Economy

67 and Rising: India’s Financial Inclusion Gains Momentum

RBI’s Financial Inclusion Index rises to 67 in 2025 indicating Growth for Everyone

Posted On:

06 AUG 2025 3:27PM

“Economic growth cannot only be restricted to a few cities and a few citizens. Development has to be all-round and all-inclusive.”

– PM Narendra Modi

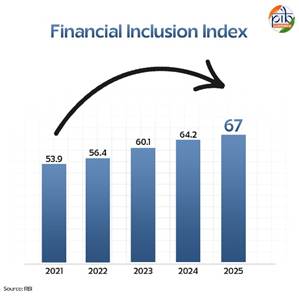

- Financial Inclusion Index risen to 67 in 2025, up by 24.3% since 2021

- 55.98 crore beneficiaries under the revolutionary Pradhan Mantri Jan Dhan Yojana

- 6.65 Lakhs accounts opened in 1-month campaign for Saturation of Financial Inclusion Schemes

|

|

Introduction

The foresightedness to build financially empowered India with the aim of taking banking beyond branches is making a success. From remote to urban areas, the wave of change can be noticed all over the country with inclusive financial system. Bank accounts, credits, pensions, insurance which was once luxury for some, is now available for all. The accessibility of financial services, products and financial literacy has been on a rise and it could be confirmed with the data released by RBI. The Reserve Bank of India released Financial Inclusion Index (FI-Index) for the year ending March 2025 which stands at 67.0 in comparison to 64.2 in March 2024. The FI-Index was launched in 2021 with the aim of capturing the financial inclusion across the country while representing different sectors such as banking, investment, insurance, postal and pension too. With the boost in the index, the growth was witnessed across all three sub-indices of Access, Usage and Quality. Improvement in the FI-Index in FY2025 is a reflection of enhancement in usage and quality dimensions, which indicates strengthening of financial inclusion and financial literacy initiatives. Furthermore, since 2021, it has increased by 24.3 per cent, which highlights the continuous dedication of government to include every citizen in the growing digital financial infrastructure of the country.

Financial Inclusion is defined as the availability of affordable financial products and services to meet the needs of individuals and businesses in a responsible and sustainable way.

It supports entrepreneurship, business growth, empowers women and support in managing risks too which leads to strengthening of economic activities, boost in productivity and economic growth.

|

|

What is Financial Inclusion and why it is important?

The 2030 Agenda for Sustainable Development Goals adopted by United Nation members identified Financial Inclusion as a key enabler for 7 out of 17 goals. World Bank also recognised financial inclusion as a crucial part of development and publishes Global Findex Database, to track the use of financial services by the adults across the world. The Global Findex 2025 highlighted that account ownership in India has reached to 89 per cent since 2011 and the country has made progress in increasing the share of adults with active accounts.

Financial Inclusion Index Explained

Bridging the financial gap is vital for the economic growth of a country and therefore the promotion of equitable financial access is necessary. Accordingly, a consolidated measure of financial inclusion was introduced in India to effectively monitor the progress of the policy initiatives undertaken to promote access of finance to all. FI-Index is based on 97 indicators and they quantify the progress in financial inclusion, majorly sensitive to availability of financial services, ease of access, usage, unequal distribution and deficiency in services, financial literacy and consumer protection. The index varies from a scale of 0 to 100 where 0 indicates no financial inclusion and 100 indicates complete financial inclusion. The index has 3 sub-indices, “Access”, “Usage” and “Quality”, with each sub-index having respective weight of 35, 45 and 20 per cent respectively.

The “Access” sub-index reflects the availability of supply side of financial inclusion such as physical and digital infrastructure. It is an index of 26 indicators which are divided into four-dimensions i.e., banking, digital, pension and insurance. The growth in the value of “Access” is related to the change in the number of saving accounts, post offices, subscribers to Mutual funds, JAM ecosystem, number of offices for insurance, Prepaid Payment Instrument (PPI) issuers, and Point of Sale (PoS) terminals etc.

“Usage” is the sub-index which reflects the demand side of financial inclusion and has five dimensions, viz., savings & investments, digital, pension, insurance and credit. It is comprised of 52 indicators which reflects the usage of financial infrastructure by the way of savings, investments, insurance, credits etc. The sub-index of “Usage” deviate on the basis of total number of credit accounts, amount outstanding in the credit accounts, volume and value of UPI transactions, direct benefit transfers.

