Industries

India’s Manufacturing Momentum: Performance and Policy

Reforms, Resilience, and Roadmap to Global Manufacturing Leadership

Posted On:

19 SEP 2025 2:05PM

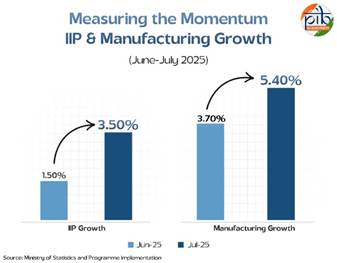

- Index of Industrial Production (IIP) surged to 3.5% YoY in July-led by 5.4% YoY manufacturing growth.

- Flagship schemes such as PLI, PM MITRA, National Manufacturing Mission, and Skill India are accelerating capacity building and strengthening India’s manufacturing ecosystem.

- India’s manufacturing export engine remained strong, with merchandise exports rising 2.52% YoY to US$ 184.13 billion in April–August 2025.

- August 2025 data shows Unemployment Rate (UR) among male easing to 5-month low level to 5.0%.

|

|

Manufacturing at a Turning Point

Every great economy has a story of factories at its core and for India, that story is rapidly unfolding. Over the past few years, manufacturing has increasingly emerged as a central pillar of the nation’s growth model, not just meeting domestic demand but also strengthening India’s position in global value chains.

Every great economy has a story of factories at its core and for India, that story is rapidly unfolding. Over the past few years, manufacturing has increasingly emerged as a central pillar of the nation’s growth model, not just meeting domestic demand but also strengthening India’s position in global value chains.

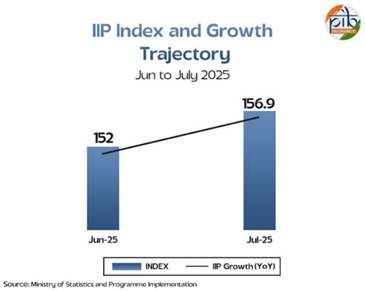

The Index of Industrial Production (IIP), which tracks the volume of output across manufacturing, mining, and electricity, is a snapshot of how industry is performing and its contribution to GDP growth.In July 2025, the IIP recorded a growth of 3.5% year-on-year, rising significantly from 1.5% in June 2025.Manufacturing Growth also grew by 5.40% in July 2025 year-on-year, up from 3.7% of June 2025.

India’s growth story is increasingly powered by the hum of modern factory floors. From Electronics Manufacturing Cluster (EMC)in Pune, to laptop assembly line in Chennai, it reflects the spread of industrial activity across regions. Behind the scenes, policies like PLI, National Manufacturing Mission and others are turning these hubs into high-performance nodes.

With global supply chains shifting and India’s domestic market expanding, the sector is well positioned to play a pivotal role in driving and sustaining overall growth.

The Pulse of Performance

The growth in IIP in July, 2025 was driven largely by manufacturing, underscoring rising demand and stronger capacity utilization across industries.

The growth in IIP in July, 2025 was driven largely by manufacturing, underscoring rising demand and stronger capacity utilization across industries.

The momentum was also mirrored in the HSBC India Manufacturing Purchasing Managers’ Index (PMI)for manufacturing. In June 2025, PMI stood at 58.4, climbing to 59.1 in July- it’s highest in 16 months, before inching up further to 59.3 in August. This latest reading signalled the fastest improvement in operating conditions in over 17 years.

The uptick was driven by a sharp acceleration in production volumes-the quickest pace in nearly five years alongside robust growth in new factory orders. Companies responded by scaling up input purchases and expanding their workforce, underscoring confidence in the sector’s near-term prospects.

The IIP’s uptick reflects India’s broader industrial ambition. By 2047, in the Amrit Kaal of independence, the goal is not just participation but leadership in global manufacturing, creating millions of jobs, and boosting exports.

Together, these indicators show a clear trajectory: India is laying the foundation for its economic growth, with manufacturing at its core.

Engines of Growth: Sectors on the Move

India’s manufacturing export engine is firing on multiple cylinders as broader merchandise trade stabilizes.

The contribution of manufacturing sector in the economy is evident with the rise in exports. In April-August 2025, total exports rose 6.18%YoY to US$ 349.35 Billion. The cumulative value of merchandise exports during April-August 2025 was US$ 184.13 Billion, as compared to US$ 179.60 Billion during April-August 2024, registering a positive growth of 2.52%.

