Farmer's Welfare

Empowering Annadatas: Pradhan Mantri Fasal Bima Yojana

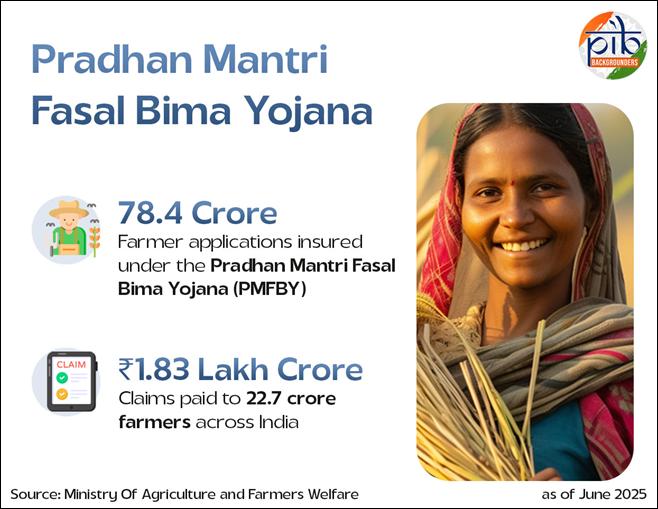

78.41 Crore Applications Insured, ₹1.83 Lakh Crore Paid in Claims

Posted On:

11 AUG 2025 1:47PM

|

Key Takeway

- 78.41 crore applications insured and ₹1.83 lakh crore claims paid under PMFBY since 2016.

- Farmer enrolment rose by 32% from 3.17 crore (2022–23) to 4.19 crore (2024–25), the highest since launch.

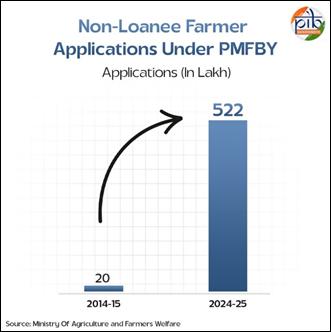

- Non-loanee farmer applications grew from 20 lakh (2014–15) to 522 lakh (2024–25), reflecting wider adoption.

|

Introduction

Every season, farmers across India work hard to grow their crops. But nature doesn’t always support them. Droughts, floods, pests, or storms can destroy months of effort in just a few hours.

That’s exactly what happened to Shri Lal Krishnesh, a farmer from Kerala. In 2022, heavy rains ruined his entire crop. He was heartbroken. But he had made one smart decision, he chose to secure his farm by investing ₹20,000 in the Pradhan Mantri Fasal Bima Yojana (PMFBY).

“PMFBY paid me 9 times my premium,” he says. This helped him recover and continue farming. In 2023, the weather played spoilsport again. His banana and areca nut crops were damaged. But once again, PMFBY came to his rescue. He received 6.6 times his premium. “The scheme gave me the courage to stand up again,” he says.

For farmers like Shri Krishnesh, PMFBY is not just insurance. It is a safety net when everything else fails.

Launched on 18th February 2016, Pradhan Mantri Fasal Bima Yojana (PMFBY) is a flagship scheme of the Government of India. It aims to provide farmers with a simple, affordable, and comprehensive crop insurance solution. The scheme protects farmers from crop losses caused by non-preventable natural risks like droughts, floods, cyclones, hailstorms, pest attacks, and plant diseases.

PMFBY covers the entire crop cycle, from pre-sowing to post-harvest, including damage during storage if caused by a notified calamity. It offers timely financial support, helping farmers manage risks and avoid falling into debt.

PMFBY follows the principle of “One Nation, One Crop, One Premium”, ensuring uniformity and fairness in premium rates across the country. By reducing the financial risks of farming, PMFBY encourages farmers to invest in better seeds, improved technology, and sustainable farming practices, helping them build a more secure future.

Achievements under the Scheme

- Total number of farmers enrolled has increased from 3.17 crore in 2022-23 to 4.19 crore in 2024-25, i.e. an increase of 32%.

- Since inception in 2016 till 2024-25 (as on 30.06.2025), a total of 78.407 crore farmer applications have been insured under PMFBY.

