Economy

Enabling Business, Empowering Growth

Posted On:

19 JUN 2025 9:32AM

Introduction

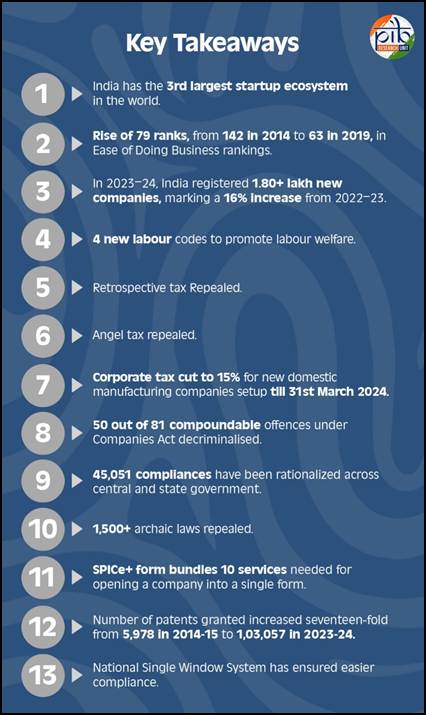

Over the past 11 years, India has undergone a quiet revolution, transforming from a red-tape economy to a red-carpet destination for investors and entrepreneurs. Under the visionary leadership of Prime Minister, the government has systematically dismantled outdated regulations, streamlined compliance processes, and ushered in a new era of transparency and trust-based governance. Today, India is not just the world’s fastest-growing major economy, but also the third-largest startup ecosystem, a global innovation huband a preferred investment destination. These achievements are not incidental, they are the outcome of bold structural reforms, digitization, and a relentless commitment to improving the Ease of Doing Business across every stage of an enterprise’s life cycle, from incorporation to exit. India has garnered global investor interest and India is on the rise as a startup and innovation hub.

Boosting Startups and Innovation through Tax Reforms

Seamless Tax System: In August 2020, the Prime Minister launched a platform for “Transparent Taxation- Honouring the Honest”. It was launched to meet the requirements of the 21st century taxation system. The new platform apart from being faceless was also aimed at boosting the confidence of the taxpayer and making him/her fearless.[1]

Elimination of Angel Tax: The 'Angel Tax' was abolished for all classes of investors in July 2024. This move was aimed to bolster the Indian start-up ecosystem, boost the entrepreneurial spirit and support innovation. Additionally, the corporate tax rate on foreign companies was reduced to 35 per cent.[2]

GST (Goods and Services Tax): GST replaced a fragmented and complex indirect tax regime that burdened businesses and consumers alike. Before GST, the tax framework consisted of numerous levies such as excise duty, service tax, VAT, CST, and others, each with its own set of compliance challenges and inefficiencies. This multiplicity not only increased the cost of doing business but also hindered seamless interstate movement of goods due to tax barriers.

GST unified India's tax system, creating a single market that removed interstate barriers and boosted operational efficiency. It ended tax cascading by allowing businesses to claim input tax credit across the supply chain, reducing overall tax burden and simplifying compliance. This reform also enhanced transparency, accountability, and economic growth by rationalizing rates and standardizing procedures.[3]

Transforming India’s Business Landscape

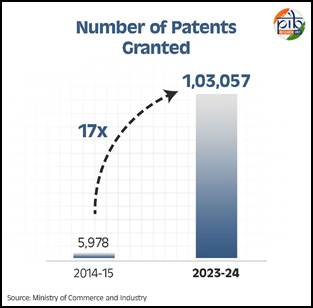

Since 2014, the government is not an obstacle in the path of risk-takers but is an active enabler. Entrepreneurs and investors in India are now delighted by abusiness-friendly environment and a government that actively addresses their concerns and redresses grievances. This paradigm shift has been made possible through landmark decisions such as removing retrospective taxation, and Angel Tax, and lowering corporate tax. The National Single Window System now allows obtaining all approvals through a single platform. Moreover, the government has reduced unnecessary compliance burden by repealing more than 1,500 archaic laws and thousands of compliances. These used to create unnecessary costs and hurdles for Indian enterprises.

- The National Single Window System (NSWS) is a digital platform designed to assist businesses in identifying and applying for the necessary approvals based on their specific requirements. The "Know Your Approvals" (KYA) module provides guidance for approvals across 32 Central Departments and 34 States. The NSWS also facilitates the submission of applications for approvals from 32 Central Departments and 29 State Governments through the portal itself.[4]

- SPICe+ Form: As part of the Government of India’s Ease of Doing Business (EODB) initiatives, the Ministry of Corporate Affairs introduced a new web-based form in 2020 named ‘SPICe+’, replacing the earlier SPICe form. SPICe+ offers 10 integrated services provided by three Central Government Ministries and Departments- the Ministry of Corporate Affairs, the Ministry of Labour, and the Department of Revenue under the Ministry of Finance as well as the State Government of Maharashtra. This integrated platform significantly reduces procedures, time, and costs associated with starting a business in India and is mandatory for all new company incorporations.[5]