With the visible development in manufacturing sector, it shows that the sector has potential to reach Rs. 87,57,000 crore (US$ 1 trillion) in FY26 and potentially add more than Rs. 43,43,500 crore (US$ 500 billion) annually to the global economy by 2030, which indicates that India is steadily cementing its position as a global manufacturing hub.

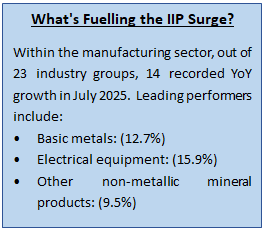

While July’s IIP surge was powered primarily by basic metals, electrical equipment, and non-metallic minerals, the broader story of India’s manufacturing ascent goes beyond these categories. Alongside these high-performing industries, a set of strategic sectors- electronics, pharmaceuticals, automobiles and textiles are driving long-term structural growth and shaping India’s global competitiveness.

Together, these sectors not only anchor India’s export momentum but also reinforce its ambition to become a US$ 1 trillion manufacturing economy by FY26. The following highlights showcase how these industries are emerging as the engines of India’s manufacturing renaissance.

Electronics: India’s Factory Floor Goes Digital

India’s electronics manufacturing sector has seen a sixfold rise in production and an eightfold surge in exports over the past 11 years. Electronics value addition has jumped from 30% to 70%, with targets to reach 90% by FY27.

|

#

|

2014-15

|

2024-25

|

Remarks

|

|

Production of Electronics Goods (Rs.)

|

1.9 Lakh Cr

|

11.3 Lakh Cr

|

Increased ~ 6 times

|

|

Export of Electronics Goods (Rs.)

|

38 thousand Cr

|

3.27 Lakh Cr

|

Increased 8 times

|

|

Mobile Manufacturing Units

|

2

|

300

|

Increased 150 times

|

|

Production of Mobile Phones (Rs.)

|

18 thousand Cr

|

5.45 Lakh Cr

|

Increased 28 times

|

|

Export of Mobile Phones (Rs.)

|

1,500 Cr

|

2 Lakh Cr

|

Increased 127 times

|

|

Mobile Phones Imported (Units)

|

75% of the total demand

|

0.02% of the total demand

|

|

One of the most striking shifts has been in mobile manufacturing. From just two units a decade ago, India now houses around 300 units, reflecting a 150-fold expansion in production capacity. Exports of mobile phones tell even more dramatic story, expanding from a modest ₹1,500 crore to nearly ₹2 lakh crore, an increase of 127 times. At the same time, dependence on imports has almost disappeared from 75% of domestic demand being met through imports in 2014-15 to just 0.02% in 2024-25. Overall, these numbers underscore India’s transition from being a large importer to becoming a global hub of electronics and India is now the world’s second-largest mobile manufacturer.

India has attracted more than USD 4 billion FDI Inflow in the field of electronics manufacturing since FY2020-21 and nearly 70% of this FDI is contributed by the beneficiaries of PLI Scheme.

Pharma: The "Pharmacy of the World"

India’s pharmaceutical industry is a global powerhouse ranking 3rd in the world by volumeand 14th in terms of value of production supplying over 50% of global vaccine demand and nearly 40% of generics to the US. The industry is projected to grow to USD 130 billion by 2030 and US$ 450 billion market by 2047.

Backed by policy support for Pharmaceuticals like the PLI scheme (₹15,000 crore) and Strengthening of Pharmaceuticals Industry (SPI) scheme (₹500 crore), the industry continues to expand its global footprint. The PLI scheme is driving investments into 55 projects to make high-end drugs such as cancer and diabetes medicines in India, while the SPI scheme that focuses on raising the quality, competitiveness, and resilience of smaller pharma companies, is funding R&D and modernizing labs, enabling Indian companies to compete globally. Beyond cost efficiency, India has emerged as a hub for affordable, high-quality medicines, reinforcing its rightful title as the “Pharmacy of the World.”

Automobiles: Shifting into High Gear

India’s automotive industry is a cornerstone of the nation’s manufacturing and economic growth, contributing 7.1% to India’s Gross Domestic Product (GDP) and 49% to manufacturing GDP, as per NITI Aayog report. During FY25, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was over 3.10 crore units. As the fourth-largest automobile producer globally, India possesses the scale and strategic depth to emerge as a global leader in the automotive value chain.