- Out of these applications, 22.667 crore farmers received claims totaling₹1.83 lakh crore.

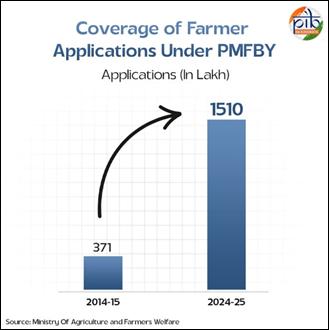

- As compared to erstwhile crop insurance schemes, coverage of farmer applications has increased from 371 lakh in 2014-15 to 1510 lakh in 2024-25.

- Number of non-loanee farmer applications has increased from 20 lakh in 2014-15 to 522 lakh in 2024-25.

Witnessing the success and potential of the scheme, the Union Cabinet in January 2025 approved the continuation of Pradhan Mantri Fasal Bima Yojana and Restructured Weather Based Crop Insurance Scheme till 2025-26 with a total budget of ₹69,515.71 crore.

|

Restructured Weather Based Crop Insurance Scheme (RWBCIS) is a weather index-based scheme, which was introduced along with PMFBY. The basic difference between the PMFBY and RWBCIS is in its methodology for calculation of admissible claims to the farmers.

|

Strengthening the Pradhan Mantri Fasal Bima Yojana

Since its launch in 2016, the Government has undertaken several measures to strengthen the Pradhan Mantri Fasal Bima Yojana (PMFBY), with a focus on enhancing transparency, accountability and timely settlement of claims. These efforts have led to significant improvements in the scheme’s implementation.

As a result, both the area covered and the number of farmers enrolled have reached record levels in 2024–25. A total of 4.19 crore farmers have been enrolled under the scheme, marking the highest enrolment since inception. Out of the total farmer applications enrolled under the scheme in 2024-25,6.5%, 17.6% and 48% are pertaining to tenant, marginal and loanee farmers respectively.

PMFBY is now the largest crop insurance scheme in the world in terms of farmer applications. In addition, several States have waived the farmer’s share of the premium, significantly reducing the financial burden on farmers and encouraging wider participation in the scheme.

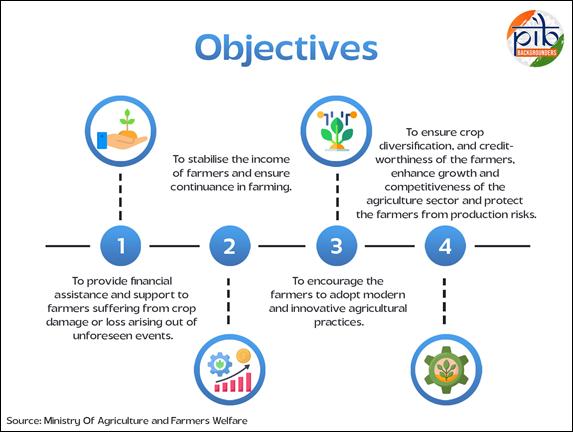

Objectives

Benefits

- Affordable Premiums: The maximum premium payable by the farmer will be 2% for the Kharif food and oilseed crops. For rabi food and oilseeds crop, it is 1.5% and for yearly commercial or horticultural crops it will be 5%. The remaining part (95% to 98.5%) of the actuarial premium is borne jointly by the Central and State Governments on 50:50 basis, except for North Eastern States (from Kharif 2020) and Himalayan States (from Kharif 2023) where it is shared in the ratio of 90:10.

|

For instance, if a farmer has a sum of ₹35,000 and one hectare of land assured, and the total premium charged by the insurance company is ₹4,000, then the farmer needs to pay only ₹800 (2%) if he is growing a Kharif crop on the insured land. The remaining ₹3,200 will be equally shared between the Central and State Governments-₹1,600 each.

|

- Comprehensive Coverage: The scheme covers natural disasters (droughts, floods), pests, and diseases. Post-harvest losses due to local risks like hailstorms and landslides are also included.

- Timely Compensation: PMFBY aims to process claims within two months of the harvest to ensure that farmers get the compensation quickly, preventing them from falling into debt traps.

