more than 7.66 crore individuals have subscribed to the APY scheme

Posted On:

09 MAY 2025 8:36PM by PIB Delhi

The three Jansuraksha schemes have completed 10 years of providing social security cover today. The three schemes- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY) were launched by Prime Minister Shri Narendra Modi on 9th May 2015. All three schemes were envisioned to extend affordable financial protection to all, particularly the underserved and vulnerable sections of society. These flagship schemes aim to broaden the insurance and pension landscape by shielding citizens against life’s uncertainties and fostering long-term financial resilience.

Highligting on the guiding principles of the three Jan Suraksha schemes, Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman said, “With the vision of "Securing the Unsecured," the Prime Minister Shri Narendra Modi, on 9th May 2015, launched the 'Jan Suraksha' schemes comprising PM Jeevan Jyoti Bima Yojana, PM Suraksha Bima Yojana and Atal Pension Yojana to provide affordable insurance and pension benefits to all.”

Citing data on the 10th anniversaries of the Jan Suraksha Schemes, Smt. Sitharaman said that over 23.6 crore, 51 crore and 7.6 crore enrolments have been done under PMJJBY, PMSBY & APY respectively till April 2025.

On PMJJBY scheme, the Finance Minister said that the scheme has settled claims worth ₹18,398 crore for over 9 lakh families.

Under PMSBY scheme, the scheme has settled claims worth ₹3,121 crore for over 1.57 lakh families, Smt. Sitharaman said.

“A key focus of the schemes has been digitization and simplification of enrolment and claims. The launch of the online Jan Suraksha Portal has made it possible for citizens to enrol conveniently without visiting bank branches or post offices. Digitising the claims process has ensured faster settlements, enabling timely support to bereaved families when they need it the most. As we mark the 10th anniversary of the Jan Suraksha schemes, heartfelt appreciation for all the stakeholders, including field functionaries of banks and insurance companies, whose dedicated efforts have made these schemes a huge success” Smt. Sitharaman concluded.

On the occasion, Union Minister of State for Finance, Shri Pankaj Chaudhary said, “The objective of these schemes is to provide financial security to the poor and disadvantaged sections of the society. The vision was to provide timely assistance to the poor and disadvantaged people of the country at the bottom of the pyramid. The three schemes are dedicated to the welfare of the citizens, built on the need for securing human life from unexpected events and financial uncertainties”

As we celebrate the 10th anniversaries of the three-social security (Jan Suraksha) schemes — Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY), let us recount how these schemes have enabled affordable insurance and security to people (Jan Suraksha), their achievements and salient features.

1. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is designed to provide Life Insurance cover for death due to any reason at premium of less than Rs. 2/- per day.

Key feature of the scheme: PMJJBY is a one-year cover, renewable from year to year. The scheme is offered / administered through LIC and other Life Insurance companies willing to offer the product on similar terms with necessary approvals and tie ups with Banks / Post office for this purpose. Participating banks/ Post office are free to engage any such life insurance company for implementing the scheme for their subscribers.

Eligibility Conditions: All Individual bank/ Post office account holders of the participating banks/ Post office in the age group of 18 to 50 years, who give their consent to join / enable auto-debit, are entitled to join the scheme. In case of multiple bank / Post office accounts held by an individual in one or different banks/ Post office, the person is eligible to join the scheme through one bank/ Post office account only.

Enrolment period: The cover shall be for one-year period stretching from 1st June to 31st May for which option to join / pay by auto-debit from the designated individual bank / Post office account on the prescribed forms will be required to be given by 31st May of every year.

Premium: Rs.436/- per annum per member. The premium will be deducted from the account holder’s bank / Post office account through ‘auto debit’ facility in one instalment, as per the option given, at the time of enrolment under the scheme. Delayed enrolment for prospective cover is possible with payment of pro-rata premium as described below;

a) For enrolment in June, July and August – Full Annual Premium of Rs.436/- is payable.

b) For enrolment in September, October, and November – pro rata premium of Rs. 342/- is payable

c) For enrolment in December, January and February – pro rata premium of Rs. 228/- is payable.

d) For enrolment in March, April and May – pro rata premium of Rs. 114/- is payable.