“Quality” is a three-dimensional sub-index i.e., financial literacy, consumer protection and inequality with 19 indicators. This index captures the efforts by the stakeholders to educate the citizens about financial services, their rights, safe ways to using them and effective grievance redressal mechanism.

Strategies for Financial Inclusion

To achieve the vision of banking for all and reap the benefit of multiplier effect in economic output, poverty and income inequality, the government has introduced multiple strategies focusing on supply & demand side infrastructure and financial literacy. The National Strategy for Financial Inclusion 2019-2024 (NSFI) and National Strategy for Financial Education 2020-2025 (NSFE) provide a road map for a coordinated approach towards financial inclusion, financial literacy, and consumer protection.

National Strategy for Financial Inclusion (2019-2024)

National Strategy for Financial Inclusion was launched in 2019 to address the inherent barriers to access the financial services and products, with the following objectives:

- Universal access to financial services: The objective is to provide access to a formal financial service provider to every village within a distance of 5km radius and the onboarding process should be hassle free, digital and less use of paper.

- Providing basic bouquet of financial services: Every adult who is willing and eligible needs to be provided with a basic bouquet of financial services that include a Basic Savings Bank Deposit Account, credit, a micro life and non-life insurance product, a pension product and a suitable investment product. Pradhan Mantri Jan Dhan Yojna (PMJDY) was part of such objective.

- Access to livelihood and skill development: If a citizen is eligible and willing to undertake a skill development program, such information should be provided to them, hence supporting them in engaging economic activity and income generation.

- Financial literacy and education: Module which are easy to understand should be created with audio visual content for target audience, so that the knowledge of financial products could be shared.

- Customer protection and grievance redressal: Customers shall be made aware of the recourses available for resolution of their grievances.

National Strategy for Financial Education (NSFE) (2020-2025)

Financial literacy empowers the users to make sound financial decisions which result in financial well-being of the individuals. In India, the stakeholders which involves, Central and State government, financial sector regulators, financial institutions, civil societies, academia, educational institutions, all are involved in spreading financial literacy. National Strategy for Financial Education focuses on ensuring that the work of different stakeholders is aligned and progressive.

In order to achieve the Strategic Objectives, the NSFE laid down “5-C Approach” which includes development of relevant Content (including Curriculum in schools, colleges and training establishments), developing Capacity among the intermediaries involved in providing financial services, leveraging on the positive effect of Community-led model for financial literacy through appropriate Communication strategy and enhancing Collaboration among various stakeholders.

Key Initiatives for Financial Inclusion

The vision of government is to extend the financial services to the underserved and unserved population. To widen the financial participation of citizens in the country, government launched several initiatives extended in different sectors and segments of the population.

Pradhan Mantri Jan Dhan Yojana (PMJDY)

It is not a scheme but a revolution for making India financially inclusive. Under the scheme the citizen gets the access to basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner. Benefits provided under PMJDY are

- One basic saving bank account

- No minimum balance requirement,

- Rupay debit card

- Accident insurance cover of 1 Lakh

- Overdraft facility of ₹10,000 to eligible account holders

The success of scheme resulted in over 55.98 crore beneficiaries (as on 4 August 2025) where over 55 per cent accounts are held by women. For financial awareness several campaigns were launched to reach last mile beneficiaries. Centre for Financial Literacy was initiated by RBI with an objective to adopt community led innovative and participatory approaches for financial inclusion. A network of 13.55 lakh Bank Mitras was created to connect eligible people with banking services. 107 Digital Banking Units (DBUs) have been set-up by Banks (as on December 2024) where these units offer facilities like opening of saving bank accounts, passbook printing, transfer of funds, loan applications, etc.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Launched on 9th May 2015, the Pradhan Mantri Suraksha Bima Yojana has now completed a decade of providing accidental death and disability coverage specially for poor and unprivileged. The Pradhan Mantri Suraksha Bima Yojana (PMSBY) has demonstrated significant success in providing accident insurance coverage across the nation. As of March 19, 2025, the scheme has achieved a cumulative enrolment of 50.54 crore individuals, showcasing its extensive reach. The scheme provides one year cover for accidental death and disability cover for death or disability on account of an accident with a premium of ₹20/- annually, which is renewed annually. On death, the nominee receives ₹2 lakhs.