- Technology-Driven Implementation: PMFBY integrates advanced technologies like satellite imaging, drones, and mobile apps for precise estimation of crop loss, ensuring accurate claim settlements.

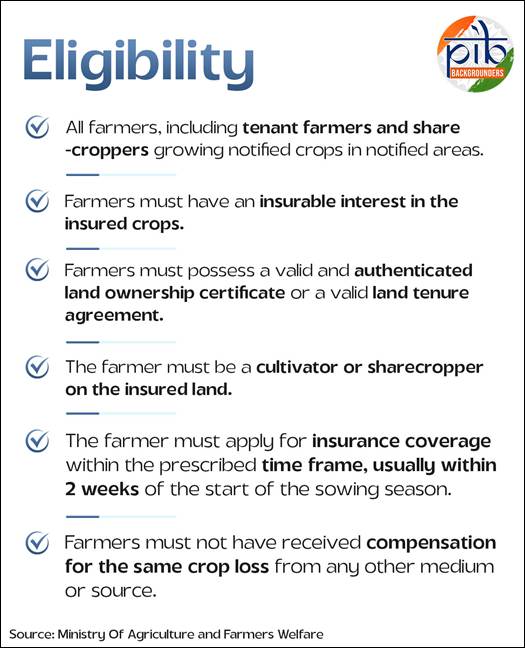

Eligibility

Non-Loanee Farmers

- All farmers who have opted for non-standard Kisan Credit Card (KCC) scheme-linked crop loans

- All farmers who have not taken any crop loans

- All loanee farmers can voluntarily enroll under the PMFBY to mitigate risk and claim insurance benefits

|

Loanee Farmers

- All farmers who have been sanctioned loans from financial institutions (FIs) for seasonal agricultural operations (SAO).

- Insurance premiums to be paid by farmers are deducted from SAO crop loans.

- Crop loans sanctioned against other collateral securities, such as fixed deposits, gold or jewel loans and mortgage loans, which do not include insurable interest on the insurable land are not covered.

- All loanee farmers are required to enroll under the PMFBY.

|

The eligible farmers can be broadly classified into two categories:

Risks Covered

- Yield Losses (Standing Crops): The Government provides this insurance coverage for yield losses that fall under the non-preventable risks, such as Natural Fire and Lightning: Storm, Hailstorm, Tornado etc.: Flood, Inundation and Landslide; Pests/ Diseases, etc.; Drought etc.

- Prevented Sowing: Cases may arise where most of the farmers (insured) of notified areas may want to plant or sow. In such cases, they have to bear the expenditure for that cause and are restricted from planting or sowing insured crops because of unfavorable weather conditions. These farmers will then become eligible for the indemnity claims of up to a maximum of 25% of the sum insured.

- Post-harvest Losses: The Government provides for post-harvest losses on an individual farm basis. The Government offers coverage of up to 14 days (maximum) from harvesting for crops that are stored in “cut and spread” condition. It means that the Government covers farmers who have put the crops to become sun-baked in the field after harvesting that have been destroyed due to cyclone or cyclonic rains occurred across the country.

- Localized Calamities: The Government provides for localized calamities on an individual farm basis. Risks such as loss or damage arising from identified localized hazards, such as hailstorms, landslides, and inundation impacting separated farmlands in the notified area comes under this coverage.

Key Government Initiatives to Strengthen PMFBY Implementation

The Government has taken several steps to improve the Pradhan Mantri Fasal Bima Yojana (PMFBY). These focus on better implementation, faster claim settlement, and increased awareness among farmers:

- A National Crop Insurance Portal (NCIP) has been created. It helps with online farmer enrolment, data sharing, monitoring, and direct transfer of claim amounts to farmers' bank accounts.

- A dedicated Digi claim Module has been operationalized from Kharif 2022 onwards. It links NCIP with the Public Finance Management System (PFMS) and insurance company systems. From Kharif 2024, if there is a delay in claim payment, a 12% penalty is automatically added.

- The Central Government’s premium subsidy has been separated from the State share. This allows farmers to receive the Central share of the claim without delay.