Benefits: Rs.2 lakh is payable on subscriber’s death due to any cause. Lien period of 30 days shall be applicable from the date of enrolment.

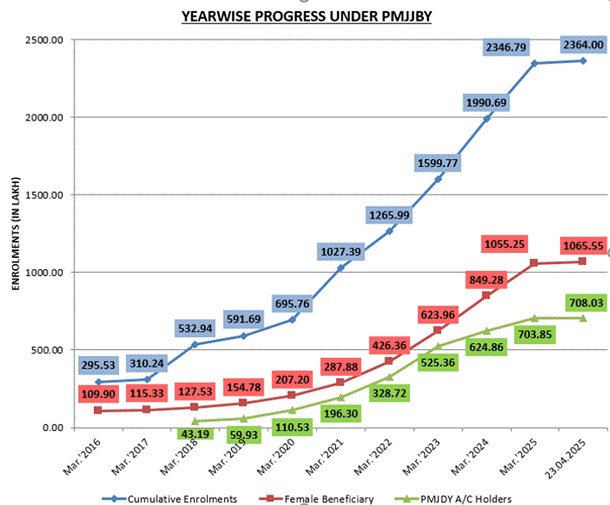

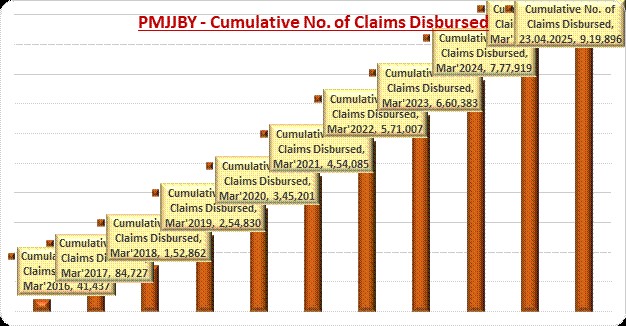

Achievements: As on 23.04.2025, the cumulative enrolments under PMJJBY have been more than 23.63 crore and an amount of Rs. 18,397.92 crore has been paid for 9,19,896 claims.

As on 23.04.2025, the scheme has recorded 10.66 crore female enrollments and 7.08 crore enrollments from PMJDY account holders.

Source: Banks and Insurance Companies for Cumulative Enrolments

Banks for Female Beneficiaries and PMJDY Accountholders

Source: Insurance Companies

2. Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is structured to provide accidental death and disability cover for death or disability on account of an accident, up to Rs 2 Lakhs to persons aged between 18-70 years, at a minimal premium of less than Rs. 2/- per month.

Key feature of the scheme: PMSBY is a one-year cover, renewable from year to year. The scheme is offered / administered through Public Sector General Insurance Companies (PSGICs) and other General Insurance companies willing to offer the product on similar terms with necessary approvals and tie up with Banks / Post office for this purpose. Participating banks / Post office will be free to engage any such insurance company for implementing the scheme for their subscribers.

Eligibility Conditions: All Individual bank/ Post office account holders of the participating banks/ Post office in the age group of 18 to 70 years, who give their consent to join / enable auto-debit, are entitled to join the scheme. In case of multiple bank / Post office accounts held by an individual in one or different banks/ Post office, the person is eligible to join the scheme through one bank/ Post office account only.

Enrolment period: The cover shall be for one-year period stretching from 1st June to 31st May for which option to join / pay by auto-debit from the designated individual bank / Post office account on the prescribed forms will be required to be given by 31st May of every year.

Premium: Rs.20/- per annum per member. The premium will be deducted from the account holder’s bank / Post office account through ‘auto debit’ facility in one instalment, as per the option given, at the time of enrolment under the scheme.