India’s automotive industry is a cornerstone of the nation’s manufacturing and economic growth, contributing 7.1% to India’s Gross Domestic Product (GDP) and 49% to manufacturing GDP, as per NITI Aayog report. During FY25, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was over 3.10 crore units. As the fourth-largest automobile producer globally, India possesses the scale and strategic depth to emerge as a global leader in the automotive value chain.

Textiles: Emerging Leader

As per economic survey 2024-25, India’s textile & apparel industry is among the largest industry globally, contributing around 2.3% to GDP, 13% to industrial production, and 12% to total exports.

The sector is set to grow to US$350 billion by 2030 further strengthening India’s position in the global market. This growth is expected to create 3.5 crore jobs. It is also the second largest employment generators, after agriculture, with over 45 million people employed directly, including women and the rural population. As further evidence of the inclusive nature of this industry, nearly 80% of its capacity is spread across Micro, Small and Medium Enterprises (MSME) clusters in the country.

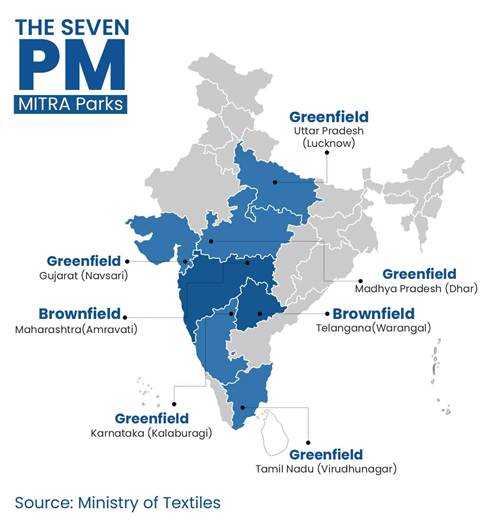

To support the industry further, the government has approved seven PM Mega Integrated Textile Region & Apparel (PM MITRA) Parks backed by ₹4,445 crore over six years through 2027-28. Under the scheme, the parks aim to attract ₹70,000 crore in investment and generate nearly 20 lakh direct and indirect jobs. The Prime Minister recently inaugurated the PM MITRA Park in Dhar, Madhya Pradesh on 17th September 2025, where 1,300 acres of land and over 80 industrial units have been allocated. The park is expected to generate about three lakh new jobs.

Investment Flows & Global Confidence

India has steadily positioned itself as a preferred destination for global investors. Over the past decade, consistent reforms, simpler regulations, and a stable policy environment have attracted significant investments in manufacturing. Initiatives to enhance ease of doing business, coupled with targeted sectoral incentives, have reinforced India’s competitiveness as a global manufacturing hub.

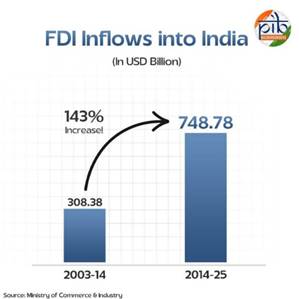

- Total FDI inflows into India over the last eleven years (2014–25) stood at USD 748.78 billion, up 143% compared to USD 308.38 billion received during 2003–14.

- India clocked USD 81.04 billion in gross FDI inflows in FY 2024–25, up by 14% year-on-year growth.

- Manufacturing FDI accelerated 18% to USD 19.04 billion in FY 2024-25 (from USD 16.12 billion in FY 2023–24)

- Maharashtra led the FDI leaderboard with 39% of equity inflows, followed by Karnataka (13%) and Delhi (12%) in 2024-25.

- Singapore (30%) remained the top origin, ahead of Mauritius (17%) and the United States (11%), reflecting both capital-market intermediation and strategic investors deepening their India footprint.

- The Government aims to raise annual FDI inflows to USD 100 billion.

These trends reaffirm India’s position as a preferred global investment hub, enabled by a proactive policy framework, an evolving business ecosystem, and rising international confidence in India’s economic resilience.

Employment, Skills, and Human Capital

Manufacturing is not just about machines and assembly lines; it is also about people. As one of the significant employment-generating sectors, manufacturing contributes significantly to India’s job market, particularly for semi-skilled and skilled workers.