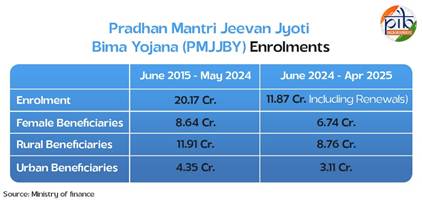

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Jeevan Bima Yojana is an insurance scheme which offers life insurance cover for death due to any reason providing affordable insurance to broader population including poor and rural population. With the premium of ₹436/- annually per subscriber, the scheme offers the life cover of ₹2 lakhs. This means that in ten years, over 23 crore Indians have been covered, and more than 9 lakh families have received timely financial support after the loss of a loved one.

Under the scheme of Atal Pension Yojana, monthly pension is provided to the people so that they can continue living a dignified life in old age. The scheme aimed at workers in the unorganised sector, who often lack formal pension coverage. To join the scheme, the age should be between 18 and 40 years and a savings bank account is required. Under the APY, guaranteed minimum pension of ₹1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given at the age of 60 years depending on the contributions by the subscribers. As of April 2025, APY has accumulated over 7.65 crore subscribers, mobilised a total corpus of ₹45,974.67 crore, and recorded increasing participation from women, who now comprise about 48% of all subscribers.

Pradhan Mantri MUDRA Yojana (PMMY)

The Pradhan Mantri MUDRA Yojana (PMMY), launched on 8th April 2015 is a flagship scheme of Government of India. The scheme facilitates loan up to ₹20 lakhs to income generating small and micro enterprises engaged in the manufacturing, trading or service sectors including activities allied to agriculture such as poultry, dairy, beekeeping, etc. This government initiative to support MSMEs’ access to credit is aptly described as a scheme dedicated to “Funding the Unfunded”. The availability of credit for MSMEs has seen consistent growth, driven by advancements in technology and data-driven lending practices. As on 4 August 2025, total of 53.85 crore loans was sanctioned and ₹35.13 lakh crore amount was sanctioned, with a major focus on women and minority borrowers, and new entrepreneurs.

The newly announced loan category, Tarun Plus, is designed specifically for those who have previously availed and successfully repaid loans under the Tarun category, allowing them to access funding between ₹10 lakh and ₹20 lakh. Additionally, the Credit Guarantee Fund for Micro Units (CGFMU) provides guarantee coverage for these enhanced loans, further reinforcing the government’s commitment to nurturing a robust entrepreneurial ecosystem in India.

Stand Up India Scheme (SUI)

Stand up India Scheme was launched on 5th April 2016 to promote entrepreneurship at grassroot level focusing on economic empowerment and job creation for energetic, enthusiastic, and aspiring SC, ST and women entrepreneurs to help them in starting a greenfield enterprise in manufacturing, services or the trading sector and activities allied to agriculture. The Stand-Up India Scheme has shown remarkable growth over the years, with the total amount sanctioned to an impressive ₹61,020.41 crore by 17th March 2025, since its launch. This reflects a substantial increase, highlighting the scheme’s expanding impact in empowering entrepreneurs across the country.

Unified Payments Interface (UPI)

Launched in 2016 by the National Payments Corporation of India (NPCI), UPI has revolutionized the nation’s payment ecosystem by integrating multiple bank accounts into a single mobile application. This system enables seamless fund transfers, merchant payments, and peer-to-peer transactions, offering users flexibility through scheduled payment requests. In June 2025 alone, it handled over ₹24.03 lakh crore in payments. This was spread across 18.39 billion transactions. UPI accounts for 85 per cent of all digital transactions in India. Its impact goes beyond national borders, powering nearly 50 per cent of global real-time digital payments. By making payments quick and accessible, UPI has become a powerful tool for financial inclusion.

Mahila Sammriddhi Yojana (MSY)

Mahila Sammriddhi Yojana (MSY) is a scheme aimed to benefit women from socially and economically weak backgrounds. The scheme provides training to a group of 20 women in a suitable craft activity and then formed into a SHG (Self help group). The group is then provided with a loan of upto ₹1,40,000 and the repayment timeline of 3.5 years. Till March, 2025 the scheme has disbursed ₹72,859 lakhs to women beneficiaries in all over India.