Benefits: As per the following table:

|

|

Table of Benefits

|

Sum Insured

|

|

a

|

Death

|

Rs. 2 Lakh

|

|

b

|

Total and irrecoverable loss of both eyes or loss of use of

both hands or feet or loss of sight of one eye and loss of

use of hand or foot

|

Rs. 2 Lakh

|

|

c

|

Total and irrecoverable loss of sight of one eye or loss of

use of one hand or foot

|

Rs. 1 Lakh

|

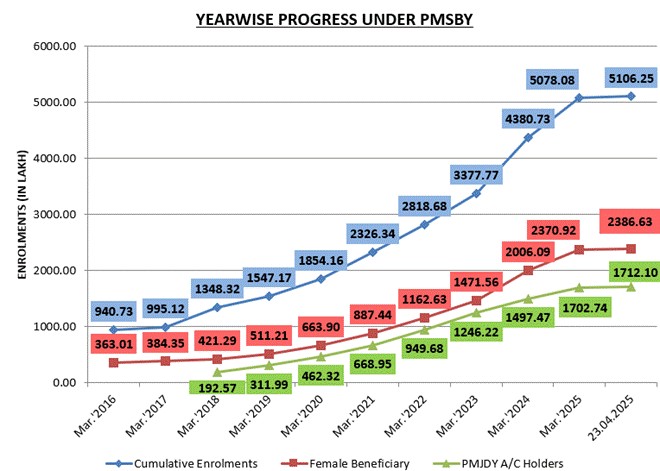

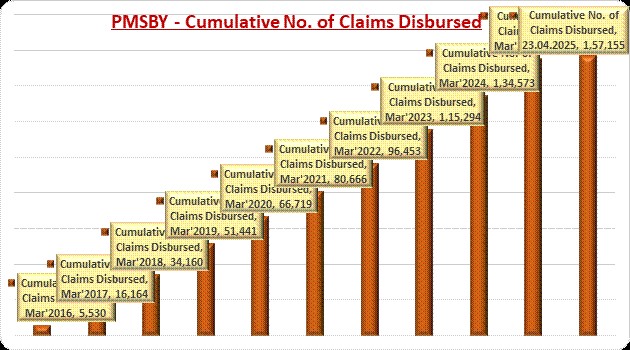

Achievements: As on 23.04.2025, the cumulative enrolments under PMSBY have been more than 51.06 crore and an amount of Rs. 3,121.02 crore has been paid for 1,57,155 claims.

As on 23.04.2025, the scheme has recorded 23.87 crore female enrollments and 17.12 crore enrollments from PMJDY account holders.

Source: Banks and Insurance Companies for Cumulative Enrolments

Banks for Female Beneficiaries and PMJDY Accountholders

Source: Insurance Companies

3. Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) was launched to create a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector. It is an initiative of the Government to provide financial security and cover future exigencies for the people in the unorganised sector. APY is administered by Pension Fund Regulatory and Development Authority (PFRDA) under the overall administrative and institutional architecture of the National Pension System (NPS).

Eligibility: APY is open to all bank account holders in the age group of 18 to 40 years who are not income tax payers and the contributions differ, based on pension amount chosen.

Benefits: Subscribers would receive the guaranteed minimum monthly pension of Rs. 1000 or Rs. 2000 or Rs. 3000 or Rs. 4000 or Rs. 5000 after the age of 60 years, based on the contributions made by the subscriber after joining the scheme.

Disbursement of the Scheme Benefits: The monthly pension is available to the subscriber, and after him to his spouse and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the nominee of the subscriber.

In case of premature death of subscriber (death before 60 years of age), spouse of the subscriber can continue contribution to APY account of the subscriber, for the remaining vesting period, till the original subscriber would have attained the age of 60 years.

Payment frequency: Subscribers can make contributions to APY on monthly/ quarterly / half-yearly basis.

Withdrawal from the Scheme: Subscribers can voluntarily exit from APY subject to certain conditions, on deduction of Government co-contribution and return/interest thereon.

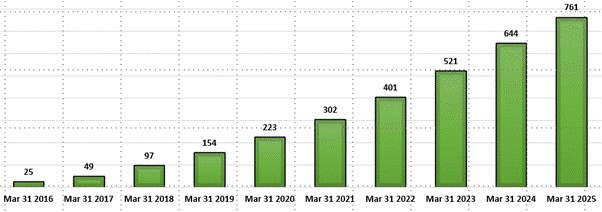

Progress of scheme – Cumulative enrolments in lakh:

Females constitute around 47% of total subscribers enrolled under Scheme

Achievements: As on 29.04.2025, more than 7.66 crore individuals have subscribed to the scheme.

*****

NB/AD

(Release ID: 2127981)

Visitor Counter : 2