Social Welfare

GST for Affordable Healthcare

Posted On:

12 SEP 2025 11:03 AM

Encouraging Preventive Care and Nutrition for a Healthier India

Introduction

The Ministry of Health and Family Welfare, under the guidance of Prime Minister Shri Narendra Modi, is working to make quality healthcare more affordable, accessible, and preventive in nature. Guided by the vision of “Affordable Healthcare for All”, the government has aligned health reforms with flagship programmes like Ayushman Bharat, Poshan Abhiyaan, and the Fit India Movement, ensuring that both curative and preventive care reach every section of society.

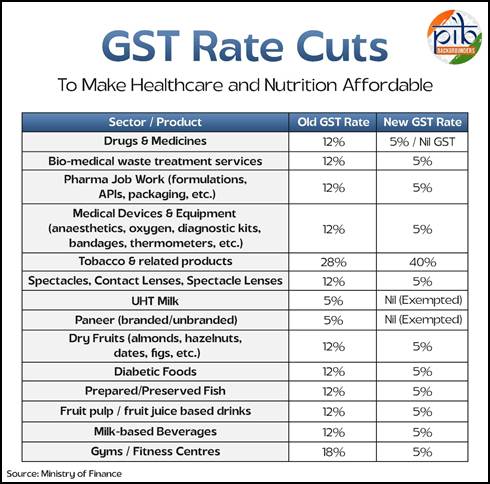

The recent GST rationalisation reflects this vision by promoting a health-positive tax regime. While healthcare services by doctors, hospitals, and diagnostic centres remain exempt from GST, the reduction in taxes on essential medicines and medical devices has brought down treatment costs for patients. At the same time, higher taxes on harmful ‘sin goods’ like tobacco, pan masala, and sugary drinks underline the government’s focus on preventive healthcare and tackling lifestyle diseases such as diabetes, obesity, and cancer. This balanced approach ensures that the tax system itself becomes a tool for protecting public health and strengthening families’ well-being.

“The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and strengthening the economy.”- Prime Minister Narendra Modi

Drugs & Medicines

GST reduced from 12% to 5%/Nil

-

- GST Reduction will cut the costs of various essential medicines, easing the financial burden on patients.

- Boosts the affordability of long-term treatments for chronic illnesses.

- More people will be able to continue their long-term medications.

- Strengthens India’s role as the “Pharmacy of the World”, especially for generics, while ensuring domestic affordability.

- Services by way of treatment or disposal of bio-medical waste will be reduced from 12% to 5%

- The supply of job work in relation to manufacture of pharmaceutical products will also be reduced from 12% to 5%.

Medical Devices & Equipment (12% to 5% GST):

GST cut from 12% to 5%

-

- 12 to 5%: Anaesthetics, medical grade oxygen, gauze, bandages, etc., diagnostic kits, surgical rubber gloves, glucometer, various thermometers, instruments and appliances, etc.

- Makes healthcare delivery cheaper for hospitals, diagnostic centres, and clinics.

- Encourages adoption of modern diagnostic tools, improving quality of care in Tier-2/3 towns.

Job-Work Services for Pharma Manufacturing

GST reduction from 12% to 5%

-

- Pharma companies rely heavily on contract manufacturing and job-workers for formulations, APIs, packaging, etc.

- Lower GST (5% instead of 12%) directly reduces the tax outgo on job-work invoices.

- Lower job-work costs will reduce the overall cost of production for medicines. It will reduce inverted duty structure issues.

"We are a 100% export company, largely exporting formulations... I take this as a very big positive for the healthcare sector. And it’s not only for the industry, it is also for the people. The government has now abolished GST on many life-saving drugs, which will make medicines more affordable for the public..." - Vidyut Shah, MD, VS International Private Limited

Vision Correction Products

GST cut from 12% to 5%

-

- Spectacles are not a luxury but a health necessity. It is expected that the population dependent on lenses/ spectacles will increase.

- Some reports suggest that 10 crore people may be without proper spectacles. The GST rate cut will help in increasing affordability and adoption of spectacles.

- Lower GST makes vision correction affordable for many people, especially students, the elderly, and low-income households. It will also improve productivity.

- Lower GST and improved demand will boost the spectacles industry.

No GST on Individual Health Insurance

Exempting individual health insurance from GST:

-

- Makes premiums cheaper for middle-class families.

- Encourages wider adoption of health insurance, reducing out-of-pocket medical expenses.

- Complements Ayushman Bharat and PMJAY by expanding private coverage and drive the mission of Health for All.

"This path-breaking announcement by the Indian government to reduce GST from 12% to 5% is excellent for consumers and patients, and is very welcome by AiMeD. Affordable accessibility will help reduce healthcare costs..." - Rajiv Nath, Forum Coordinator of AiMeD

Essential Nutrition & Daily Health – Holistic Health

- UHT Milk, Paneer (branded or unbranded) exempted from GST: All dairy milk were exempt. Only UHT milk attracted 5% which is now fully exempt. Ensures daily nutrition remains tax-free, making these essential protein sources affordable. It directly benefits households, especially women, children, and the elderly.

- Diabetic foods (12% to 5% GST): Lower prices for special dietary products, reducing burden on diabetic patients.

- GST brought to 5% from 12% on Dried fruits such as Almonds, hazelnuts, dates, figs, etc. This will promote health-conscious diets. It will encourage consumption of healthy food and snack alternatives, improving household nutrition.

- Prepared or preserved fish (12% to 5%); Fruit pulp or fruit juice based drinks (12% to 5%) and Beverages containing milk will also be cheaper (12% to 5%)

Consumers will benefit from reduced food prices, making nutritious staples more affordable. This encourages healthier eating habits and boosts demand for wholesome products. FMCG and packaged food businesses are likely to see growth, while simplified rules ease compliance and lower litigation risks for enterprises.

Tobacco and Tobacco related products

GST increased from 28% to 40%

- Unmanufactured tobacco; tobacco waste (other than tobacco leaves).

- Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes.

- Other manufactured tobacco and manufactured tobacco substitutes; “homogenised” or “reconstituted” tobacco; tobacco extracts and essences.

- Products containing tobacco or reconstituted tobacco and intended for inhalation without combustion.

- Products containing tobacco or nicotine substitutes and intended for inhalation without combustion.

Gyms/Fitness Centres (18% to 5% GST):

GST cut down from 18% to 5%

- Makes fitness more affordable, encouraging citizens to adopt healthier lifestyles.

- Complements the ‘Fit India Movement’ and preventive healthcare initiatives.

- Expands access for middle-class youth and urban working professionals.

Conclusion

The GST rationalisation in the healthcare sector marks a decisive step towards a healthier India. By reducing the cost of essential medicines and devices, exempting critical health services, and discouraging harmful consumption through higher taxes on sin goods, the government has created a tax structure that directly benefits people’s well-being. Guided by Prime Minister Shri Narendra Modi’s vision, the Ministry of Health and Family Welfare continues to ensure that economic policy supports health outcomes, empowering families with affordable care and protecting future generations from preventable diseases.

References

Ministry of Finance

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=2163555

Ministry of Food Processing Industries

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2164586#:~:text=These%20changes%20come%20into%20effect,decline%20to%205%25%20GST%20slab.

Important Bytes

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2163785

https://x.com/ians_india/status/1963478740509626479

https://x.com/ians_india/status/1963500858865565900

Click here to see pdf

***

SK | RK

(Factsheet ID: 149278)

Visitor Counter : 279

Provide suggestions / comments

Read this explainer in :

हिन्दी