Kisan Credit Card (KCC) is a banking product that provides farmers with timely and affordable credit for purchasing agricultural inputs, meeting short term credit requirements, post-harvest expenses, produce marketing loan, consumption requirement for farmer household, working capital for maintenance of farm and investment credit requirement for agriculture and allied activities. The amount under operative Kisan Credit Card (KCC) accounts has more than doubled from ₹4.26 lakh crore in March 2014 to ₹10.05 lakh crore in December 2024 benefitting 7.72 crore farmers. This indicates significant increase in quantum of affordable working capital loans provided to the farmers for agriculture and allied activities. This is reflection of credit deepening in agriculture and reduced dependency on non-institutional credit.

Nationwide Campaign for Financial Inclusion

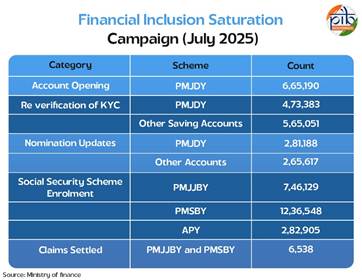

The Department of Financial services, Ministry of Finance recently launched a 3 months campaign for Saturation of Financial Inclusion schemes at Gram Panchayat and Urban Local Bodies which started from July, 2025 and will continue till September, 2025 so that every unbanked citizen could be included. The campaign covers the re-KYC of due savings accounts, opening of new bank accounts, enrolment under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojna (APY). To focus on the financial education, the campaign also provides awareness on the digital fraud prevention, grievance redressal and access to unclaimed deposits. Based on the report of Ministry of Finance, the one-month report of the campaign shows success. 99,753 camps were held in the month of July, where around 6.65 lakhs accounts were opened under Pradhan Mantri Jan Dhan Yojana (PMJDY) and over 10 lakhs re-verification of KYC was done.

Conclusion

The release of the Financial Inclusion Index highlights consistent growth over the years, with a focus on every unbanked individual. The Pradhan Mantri Jan Dhan Yojna proved to be a key initiative in the development of the financial inclusive India. The government has taken significant strides for equitable access through initiatives like the Saturation of Financial Inclusion Campaign which brings finance to the last mile. The support of the government remains steady, progressive and inclusive of different sectors such as agriculture, MSMEs and different segments such as SC/ST and economically weak women. The journey of India towards financial inclusion is not only the result of policy making but a commitment of developed India where every citizen matters.

References:

PIB Backgrounders

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154426

https://static.pib.gov.in/WriteReadData/specificdocs/documents/2025/may/doc202558551501.pdf

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154432&ModuleId=3®=3&lang=1

https://www.pib.gov.in/FactsheetDetails.aspx?Id=149200

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154912&ModuleId=3

Ministry of Finance

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=2101428

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2119954

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2106230

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2127981

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2150999

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2152230

PM India

https://www.pmindia.gov.in/en/quotes/?query=inclu

RBI

https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=60875

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54133

https://rbi.org.in/scripts/BS_ViewBulletin.aspx?Id=20502

https://www.rbi.org.in/scripts/FS_PressRelease.aspx?prid=58259&fn=2754

https://www.rbi.org.in/commonman/Upload/English/Content/PDFs/English_16042021.pdf

Ministry of Finance

https://sdgknowledgehub.undp.org.in/wp-content/uploads/2024/11/4.-Financial-inclusion-as-an-SDG-accelerator-Indias-technology-driven-experience.pdf

https://www.pmjdy.gov.in/

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=2101428

World Bank

https://www.worldbank.org/en/publication/globalfindex

https://www.worldbank.org/en/topic/financialinclusion/overview

My Scheme

https://www.myscheme.gov.in/hi/schemes/pmsby

https://www.myscheme.gov.in/schemes/cbssc-msy

Sansad

https://sansad.in/getFile/loksabhaquestions/annex/184/AU2029_4rxW6q.pdf?source=pqals#:~:text=(ii)%20State%2Dwise%20and,identifying%20eligible%20beneficiaries%20under%20MSY.&text=Annexure%2DI%20to%20the%20part,Samridhi%20Yojana%20(MSY)%E2%80%9D.&text=36%20Puducherry%203503.00%203503.00%20Sub,Samridhi%20Yojana%20(MSY)%22.&text=TOTAL:%2072859.01%2069511.81%2095.41%20%2D3,Samridhi%20Yojana%20(MSY)%E2%80%9D.

National centre for Financial Education

https://ncfe.org.in/nsfe/

Click here to see pdf

****

SK/M

(Explainer ID: 154980)

आगंतुक पटल : 20685

Provide suggestions / comments