Economy

11 Years of PM Jan Dhan Yojana: Banking the Unbanked

Posted On:

27 AUG 2025 5:10PM

“Pradhan Mantri Jan Dhan Yojana has transformed access to financial services for the poorest. It has bridged the gap between banks and the unbanked, promoting dignity, self-reliance and economic inclusion.”

– PM Narendra Modi

|

- Launched on August 28, 2014, PMJDY is one of the world’s largest financial inclusion initiatives.

- Over 56.16 crore bank accounts have been opened under the Pradhan Mantri Jan Dhan Yojana (PMJDY), with total deposits reaching ₹2.67 lakh crore as of mid-August 2025.

- 56% Jan Dhan accounts belong to women, highlighting the scheme’s role in promoting gender equality in financial access.

Introduction

A decade ago, banking for many Indians, especially in rural and marginalised communities, was a distant dream. Without access to formal financial services, millions relied on cash savings at home and high-interest loans from informal lenders, trapping them in cycles of vulnerability.

In August 2014, this reality began to change. The Pradhan Mantri Jan Dhan Yojana (PMJDY), launched as National Mission for Financial Inclusion, set out to give every unbanked adult in India a bank account, a financial identity, and access to essential services like credit, insurance, and pensions. Guided by the mission of banking the unbanked, securing the unsecured, funding the unfunded, and serving the unserved and underserved, PMJDY has grown into the largest financial inclusion initiative in the world.

|

Guinness World Records has also recognized the achievements made under the Pradhan Mantri Jan Dhan Yojana. It has been certified that "Most bank accounts opened in one week as part of the financial inclusion campaign is 18,096,130 and was achieved by the Department of Financial Services, Government of India"

|

As the scheme turns 11 years old on August 28, 2025, its achievements are visible nationwide, from the rise in rural account ownership to the surge in digital transactions, signalling a transformed financial landscape.

Core Tenets of the Scheme

Banking the unbanked- Opening of basic savings bank deposit (BSBD) account with minimal paperwork, relaxed KYC, e-KYC, account opening in camp mode, zero balance & zero charges

Securing the unsecured- Issuance of Indigenous Debit cards for cash withdrawals & payments at merchant locations, with free accident insurance coverage of Rs. 2 lakhs.

Funding the unfunded- Other financial products like micro-insurance, overdraft for consumption, micro-pension & micro-credit.

Benefits Under PMJDY

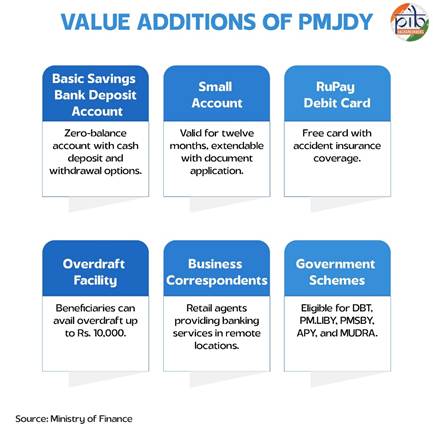

PMJDY offers a comprehensive range of benefits tailored to meet the diverse financial needs of individuals, fostering both security and empowerment. It includes features like zero-balance accounts, RuPay debit cards with built-in insurance, overdraft options, and access to services through Business Correspondents (BCs) in remote locations. The initiative supports inclusive economic growth and social equity, while also linking beneficiaries to other government programs for enhanced financial stability.

- Basic Savings Bank Deposit Account (BSBDA)- Any Indian citizen eligible to open a standard bank account can also open a BSBDA. This account type does not require maintaining a minimum balance. Transactions can be done through bank branches, ATMs, and BCs. Withdrawals are limited to a maximum of four per month.

- Small Account / Chota Khata- For individuals without formal legal documents, small accounts can be opened. These are valid for 12 months and may be extended by another 12 months if proof of application for an Officially Valid Document is submitted within the first year.

- RuPay Debit Card with Inbuilt Accident Insurance- All beneficiaries receive a free RuPay debit card with accident insurance cover of ₹2 lakhs (₹1 lakh for accounts opened before August 28, 2018).

- Overdraft Facility- Beneficiaries can avail overdraft facilities of up to ₹10,000.

- Business Correspondents (BCs) / Bank Mitras- Retail agents engaged by banks to offer banking services beyond branch/ATM locations, particularly in rural areas. BCs/Bank Mitras assist residents with savings, deposits, withdrawals, and mini-statements, ensuring last-mile delivery of banking services.

- Eligibility for Additional Government Schemes- PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), and Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

Transformative Achievements and Impact

Pradhan Mantri Jan Dhan Yojana (PMJDY) has significantly contributed to enhancing financial inclusion throughout India and has reached the following key milestones:

Broadening Financial Horizons

PMJDY has evolved into the foundation for numerous economic and welfare initiatives, enabling Direct Benefit Transfers (DBT) for 327 government schemes, eliminating leakages and middlemen.