- Increased usage of ICEGATE for faster cross-border trade facilitation: The Indian Customs Electronic Data Interchange (EDI) Gateway. Known as ICEGATE, was established in 2007. It Serves as a centralized hub for all electronic interactions between Indian customs and the trading community. ICEGATE offers a range of services including e-filing, online amendment submission, online duty payment, query resolution, and only integrated goods and services tax (IGST) refund processing for traders.[6]

Launched in September 2024, the Trade Connect e-Platform is a single window initiative that is fast, accessible and transformational as it will enable exporters to add newer markets. It aims to empower Indian exporters by facilitating entry into new international markets. The platform is expected to contribute significantly to increasing India’s share in global trade by showcasing international opportunities in a centralized manner. Additionally, small Farmer Producer Organizations (FPOs), businesses, and entrepreneurs will be able to access the platform to explore and leverage the benefits available under various Free Trade Agreements (FTAs) to expand their trade footprint.[7]

- Regulatory & Legal Simplification

- Repeal of over 1,500 archaic laws.

- 45,051 compliance burdens eliminated across central and state governments.

- Decriminalization of 50 out of 81 compoundable offences under Companies Act.

- Implementation of Jan Vishwas Act, 2023: 183 provisions across 42 Acts decriminalized.

What is Jan Vishwas Act, 2023?

An Act to amend certain enactments for decriminalising and rationalising offences to further enhance trust-based governance for ease of living and doing business.[8]

- The Department for Promotion of Industry and Internal Trade (DPIIT) is working on about 100 rules and laws of various departments of government to bring Jan Vishwas 2.0 bill to achieve a greater ease of doing business environment in the country.[9]

- The Government has enacted the four Labour Codes, namely:the Code on Wages, 2019; the Industrial Relations Code, 2020 (IR Code); the Code on Social Security, 2020 (SS Code) and the Occupational Safety, Healthand Working Conditions Code, 2020 (OSH Code).[10]

- Insolvency and Bankruptcy Code, 2016 (IBC): The legislative intent of the Code is to provide a consolidated framework for reorganization, insolvency resolution and liquidation of corporate persons, partnership firms and individuals for maximization of the value of assets. Further, IBC has had a significant impact on the health of the country's banking sector and redefined the debtor creditor relationship.

Easier to protect Intellectual Property: Obtaining Patents, Trademarks and Copyrights has become much easier- due to Reduction in filing fees, Introduction of e-filing and Simplifying the process and reducing issuance time.

Infrastructure & Logistics Improvements

PM Gati Shakti, a digital platform, is designed to bring together various ministries, including Railways and Roadways, to ensure integrated planning and coordinated execution of infrastructure projects.The initiative aims to provide seamless and efficient connectivity for the movement of people, goods, and services across various modes of transport, thereby enhancing last-mile connectivity and reducing travel time.[11]

To complement the PM GatiShakti NMP, the National Logistics Policy (NLP) was launched on 17th Sept. 2022. While the PM GatiShakti NMP addresses integrated development of the fixed infrastructure and network planning, the NLP addresses the soft infrastructure and logistics sector development aspect, inter alia, including process reforms, improvement in logistics services, digitization, human resource development and skilling.The aimof the National Logistics Policy 2022 is to develop a technologically enabled, integrated, cost efficient, resilient, sustainable and trusted logistics ecosystem in the country for accelerated and inclusive growth.[12]

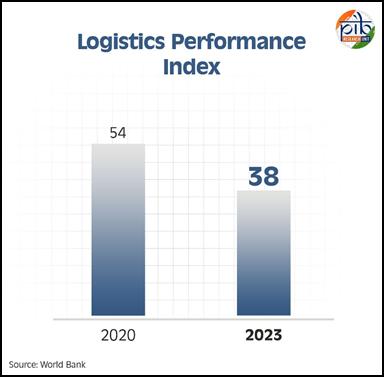

The Logistics Performance Index is an interactive benchmarking tool created to help countries identify the challenges and opportunities they face in their performance on trade logistics and what they can do to improve their performance. [13]On a global scale, India improved its position on the index by 16 ranks from 54 in 2020 to 38 in 2023.

Redefining Growth: India’s Startup Boom

- India is now the third-largest startup ecosystem globally, after the US and China.

- From a few hundred startups before 2014, India now boasts over 1.6 lakh+ recognized startups.

- These ventures have created 17.6 lakh+ jobs

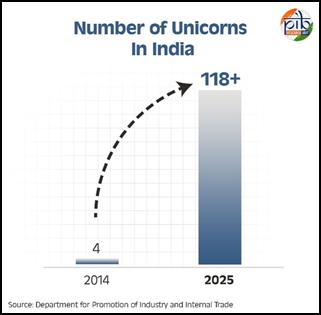

- In 2014, India had only 4 unicorns (startups valued at $1 billion+). As of 2025, this number has surged to 118+, reflecting deep investor confidence and domestic innovation.