- From Kharif 2025, it is mandatory for States to open an ESCROW Account and deposit their premium share in advance.

- Technology is being used more effectively. Crop yield data is collected using the CCE-Agri mobile app, uploaded to NCIP, and insurance companies can now attend Crop Cutting Experiments (CCEs). State land records are also being linked to NCIP.

- The Government supports awareness drives by States, insurance companies, banks, and Common Service Centres (CSCs) to inform farmers and Panchayati Raj Institutions (PRIs) about the scheme.

- A special campaign called ‘Crop Insurance Week/Fasal Bima Saptah (twice every year) is held from Kharif 2021 onwards. ‘Fasal Bima Pathshalas’ are also held in villages to educate farmers.

- Under the ‘Meri Policy Mere Haath’, crop insurance policy receipts are distributed to farmers enrolled under PMFBY through special camps at gram Panchayat/village level.

- KRPH – KrishiRakshak Portal and Helpline:

To help farmers with queries and complaints under PMFBY, the KRPH platform and toll-free number 14447have been launched. Farmers get a ticket number to track their complaint, which is resolved within a fixed time. The system also helps the government monitor grievance redressal.

Advancing Crop Insurance Through Technology

YES-TECH (Yield Estimation System Based on Technology):

YES-TECH has been introduced to enable gradual migration towards remote sensing-based crop yield estimation. It aims to ensure fair and accurate assessment of crop yields. The initiative was launched for paddy and wheat crops from the Kharif 2023 season, with a mandatory 30% weightage assigned to YES-TECH-derived yield data. From the Kharif 2024 season, soybean has also been included under this initiative.

WINDS (Weather Information Network and Data System):

WINDS has been developed to establish an expanded network of Automatic Weather Stations (AWS) and Automatic Rain Gauges (ARG), increasing the current network fivefold. These installations will collect hyper-local weather data at Gram Panchayat and Block levels. The data will be integrated into a national database with interoperability and sharing ensured in coordination with the India Meteorological Department (IMD). WINDS supports not only YES-TECH but also plays a vital role in drought and disaster management, accurate weather forecasting and the development of improved parametric insurance products.

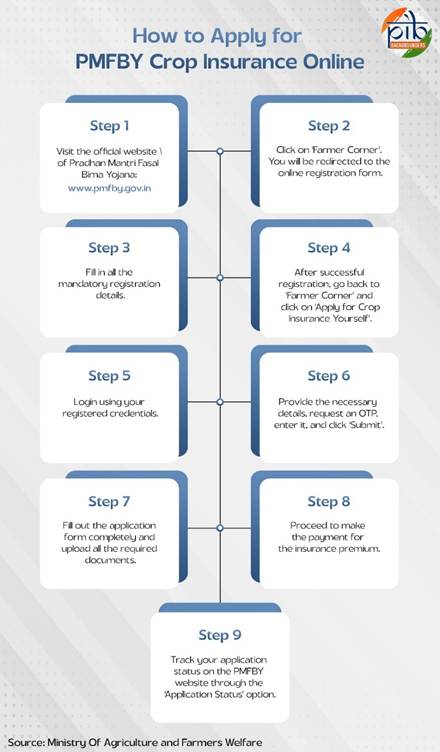

Application Process

Conclusion

The Pradhan Mantri Fasal Bima Yojana (PMFBY) has transformed India’s agricultural safety net by providing affordable premiums and extensive risk coverage, including yield losses, post-harvest losses and localized calamities. The scheme ensures timely compensation and stabilizes farmers’ income.

By adopting advanced technologies such as satellite imagery, drones, mobile data capture and weather monitoring, PMFBY has improved transparency, accuracy and efficiency in crop loss assessment. Growing participation of non-loanee and marginal farmers reflects the increasing trust in the scheme.

As PMFBY enters its next phase, it remains focused on protecting farmers from agricultural uncertainties and promoting sustainable farming practices.

References

Ministry of Agriculture & Farmers Welfare

Cabinet

IBEF

Click here to see pdf

*****

SK/ SM

(Explainer ID: 155010)

आगंतुक पटल : 10433

Provide suggestions / comments