India’s employment has surged, with 17 crore jobs created in the past decade, reflecting the government’s focus on youth-centric policies and its Viksit Bharat vision. Recent PLFS data of August 2025 further underlines this positive trend. The Worker Population Ratio (WPR) rose to 52.2%, while the female WPR climbed to 32%, marking steady gains in women’s workforce participation. The Labour Force Participation Rate (LFPR) also improved for the second successive month this year, reaching 33.7% for women. The overall unemployment rate eased to 5.1% and Unemployment Rate (UR) among male eased to 5-month low level to 5.0% in August 2025, highlighting broad-based employment creation and inclusivity across sectors, including manufacturing. In the manufacturing sector, job creation stood at 6% between 2004 and 2014, while it rose to 15% in the last decade.

The Union Budget 2025–26 provides a strong tailwind to India’s manufacturing ecosystem. A key enabler is the restructuring of the Skill India Programme, with an outlay of ₹8,800 crore (US$ 1.1 billion) extended until 2026. By integrating Pradhan Mantri Kaushal Vikas Yojana 4.0, the National Apprenticeship Promotion Scheme, and the Jan Shikshan Sansthan Scheme into a unified, industry-aligned framework, the initiative is building a demand-driven, technology-enabled workforce tailored to the evolving needs of modern industry.

Together, these efforts aim to ensure that India’s demographic dividend is channeled effectively into building a competitive, skilled, and adaptive workforce turning human capital into a true engine of industrial growth.

Policy Catalysts Powering the Surge

On this foundation, a set of complementary policy measures- spanning manufacturing, logistics, industrial growth, urban development, and entrepreneurship are shaping the next phase of India’s manufacturing surge. Flagship initiatives have created a strong ecosystem for investment, innovation, and scale, fuelling industrial vibrancy and job creation. Adding further momentum, the recently announced GST 2.0 reforms, with a simplified two-slab structure and reduced rates on essentials, have lowered compliance costs and boosted consumption.

Together, these measures are not just strengthening India’s domestic manufacturing base but also positioning the country as a competitive player in global value chains.

Just as factories thrive on steady demand and lean costs, India’s recent GST rate cuts arrive as the fuel that keeps the manufacturing engine humming, making goods cheaper for households, inputs lighter for industries, and growth faster for the economy.

Key industrial advantages include:

- Cost Compression & Stronger Value Chains: Goods like packaging, textiles, leather, wood, and logistics essentials now attract only 5% GST, cutting manufacturing costs and enhancing export competitiveness

- MSMEs & Export-Oriented Industries Empowered: Rationalised rates and faster refunds in textiles, handicrafts, food processing, toys, and leather industries ease working capital constraints and support scale-up

- Logistics Gets Leaner: Reduced GST on trucks and delivery vans (from 28% to 18%) combined with lower packaging costs reinforce supply chain efficiency and will benefit freight-intensive manufacturing sectors

- Ease of Doing Business & Compliance: Simpler slab structure coupled with procedural simplification like relaxed registration rules for small suppliers will lower regulatory friction and boost formal participation

- Auto & Ancillary Ecosystem Acceleration: Slashed GST on vehicles (including two-wheelers up to 350cc), auto parts, and tractors will drive consumer affordability and fuel demand and, in turn, increase production.

National Manufacturing Mission: The Strategic Compass

The National Manufacturing Mission (NMM), announced in the Union Budget 2025–26, is the crown jewel of India’s industrial policy. It is a long-term strategic roadmap that integrates policy, execution, and governance into a single, unified vision. Unlike previous fragmented approaches, the NMM is designed as a mission-mode framework that cuts across ministries and states to create a synchronized manufacturing push.

Crucially, the NMM places sustainability at the heart of industrialization. It prioritizes clean-tech manufacturing from solar PV modules and EV batteries to green hydrogen and wind turbines ensuring India’s rise in global supply chains aligns with its net-zero 2070 commitment.

In short, the NMM is not just a policy, it is the strategic compass guiding India’s transition from incremental gains to manufacturing leadership on the world stage.