The nation's entrepreneurial landscape, fuelled by more than 100 unicorns, is redefining innovation and creating new opportunities across sectors. Major hubs like Bengaluru, Hyderabad, Mumbai, and Delhi-NCR have been at the forefront of this transformation, while smaller cities are increasingly contributing to the momentum with over 51% of the startups emerging from Tier II/ III cities. Through initiatives like Startup India, the government has played a pivotal role in nurturing this growth and empowering the next generation of entrepreneurs.[14]

Innovation Index Leap

Transforming the MSME Landscape for Ease and Efficiency

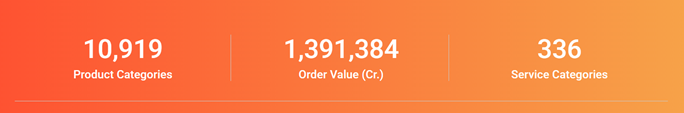

Government e Marketplace (GeM) facilitates online procurement of common use Goods & Services required by various Government Departments / Organisations / PSUs. GeM aims to enhance transparency, efficiency and speed in public procurement. It provides the tools of e-bidding, reverse e-auction and demand aggregation to facilitate the government users, achieve the best value for their money.

Government e Marketplace Surpassed ₹5 Lakh Crore GMV Before FY 2024-25 Year-End.

Source: GeM website

ONE DISTRICT, ONE PRODUCT

ODOP initiative promotes balanced regional growth by highlighting 1,240 unique products from 773 districts across India. With over 500 categories featured on the Government e-Marketplace (GeM) Bazaar, ODOP enhances local economies, boosts rural entrepreneurship, and drives public procurement. Launched in 2020, it has empowered artisans and small businesses, contributing significantly to India’s Atmanirbhar Bharat mission.

Some of the major schemes for MSMEs in India are:

- Prime Minister’s Employment Generation Programme (PMEGP):Provides financial assistance to set up self-employment ventures and generate sustainable employment in rural and urban areas. Aims at continuous employment for rural youth and traditional artisans to halt occupational migration.Margin Money subsidy ranges from 15% to 35% for projects up to ₹50 lakh (Manufacturing) and ₹20 lakh (Service sector).

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE):Encourages first-generation entrepreneurs through credit guarantee support for collateral-free/third-party guarantee-free loans to MSEs. Covers loans up to ₹5 crore with 75%–90% guarantee.

- Micro & Small Enterprises Cluster Development Programme (MSE-CDP):Supports MSE sustainability and growth by addressing common issues like technology, skills, quality, and market access. Aims to upgrade infrastructure in industrial clusters and set up Common Facility Centres. Promotes green & sustainable manufacturing.

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI):Organizes traditional industries/artisans into collectives to boost production and value addition. Promotes traditional sectors and sustainable employment. Government support includes up to ₹2.5 crore for upto 500 artisans; ₹5 crore for more than 500 artisans.[15]

Transforming the Investment Landscape in India

India’s investor-friendly reforms and improved business climate have made it a top global investment destination.With this, India has achieved a remarkable milestone in its economic journey, with gross foreign direct investment (FDI) inflows reaching an impressive $1 trillion since April 2000 (as of December 2024). This robust inflow of investments underscores India's pivotal role in shaping the global economic landscape.

- Highest ever annual FDI Inflow of USD 84.84 billion in the financial year 2021-22.

- FDI inflow USD 667.74 billion in the last 10 financial years (2014-24). It is nearly 67% of the total FDI reported in the last 24 years (USD 991.32 billion).

- 26% Jump in FDI, in H1-FY 2024-25 FDI hits USD42+ Billion

- More than 90% of FDI Equity Inflow received under Automatic Route.

Such growth reflects India’s growing appeal as a global investment destination, driven by a proactive policy framework, a dynamic business environment, and increasing international competitiveness. FDI has played a transformative role in India’s development by providing substantial non-debt financial resources, fostering technology transfers, and creating employment opportunities. Initiatives like "Make in India," liberalised sectoral policies, and the Goods and Services Tax (GST) have enhanced investor confidence, while competitive labour costs and strategic incentives continue to attract multinational corporations.[16]

Conclusion

Over the last 11 years, India has seen a major shift in the way the government engages with businesses. Moving away from a legacy of mistrust, the government now sees entrepreneurs not just as profit-makers but as key partners in building the nation. This new approach has helped startups, MSMEs, and big companies grow in an environment of trust, transparency, and support. As a result, more resources are flowing into public welfare, new jobs are being created, incomes are rising, and the economy is growing stronger. These years have not only improved the way business is done in India, they have laid a strong foundation for Amrit Kaal, the vision of a Viksit Bharat by 2047.

References:

- Ministry of Commerce and Industry:

Click here for pdf file.

****

Santosh Kumar/ Sheetal Angral/ Kritika Rane

Explainer 18/ Series on 11 Years of Government

(Explainer ID: 154686)

आगंतुक पटल : 4418

Provide suggestions / comments