- Accounts have grown from 14.72 crore in 2015 to over 56.16 crore by August 2025, with around 67% in rural/semi-urban areas and 33% of Jan Dhan accounts were opened in urban/ metro areas.

- 33% of Jan Dhan accounts have been opened in urban/metro areas while 67% opened in rural/semi-urban areas.

Women at the Forefront of PMJDY

56% Jan Dhan accounts belong to women, highlighting the scheme’s role in promoting gender equality in financial access. Women, especially in the unorganised sector, have benefited from access to social security and credit schemes like PMJJBY, PMSBY, and APY.

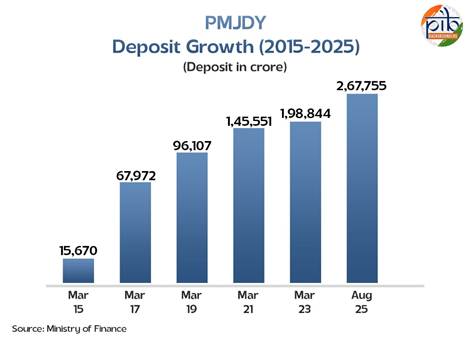

The total deposits in PMJDY accounts have increased from ₹15,670 crore in March 2015 and reached an impressive Rs. 2,67,755 crores, showcasing the growing trust of beneficiaries in the formal banking system and their active participation in financial activities.

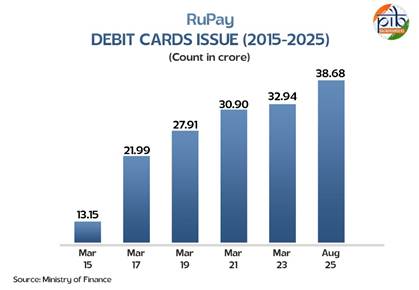

Number of RuPay Debit Cards Issued

A total of 38.68 crore RuPay debit cards have been issued to PMJDY account holders, facilitating cashless transactions and providing access to the inbuilt accident insurance cover.

PMJDY has been a cornerstone of India’s digital payment revolution. RuPay cards have driven cashless transactions. India now leads in global real-time payments, with PMJDY playing a critical role in bringing millions into the formal banking system.

Campaign for Financial Outreach

Recently, the Department of Finance launched a three-month nationwide saturation campaign, effective from 1st July 2025 to 30th September 2025, to bolster the outreach of flagship schemes such as the Pradhan Mantri Jan Dhan Yojana (PMJDY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), and Atal Pension Yojana (APY). This campaign seeks to achieve comprehensive coverage across all Gram Panchayats (GPs) and Urban Local Bodies (ULBs), ensuring that every eligible citizen is able to avail the intended benefits of these transformative schemes.

A total of 99,753 camps have been held in the first month (till 31 July 2025), across various Indian districts to facilitate beneficiary enrolment under key schemes and promote financial literacy. Notably, these camps have served as vital touchpoints for community engagement, supporting enrolment, updates and awareness efforts.

Progress reports have been compiled for 80,462 of these camps (till 31 July 2025). Adding on to the first-month milestone, nearly 6.6 lakh new PM Jan Dhan Yojana accounts were opened and over 22.65 lakh new enrolments occurred under three Jan Suraksha Schemes. KYC details were re-verified for over 4.73 lakhs inactive PMJDY accounts and 5.65 lakhs other savings accounts. Several key activities have been undertaken under the Pradhan Mantri Jan Dhan Yojana (PMJDY) to strengthen financial inclusion and enhance account management.

Conclusion

As India is about to mark 11 years of the Pradhan Mantri Jan Dhan Yojana (PMJDY), it is evident that the initiative has significantly transformed the country’s financial ecosystem. Launched in 2014, PMJDY has not only delivered on its promise of bringing the unbanked into the formal banking system but has also established a solid framework for inclusive economic development. With over 56 crore accounts opened, including nearly 30 crore women beneficiaries alongside sizable deposits and extensive distribution of RuPay debit cards, the scheme has reached even the most remote regions, uplifting millions, particularly those from underprivileged backgrounds.

The seamless integration of PMJDY accounts with various government welfare schemes has further strengthened financial inclusion, ensuring that benefits reach the intended recipients directly. Looking ahead, the accomplishments of PMJDY provide a strong foundation for expansion, paving the way toward universal financial access and increased citizen participation in India’s economic growth. The next phase will aim to deepen these efforts and bring every individual into the fold of the country’s financial progress.

References:

Ministry of Finance

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=1952793

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=152060

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2144990

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2150999

https://www.pmjdy.gov.in

Ministry of Electronics & IT

https://www.myscheme.gov.in/schemes/pmjdy#sources

Click here to see PDF.

*****

SK/M

(Explainer ID: 155102)

आगंतुक पटल : 19992

Provide suggestions / comments