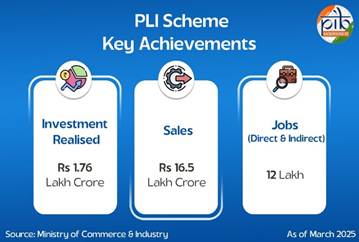

PLI Scheme: Scale, Speed, Jobs

The Production Linked Incentive (PLI) Scheme, launched in 2020, is one of the Government of India’s flagship initiatives to boost domestic manufacturing and enhance India’s participation in global supply chains. Covering 14 key sectors ranging from mobile phones, electronics, pharmaceuticals, textiles, to drones the scheme provides financial incentives linked directly to incremental production and sales.

Some standout outcomes include:

- Pharma: From a deficit of ₹1,930 crore (FY22) to a ₹2,280 crore trade surplus (FY25), with exports touching ₹1.70 lakh crore.

- Another record-breaking performance in Smartphone exports under the PLI Scheme. Smartphone exports have crossed INR 1 lakh crore within just five months of FY 2025 - 26 - 55% higher than the same period in last fiscal.

- Solar PV, Auto, Medical Devices, Food Processing – all sectors are showing strong investment traction and job creation.

With an outlay of ₹1.97 lakh crore, PLI is ensuring Indian manufacturers achieve economies of scale and become globally competitive suppliers.

National Logistics Policy

Launched in September 2022, it aims to overhaul India’s logistics ecosystem by reducing costs, enhancing efficiency, and driving digital integration. Working in tandem with the PM GatiShakti National Master Plan, the NLP sets ambitious goals: bringing down logistics costs, improving India’s position in the World Bank’s Logistics Performance Index (LPI) to among the top 25 countries by 2030, and building a robust, data-driven decision support mechanism. To operationalize these objectives, the government has rolled out the Comprehensive Logistics Action Plan (CLAP), focusing on digital systems, standardization, human resource development, state-level coordination, and the creation of logistics parks. Together, these initiatives are designed to provide seamless multi-modal connectivity and strengthen India’s competitiveness in global value chains.

Launched on January 16, 2016, the Startup India Initiative has rolled out several programs aimed at supporting entrepreneurs, building a robust startup ecosystem, and transforming India into a country of job creators instead of job seekers. India boasts the third-largest startup ecosystem in the world, with1.91 lakh DPIIT-recognized startups as of 9 September 2025, which have created over 17.69 lakh direct jobs as of January 31, 2025. This remarkable growth underscores the initiative's success in fostering innovation, enhancing employment opportunities, and driving economic development across the nation.

Industrialization and Urbanization

The National Industrial Corridor Development Programme is India's most ambitious infrastructure initiative, aiming to create new industrial cities as "Smart Cities". This program focuses on developing integrated industrial corridors with robust multi-modal connectivity, promoting growth in manufacturing and systematic urbanization. Last year, government approved12 new project proposals, involving an estimated ₹28,602 crore investment, marking a significant step in this transformative effort, positioning India as a leading global destination for manufacturing and investment.

The Road Ahead: From Momentum to Leadership

As India advances toward its $35 trillion vision by 2047, manufacturing will be the engine of growth. Supported by reforms, sectoral incentives, and resilient supply chains, the sector has gained strong momentum, reflected in GDP growth projections revised upward in Fitch ratings, IMF and S&P Global Outlook and the manufacturing PMI (S&P Global) hitting a 16-month high. The sector has demonstrated resilience even amidst global uncertainties.

The government’s vision of raising manufacturing’s share in GDP, backed by transformative policies like the PLI scheme, the National Manufacturing Mission, and skill development initiatives, provides a clear roadmap for industrial resurgence.

With global supply chains undergoing a strategic realignment, India has a unique window of opportunity to step forward as the preferred destination for investment, innovation, and large-scale production. If this momentum is sustained, India can transform from being the “factory of the world” to becoming the “innovation and leadership hub of the world.”

References used:

NITI Aayog

Ministry of Statistics & Programme Implementation

Ministry of Skill Development and Entrepreneurship

Ministry of Commerce & Industry

Startup India

Skill India

Ministry of Finance

Ministry of Textiles

Ministry of Science & technology

Ministry of Labour & Employment

Ministry of Electronics & IT

Parliamentary Question

PIB

DD News

CII

S&P Global

Twitter

India’s Manufacturing Momentum: Performance and Policy

*****

SK/M

(Explainer ID: 155242)

आगंतुक पटल : 5212

Provide suggestions / comments